PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850173

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850173

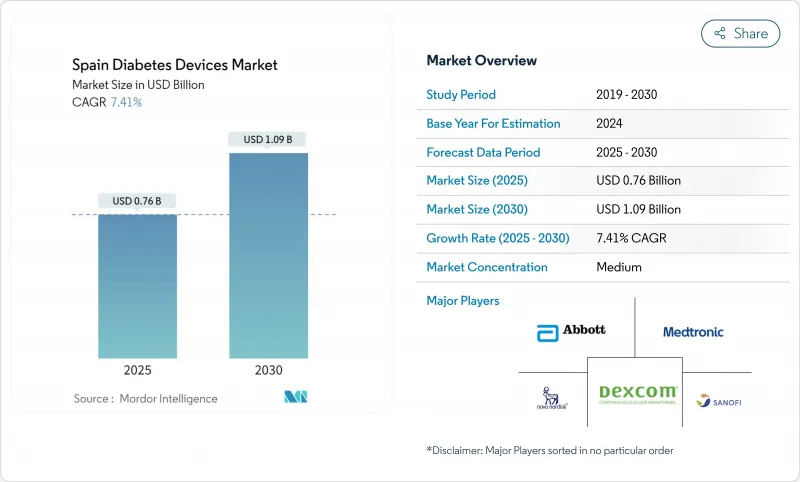

Spain Diabetes Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Spain diabetes devices market is valued at USD 760 million in 2025 and is projected to reach USD 1,090 million by 2030, expanding at a 7.41% CAGR.

Growth stems from rising diabetes prevalence, wider continuous glucose monitoring (CGM) reimbursement, and integration with Spain's national e-prescription platform. The shift from reactive treatment to proactive monitoring is accelerating demand for Bluetooth-enabled glucometers, smart insulin pens, and hybrid closed-loop pumps. Multinational producers are strengthening local partnerships to navigate Spain's decentralized procurement, while regional distributors are using their familiarity with autonomous community tenders to gain share. Retail pharmacies, bolstered by Grupo Cofares' expansion, now serve as full-service diabetes hubs offering device education and refill services. Across the Spain diabetes devices market, cybersecurity certification hurdles and price caps on consumables temper pricing power but also motivate manufacturers to highlight product safety and cost-effectiveness.

Spain Diabetes Devices Market Trends and Insights

Ageing-linked diabetes prevalence spike

Spain's coastal and southern regions report diabetes rates well above the national average, driven by an aging population that peaks at age 80 . Concentrated prevalence translates into higher per-capita device demand, prompting suppliers to align inventory and after-sales support with autonomous-community programs targeting seniors. Regional initiatives such as Madrid Salud's ALAS program illustrate how localized prevention strategies can normalize glucose levels in 35% of pre-diabetic participants, underscoring unmet demand for continuous monitoring in older cohorts. The Spain diabetes devices market consequently sees sustained baseline growth as each successive age bracket enters high-risk status. Manufacturers are tailoring simple-interface glucometers and larger-font CGM displays to meet geriatric usability needs, while pharmacies in Andalusia and Valencia boost stock of easy-load test strips to address dexterity challenges in elderly users.

Primary-care CGM reimbursement rollout

The 2024 national policy authorizing CGM funding through primary-care clinics removed specialist gatekeeping and opened access for insulin-treated Type 2 patients. Catalonia's phased launch showed 69% uptake among contacted candidates, a pattern now replicated in Basque Country and Madrid . Health-economic analyses project annual savings of EUR 580 per patient from reduced severe hypoglycemia, motivating additional autonomous communities to widen eligibility. Suppliers positioned within the Spain diabetes devices market are reallocating marketing budgets from endocrinology centers toward primary-care physician education. Demand for factory-calibrated CGMs that integrate with standard electronic health records is rising, and Spanish distributors are vying for exclusive tenders that bundle sensors with cloud dashboards for general practitioners.

Stringent AEMPS cybersecurity certification for connected pumps

Spain's regulator demands advanced penetration-testing evidence before connected insulin pumps gain market entry. Certification adds 6-12 months to launch schedules and lifts compliance costs, discouraging smaller innovators. While patients eventually benefit from stronger data protection, delayed product availability suppresses near-term pump sales within the Spain diabetes devices market. Multinationals respond by staging Spanish rollouts after initial clearance in other EU states, reallocating early promotional spending to neighboring markets. The extra scrutiny also obliges distributors to provide detailed cybersecurity training to biomedical engineers in public hospitals.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid closed-loop clinical trials at university hospitals

- Retail-pharmacy smart-pen penetration

- Growth of e-prescription platform enabling auto-refills

- Low CGM uptake in rural Castilla-La Mancha and Extremadura

- Pricing reference system caps on test strips

- Fragmented regional procurement delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monitoring Devices held 60.24% of the Spain diabetes devices market in 2024, reinforced by standardized glucose-testing protocols across all autonomous communities. CGM sub-segment momentum continues at an 8.41% CAGR as funding grows and clinical evidence validates cost savings. The Spain diabetes devices market size for Monitoring Devices is forecast to reach USD 690 million by 2030, demonstrating sustained volume and value expansion.

Management Devices-including pumps and smart pens-represent a smaller but strategically significant share. Hybrid closed-loop systems trialed in Spanish hospitals prove significant glycemic improvements, prompting more regions to reimburse advanced pumps. Retail pharmacy availability of smart pens has lowered access barriers; coupled with automated dosing algorithms, these devices reduce user burden and boost adherence. Suppliers bundle cloud dashboards with pens to capitalize on the emergent data-driven care model, further enlarging their footprint within the Spain diabetes devices market.

Hospitals commanded 46.12% of the Spain diabetes devices market share in 2024 thanks to their gatekeeper role for complex device initiation. Central pharmaco-therapeutic committees still approve pump and CGM prescriptions, influencing subsequent outpatient trajectories. In-hospital adoption of professional CGMs for acute management supports continued unit placements.

Home-care settings grow fastest at 7.83% CAGR, underpinned by telemedicine expansion encouraged by Spain's Digital Health Strategy. Lockdown-era studies showed improved time-in-range despite fewer clinic visits, validating remote monitoring benefits doi.org. The Spain diabetes devices market size generated by home-care users is projected to surpass USD 350 million by 2030, lifting overall sector resilience.

The Report Covers Spanish Diabetes Devices Market Trends and is Segmented Into Device Category (Management Devices and Monitoring Device), End User ( Hospitals, and More), Distribution Channel (Hospital Pharmacies, and More), Patient Type (Type 1 Diabetes, Type 2 Diabetes, and More), Device Connectivity (Bluetooth and Non-Connected). The Report Offers the Value (In USD) and Volume (In Units) for the Above Segments.

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Medtronic

- Dexcom

- Ascensia

- Beckton Dickinson

- Novo Nordisk

- Sanofi

- Eli Lilly and Company

- Insulet

- Tandem Diabetes Care

- Ypsomed

- Terumo

- Menarini Diagnostics

- Lifescan

- Senseonics Holdings

- Medtrum Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing-linked Diabetes Prevalence Spike in Southern & Coastal Spain

- 4.2.2 Roll-out of Primary-Care-Driven CGM Reimbursement (2024)

- 4.2.3 Surge in Hybrid-Closed-Loop Clinical Trials at Spanish University Hospitals

- 4.2.4 Employer-backed Diabetes-Wellness Programs in Catalonia & Madrid

- 4.2.5 Retail-pharmacy Penetration of Smart Pens via Grupo Cofares

- 4.2.6 Growth of e-Prescription Platform (Receta Electronica) Enabling Auto-Refills

- 4.3 Market Restraints

- 4.3.1 Stringent AEMPS Cyber-security Certification for Connected Pumps

- 4.3.2 Low CGM Uptake in Rural Castilla-La Mancha & Extremadura

- 4.3.3 Pricing Reference System Caps on Test-Strips

- 4.3.4 Fragmented Regional Procurement Delays (17 Autonomous Communities)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, EUR Mn)

- 5.1 By Device Category

- 5.1.1 Monitoring Devices

- 5.1.1.1 Self-Monitoring Blood Glucose (SMBG)

- 5.1.1.1.1 Glucometer Devices

- 5.1.1.1.2 Test Strips

- 5.1.1.1.3 Lancets

- 5.1.1.2 Continuous Glucose Monitoring (CGM)

- 5.1.1.2.1 Sensors

- 5.1.1.2.2 Transmitters & Receivers (Durables)

- 5.1.2 Management Devices

- 5.1.2.1 Insulin Pump Systems

- 5.1.2.1.1 Pump Device

- 5.1.2.1.2 Pump Reservoir

- 5.1.2.1.3 Infusion Set

- 5.1.2.1.4 Patch Pump

- 5.1.2.2 Insulin Delivery Pens

- 5.1.2.2.1 Disposable Pens

- 5.1.2.2.2 Reusable Smart Pens

- 5.1.2.3 Insulin Syringes

- 5.1.2.4 Insulin Cartridges

- 5.1.1 Monitoring Devices

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Specialty Clinics

- 5.2.3 Home-Care Settings

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Pharmacies

- 5.4 By Patient Type

- 5.4.1 Type 1 Diabetes

- 5.4.2 Type 2 Diabetes

- 5.4.3 Gestational / Other

- 5.5 By Device Connectivity

- 5.5.1 Bluetooth / Wireless-Connected

- 5.5.2 Non-Connected

6 Market Indicators

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 7.4.1 Abbott Laboratories

- 7.4.2 Roche Diagnostics

- 7.4.3 Medtronic plc

- 7.4.4 Dexcom Inc.

- 7.4.5 Ascensia Diabetes Care

- 7.4.6 Becton, Dickinson & Company

- 7.4.7 Novo Nordisk A/S

- 7.4.8 Sanofi S.A.

- 7.4.9 Eli Lilly and Company

- 7.4.10 Insulet Corporation

- 7.4.11 Tandem Diabetes Care

- 7.4.12 Ypsomed AG

- 7.4.13 Terumo Corporation

- 7.4.14 Menarini Diagnostics

- 7.4.15 LifeScan (Johnson & Johnson)

- 7.4.16 Senseonics Holdings

- 7.4.17 Medtrum Technologies

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-Need Assessment