PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851476

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851476

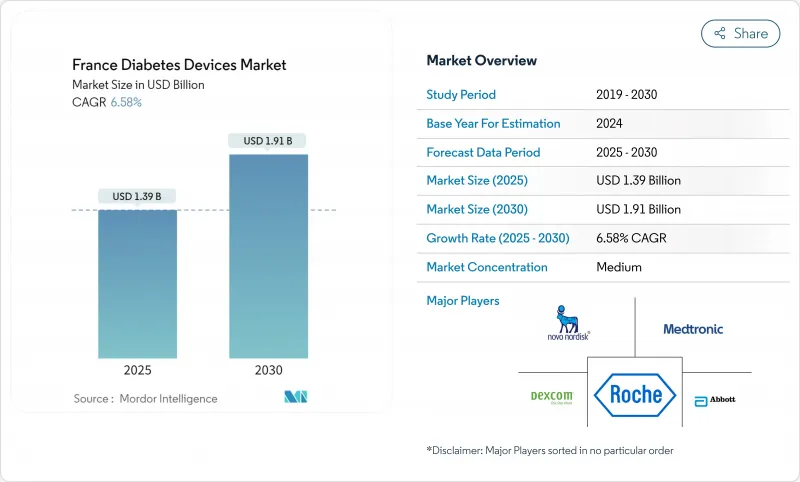

France Diabetes Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The France diabetes devices market reached USD 1.39 billion in 2025 and is projected to attain USD 1.91 billion by 2030, equating to a 6.58% CAGR and pointing to steady mid-single-digit expansion over the next five years.

This momentum reflects the world-first decision by France to reimburse continuous glucose monitoring (CGM) for every insulin user, including the 100,000 people with Type 2 diabetes who received coverage for Dexcom ONE in mid-2024. Reimbursement removes cost barriers, so hospitals, diabetes specialty centers, and general practitioners prescribe sensors earlier in the care pathway. Public-private grants through France 2030 and the Important Project of Common European Interest (IPCEI) for Health reinforce domestic semiconductor capacity, cutting reliance on foreign sensors and stabilizing supply chains. Meanwhile, the "Mon Espace Sante" platform integrates real-time glucose data with electronic health records, streamlining teleconsultation, which rose six-fold among general practitioners between 2022 and 2024. Together, reimbursement, state funding, and digital connectivity give the France diabetes devices market a structural growth foundation that remains resilient to macro-economic swings.

France Diabetes Devices Market Trends and Insights

Rising diabetes prevalence & an aging population

Roughly 3.5 million French citizens live with diabetes, up from 2024 levels, and prevalence in men already ranges 3-5%. Incidence of Type 1 diabetes in children nearly tripled between the 1994-2003 and 2013-2022 periods. Higher case counts, longer lifespans, and more complex comorbidities boost durable demand for CGM, patch pumps, and data-driven care. As seniors adopt smartphones, CGM apps scale into older age brackets, widening revenue pools in the France diabetes devices market.

Patient-centric move to home care & telemonitoring

The state-run "Mon Espace Sante" portal lets patients push CGM data directly to physicians, enabling virtual dose adjustments and lowering travel burdens. Teleconsultations jumped six-fold since COVID-19, and remote prescribers can now bill for digital follow-ups under July 2023 reimbursement rules. Pharmacists, nurses, and dietitians receive real-time dashboards, creating a multidisciplinary continuum that raises adherence and reduces acute admissions. These changes stimulate sustained CGM reorder cycles, particularly in remote regions with fewer endocrinologists.

Stringent CEPS price caps compress margins

The Economic Committee for Health Products mandates pricing tied to clinical-benefit scores, limiting premium surcharges even for breakthrough devices. Hospitals must run competitive tenders that weigh price above features, squeezing suppliers. Manufacturers respond by shifting to subscription models where analytics and coaching carry extra value, but margin headroom remains thin across the France diabetes devices market.

Other drivers and restraints analyzed in the detailed report include:

- Government & EU funding strengthens local supply

- Hybrid closed-loop & patch-pump innovation

- Regulatory complexity prolongs certification

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monitoring devices generated 57.13% of revenue in 2025, underlining data's central role in the France diabetes devices market. CGM overtakes self-monitoring blood glucose (SMBG) as reimbursement widens; Dexcom ONE coverage alone added 0.1 million Type 2 users. The France diabetes devices market size for monitoring devices equaled USD 0.79 billion in 2025 and is forecast to exceed USD 1.10 billion by 2030, implying a sensor unit CAGR ahead of total market due to falling average selling prices. Factory-calibrated Libre 3 sensors from Abbott provide 14-day wear without finger-stick confirmation, supporting rapid replacement cycles. Domestic fab capacity under France 2030 could lower BOM costs by 2027 and help new entrants attack price-sensitive segments.

Management devices-pens, pumps, and closed-loop systems-grow 3.10% annually from a smaller base. Updated 2024 guidelines extend AID to new cohorts, improving user confidence. The France diabetes devices market size for management devices reached USD 0.60 billion in 2025 and may touch USD 0.81 billion by 2030. Trials like RADIANT assess direct leaps from injections to full automation, potentially opening a pipeline of 450,000 pump-naive adults. As sensors and pumps bundle, ecosystem lock-in intensifies, prompting third-party app developers to seek interoperable Bluetooth standards to safeguard user choice in the France diabetes devices market.

The Report Covers France's Diabetes Device Market Trends and It is Segmented by Device Type (Monitoring Devices and Management Devices), End User (Hospitals & Clinics, Home-Care Settings, and More), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Sales). The Market Provides the Value (in USD) for the Above-Mentioned Segments.

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Dexcom

- Medtronic

- Insulet

- Tandem Diabetes Care

- Ypsomed

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Becton Dickinson & Co.

- Lifescan LLC

- Ascensia

- Senseonics

- Owen Mumford

- Diabeloop SA

- Med-tronic (France) SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Diabetes Prevalence And An Aging French Population Expanding The Addressable Device User Base

- 4.2.2 Patient-Centric Shift Toward Home-Based Self-Management And Telemonitoring Supported By "Mon Espace Sante" Digital-Health Infrastructure

- 4.2.3 Nationwide Expansion Of Reimbursement (Lppr Listings)

- 4.2.4 Ongoing Technology Improvements

- 4.2.5 Government And Eu Funding (France 2030, Ipcei Health) Stimulating Domestic R&D And Sensor Manufacturing Capacity

- 4.2.6 Emergence Of Hybrid Closed-Loop And Patch-Pump Solutions Offering Superior Glycemic Control And Quality-Of-Life Benefits

- 4.3 Market Restraints

- 4.3.1 Stringent Ceps Price Caps And Tendering Processes Compressing Manufacturer Margins And Discouraging New Entrants

- 4.3.2 Complex Eu-Mdr Compliance And Ansm Cybersecurity Mandates Prolonging Certification Timelines And Raising Regulatory Costs

- 4.3.3 Shortage Of Diabetes-Specialist Nurses

- 4.3.4 GLP-1 Therapy Reducing Smbg Frequency

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Reimbursement Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Monitoring Devices

- 5.1.1.1 Self-Monitoring Blood Glucose Devices

- 5.1.1.1.1 Glucometers (smart/basic)

- 5.1.1.1.2 Test Strips

- 5.1.1.1.3 Lancets

- 5.1.1.2 Continuous Glucose Monitoring

- 5.1.1.2.1 Sensors

- 5.1.1.2.2 Transmitters & Receivers

- 5.1.1.2.3 Durables (Transmitters, Re-useable Parts)

- 5.1.2 Management Devices

- 5.1.2.1 Insulin Delivery Devices

- 5.1.2.1.1 Insulin Pumps

- 5.1.2.1.2 Insulin Pump Resorvoir

- 5.1.2.1.3 Infusion Sets

- 5.1.2.1.4 Insulin Pens

- 5.1.2.1.5 Insulin Catridges

- 5.1.1 Monitoring Devices

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Home-care Settings

- 5.2.3 Diabetes Specialty Centres

- 5.2.4 Ambulatory Surgical Centres

- 5.2.5 Pharmacies & Retail Outlets

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Sales

6 Market Indicators

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves (M&A, Partnerships, Funding)

- 7.3 Market Share Analysis

- 7.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 7.4.1 Abbott Laboratories

- 7.4.2 Roche Diabetes Care

- 7.4.3 Dexcom Inc.

- 7.4.4 Medtronic plc

- 7.4.5 Insulet Corporation

- 7.4.6 Tandem Diabetes Care

- 7.4.7 Ypsomed AG

- 7.4.8 Novo Nordisk A/S

- 7.4.9 Eli Lilly and Company

- 7.4.10 Sanofi S.A.

- 7.4.11 Becton Dickinson & Co.

- 7.4.12 Lifescan LLC

- 7.4.13 Ascensia Diabetes Care

- 7.4.14 Senseonics Holdings Inc.

- 7.4.15 Owen Mumford Ltd.

- 7.4.16 Diabeloop SA

- 7.4.17 Med-tronic (France) SAS

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-need Assessment