PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850116

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850116

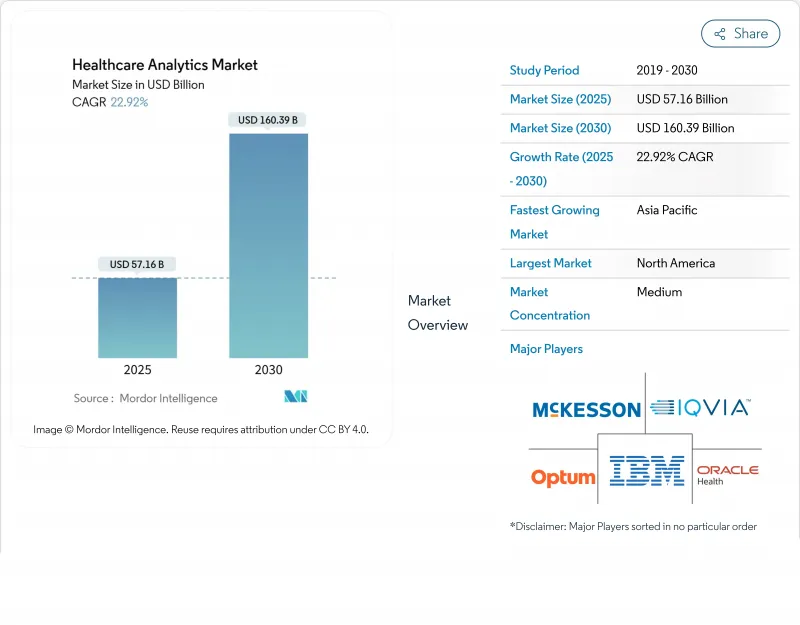

Healthcare Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The healthcare analytics market stands at USD 57.16 billion in 2025 and is on course to reach USD 160.39 billion by 2030, translating into a robust 22.92% CAGR over the forecast horizon.

Expanded payer-provider collaboration, wider deployment of AI-driven data pipelines, and a steady shift toward cloud-native analytic environments are accelerating revenue growth. Provider networks are scaling population health programs that rely on predictive risk scores, while life-science companies continue to embed real-world evidence in clinical trial designs to speed regulatory approvals. At the same time, venture investors are favoring analytics start-ups that bring low-code data-integration tools to overstretched hospital IT teams, creating an active acquisition pipeline for incumbent platform vendors. Competition is intensifying as hyperscale cloud providers, legacy EHR firms, and pure-play analytics specialists race to integrate generative AI and domain-specific large language models into existing workflows.

Global Healthcare Analytics Market Trends and Insights

Transition to Value-Based Care

The shift from fee-for-service to value-based care (VBC) models is fundamentally altering healthcare analytics requirements, with the VBC market projected to double from USD 500 billion to USD 1 trillion as organizations seek analytics solutions that connect clinical outcomes to financial performance. Despite this growth trajectory, only 46% of primary care practitioners currently participate in value-based payment arrangements, creating a significant market gap for analytics vendors who can address the financial barriers and administrative burdens that impede adoption, as per the Commonwealth Fund, July 2024. The transition demands more sophisticated patient-centered care management analytics that can adapt to dynamic patient needs while measuring outcomes beyond cost reduction, including health equity metrics that are increasingly tied to reimbursement.

Real-World Evidence Mandates to Enhance Drug Development and Patient Safety

Regulators in the United States, European Union, and Japan encourage life-science sponsors to supplement randomized-trial data with real-world evidence. Pharmaceutical firms are integrating de-identified claims and registry information to support label expansions, safety surveillance, and rare-disease studies. Life-science analytics teams increasingly partner with academic medical centers to build federated data networks that meet privacy standards without sacrificing longitudinal detail. This collaboration drives spending on high-performance analytic platforms capable of processing petabyte-scale datasets with robust lineage tracking. New guidance from the U.S. Food & Drug Administration on electronically derived endpoints reinforces the need for transparent, auditable algorithms, a capability vendors highlight as a core differentiation point when marketing to biopharma customers.

.

Fragmented Data Standards and Compliance Costs

The lack of universally adopted interoperability frameworks raises extraction and transformation costs for multi-site analytics deployments. Divergent privacy statutes such as HIPAA, GDPR, and country-specific localization rules require sophisticated consent-management workflows. Hospitals operating cross-border telehealth programs must duplicate datasets across sovereign clouds, inflating storage budgets and complicating access governance. These structural frictions slow deployment timetables and redirect budget away from advanced analytics toward compliance tooling, dampening near-term spending momentum.

Other drivers and restraints analyzed in the detailed report include:

- Cloud Adoption and AI-Enabled Health Tools

- Venture Capital Investments and the Digitization of Insurance Processes

- Skilled Professional Shortage and Cybersecurity Threats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Descriptive analytics remained the largest revenue contributor, holding 46.3% of the healthcare analytics market share in 2024. Organizations continue to rely on retrospective dashboards to satisfy basic regulatory reporting and claims adjudication requirements. Budget-constrained community hospitals also view descriptive modules as entry-level solutions while they build data governance foundations. In parallel, predictive analytics is clocking a 24% CAGR, the highest among analytic categories. Care-management teams deploy risk-propensity scores to flag high-risk members and to prioritize outreach resources. Vendor roadmaps place special emphasis on auto-ML and explainable-AI functions to ease model maintenance once solutions are embedded in electronic health record workflows.

Demand for near-real-time sepsis alerts, early-warning systems for congestive-heart-failure exacerbations, and operating-room scheduling optimizers further underpins the predictive segment's trajectory. The healthcare analytics market size at the predictive level is projected to expand as hospital networks unlock streaming telemetry from bedside monitors. Market entrants differentiate by offering drag-and-drop model builders aimed at clinicians who lack formal data-science training. As application catalogs grow, platform consolidation looms, with high-end providers bundling descriptive, diagnostic, and prescriptive modules into unified subscription tiers.

Software licenses generated 60.2% of total revenue in 2024 thanks to high-priced, enterprise-wide platform agreements. These contracts typically bundle data integration, visualization, and advanced modeling engines, giving vendors durable account control. Nonetheless, service engagements are expanding at a 25.5% CAGR as clients seek vendor-led configuration, data-quality remediation, and managed-model-performance support. Outsourced services appeal to hospitals facing workforce shortages and to life-science firms that operate global trial networks requiring around-the-clock analytic oversight.

Many providers opt for modular services to augment in-house teams during initial deployments. This hybrid approach reduces upfront capital expenditure while ensuring system uptime. Service providers increasingly incorporate automation to streamline data-mapping tasks, accelerating time to value. As hospital CFOs press for predictable operating expenses, subscription-based managed services gain favor, positioning the component services line to narrow the revenue gap with software over the forecast period. The healthcare analytics market size attributable to services is expected to capture larger renewal budgets as legacy software installations reach end-of-life.

The Healthcare Analytics Market is Segmented by Technology Type (Predictive Analytics, and More), Component (Hardware, Software, and More), Delivery Mode (On-Premise Model, and Morel), Application (Clinical Data Analytics, Financial Data Analytics, and More), End User (Healthcare Providers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 48.6% of global revenue in 2024 thanks to mature EHR adoption, widespread value-based payment schemes, and favorable venture-capital flows. Provider consolidation amplifies spending power, while stringent interoperability regulations such as the 21st Century Cures Act foster a vibrant ecosystem of application-programming-interface vendors. Reimbursement mandates for quality reporting further entrench analytics in day-to-day operations, sustaining the region's leadership position.

Europe follows with solid demand, led by Scandinavian nations that prioritize national registries and outcome-based procurement models. Regional data-protection rules do lengthen procurement cycles, but pan-European initiatives to establish common health-data spaces promise to harmonize standards over the medium term. Public-sector research consortia also drive uptake by funding cross-border data-sharing projects focused on rare diseases and pandemic preparedness.

Asia Pacific is the fastest-growing region at 22.9% CAGR. Government-funded insurance expansions in India, Indonesia, and Thailand create new datasets requiring scalable analytic infrastructure. Chinese provinces pilot value-based reimbursement schemes that incorporate hospital readmission penalties, spurring domestic analytics vendors to integrate predictive models into local hospital information systems. Australia and Singapore advance cloud-first national health-IT strategies, opening doors for global platform providers. As a result, the healthcare analytics market size in Asia Pacific is projected to overtake Europe in absolute revenue shortly after 2030, given current growth trajectories.

- 3M

- Veradigm Inc.

- Oracle Health

- Digital Reasoning Systems

- Information Builders, Inc. (IBI)

- IBM

- IQVIA

- Mckesson

- MedeAnalytics

- Optum

- Koninklijke Philips

- Health Catalyst, Inc.

- VitreosHealth, Inc.

- Inovalon, Inc.

- SAS Institute

- Verisk Analytics, Inc.

- CitiusTech, Inc.

- Merative

- SAP

- Microsoft

- Siemens Healthineers

- Deloitte Consulting LLP

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Transition to Value-Based Care

- 4.2.2 Real-World Evidence Mandates to Enhance Drug Development and Patient Safety

- 4.2.3 Cloud Adoption and AI-Enabled Health Tools

- 4.2.4 Venture Capital Investments and the Digitization of Insurance Processes

- 4.2.5 VC Influx into Analytics Start-ups

- 4.2.6 Insurance Digitization Fueling Fraud Analytics

- 4.3 Market Restraints

- 4.3.1 Fragmented Data Standards and Compliance Cost to Data Protection Regulations

- 4.3.2 Shortage of Skilled Professionals and Cybersecurity Threats

- 4.3.3 Rising HIPAA /GDPR Compliance Costs

- 4.3.4 Escalating Cyber-attacks on Hospital Data Lakes

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Analytics Type

- 5.1.1 Descriptive Analytics

- 5.1.2 Diagnostic Analytics

- 5.1.3 Predictive Analytics

- 5.1.4 Prescriptive Analytics

- 5.1.5 Cognitive Analytics

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Delivery Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud-Based

- 5.3.3 Hybrid

- 5.4 By Application

- 5.4.1 Clinical Analytics

- 5.4.2 Financial & RCM Analytics

- 5.4.3 Operational & Administrative Analytics

- 5.4.4 Population Health Management

- 5.4.5 Fraud Detection & Risk Analytics

- 5.4.6 Life Sciences / R&D Analytics

- 5.5 By End User

- 5.5.1 Healthcare Providers

- 5.5.2 Healthcare Payers

- 5.5.3 Life Science Companies

- 5.5.4 Public Health Agencies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Veradigm Inc.

- 6.3.3 Oracle Health

- 6.3.4 Digital Reasoning Systems Inc.

- 6.3.5 Information Builders, Inc. (IBI)

- 6.3.6 International Business Machines Corporation (IBM)

- 6.3.7 IQVIA Holdings Inc.

- 6.3.8 McKesson Corporation

- 6.3.9 MedeAnalytics, Inc.

- 6.3.10 Optum, Inc.

- 6.3.11 Koninklijke Philips N.V.

- 6.3.12 Health Catalyst, Inc.

- 6.3.13 VitreosHealth, Inc.

- 6.3.14 Inovalon, Inc.

- 6.3.15 SAS Institute Inc.

- 6.3.16 Verisk Analytics, Inc.

- 6.3.17 CitiusTech, Inc.

- 6.3.18 Merative

- 6.3.19 SAP SE

- 6.3.20 Microsoft Corporation

- 6.3.21 Siemens Healthineers AG

- 6.3.22 Deloitte Consulting LLP

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment