PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850188

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850188

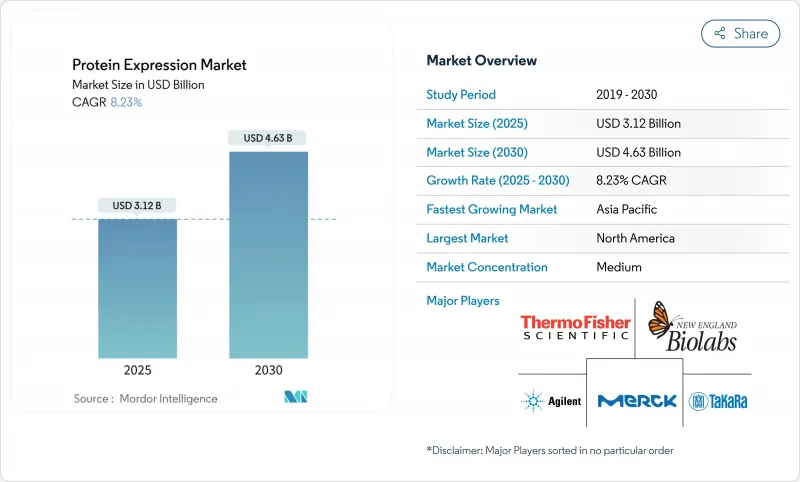

Protein Expression - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The protein expression market size reached USD 3.12 billion in 2025 and is expected to advance to USD 4.63 billion by 2030, reflecting an 8.23% CAGR.

Growth traces back to the rapid shift from conventional recombinant methods toward AI-enabled platforms that fine-tune codon usage, lift yields, and shorten development cycles. Strong R&D budgets by large-cap pharmaceutical firms, such as Thermo Fisher Scientific's USD 2 billion U.S. manufacturing program, are adding modern capacity while de-risking supply chains. Government-funded multi-omics agendas, together with the commercial rollout of continuous-flow micro-bioreactors, dismantle historic scale and cost barriers. Meanwhile, a pipeline of 698 biologics projects at WuXi Biologics illustrates how clinical complexity translates into unrelenting demand for advanced expression technologies.

Global Protein Expression Market Trends and Insights

Rising R&D Investments by Large-Cap Pharma

Industry majors are investing heavily in expression infrastructure; Thermo Fisher Scientific alone allocated USD 2 billion for U.S. expansion that targets both capacity and next-generation process innovation. Such capital flows align with the fact that biologics now account for nearly 70% of biopharmaceutical sales, making dependable protein output a strategic imperative. M&A activity, illustrated by Roche's USD 1 billion agreement to acquire Poseida Therapeutics, concentrates valuable expression know-how within top tier firms. Start-ups also benefit; ExpressionEdits raised USD 13 million to engineer higher-fidelity proteins, signalling broad confidence in the space. As this funding surge translates into new pilot and commercial facilities, the protein expression market experiences stronger order books and faster technology refresh cycles.

Expansion of Therapeutic Biologics Pipeline

WuXi Biologics' 698 active programs, including 51 late-phase projects, highlight the unprecedented scale of clinical development that hinges on sophisticated expression systems. Growing FDA approvals of monoclonal antibodies and the advent of gene-edited cell therapies, such as CASGEVY under Lonza's supply agreement, intensify demand for platforms that can handle complex post-translational requirements. Antibody-drug conjugates and bispecific formats require high-yield mammalian systems, while microbial platforms are being re-engineered to deliver plasmid DNA at commercial scale. This broad modality mix stretches existing capacity and drives multiyear outsourcing contracts, fuelling consistent revenue streams across equipment, reagents, and services. Geographic diversification of clinical trials reinforces the need for local manufacturing footprints in Asia-Pacific and Europe, further widening the protein expression market.

Capital-Intensive High-Throughput Systems

Scaling from 10 to 288 recombinant proteins per week necessitates liquid-handling robots, parallel bioreactors, and integrated purification skids that carry heavy upfront costs. Platforms such as the Protein Expression and Purification Platform rely on fully automated HEK and CHO lines, requiring specialised facilities, ongoing maintenance, and skilled operators. Downstream processing outlays can consume up to 60% of total development budgets, stretching the finances of smaller firms and slowing adoption in lower-income regions. While low-cost DIY reactors offer limited relief, they sacrifice throughput and compliance readiness. This financial barrier narrows supplier diversity and tempers the near-term growth of the protein expression market in capital-constrained geographies.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded Multi-Omics Initiatives

- AI-Optimised Codon Usage Accelerating Yield

- Limited Post-Translational Modification Fidelity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents & Kits captured 47.35% protein expression market share in 2024, underlining their status as indispensable inputs across every workflow, from vector construction to final purification. Service providers are gaining momentum; the segment is forecast to post a 12.25% CAGR through 2030 as developers outsource complex or high-volume programs to partners with proprietary cell lines and GMP suites. KBI Biopharma secured USD 250 million worth of long-term mammalian production contracts that illustrate sustained demand for external expertise.

Innovation within reagents remains brisk: Bioneer's ExiProgen system and newer cell-free formulations cut expression timelines while preserving yields. Meanwhile, multi-modality CDMO deals, reported by BioProcess International, broaden service menus to include cell-free and microbial options, signalling that service revenues will outpace reagent growth as biologic complexity rises. Collectively, these forces deepen the protein expression market, creating parallel revenue streams from consumables and turnkey outsourcing.

The Protein Expression Market Report is Segmented by Product & Services (Reagents & Kits [Cell-Free Expression, Bacterial Expression, and More], Services, and Other Products), Application (Therapeutic, Industrial Enzymes, and More), End User (Academia & Research Institutes, Cros / CDMOs, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Thermo Fisher Scientific

- Merck

- Agilent Technologies

- Takara Bio

- QIAGEN

- Bio-Rad Laboratories

- New England Biolabs

- Promega

- GenScript Biotech

- Lonza Group

- Abcam

- Danaher

- Bio-Techne

- Sino Biological

- Bioneer Corp

- Oxford Expression Technologies

- Synthetic Genomics

- Charles River

- Evitria AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising R&D Investments By Large-Cap Pharma

- 4.2.2 Expansion Of Therapeutic Biologics Pipeline

- 4.2.3 Government-Funded Multi-Omics Initiatives

- 4.2.4 AI-Optimised Codon Usage Accelerating Yield

- 4.2.5 Continuous-Flow Micro-Bioreactors Adoption

- 4.3 Market Restraints

- 4.3.1 Capital-Intensive High-Throughput Systems

- 4.3.2 Limited Post-Translational Modification Fidelity

- 4.3.3 IP Clustering Around AI-Generated Protein Libraries

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product & Services

- 5.1.1 Reagents & Kits

- 5.1.1.1 Cell-free Expression

- 5.1.1.2 Bacterial Expression

- 5.1.1.3 Yeast Expression

- 5.1.1.4 Algal Expression

- 5.1.1.5 Insect Expression

- 5.1.1.6 Mammalian Expression

- 5.1.1.7 Plant-based Expression

- 5.1.2 Services

- 5.1.3 Other Products

- 5.1.1 Reagents & Kits

- 5.2 By Application

- 5.2.1 Therapeutic

- 5.2.2 Industrial Enzymes

- 5.2.3 Research & Discovery

- 5.2.4 Agricultural Biotechnology

- 5.3 By End-user

- 5.3.1 Academia & Research Institutes

- 5.3.2 Biotechnology & Pharmaceutical Companies

- 5.3.3 CROs / CDMOs

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Merck KGaA (Sigma-Aldrich)

- 6.3.3 Agilent Technologies

- 6.3.4 Takara Bio

- 6.3.5 Qiagen

- 6.3.6 Bio-Rad Laboratories

- 6.3.7 New England Biolabs

- 6.3.8 Promega

- 6.3.9 GenScript Biotech

- 6.3.10 Lonza Bioscience

- 6.3.11 Abcam Plc

- 6.3.12 Danaher (Cytiva)

- 6.3.13 Bio-Techne

- 6.3.14 Sino Biological

- 6.3.15 Bioneer Corp

- 6.3.16 Oxford Expression Technologies

- 6.3.17 Synthetic Genomics

- 6.3.18 Charles River Laboratories

- 6.3.19 Evitria AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment