PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850057

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850057

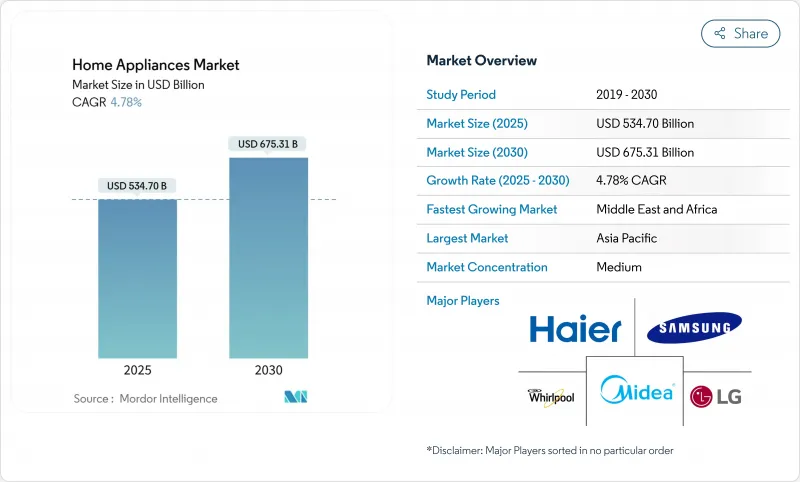

Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The home appliances market is valued at USD 534.70 billion in 2025 and is forecast to climb to USD 675.31 billion by 2030, advancing at a 4.78% CAGR.

Intensifying sustainability mandates, rapid digitalization, and expanding middle-class spending underpin this steady rise. The adoption of connected appliances now extends well beyond early adopters as mainstream consumers look for time-saving, energy-saving, and health-centric solutions. Manufacturers are accelerating product refresh cycles to comply with stricter efficiency rules, while AI-enabled features help premium brands defend margins. Supply-chain re-engineering and near-shoring keep production agile even as semiconductor allocations favor high-performance computing over traditional electronics. Retail dynamics continue to blur, with shoppers mixing digital discovery, omnichannel price checks, and in-store validation before purchase.

Global Home Appliances Market Trends and Insights

IoT-Enabled Convenience and Home Automation Boom

Connected functionality has become a core purchase criterion for the home appliances market. Refrigerator ranges from Samsung and Haier now integrate voice assistants that reorder consumables, offer food-safety prompts, and monitor energy use directly on screen. LG's ThinQ platform links laundry, cooling, and cooking products under a single app, while Qualcomm-powered edge-AI chips let devices optimize settings without the cloud, reducing latency and data-privacy risk. Mainstream acceptance in North America and the EU is pushing component suppliers to add Wi-Fi, Bluetooth, and advanced sensors as default configurations. As interoperability standards mature, manufacturers gain additional revenue from subscription services, software updates, and in-app marketplaces, reinforcing recurring-revenue models that extend value beyond the initial sale.

Stricter Energy-Efficiency Mandates Spurring Replacement Demand

The U.S. Department of Energy's 2024 water-heater rule alone is projected to save consumers USD 124 billion over 30 years while elevating heat-pump share from 3% to more than 50% of units sold. Canada's Amendment 18 adds verification-mark obligations in 2025, prompting early redesigns by market leaders that can absorb testing costs. Europe's Eco-design framework tightens dishwasher power ceilings to 223 kWh per year, compelling OEMs to invest in more efficient motors and hydraulic systems. These overlapping regulations compress product lifecycles, accelerate research and development spending on heat-pump compressors, inverters, and low-GWP refrigerants, and raise replacement demand, especially in mature housing stocks across the United States, Germany, and Japan.

Commodity and Freight-Cost Volatility Compressing Margins

Tariff shifts and freight capacity mismatches raise landed costs for steel, aluminum, and electronic sub-assemblies used across the home appliances market. The World Bank notes a 4% year-on-year dip in broad commodity prices, yet spot freight rates on key Asia-North America lanes remain volatile due to vessel re-routing and port congestion. OEMs deploy multi-sourcing and regionalization strategies to hedge exposure, but smaller brands lack the volume leverage to secure long-term contracts. Currency fluctuations exacerbate procurement swings for Latin American and African importers, making retail pricing unpredictable and pressuring channel inventories.

Other drivers and restraints analyzed in the detailed report include:

- Growth of E-Commerce and Online Sales Channels

- Rising Disposable Income and Consumer Spending Power

- High Initial Costs of Smart and Energy-Efficient Appliances

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Strong fundamentals keep refrigerators in the top position, representing 23% of the home appliances market size in 2024. Ongoing inverter-compressor upgrades, low-GWP refrigerant transitions, and expanded matte-glass finish options refresh demand cycles. At the opposite end, small appliances led by air fryers record the fastest expansion, with an 8.2% CAGR to 2030. Major brands introduce dual-drawer formats enabling simultaneous cooking of proteins and sides, while ceramic-coated baskets address durability concerns. This momentum elevates OEM bargaining power with upstream component suppliers, fostering investments in rapid-cycle heating elements and smart-thermostat integration.

Washing-machine innovation centers on AI-driven load sensing and auto-detergent dosing that can cut water use by 20%. Dishwasher redesigns follow energy-standard convergence, triggering the adoption of variable-speed circulation pumps and low-temperature detergents. Air-conditioner launches pivot toward R32 and R454b refrigerants paired with Wi-Fi modules for grid-interactive demand response. The cumulative effect across categories broadens the addressable installed base for aftermarket filters, descaling solutions, and subscription consumables, reinforcing recurring-revenue frameworks that firms now embed in business plans.

The Home Appliances Market Report Segments the Industry Into by Product (Major Appliances (Refrigerators, Freezers, and More), Small Appliances (Coffee Makers, Air Fryers, and More), by Distribution Channel (Multi-Branded Stores, Exclusive Brand Outlets, Online, Other Distribution Channels), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 46% of global revenue, strengthened by China's export of 4.48 billion appliances in 2024 and the Belt and Road Initiative that lowers tariff barriers for regional partners. Local champions such as Haier accelerate premiumization, launching glass-door refrigerators and AI washers tailored to niche lifestyle aspirations. Rising urbanization in Indonesia and Vietnam boosts basic large-capacity refrigeration penetration, while Japanese consumers gravitate toward high-end combo ovens with steam and convection modes.

North America remains the second-largest contributor, buoyed by stable housing starts and generous federal tax incentives for high-efficiency appliances. U.S. retailers report robust sales of Wi-Fi-enabled laundry pairs that integrate with energy-utility demand-response programs. Canada mirrors the shift but at a slower cadence due to colder-climate heating requirements, pushing integrated heat-pump dryer adoption into early mainstream phases.

Europe experiences mixed trends: Southern markets see replacement activity as energy bills spike, driving adoption of heat-pump dryers, whereas Northern markets push connected dishwashers to align with local smart-grid initiatives. Meanwhile, the Middle East and Africa region is set for 6.1% CAGR, propelled by rapid household formation, rising incomes in Gulf states, and government electrification drives that widen addressable off-grid appliance segments through solar-ready refrigerators. Latin America exhibits renewed momentum after macroeconomic stabilization in Brazil and Mexico, with government trade-in schemes lifting demand for A+++ rated products.

- Haier

- Whirlpool Corporation

- Samsung Electronics

- LG Electronics

- Bosch-Siemens Hausgerate

- Midea Group

- Electrolux AB

- Panasonic Corporation

- Philips Domestic Appliances

- GE Appliances

- Hisense

- Arcelik (Beko, Grundig)

- Sharp Corporation

- Gree Electric Appliances

- TCL Electronics

- Sub-Zero Group

- SMEG

- Dyson

- SharkNinja

- Fisher & Paykel

- Miele & Cie. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Income and Consumer Spending Power

- 4.2.2 IoT-Enabled Convenience & Home Automation Boom

- 4.2.3 Stricter Energy-Efficiency Mandates Spurring Replacement Demand

- 4.2.4 Growth of E-Commerce and Online Sales Channels

- 4.2.5 Urbanization and Changing Lifestyles

- 4.3 Market Restraints

- 4.3.1 Commodity & Freight-Cost Volatility Compressing Margins

- 4.3.2 High Initial Costs Of Smart And Energy-Efficient Appliances

- 4.3.3 Chip-Set Supply Bottlenecks Disrupting Production

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Major Home Appliances

- 5.1.1.1 Refrigerators

- 5.1.1.2 Freezers

- 5.1.1.3 Washing Machines

- 5.1.1.4 Dishwashers

- 5.1.1.5 Ovens (Incl. Combi & Microwave)

- 5.1.1.6 Air Conditioners

- 5.1.1.7 Other Major Home Appliances (range hoods, cooktops, etc.)

- 5.1.2 Small Home Appliances

- 5.1.2.1 Coffee Makers

- 5.1.2.2 Food Processors

- 5.1.2.3 Grills and Roasters

- 5.1.2.4 Electric Kettles

- 5.1.2.5 Juicers and Blenders

- 5.1.2.6 Air Fryers

- 5.1.2.7 Vacuum Cleaners

- 5.1.2.8 Other Small Home Appliances (waffle makers, toasters, tea makers, rice cookers, etc.)

- 5.1.1 Major Home Appliances

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Stores

- 5.2.2 Exclusive Brand Outlets

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 Canada

- 5.3.1.2 United States

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Peru

- 5.3.2.3 Chile

- 5.3.2.4 Argentina

- 5.3.2.5 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 Germany

- 5.3.3.3 France

- 5.3.3.4 Spain

- 5.3.3.5 Italy

- 5.3.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.3.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.3.3.8 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 India

- 5.3.4.2 China

- 5.3.4.3 Japan

- 5.3.4.4 Australia

- 5.3.4.5 South Korea

- 5.3.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.3.4.7 Rest of Asia-Pacific

- 5.3.5 Middle East And Africa

- 5.3.5.1 United Arab of Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle East And Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Haier

- 6.4.2 Whirlpool Corporation

- 6.4.3 Samsung Electronics

- 6.4.4 LG Electronics

- 6.4.5 Bosch-Siemens Hausgerate

- 6.4.6 Midea Group

- 6.4.7 Electrolux AB

- 6.4.8 Panasonic Corporation

- 6.4.9 Philips Domestic Appliances

- 6.4.10 GE Appliances

- 6.4.11 Hisense

- 6.4.12 Arcelik (Beko, Grundig)

- 6.4.13 Sharp Corporation

- 6.4.14 Gree Electric Appliances

- 6.4.15 TCL Electronics

- 6.4.16 Sub-Zero Group

- 6.4.17 SMEG

- 6.4.18 Dyson

- 6.4.19 SharkNinja

- 6.4.20 Fisher & Paykel

- 6.4.21 Miele & Cie. KG

7 Market Opportunities & Future Outlook

- 7.1 Smart Home Ecosystem Integration