PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850086

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850086

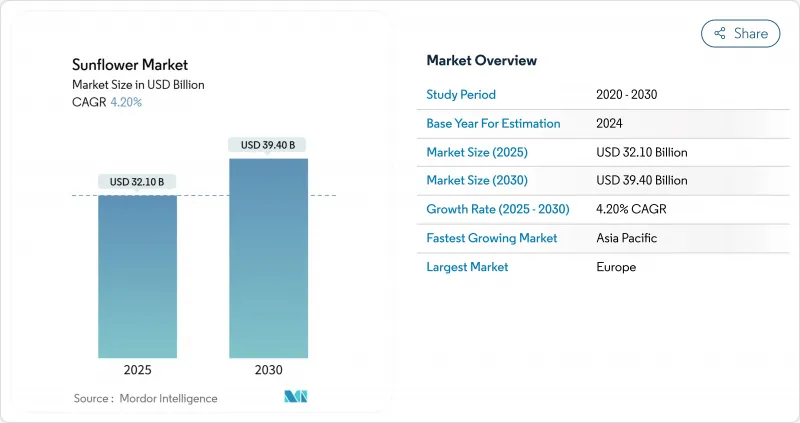

Sunflower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sunflower market size is valued at USD 32.1 billion in 2025 and is projected to reach USD 39.4 billion by 2030, registering a CAGR of 4.2% during the forecast period.

The market growth is driven by sustained demand for edible oils, advances in genetic development, and increasing consumer preference for healthy oils, despite ongoing supply chain challenges from the Ukraine-Russia conflict. Europe maintains the largest market share, while the Asia-Pacific region demonstrates the highest growth rate as import-dependent countries expand their supplier base. South American producers are benefiting from shifting trade patterns, though processors continue to manage variable crush margins and transportation challenges. While climate change and environmental regulations present challenges, advancements in parthenogenesis breeding and precision agriculture technologies are enhancing yields and supporting stable market prospects.

Global Sunflower Market Trends and Insights

Robust Expansion in Edible-Oil Demand

Emerging economies are driving the growth in global vegetable oil consumption, with sunflower oil emerging as a premium alternative to palm and soybean oils. India's imports of sunflower oil reached 1.9 million metric tons in 2024, representing 26% of global imports, driven by increasing disposable incomes and changing dietary preferences. The European food industry utilizes high-oleic varieties to meet trans-fat regulations, while Asian food processors prefer sunflower oil for its neutral flavor and high smoke point in processed foods. The increasing demand maintains price premiums that benefit growers and crushers despite logistical challenges. The continuous growth in consumption enhances the sunflower market's stability against other oilseed alternatives.

Genetic and Precision-Ag Productivity Gains

Syngenta's parthenogenesis-enabled doubled-haploid breeding reduces breeding cycles from six years to ten months, enabling faster development of high-yield, stress-resistant cultivars. Machine learning applications in variable-rate planting and nutrient management have increased yields by up to 41% in high-productivity areas. Farmers in North America and Europe increasingly use sensor and imaging technology for crop monitoring, while South American farmers implement drone technology to reduce scouting expenses. The widespread adoption of these technologies improves field efficiency, stabilizes supply, and reduces production costs. Advanced genetics enhances crop resilience to climate stress, supporting sustained production growth.

High Price Volatility and Logistics Risk

Wholesale sunflower seed prices ranged between USD 0.48 and USD 2.35 per kg in 2024, with export prices reaching USD 7.56 per kg due to Black Sea supply disruptions. Ukrainian exports decreased by 20% in March 2025, leading to global supply constraints and increased demand for South American supplies. Higher freight costs and extended shipping routes increased costs for Asian refiners. Price volatility affected hedging strategies, reduced investment in processing facilities, and strained working capital for small trading companies. Market uncertainty limited producers' investments in expanding cultivation areas during volatile periods.

Other drivers and restraints analyzed in the detailed report include:

- Government Acreage and Export Incentives

- Premium Pull from High-Oleic Oil Uses

- Intensifying Climate-Change Yield Impacts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Sunflower Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Study Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Europe holds 71% of the sunflower market in 2024, supported by established processing infrastructure and traditional cultivation centers in Ukraine, Russia, Bulgaria, and Spain. The regional conflict has shifted Black Sea trade routes to rail and river corridors, increasing transportation costs while driving new investments, including a USD 40.3 (EUR 35 million) processing facility in Bulgaria funded by the European Investment Bank. Farmers are implementing early-maturing hybrids and drip irrigation systems to mitigate heat stress. However, stricter pesticide regulations and biodiversity requirements limit yield improvements, indicating that future production growth will depend on technological advancement rather than expanding cultivation areas.

Asia-Pacific demonstrates increasing sunflower oil demand. India's annual imports of 1.9 million metric tons and China's consumption of 1.31 million metric tons support a 5.0% CAGR through 2030 for the region. India's edible oil consumption increases with rising household income, with consumers preferring sunflower oil for its health attributes. Chinese food producers maintain sunflower oil in their product formulations for flavor and stability benefits, despite favorable soybean crush margins. Turkey maintains a dual market position, with domestic production meeting approximately half of its requirements, while government procurement initiatives support local processors to reduce foreign currency expenditure.

North America experienced minimal sunflower production in 2024 as farmers shifted to canola and soybean cultivation, though 2025 projections indicate recovery supported by federal acreage subsidies. South America demonstrates the market's resilience, with Argentina producing 4 million metric tons, benefiting from reduced export taxes and efficient transportation to Asia-Pacific markets. The region, including Uruguay and Brazil's specialized production, provides reliable supply alternatives during Black Sea trade disruptions.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Expansion in Edible-Oil Demand

- 4.2.2 Genetic and Precision-Ag Productivity Gains

- 4.2.3 Government Acreage and Export Incentives

- 4.2.4 Premium Pull from High-Oleic Oil Uses

- 4.2.5 Plant-Protein Boom Lifting Sunflower Meal Demand

- 4.2.6 Crop-Rotation Sustainability Benefits

- 4.3 Market Restraints

- 4.3.1 High Price Volatility and Logistics Risk

- 4.3.2 Intensifying climate change Yields Impacts

- 4.3.3 Crush-Margin Swing Toward Other Oilseed Crops

- 4.3.4 Pesticide and Land-Use Limits on Acreage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 Europe

- 5.1.2.1 Russia

- 5.1.2.2 Ukraine

- 5.1.2.3 France

- 5.1.2.4 Spain

- 5.1.2.5 Romania

- 5.1.2.6 Bulgaria

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Australia

- 5.1.3.4 Kazakhstan

- 5.1.3.5 Pakistan

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Paraguay

- 5.1.5 Middle East

- 5.1.5.1 Turkey

- 5.1.5.2 Iran

- 5.1.5.3 Saudi Arabia

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Egypt

- 5.1.6.3 Tanzania

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook