PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850126

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850126

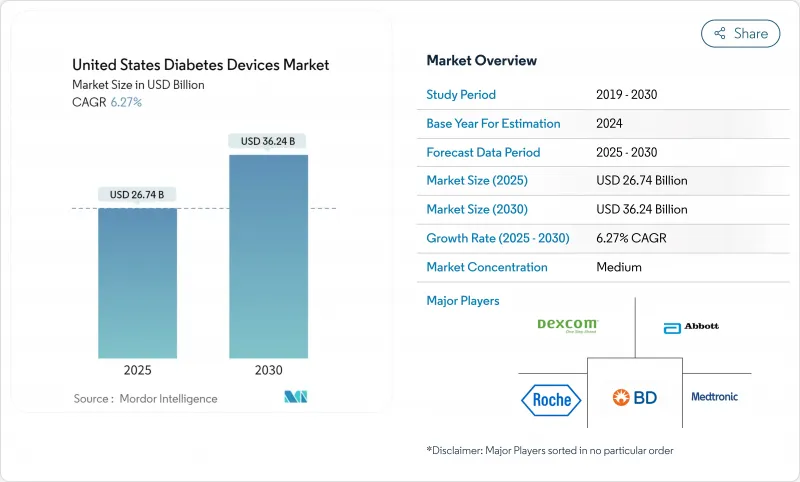

United States Diabetes Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Diabetes Devices market size is estimated at USD 26.74 billion in 2025 and is forecast to reach USD 36.24 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.27 % over the period.

This trajectory unfolds against an epidemiological backdrop of 38.4 million Americans living with diabetes, a figure that continues to propel demand for both monitoring and management solutions. The economic burden of USD 413 billion in 2022 further exposes the cost of inadequate control and places medical technology at the center of policy discussions . One direct consequence is the rising penetration of connected devices, which now underpin remote-first care models across much of the US healthcare system. The sizeable chronic population ensures long product lifecycles, giving manufacturers scope to recoup hefty research outlays while still holding prices within reimbursement ceilings. Because of this combination of persistent clinical need and policy support, the US Diabetes Devices industry has become a crucial bellwether for global product launches, as firms increasingly prioritize stateside clearance before moving into other regions.

Over the next five years, payer rules are set to shape the competitive field almost as strongly as novel engineering. Medicare's expansion of continuous glucose monitoring (CGM) coverage to all insulin-using beneficiaries has already broadened the eligible pool by several million patients. That decision has also triggered parallel moves among commercial insurers that fear adverse selection if they lag behind federal policy. As the payer landscape liberalizes, suppliers are re-designing workflows to favor pharmacy and direct-to-consumer dispensing, which shorten refill cycles and reduce total cost to serve. An observable result is the convergence of monitoring and dosing hardware inside app-based ecosystems, making software upgrades as strategically important as sensor chemistry. The stronger pull-through of consumables implied by a 6.27 % CAGR therefore hints at widening gross margins, even if average selling prices of base hardware continue their gradual decline.

United States Diabetes Devices Market Trends and Insights

Surge in Adoption of Real-Time CGM Driven by Medicare Reimbursement Expansion

Medicare's April 2023 policy update extended CGM eligibility to all insulin users and individuals with problematic hypoglycemia, removing a critical access barrier . Prescription abandonment rates fell sharply as finger-stick documentation disappeared from coverage requirements. Providers now use automated alerts to intercept glucose excursions, replacing many routine phone calls with data-driven interventions. This operational relief enables clinics to enroll more patients without expanding staffing, a clear productivity dividend.

Rising Prevalence of Obesity Among Youth Increasing Earlier Onset Diabetes

The sharp climb in childhood obesity is translating into more type 2 diagnoses during adolescence, expanding lifetime exposure to device therapy. Manufacturers are releasing youth-oriented form factors, such as smaller on-body transmitters and colorful user interfaces, which help mitigate device stigma in school settings. Because these users may require technology for several decades, product loyalty established in teenage years could create unusually sticky revenue streams. This demographic shift also suggests that long-horizon actuarial models may underestimate the eventual installed base of advanced pumps and sensors.

High Associated Costs

Cost remains the single biggest brake on technology penetration. A 2024 claims analysis reported that patients filling CGM prescriptions at retail pharmacies incurred 53 % higher annual medical costs than those using durable medical equipment channels . Even with supplemental coverage, the typical 20 % Medicare co-insurance can deter budget-constrained seniors. Price sensitivity thus skews adoption toward higher-income users, widening glycemic control disparities.

Other drivers and restraints analyzed in the detailed report include:

- Integration of Diabetes Devices with Smartphone Ecosystem Boosting Patient Engagement

- Growing Usage of Insulin Delivery Devices

- Shift Toward Value-Based Care Incentivizing Remote Monitoring Penetration

- Insurance Coverage Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monitoring devices account for 58.12% US Diabetes Devices market share in 2024, creating the single largest revenue block within the product taxonomy. Continuous glucose monitoring systems exhibit a forecast 7.82% CAGR from 2025 to 2030, markedly faster than the sector average, and this spread implies progressive mix shift toward higher-margin disposables. Many suppliers now bundle starter kits with smartphone apps that auto-generate time-in-range charts, reducing the need for manual logbooks and boosting perceived value. Because CGM data provide actionable insights every five minutes, clinicians are increasingly comfortable titrating therapy based on trends rather than isolated finger-stick values, reinforcing device indispensability. A notable spillover is the shrinking SMBG strip market, as patients who transition seldom revert, which accelerates revenue cannibalization for firms still heavily exposed to legacy meters.

The FDA's 2024 clearance of an over-the-counter biosensor specifically aimed at non-insulin users effectively widened the addressable pool by tens of millions of adults, even if near-term monetization relies on cash-pay purchases. Early commercial pilots reveal that retail pharmacy staff can complete onboarding in under 10 minutes, hinting at a scalable point-of-sale model that differs markedly from prescription-based workflows. The move has also introduced consumer electronics players into the conversation, as glucose trend lines fit naturally within broader wellness dashboards. From a competitive standpoint, monitoring giants face the strategic dilemma of balancing medical claims with lifestyle branding, because over-medicalizing messaging may dampen mass-market appeal.

Type 2 patients account for 92.14% of US Diabetes Devices market size in 2024, and their sheer numbers ensure they drive absolute unit growth even if per-capita spend lags type 1 cohorts. The 2024 regulatory nod for an automated insulin dosing algorithm tailored to adults with type 2 diabetes signals a turning point in technology parity between patient groups. As payers study early real-world data showing fewer emergency visits, coverage policies are expected to broaden, further eroding historical access gaps. Because type 2 onset often occurs later in life, device design priorities include simplified interfaces and low maintenance, factors that favor patch-style pumps over tubed systems.

Type 1 patients, representing 8% of volume, sustain a higher 6.92% forecast CAGR because they adopt multiple device classes in tandem and replace hardware more rapidly as firmware advances. Nearly eight out of ten people with type 1 diabetes already combine CGM with pump therapy, creating an environment where incremental software innovation can unlock measurable clinical gains. This cohort also generates dense data sets that attract academic scrutiny, making them prime candidates for first-in-human studies of algorithmic dosing. The knowledge spillovers from type 1 trials often inform later-stage protocols for type 2 users, effectively positioning this smaller segment as a proving ground for next-generation products.

The Report Covers US Diabetes Devices Companies and It is Segmented by Management Devices (insulin Pumps, Insulin Syringes, Cartridges in Reusable Pens, Insulin Disposable Pens, and Jet Injectors) and Monitoring Devices (self-Monitoring Blood Glucose and Continuous Glucose Monitoring). The Report Offers the Value (in USD) for the Above Segments.

List of Companies Covered in this Report:

- Abbott Laboratories

- Medtronic

- Dexcom

- Insulet

- Roche

- Beckton Dickinson

- Tandem Diabetes Care

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Ypsomed

- Senseonics

- Ascensia

- Glooko Inc.

- AgaMatrix

- Bigfoot Biomedical

- Terumo

- Owen Mumford

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Adoption of Real-Time CGM Driven by Medicare Reimbursement Expansion

- 4.2.2 Rising Prevalence of Obesity Among Youth Increasing Earlier Onset Diabetes

- 4.2.3 Integration of Diabetes Devices with Smartphone Ecosystem Boosting Patient Engagement

- 4.2.4 Growing Usage of Insulin Delivery Devices

- 4.2.5 Shift Toward Value-Based Care Incentivizing Remote Monitoring Penetration

- 4.2.6 Increasing Prevalence of Diabetes

- 4.3 Market Restraints

- 4.3.1 High Associated Costs

- 4.3.2 Insurance Coverage Limitations

- 4.3.3 Sustainability Pressure on Single-Use Plastic Pens

- 4.3.4 Stringent Regulatory Requirements

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Market Indicators

- 4.8.1 Type-1 Diabetes Population

- 4.8.2 Type-2 Diabetes Population

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Device Type

- 5.1.1 Monitoring Devices

- 5.1.1.1 Self-Monitoring Blood Glucose (SMBG)

- 5.1.1.1.1 Glucometers

- 5.1.1.1.2 Test Strips

- 5.1.1.1.3 Lancets

- 5.1.1.2 Continuous Glucose Monitoring (CGM)

- 5.1.1.2.1 Sensors

- 5.1.1.2.2 Durables (Transmitters & Readers)

- 5.1.2 Management Devices

- 5.1.2.1 Insulin Pumps

- 5.1.2.1.1 Pump Device

- 5.1.2.1.2 Reservoir

- 5.1.2.1.3 Infusion Set

- 5.1.2.2 Insulin Pens

- 5.1.2.2.1 Disposable Pens

- 5.1.2.2.2 Cartridges for Re-usable Pens

- 5.1.2.3 Insulin Syringes

- 5.1.2.4 Jet Injectors

- 5.1.1 Monitoring Devices

- 5.2 By Patient Type

- 5.2.1 Type-1 Diabetes

- 5.2.2 Type-2 Diabetes

- 5.3 By End User

- 5.3.1 Homecare Settings

- 5.3.2 Hospitals & Specialty Clinics

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 E-commerce

- 5.5 By US Region

- 5.5.1 Northeast

- 5.5.2 Midwest

- 5.5.3 South

- 5.5.4 West

6 Market Indicators

- 6.1 Type-1 Diabetes Populaton

- 6.2 Type-2 Diabetes Populaton

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Market Share Analysis

- 7.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 7.3.1 Abbott Laboratories

- 7.3.2 Medtronic plc

- 7.3.3 Dexcom Inc.

- 7.3.4 Insulet Corporation

- 7.3.5 F. Hoffmann-La Roche AG

- 7.3.6 Becton, Dickinson and Company

- 7.3.7 Tandem Diabetes Care Inc.

- 7.3.8 Novo Nordisk A/S

- 7.3.9 Eli Lilly and Company

- 7.3.10 Sanofi

- 7.3.11 Ypsomed Holding AG

- 7.3.12 Senseonics Holdings Inc.

- 7.3.13 Ascensia Diabetes Care

- 7.3.14 Glooko Inc.

- 7.3.15 AgaMatrix Inc.

- 7.3.16 Bigfoot Biomedical

- 7.3.17 Terumo Corporation

- 7.3.18 Owen Mumford Ltd.

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-Need Assessment