PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850203

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850203

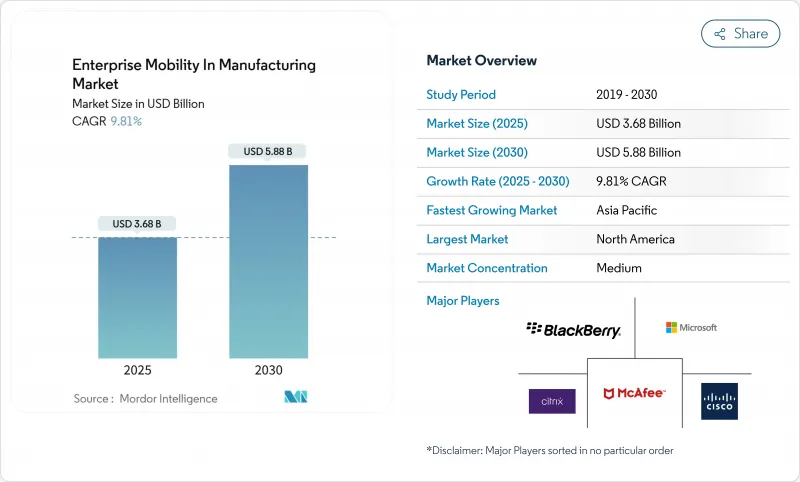

Enterprise Mobility In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The enterprise mobility in manufacturing market size was USD 3.68 billion in 2025 and is forecast to reach USD 5.88 billion by 2030, expanding at a 9.8% CAGR.

The uptrend mirrors the sector's rapid transition toward Industry 4.0, where mobile-enabled workflows shorten response times, elevate asset visibility, and reinforce operational resilience. Growing deployment of private 5G networks, tighter integration between mobile devices and Manufacturing Execution Systems (MES), and the spread of edge-based augmented-reality applications collectively widen use cases for shop-floor mobility. Yet only 16% of manufacturers enjoy real-time production visibility, underscoring the sizeable headroom for digital tools that dissolve long-standing information silos. Cyber-physical security gaps and data-sovereignty constraints temper adoption, pushing vendors toward zero-trust architectures and region-specific cloud strategies.

Global Enterprise Mobility In Manufacturing Market Trends and Insights

Accelerating Industry 4.0 and IIoT adoption

Manufacturers are scaling Industrial Internet of Things deployments from proof-of-concept projects to plant-wide rollouts, linking sensors, machines, and mobile endpoints into unified data loops. Eighty-three percent of producers intend to embed generative AI in decision support during 2024, reflecting confidence that mobile dashboards can operationalize complex analytics at the edge. The pronounced impact shows in process plants where mobile cyber-physical systems let operators tweak parameters remotely in minutes rather than hours. Asian factories lead readiness, with 53% of managers targeting autonomous operations by 2040 compared to under half in Western facilities. Increased IIoT maturity lifts demand for rugged smartphones that merge scanning, visualization, and voice in a single device, streamlining maintenance and quality tasks. Vendors that pre-integrate hardware with low-code app builders shorten deployment cycles and reduce IT overhead.

BYOD/CYOD policies expand connected workforce

Factory policies are shifting from restrictive device rules toward structured Bring-Your-Own-Device and Choose-Your-Own-Device programs that broaden workforce access to digital tools. Sixty-three percent of manufacturers already tolerate personal devices on the floor, yet only 17% run formal BYOD frameworks, signalling a wide adoption gap. Formalized schemes improve agility during labor shortages by allowing new hires to onboard with familiar gear. Samsung's eight-step CYOD blueprint highlights the need for executive sponsorship, risk-based segmentation, and user training to safeguard data while sustaining productivity. Successful rollouts embed enterprise credentials into secure containers, route traffic through zero-trust gateways, and synchronize with MES and ERP back ends. Early adopters report shorter shift handovers and lower provisioning costs relative to a corporate-only hardware fleet.

Cybersecurity vulnerabilities and mobile malware

The fusion of IT and OT domains leaves production assets more exposed, with 93% of firms recording an OT intrusion last year while only 13% enjoy consolidated oversight. Mobile endpoints enlarge the attack surface as legacy antivirus and patch cycles rarely align with continuous operations. Ransomware campaigns increasingly target human-machine interface tablets, locking out supervisors from control systems. Manufacturers counter with micro-segmentation, mobile threat defense agents, and strict least-privilege policies, yet shortages in dual-skilled security professionals slow program maturity. Insurance underwriters respond by demanding proof of zero-trust frameworks before renewing cyber-risk coverage, adding financial pressure to remediate weaknesses.

Other drivers and restraints analyzed in the detailed report include:

- Private 5G and Wi-Fi 6 enable low-latency mobility

- Integration of mobile devices with MES and cloud PLM

- Legacy OT integration complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated 48.7% of total revenue in 2024, confirming smartphones as the primary mobile gateway for factory staff. Their all-in-one scanning, voice, and data functions cut hardware counts and lighten IT provisioning. Over the review period, vendors ruggedized form factors with MIL-STD-810H housings, hot-swappable batteries, and glove-friendly touchscreens, widening suitability for harsh shop-floor conditions. Operators value integrated cameras for remote assistance and AI-driven defect recognition, while supervisors exploit high-resolution displays for KPI dashboards during gemba walks.

The wearables sub-segment nonetheless records a 9.9% CAGR, propelled by hands-free picking, heads-up maintenance, and ergonomic load balancing. Smart glasses paired with digital twins reduce cognitive effort by overlaying repair steps and sensor trends in the worker's line of sight. Tablets anchor quality-assurance benches and engineering work cells where larger screens support CAD drawings and deviation logs. Laptops remain niche-bound to simulation and MES administration tasks that demand full keyboards. Emerging smart rings and industrial handhelds cluster under "other" but signal continual experimentation with task-specific form factors that could reshape device hierarchies as 2030 approaches.

Mobile Device Management held 46.2% revenue in 2024, a reflection of its long tenure as the compliance backbone for corporate-owned phones. MDM suites enforce password hygiene, remote wipe, and application whitelists, aligning with audit mandates under ISO 27001 and NIST CSF guidelines. However, the shift toward heterogenous fleets spanning laptops, scanners, and IoT sensors elevates Unified Endpoint Management to a 10.1% CAGR. UEM consolidates policy orchestration and patch status across Windows, Android, iOS, and Linux, reducing duplicated administrative effort.

Manufacturing clients gravitate to UEM's automation hooks that trigger remedial actions when a device crosses geofences or anomalous traffic trips a zero-trust rule. Mobile Application Management delivers containerization where personal devices participate in BYOD schemes, isolating corporate data without owning the hardware. Stand-alone mobile security plugins add machine-learning-based threat hunts, an asset in plants subject to critical infrastructure standards. Across all solution types, the momentum favors modular subscription bundles that flex with project scope and integrate native analytics consoles to evidence ROI for finance teams.

The Enterprise Mobility in Manufacturing Market is Segmented by Device Type (Smartphones, Tablets, and More), Solution (Mobile Device Management (MDM), and More), Deployment (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Manufacturing Vertical (Discrete Manufacturing and Process Manufacturing), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the enterprise mobility in manufacturing market with 39.1% of 2024 global revenue, benefiting from entrenched automation cultures and well-funded digitization road-maps. United States automotive and aerospace clusters upgrade existing mobility pilots to enterprise scopes, layering 5G campus networks over brownfield PLCs to support autonomous material handling and predictive service. Canada's food-processing sector rises as a niche adopter, harnessing tablets for allergen control and cold-chain documentation.

Europe follows, anchored by Germany's Industry 4.0 program and its Mittelstand champions that retrofit legacy machine parks with mobile dashboards. French pharmaceuticals employ intrinsically safe smartphones for clean-room documentation, while Italian machinery firms deploy augmented-reality wearables for remote field service. EU General Data Protection Regulation drives high demand for on-device encryption and data-sovereign cloud options, shaping procurement criteria across the bloc.

Asia-Pacific is the fastest-growing territory, posting a 10.4% CAGR as China, India and Southeast Asian economies leapfrog legacy systems. Chinese electronics giants deploy private 5G slices across megafactories to coordinate human and robotic tasks. India's government incentives under the Production Linked Incentive scheme accelerate SME adoption of cloud-based mobility dashboards. Singapore and South Korea spearhead pilot zones where smart-glasses equipped technicians interface with digital twins hosted in sovereign clouds. The region's momentum signals a potential shift in revenue leadership beyond 2030 as plants embrace high-density automation paired with mobile workforce augmentation.

- VMware, Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- Blackberry Limited

- Citrix Systems, Inc.

- IBM Corporation

- SAP SE

- Oracle Corporation

- Broadcom Inc. (Symantec)

- MobileIron (Ivanti)

- SOTI Inc.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Samsung SDS Co., Ltd.

- Infosys Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- McAfee, LLC

- Workspot, Inc.

- Tylr Mobile, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Industry 4.0 and IIoT adoption

- 4.2.2 BYOD/CYOD policies expand connected workforce

- 4.2.3 Private 5G and Wi-Fi 6 enable low-latency mobility

- 4.2.4 Integration of mobile devices with MES and cloud PLM

- 4.2.5 Edge-powered AR and digital twins boost rugged-tablet demand

- 4.2.6 Paperless ESG compliance drives mobile e-logbooks

- 4.3 Market Restraints

- 4.3.1 Cybersecurity vulnerabilities and mobile malware

- 4.3.2 Legacy OT integration complexity

- 4.3.3 Data-sovereignty barriers to mobile cloud

- 4.3.4 Limited supply of ATEX-certified intrinsically-safe devices

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Smartphones

- 5.1.2 Tablets

- 5.1.3 Laptops

- 5.1.4 Wearables

- 5.1.5 Other Device Types

- 5.2 By Solution

- 5.2.1 Mobile Device Management (MDM)

- 5.2.2 Mobile Application Management (MAM)

- 5.2.3 Mobile Security and Threat Defense

- 5.2.4 Unified Endpoint Management (UEM)

- 5.2.5 Other Solutions

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Manufacturing Vertical

- 5.5.1 Discrete Manufacturing

- 5.5.1.1 Automotive

- 5.5.1.2 Electronics and Semiconductor

- 5.5.1.3 Aerospace and Defense

- 5.5.1.4 Industrial Machinery

- 5.5.1.5 Others

- 5.5.2 Process Manufacturing

- 5.5.2.1 Food and Beverage

- 5.5.2.2 Pharmaceuticals and Life Sciences

- 5.5.2.3 Chemicals

- 5.5.2.4 Oil and Gas

- 5.5.2.5 Metals and Mining

- 5.5.2.6 Others

- 5.5.1 Discrete Manufacturing

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 Blackberry Limited

- 6.4.5 Citrix Systems, Inc.

- 6.4.6 IBM Corporation

- 6.4.7 SAP SE

- 6.4.8 Oracle Corporation

- 6.4.9 Broadcom Inc. (Symantec)

- 6.4.10 MobileIron (Ivanti)

- 6.4.11 SOTI Inc.

- 6.4.12 Zebra Technologies Corporation

- 6.4.13 Honeywell International Inc.

- 6.4.14 Samsung SDS Co., Ltd.

- 6.4.15 Infosys Limited

- 6.4.16 Tata Consultancy Services Limited

- 6.4.17 Tech Mahindra Limited

- 6.4.18 McAfee, LLC

- 6.4.19 Workspot, Inc.

- 6.4.20 Tylr Mobile, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment