PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850166

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850166

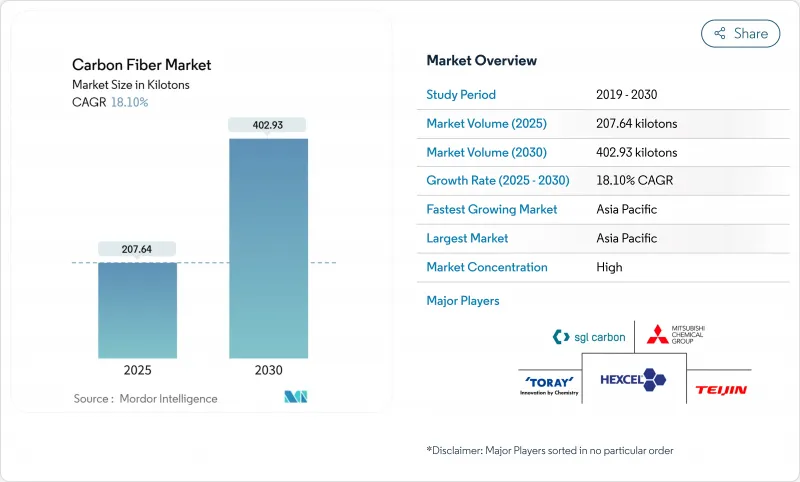

Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The carbon fiber market stands at 207.64 kilotons in 2025 and is forecast to reach 402.93 kilotons by 2030, expanding at an 18.10% CAGR for 2025-2030.

Demand is scaling rapidly as multiple industries replace metals with lightweight composites to cut fuel use, shrink emissions, and unlock design flexibility. Major growth catalysts include fast-evolving aerospace programs, accelerating wind-turbine installations, rising adoption of high-pressure hydrogen vessels, and the spread of electric-vehicle (EV) lightweighting initiatives. Innovations such as microwave-assisted carbonization that trim manufacturing energy by as much as 70% are beginning to improve cost dynamics and could widen the total addressable carbon fiber market.

Global Carbon Fiber Market Trends and Insights

Recent Advancements in Aerospace and Defense

Boeing 787, Airbus A350, and new space platforms depend heavily on carbon composites, which have pushed major suppliers to ramp up capacity. Hexcel posted 17.2% growth in its commercial-aerospace revenue in 2024 as lightweight parts replaced aluminum skins. Complementing established prepregs, Massachusetts Institute of Technology researchers introduced "nanostitching," embedding carbon nanotubes between laminate layers to boost toughness by 62% and curb delamination, which can lengthen service life while lowering lifecycle cost. Ceramic-matrix composites capable of 1,500 °C, bio-derived fibers that cut aviation CO2, and rapid-cure thermosets are widening performance envelopes, underscoring how aerospace design upgrades raise the carbon fiber market ceiling.

Increasing Applications in Wind Energy

Longer blades enable higher-capacity turbines. Carbon spar caps deliver the stiffness needed for 100-meter rotors while holding weight down. In September 2024, Kineco Exel Composites India landed a contract to supply pultruded planks to Vestas, underscoring how blade makers lean on regional supply to support offshore growth. Europe's build-out, China's auctions, and United States tax credits favor carbon fiber structural parts, reinforcing the material's role in the carbon fiber market.

Energy-Intensive Oxidation and Carbonization

Conventional lines run above 1,000 °C for long dwell times, consuming vast power and locking in more than 40% of operating cost. Energy price swings squeeze margins and deter capacity adds. Microwave-assisted furnaces and alternative precursors could eventually resolve the bottleneck, yet large-scale retrofits remain capital-heavy.

Other drivers and restraints analyzed in the detailed report include:

- Hydrogen and CNG High-Pressure Vessels in Commercial Vehicles

- EV Battery-Pack Enclosures and BIW Lightweighting

- Supply-Chain Security for Recycled Carbon Fiber

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PAN-based grades held 95% of the carbon fiber market volume in 2024, backed by refined supply chains and known mechanical properties. They are projected to keep an 18.3% CAGR to 2030, even as producers test pitch and lignin options. Adding 0.075 wt% graphene lifted PAN tensile strength 225% and Young's modulus 184% in lab trials, pointing to scope for incremental gains. Pitch fibers claim the remaining share and are securing niches in satellites and high-rigidity shafts thanks to modulus advantages, which could widen automotive reach.

Sustained investment in precursor research and development points to a gradual shift where multiple feedstocks coexist. Yet PAN's entrenched infrastructure, proven quality control, and broad certification base will safeguard its position through the decade. Cost relief from energy-efficient oxidation could allow producers to pass savings and defend their share against alternative high-performance plastics.

Virgin material commanded 63% of the carbon fiber market volume in 2024. Performance consistency, aerospace qualification, and availability favor virgin output in safety-critical parts. However, advanced solvolysis now recovers up to 90% fiber strength at lower energy load, handing recycled grades a 19.5% CAGR, runway. Automotive, consumer electronics, and sporting goods are testing recycled fiber to lower embedded emissions and cut costs, and Toray's Lenovo program illustrates mainstream appeal.

The carbon fiber market share advantage of virgin fibers will erode incrementally as OEMs integrate sustainability targets into sourcing. Scaling infrastructure, harmonizing waste regulations, and ensuring stable supply quality remain prerequisites for broader adoption. Specialized fibers with nano-pores, metal-like thermal conductivities, or other functional properties sit on the sidelines for now, yet can emerge as profit pools once volumes justify dedicated lines.

The Carbon Fiber Market Report Segments the Industry by Raw Material (Polyacrylonitrile (PAN) and Petroleum Pitch and Rayon), Fiber Type (Virgin Fiber (VCF), Recycled Carbon Fiber (RCF), and Others), Application (Composite Materials, Textiles, and More), End-User Industry (Aerospace and Defense, Alternative Energy, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 44.3% of the carbon fiber market in 2024 and should keep the fastest trajectory with a 20.6% CAGR to 2030. Japanese incumbents Toray and Mitsubishi Chemical sustain global leadership through captive PAN lines and steady innovation. Chinese producers are scaling aggressively and benefit from national energy transition programs.

North America retains a strong aviation hub and is expanding hydrogen-truck trials. Hexcel's aerospace backlog and emerging Department of Energy support for clean materials consolidate the region's position. Europe benefits from offshore wind, luxury autos, and regulatory pushes that reward low-carbon production; Brussels' debate over composite waste could, however, add compliance hurdles for imported parts.

South America and the Middle East, and Africa account for modest volumes yet offer upside. Brazil leverages wind resources and infrastructure buildouts.

- A&P Technology, Inc.

- Anshan Senoda Carbon Fiber Co., Ltd.

- DowAksa

- Formosa Plastics Group

- Hexcel Corporation

- HS HYOSUNG ADVANCED MATERIALS

- Jiangsu Hengshen Co.,Ltd

- KUREHA CORPORATION

- Mitsubishi Chemical Group Corporation

- Nippon Graphite Fiber Co., Ltd.

- Rock West Composites, Inc.

- SGL Carbon

- Sigmatex (UK) Limited

- Solvay

- Teijin Limited

- TORAY INDUSTRIES, INC.

- UMATEX

- Zhongfu Shenying Carbon Fiber Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Recent Advancements in Aerospace and Defense Sector

- 4.2.2 Increasing Applications in Wind Energy Sector

- 4.2.3 Hydrogen and CNG High-Pressure Vessels in Commercial Vehicles

- 4.2.4 Battery-Pack Enclosures and BIW Lightweighting in EV Platforms

- 4.2.5 Rising Adoption of Carbon Fiber Rebars in Seismic-Zone Construction (Asia)

- 4.3 Market Restraints

- 4.3.1 Energy-Intensive Oxidation and Carbonization Inflating Opex (more than 40% of Cost)

- 4.3.2 Supply Chain Security for Recycled Carbon Fiber

- 4.3.3 Competition from High-Performance Thermoplastics in Sporting Goods

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Degree of Competition

- 4.7 Pricing Analysis

- 4.8 Production Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Raw Material

- 5.1.1 Polyacrylonitrile (PAN)

- 5.1.2 Petroleum Pitch and Rayon

- 5.2 By Fiber Type

- 5.2.1 Virgin Carbon Fiber (VCF)

- 5.2.2 Recycled Carbon Fiber (RCF)

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Micro-Electrodes

- 5.3.4 Catalysis

- 5.4 By End-User Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction and Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 A&P Technology, Inc.

- 6.4.2 Anshan Senoda Carbon Fiber Co., Ltd.

- 6.4.3 DowAksa

- 6.4.4 Formosa Plastics Group

- 6.4.5 Hexcel Corporation

- 6.4.6 HS HYOSUNG ADVANCED MATERIALS

- 6.4.7 Jiangsu Hengshen Co.,Ltd

- 6.4.8 KUREHA CORPORATION

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 Nippon Graphite Fiber Co., Ltd.

- 6.4.11 Rock West Composites, Inc.

- 6.4.12 SGL Carbon

- 6.4.13 Sigmatex (UK) Limited

- 6.4.14 Solvay

- 6.4.15 Teijin Limited

- 6.4.16 TORAY INDUSTRIES, INC.

- 6.4.17 UMATEX

- 6.4.18 Zhongfu Shenying Carbon Fiber Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Emphasis on Usage of Lignin as Raw Material for Carbon Fiber