PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850085

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850085

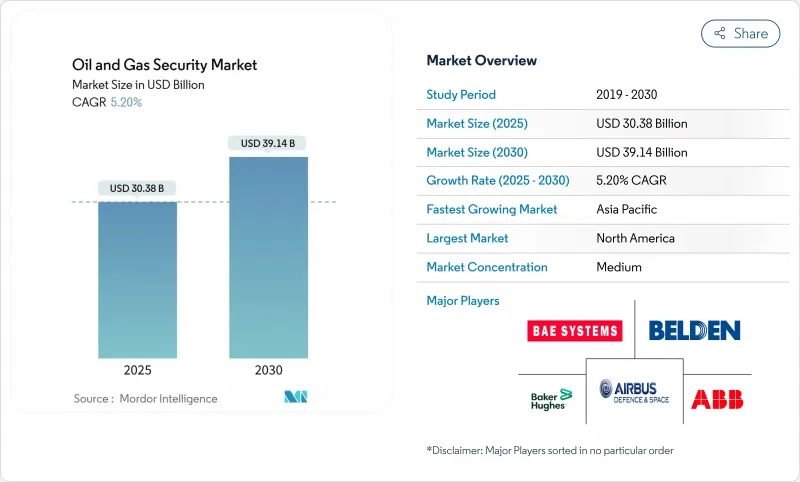

Oil And Gas Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Oil And Gas Security Market size is estimated at USD 30.38 billion in 2025, and is expected to reach USD 39.14 billion by 2030, at a CAGR of 5.20% during the forecast period (2025-2030).

This growth trajectory shows that energy companies are putting sustained capital into security programs even as commodity prices swing. The shift from reactive safeguards to proactive, intelligence-driven models is accelerating because cyber incidents now expose operational technology (OT) as well as information technology (IT) assets. Heightened geopolitical tension, stricter pipeline rules, and rising insurance prerequisites keep budgets anchored on both cyber and physical controls. Vendors that can blend hardware, software, and managed services into a unified OT-IT stack are positioned to capture disproportionate value in the next five years.

Global Oil And Gas Security Market Trends and Insights

Growing OT-IT Convergence Elevating Cyber-Risk

Operational assets, once isolated from corporate networks, now connect to cloud and enterprise systems, broadening attack surfaces. Incidents prompted by this linkage allow adversaries to pivot from IT into safety-critical OT, increasing the likelihood of physical disruption. United States agencies report that even low-skill groups successfully target industrial control systems, exposing weak segmentation and minimal multifactor authentication. Network zoning, zero-trust policies, and real-time anomaly detection are therefore moving from best practice to baseline expectation. Complexity grows as firms modernize without halting production, forcing staged rollouts and parallel architectures. Improved governance that aligns IT security, engineering, and production teams forms a critical piece of spend over the forecast horizon.

Mandatory TSA and IEC Cyber Rules for Pipelines

Revised Transportation Security Administration directives compel pipeline operators to verify controls, close gaps, and report breaches in set time windows. IEC 62443 is simultaneously emerging as the global control-system benchmark, with regional groups such as Japan's CERT delivering implementation guidance. Europe's NIS2 directive layers additional duties by mandating incident disclosure within 24 hours. Monetary penalties and potential shutdown orders for non-compliance raise security from discretionary spending to operational necessity. Vendors versed in both governance and technical deployment are in demand as operators seek turnkey compliance programs.

Legacy SCADA Upgrades Cost Overruns

Many platforms still rely on 20-year-old supervisory control systems never architected for network exposure. Firms routinely underestimate the engineering and downtime expense needed for segmentation, multifactor authentication, and encrypted telemetry. Upgrades often cost two to three times the original budget when compatibility hurdles surface mid-deployment. Extended asset lifecycles make capital allocation difficult, forcing operators to weigh short-term productivity loss against long-term resilience. Academic studies find that ineffective cross-department communication further delays execution and inflates cost.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Predictive Security Analytics Adoption

- Energy-Price Volatility Boosting Insurance Requirements

- Shortage of OT-Security Talent in Remote Basins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surveillance platforms commanded 30.4% revenue share in 2024, confirming the market's long-standing focus on perimeter and situational awareness. The oil and gas security market size tied to video analytics, drones, and access control remains significant, but annual growth moderates as budgets reallocate toward digital defenses. Network and cybersecurity solutions, advancing at an 8.1% CAGR, reflect mandatory pipeline rules and the rise in ransomware aimed at field assets. Incidents such as the Colonial Pipeline attack emphasized that an operational halt can stem from a laptop rather than a fence breach, nudging capital toward intrusion detection and secure remote-access gateways.

In the forecast window, integrated command centers that fuse camera feeds with cyber telemetry are expected to outpace single-purpose deployments. This convergence reduces false positives by correlating physical badges with network logins. Vendors able to cross-tag events from cameras, firewalls, and controllers into a unified screen are likely to capture an expanding slice of the oil and gas security market. Consequently, surveillance remains vital but increasingly embedded within broader cyber-physical platforms, moderating standalone unit sales while lifting software analytics revenue.

Hardware still comprised 52.6% of the oil and gas security market share in 2024, spanning firewalls ruggedized for hazardous zones, intrinsically safe cameras, and vibration-resistant servers. However, the managed-services segment posts a 9.3% CAGR as operators contract 24 X 7 monitoring and incident response to offset skill gaps. The oil and gas security market size attached to service retainers is increasing because each new site demands advanced analytics, threat intelligence feeds, and periodic red-team assessments.

Service growth is also tied to regulatory audits, which require independent validation and documentation. Firms lacking internal capacity rely on MSSPs that specialise in OT assets; these providers bundle asset discovery, vulnerability management, and compliance reporting into multi-year agreements. Hardware vendors are reacting through outcome-based models that package equipment and services, thereby smoothing revenue and deepening customer lock-in.

Oil and Gas Security Market is Segmented by Security Type (Network and Cyber Security, Surveillance, Screening and Detection, and More), Component (Hardware, Software Platforms, and Services), Operation Stage (Upstream, Midstream, and Downstream), Deployment Mode (On-Premise, Cloud, and Hybrid/Edge-Cloud), Application (Exploration and Production Sites, Offshore Platforms and FPSOs, and More), and Geography.

Geography Analysis

North America maintained a 36.22% stake in the oil and gas security market in 2024, supported by mandatory TSA directives and the lingering lessons of the Colonial Pipeline ransomware event. Canada's threat assessments cite state-sponsored actors targeting production and midstream hubs, prompting coordinated public-private drills and grants for OT segmentation. Offshore assets in the Gulf of Mexico and the North Slope face calls for urgent cyber upgrades following federal audits that flagged outdated firewalls and unpatched HMIs.

Asia-Pacific records the fastest CAGR at 9.1% through 2030 as China extends trunk pipelines and storage capacity into border regions, blending OT security with sovereign cloud mandates from Beijing. Japan legislated economic-security rules that classify oil and gas as critical social infrastructure, compelling operators to file security plans with regulators. India expands refinery capacity and LNG terminals, sourcing managed services from local security operations centers in Bengaluru and Hyderabad. Australia and South Korea embed OT security clauses into new LNG export projects after noting rising regional tension in the South China Sea.

Europe's modernization drive centers on the NIS2 framework that mandates 24-hour incident reporting and annual audits for essential energy entities. LNG import build-outs across Germany, France, and the Netherlands add scale and complexity, necessitating encrypted maritime-to-terminal links. The Middle East and Africa experience stepped-up funding after a 206% rise in documented attacks, showcased at regional cyber forums. Latin America remains nascent but sees incremental investment as Brazil, Argentina, and Guyana grow production and seek alignment with IEC 62443.

- ABB Ltd.

- Airbus Defence and Space

- BAE Systems plc

- Baker Hughes Cyber-Security Services

- Belden Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Claroty Ltd.

- Dragos Inc.

- Fortinet Inc.

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Johnson Controls International plc

- Kaspersky Lab JSC

- Microsoft Corp.

- Nozomi Networks Inc.

- Palo Alto Networks Inc.

- Parsons Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Tenable OT Security

- Thales Group

- Trend Micro Inc.

- Waterfall Security Solutions Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing OT and IT convergence elevating cyber-risk

- 4.2.2 Mandatory TSA and IEC cyber rules for pipelines

- 4.2.3 AI-driven predictive security analytics adoption

- 4.2.4 Energy-price volatility boosting insurance requirements

- 4.2.5 Autonomous offshore assets needing edge-to-core security

- 4.3 Market Restraints

- 4.3.1 Legacy SCADA upgrades cost overruns

- 4.3.2 Shortage of OT-security talent in remote basins

- 4.3.3 Cloud-based data-sovereignty conflicts

- 4.3.4 ESG divestments curbing long-term capex

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Security Type

- 5.1.1 Network and Cyber Security

- 5.1.2 Surveillance

- 5.1.3 Screening and Detection

- 5.1.4 Command and Control

- 5.1.5 Physical Access Control

- 5.1.6 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software Platforms

- 5.2.3 Services (Managed and Professional)

- 5.3 By Operation Stage

- 5.3.1 Upstream (Exploration and Production)

- 5.3.2 Midstream (Pipelines and Storage)

- 5.3.3 Downstream (Refining and Distribution)

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.3 Hybrid/Edge-Cloud

- 5.5 By Application

- 5.5.1 Exploration and Production Sites

- 5.5.2 Offshore Platforms and FPSOs

- 5.5.3 Pipeline Monitoring

- 5.5.4 Refineries and Petrochem Plants

- 5.5.5 LNG and Gas Processing

- 5.5.6 Retail and Distribution Terminals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Airbus Defence and Space

- 6.4.3 BAE Systems plc

- 6.4.4 Baker Hughes Cyber-Security Services

- 6.4.5 Belden Inc.

- 6.4.6 Check Point Software Technologies Ltd.

- 6.4.7 Cisco Systems Inc.

- 6.4.8 Claroty Ltd.

- 6.4.9 Dragos Inc.

- 6.4.10 Fortinet Inc.

- 6.4.11 Honeywell International Inc.

- 6.4.12 Huawei Technologies Co. Ltd.

- 6.4.13 Johnson Controls International plc

- 6.4.14 Kaspersky Lab JSC

- 6.4.15 Microsoft Corp.

- 6.4.16 Nozomi Networks Inc.

- 6.4.17 Palo Alto Networks Inc.

- 6.4.18 Parsons Corp.

- 6.4.19 Rockwell Automation Inc.

- 6.4.20 Schneider Electric SE

- 6.4.21 Siemens AG

- 6.4.22 Tenable OT Security

- 6.4.23 Thales Group

- 6.4.24 Trend Micro Inc.

- 6.4.25 Waterfall Security Solutions Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment