PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850104

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850104

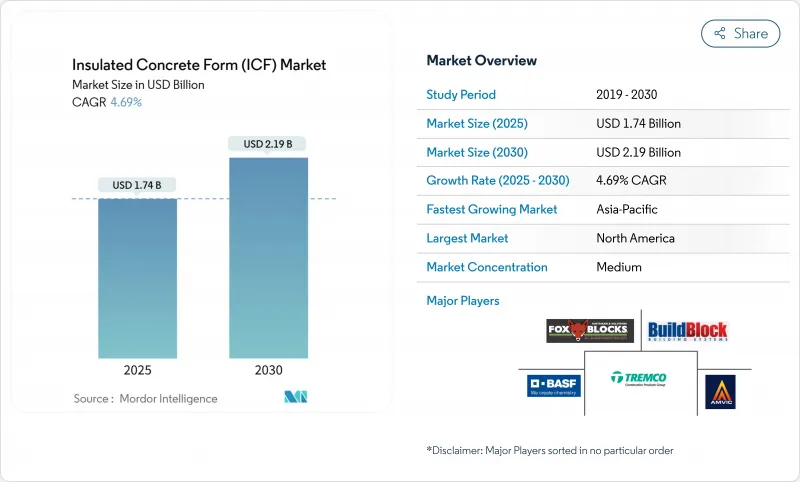

Insulated Concrete Form (ICF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The insulated concrete forms market is valued at USD 1.74 billion in 2025 and is forecast to reach USD 2.19 billion by 2030, advancing at a 4.69% CAGR.

The steady expansion reflects the construction sector's pivot toward energy-efficient building envelopes that satisfy tightening codes while lowering lifetime operating costs. Strong policy support, rising energy prices, and heightened awareness of climate resilience are amplifying adoption, especially where hurricanes, wildfires, or temperature extremes put conventional walls at risk. Residential projects still account for most placements, yet commercial developers and public agencies are scaling up orders to meet net-zero and acoustic targets. North America remains the largest regional buyer, but Asia-Pacific is logging the fastest percentage gains as China and India embed higher insulation levels in national building laws.

Global Insulated Concrete Form (ICF) Market Trends and Insights

Rising Demand for Energy-Efficient High-rise Buildings

The 2024 International Energy Conservation Code now mandates exterior continuous insulation in Climate Zones 4 and 5, positioning insulated concrete forms as a compliance solution for multi-story projects. Developers can satisfy code rules and cut thermal bridging within a single step because the concrete core is wrapped by insulation. Higher utility prices further increase the payback value, encouraging owners to select walls that lock in performance for decades. Jurisdictions adopting the code are clustered in metropolitan areas where high-rise construction dominates land-use planning, so demand is likely to intensify.

Increased Adoption of Innovative Construction Procedures

A persistent skilled-labor shortfall is prompting contractors to choose methods that reduce reliance on traditional framing crews. Crews assembling insulated concrete forms report up to 30% schedule savings thanks to simplified stacking and reduced call-backs. The block-like modules lend themselves to prefabrication and repeatable workflows, allowing firms to enlarge their labor pool without sacrificing quality. As the workforce ages and recruitment remains challenging, simplified installation strengthens long-term appeal.

High Upfront Cost Versus Wood Framing

Even after lumber price spikes, builders face a 3-8% premium when choosing insulated concrete forms, and smaller firms must rent concrete pumps and pay for structural engineering reviews. These expenses deter budget-constrained projects despite lower lifetime utility bills. Incentive programs and rising energy tariffs are gradually offsetting the difference, but first-cost sensitivity remains a hurdle.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Green-building Codes and Incentives

- Growing Demand for Acoustic Insulation in Dense Urban Infill

- Limited Contractor Familiarity and Skilled Labor Gap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polystyrene blocks controlled 88.60% of the insulated concrete forms market share in 2024, and the segment is forecast to expand at 4.72% annually to 2030. This command rests on EPS panels that deliver R-22 to R-26 while resisting moisture during concrete placement. Flame-retardant additives help meet code, and recycling programs appeal to municipalities pursuing circular-economy goals.

Polyurethane, cement-bonded wood fiber, and bead-enhanced mixes occupy specialist niches. Polyurethane delivers higher R-values per inch for tight sites, whereas cement, wood fiber blocks satisfy regional code or sourcing preferences. Bio-based polyiso containing 5% bio-circular feedstock debuted in 2024 and signals an emerging green-chemistry direction. As mandates on embodied carbon tighten, alternative foams could gain share, yet polystyrene's scaling advantages support its leadership.

Flat-wall assemblies captured 54.17% of 2024 revenues, confirming their position as the default choice for general contractors. The insulated concrete forms market size for flat-wall solutions is projected to rise steadily, but screen-grid products, growing at 5.32% CAGR, offer compelling economics by trimming concrete volumes without sacrificing load capacity. Contractors appreciate lighter lifts, faster pours, and fewer blow-out risks when stacking hollow-web grids.

Waffle-grid panels serve high-insulation jobs that demand thicker foam, while post-and-beam formats remain popular with architects who want exposed concrete ribs. Connection hardware, utility chases, and alignment bracing continue to evolve, signaling a competitive push toward ease-of-use. As engineering confidence broadens, design teams may specify hybrid grids that merge performance and aesthetic flexibility.

The Insulated Concrete Forms Market Report Segments the Industry by Material Type (Polystyrene Foam, Polyurethane Foam, and More), System Type (Flat-Wall Systems, Waffle-Grid Systems, and More), Construction Type (New-Build and Retrofit / Remodeling), Application (Residential, Commercial, and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

North America generated 39.50% of global revenue in 2024, underpinned by model energy codes that reference insulated concrete forms and a dense network of certified installers. US federal infrastructure funding emphasizes resilient construction that withstands extreme wind and wildfire, benefits that the system delivers without extra layers.

Asia-Pacific is the fastest climber, expected to post a 5.03% CAGR to 2030. India's Energy Conservation Building Code, targeting 25-50% energy savings, positions forms as a ready path for developers unfamiliar with curtain-wall detailing.

Europe enforces some of the strictest carbon and energy benchmarks, yet masonry traditions slow adoption. In South America and the Middle East, rising electricity tariffs and urban densification open potential, but limited contractor familiarity and competing low-cost methods keep penetration modest for now.

- Airlite Plastics Company & Fox Blocks (Fox Blocks)

- Alleguard

- Amvic Ireland LTD

- BASF

- Beco Products Ltd

- BuildBlock Building Systems LLC

- Carlisle Construction Materials (Carlisle Companies Inc.)

- Durisol

- Future Foam Inc.

- INTEGRASPEC

- LiteForm

- Logix Brands Ltd.

- Polycrete International

- Quad-Lock Building Systems

- RASTRA

- RPM International Inc.

- Sismo Building Technology

- SuperForm

- TF System

- Tremco CPG Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Energy-efficient High-rise Buildings

- 4.2.2 Increased Adoption of Innovative Construction Procedures

- 4.2.3 Stricter Green-building Codes and Incentives

- 4.2.4 Growing Demand for Acoustic Insulation in Dense Urban Infill

- 4.2.5 Rising Awareness of Sustainable Construction Materials

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost Versus Wood Framing

- 4.3.2 Limited Contractor Familiarity and Skilled Labor Gap

- 4.3.3 Regulations for VOC Emission

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Material Type

- 5.1.1 Polystyrene Foam

- 5.1.2 Polyurethane Foam

- 5.1.3 Cement-Bonded Wood Fiber

- 5.1.4 Cement-Bonded Polystyrene Beads

- 5.2 System Type

- 5.2.1 Flat-Wall Systems

- 5.2.2 Waffle-Grid Systems

- 5.2.3 Screen-Grid Systems

- 5.2.4 Post-and-Beam Systems

- 5.3 Construction Type

- 5.3.1 New-build

- 5.3.2 Retrofit / Remodelling

- 5.4 Application

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Institutional

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Airlite Plastics Company & Fox Blocks (Fox Blocks)

- 6.4.2 Alleguard

- 6.4.3 Amvic Ireland LTD

- 6.4.4 BASF

- 6.4.5 Beco Products Ltd

- 6.4.6 BuildBlock Building Systems LLC

- 6.4.7 Carlisle Construction Materials (Carlisle Companies Inc.)

- 6.4.8 Durisol

- 6.4.9 Future Foam Inc.

- 6.4.10 INTEGRASPEC

- 6.4.11 LiteForm

- 6.4.12 Logix Brands Ltd.

- 6.4.13 Polycrete International

- 6.4.14 Quad-Lock Building Systems

- 6.4.15 RASTRA

- 6.4.16 RPM International Inc.

- 6.4.17 Sismo Building Technology

- 6.4.18 SuperForm

- 6.4.19 TF System

- 6.4.20 Tremco CPG Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment