PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850106

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850106

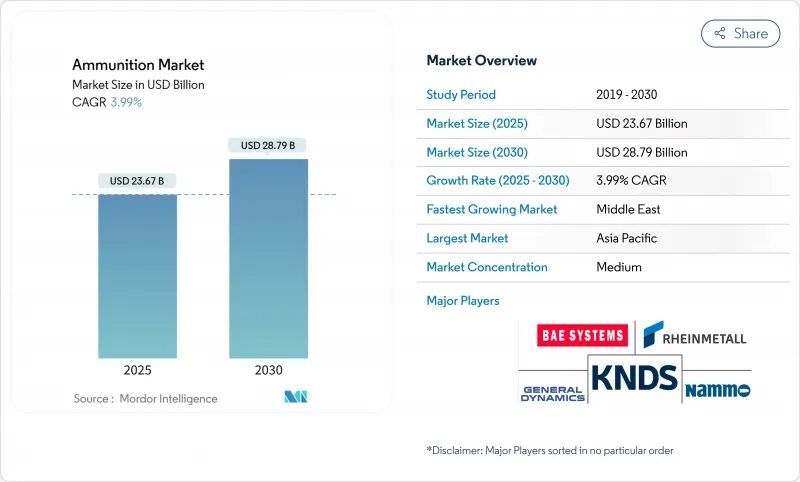

Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ammunition market size stands at USD 23.67 billion in 2025 and is projected to climb to USD 28.79 billion by 2030, registering a 3.99% CAGR.

Stockpile rebuilding across NATO, intensifying Indo-Pacific modernization programs, and shifting from volume to precision procurement are reshaping spending priorities. Smart artillery, programmable air-burst rounds, and proximity-fuzed munitions now underpin procurement as commanders demand effects-based fires that reduce logistics footprints. Environmental rules banning lead, nitrocellulose, and antimony supply disruptions are accelerating design changes. At the same time, civilian concealed-carry growth in the United States and Eastern Europe keeps small-caliber lines operating at capacity. Suppliers able to scale quickly, embed guidance technologies, and validate eco-compliant chemistries are capturing premium contracts in the highly contested ammunition market.

Global Ammunition Market Trends and Insights

Intensified NATO Stockpile Replenishment Post-Ukraine War

European nations transferred EUR 800 million (USD 925 million) in shells to Kyiv, exposing inadequate peacetime production rates. Rheinmetall's decision to expand annual output from 70,000 to 700,000 rounds by 2024 illustrates the emergency scaling underway. Multi-year contracts lock in capacity, moving the ammunition market away from spot buying and toward strategic stockpiling. Budget reallocations now favor ammunition over new platforms because advanced weapons deliver little value without a sustained supply. This pivot creates a dependable producer revenue base that can quickly ramp explosives, fuzes, and energetic materials.

Indo-Pacific Defense Modernization and Joint-Training Ammunition Demand

India's 200-unit K9 Vajra-T program, worth USD 850 million, exemplifies regional artillery renewal. Tokyo's exploration of AIM-120 co-production with Washington shows deeper industrial teaming to secure resilient supply lines. Ongoing bilateral and multilateral exercises consume ever-larger live-fire inventories, driving sustainable pull for precision rounds. Indigenous capacity is rising parallel, with governments tying offset credits to local component manufacture. Suppliers offering technology transfer and scalable assembly lines maintain a competitive edge in the crowded ammunition market.

DoD and MoD Budget Re-prioritization Toward Un-crewed Systems

The Pentagon's USD 10.1 billion allocation for unmanned vehicles in 2025, up USD 1 billion annually, exemplifies a strategic realignment. Germany's EUR 100 billion (USD 115 billion) rearmament plan applies similar logic, steering resources into loitering munitions that alter ammunition consumption patterns. Although drones still fire ordnance, their smaller magazines and smarter targeting profiles can dampen aggregate round volumes. Producers tied exclusively to legacy calibers risk under-utilization unless they pivot toward drone-compatible payload formats within the ammunition market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Programmable Air-Burst and Proximity-Fuzed Rounds in Urban Ops

- Civilian Concealed-Carry Boom in US and Eastern Europe Fueling Small-Caliber Sales

- Soaring Nitrocellulose Prices Due to Cotton Supply Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Small calibers between 5.56 mm and 12.7 mm retained 46.35% of the ammunition market share in 2024, benefiting from standardized NATO specifications that streamline multi-country procurement. Abundant civilian uptake further stabilizes volumes as new concealed-carry licensees purchase defensive rounds at premium prices. The segment enjoys predictable reorder rates that keep high-speed production lines turning year-round. Economies of scale give incumbents cost leadership, though environmental mandates push firms to transition coatings and primers to lead-free formulations.

Guided 155 mm artillery registers the quickest ascent at a 5.85% CAGR, reflecting doctrinal shifts toward precision fires rather than massed salvos. Rheinmetall plans to output 700,000 shells annually by 2025, evidencing industry appetite for larger smart rounds. The United States Army Extended Range Cannon Artillery program specifies 65-70 km reach, forcing suppliers to co-develop energetics, glide kits, and base-bleed modules. The result is an ammunition market size expansion for advanced large-caliber products that can command double-digit price premiums versus legacy dumb shells.

Artillery shells post a 6.91% CAGR to 2030 as long-range precision fires regain primacy in peer-conflict planning. Multi-mode fuzes, GPS seekers, and glide bodies increase the nominal per-round cost but reduce total shots required for effect. Nations like Spain have committed to Excalibur-S procurement, underlining a global uptick for guided projectiles.

Bullets and cartridges controlled 39.08% of the ammunition market size in 2024, underpinned by global small-arms upgrades and sustained sporting demand. Rockets, missile warheads, and aerial bombs form a smaller yet vital tranche that enables tactical deep-strike. Technology spill-over from missiles into artillery shells blurs traditional product boundaries, intensifying innovation across the ammunition industry.

The Ammunition Market Report is Segmented by Caliber (Small Caliber, and More), Product (Bullets and Cartridges, and More), Guidance (Guided and Unguided), End-User (Military, and More), Platform (Land, Naval and Airborne) and Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 35.25% of 2024 revenue, powered by India's scaling exports and robust local production. India shipped USD 2.63 billion of munitions in 2023-24 and aims for USD 6 billion by 2029. South Korea leverages K9 Vajra-T technology transfers to widen partner reach, while Japan's co-production talks build supply-chain resilience. China's export limits on key inputs compel allied states to onshore propellant factories, cementing medium-term growth in the ammunition market.

The Middle East is expanding at a 7.45% CAGR to 2030 as Saudi Arabia's USD 78 billion defense allotment lifts regional budgets. Riyadh's Vision 2030 mandates 50% defense localization, raising domestic shell and bomb plants from 4% output in 2018 to 19.35% in 2024. UAE and Gulf peers mirror this trajectory, driving imports of technology packages and turnkey lines. Persistent regional conflicts sustain consumption, ensuring a predictable pull for suppliers across the ammunition market.

Europe remains pivotal owing to NATO standards and replenishment pressures. Germany's EUR 100 billion rearmament and Rheinmetall's factories in Lithuania, Romania, and Ukraine demonstrate the bloc's intent to restore strategic depth. North America supplies cutting-edge smart fuzes and benefits from the world's largest civilian sport-shooting base. Environmental mandates for lead-free rounds reinforce first-mover advantages for firms mastering eco-compliant chemistries, differentiating them in the global ammunition market.

- BAE Systems plc

- Rheinmetall AG

- Elbit Systems Ltd.

- KNDS N.V.

- General Dynamics Corporation

- Nammo AS

- Singapore Technologies Engineering Ltd. (ST Engineering)

- Denel SOC Ltd.

- Northrop Grumman Corporation

- MESKO S.A.

- CBC Global Ammunition

- Directorate of Ordnance (Coordination and Services)

- Saab AB

- Hanwha Corporation

- ARSENAL JSCo.

- ASELSAN A.S.

- Winchester Ammunition (Olin Corporation)

- Poongsan Corporation

- Fiocchi Munizioni S.p.A.

- FN Browning Group

- CZECHOSLOVAK GROUP a.s.(CSG Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Intensified NATO stockpile replenishment

- 4.2.2 Indo-Pacific defense modernization and joint-training ammunition demand

- 4.2.3 Rapid adoption of programmable air-burst and proximity-fuzed rounds in urban ops

- 4.2.4 Civilian concealed-carry boom in US and Eastern Europe

- 4.2.5 Accelerated lifecycle replacement of legacy 155 mm propellant charges

- 4.2.6 Tier-1 militaries' transition to environment-friendly lead-free bullets

- 4.3 Market Restraints

- 4.3.1 DoD and MoD budget re-prioritisation toward un-crewed systems

- 4.3.2 Soaring nitrocellulose prices due to cotton supply shocks

- 4.3.3 Heightened ESG scrutiny on heavy-metal discharge at training grounds

- 4.3.4 Civil export bans impacting US OEM sales to LATAM

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Caliber

- 5.1.1 Small Caliber (5.56 to12.7 mm)

- 5.1.2 Medium Caliber (13 to 40 mm)

- 5.1.3 Large Caliber (Above 40 mm)

- 5.2 By Product

- 5.2.1 Bullets and Cartridges

- 5.2.2 Artillery Shells

- 5.2.3 Rockets and Missile Warheads

- 5.2.4 Aerial Bombs

- 5.3 By Guidance

- 5.3.1 Guided

- 5.3.2 Unguided

- 5.4 By End-User

- 5.4.1 Military

- 5.4.2 Law-Enforcement

- 5.4.3 Civil and Sport Shooting

- 5.5 By Platform

- 5.5.1 Land Platform

- 5.5.2 Naval Platform

- 5.5.3 Airborne Platform

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 France

- 5.6.2.3 Germany

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BAE Systems plc

- 6.4.2 Rheinmetall AG

- 6.4.3 Elbit Systems Ltd.

- 6.4.4 KNDS N.V.

- 6.4.5 General Dynamics Corporation

- 6.4.6 Nammo AS

- 6.4.7 Singapore Technologies Engineering Ltd. (ST Engineering)

- 6.4.8 Denel SOC Ltd.

- 6.4.9 Northrop Grumman Corporation

- 6.4.10 MESKO S.A.

- 6.4.11 CBC Global Ammunition

- 6.4.12 Directorate of Ordnance (Coordination and Services)

- 6.4.13 Saab AB

- 6.4.14 Hanwha Corporation

- 6.4.15 ARSENAL JSCo.

- 6.4.16 ASELSAN A.S.

- 6.4.17 Winchester Ammunition (Olin Corporation)

- 6.4.18 Poongsan Corporation

- 6.4.19 Fiocchi Munizioni S.p.A.

- 6.4.20 FN Browning Group

- 6.4.21 CZECHOSLOVAK GROUP a.s.(CSG Group)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment