PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907335

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907335

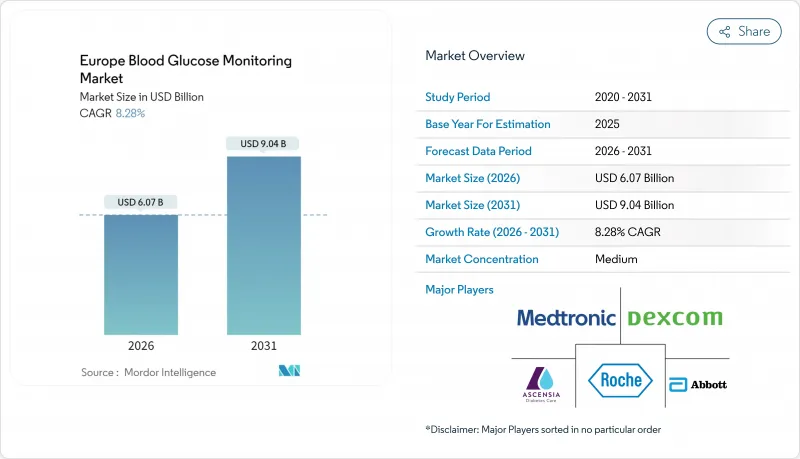

Europe Blood Glucose Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe blood glucose monitoring market is expected to grow from USD 5.61 billion in 2025 to USD 6.07 billion in 2026 and is forecast to reach USD 9.04 billion by 2031 at 8.28% CAGR over 2026-2031.

The region is shifting from episodic finger-stick testing toward integrated continuous glucose monitoring as statutory payers expand coverage and device accuracy improves. Convergence of sensors, cloud platforms and automated insulin delivery strengthens clinical outcomes while streamlining daily management for millions living with diabetes. Germany's statutory health insurance contracts and the United Kingdom's artificial-pancreas rollout validate scalable reimbursement blueprints, whereas Nordic programs showcase data-sharing frameworks that accelerate remote care. Intensifying competition, reinforced by a 10-year patent truce between Abbott and Dexcom, is spurring next-generation features such as predictive analytics, longer sensor life and non-invasive form factors. Supply-chain risk management, notably under new European Commission notice rules, now shapes procurement strategy as much as raw innovation.

Europe Blood Glucose Monitoring Market Trends and Insights

Ageing Population Drives Unprecedented Diabetes Burden Across European Demographics

An ageing population enlarges the addressable base of users for Europe blood glucose monitoring market devices. Scientific Reports confirms that 61 million Europeans aged 20-79 live with diabetes, with projections indicating 69 million by 2045. Eastern and Southern economies exhibit the steepest comorbidity indices, concentrating demand into health systems with limited fiscal capacity. NHS England data registers half a million newly identified people at high risk of type 2 diabetes in 1 year, underscoring preventive screening momentum. The demographic wave supports multisector collaboration on earlier detection, remote follow-up and coaching. Over the long term, risk-stratified programs are expected to anchor stable device utilisation and recurring sensor revenues across the continent.

Technology Convergence Eliminates Traditional CGM-SMBG Boundaries Through Accuracy Innovations

European clinicians now compare continuous and capillary monitoring on equal analytical footing as sensor MARD falls below 9%. Dexcom G7 records an 8.0% MARD with a 15.5-day wear period. Abbott FreeStyle Libre 3 streams glucose every minute over 14 days, while Medtronic's MiniMed 780G auto-adjusts insulin every 5 minutes, eliminating routine finger-stick confirmation. Roche gained CE Mark for its Accu-Chek SmartGuide CGM with AI-driven hypoglycaemia prediction in July 2024. FDA iCGM rules now benchmark accuracy across populations, further harmonising evidence requirements. Together, these milestones dissolve historical silos between SMBG and CGM device classes and lift replacement cycles.

High CGM Device Costs Create Access Barriers Despite Proven Clinical Benefits

Unit economics remain a hurdle for budget-constrained systems in Eastern and Southern Europe. France's 2025 Social Security Financing Law already projects a EUR 22 billion deficit even as health insurance outlays rise 3.4% to EUR 265.9 billion. A French cost-utility study finds CGM adds EUR 4.6 million in device costs yet lowers long-run admissions, yielding net savings over the forecast horizon. Still, Dexcom identifies limited funding and restrictive inclusion rules as top adoption barriers in its 2025 European clinician survey. German insurers require independent medical reviews to validate intensive insulin use before approving CGM, adding administrative friction. These cost concerns temper otherwise strong demand trajectories.

Other drivers and restraints analyzed in the detailed report include:

- European Reimbursement Revolution Unlocks CGM Access for Type 2 Diabetes Populations

- Digital Health Platform Integration Transforms Diabetes Management Through Remote Monitoring Capabilities

- Semiconductor MEMS Supply Chain Constraints Threaten Medical Device Production Continuity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Self-monitoring blood glucose preserved 59.85% Europe blood glucose monitoring market share in 2025 due to low upfront cost and entrenched clinical routines. Single-use test strips remain the highest-volume consumable, especially across primary care for type 2 patients managing weight and oral medication. Nonetheless, the continuous glucose monitoring segment increases at a 14.80% CAGR to 2031 and now anchors most strategic investment. Europe blood glucose monitoring market size for CGM sensors alone is projected to add USD 1.36 billion between 2026 and 2031, reflecting transitions from early adopters to mainstream prescriptions. Breakthrough accuracy gains - Dexcom G7's 8.0% MARD and Abbott Libre 3's one-minute transmission - elevate clinical confidence and simplify reimbursement dossiers. Integration with insulin pumps, as in Omnipod 5's linkage to Libre 2 Plus, further blurs hardware boundaries.

Durable components such as transmitters and receivers underpin recurring sensor revenue, while algorithm licences emerge as a nascent value pool. Non-invasive optics, led by DiaMonTech and EU-funded Talisman prototypes, promise step-change convenience if precision thresholds are met. FDA iCGM regulation now harmonises performance trials, encouraging SMBG incumbents like Roche to re-enter with AI-enabled platforms. Collectively, these shifts redirect R&D budgets from strip chemistry to sensor firmware, real-time analytics and cloud connectivity, reshaping supply chains and distributor training curricula.

The Europe Blood Glucose Monitoring Market Report is Segmented by Device Type (Self-Monitoring Blood Glucose Devices [Glucometer Devices, Test Strips, and Lancets] and Continuous Glucose Monitoring Devices [Sensors and Durables]), End User (Home Healthcare, Hospitals & Clinics, and Pharmacies & Others), and Geography (Germany, France, United Kingdom, Italy, Spain and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Dexcom

- Medtronic

- Ascensia

- Lifescan

- Senseonics, Inc.

- Ypsomed

- Nova Biomedical

- Nipro

- I-Sens

- Arkray

- AgaMatrix

- Bionime

- Acon Labs

- Rossmax

- Terumo

- Trividia Health

- Medisana

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing & Diabetes Prevalence Surge

- 4.2.2 CGM-SMBG Technology Convergence & Accuracy Gains

- 4.2.3 Expanded Public Reimbursement For CGM Sensors

- 4.2.4 Digital-Health Platform Integration & Remote Monitoring

- 4.2.5 Raising Need Of Hypoglycaemia Monitoring

- 4.3 Market Restraints

- 4.3.1 High Cost Of CGM Devices & Consumables

- 4.3.2 Semiconductor MEMS Supply-Chain Constraints

- 4.3.3 GDPR Data-Privacy Compliance Burden

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (value, USD)

- 5.1 By Device Type

- 5.1.1 Self-Monitoring Blood Glucose Devices

- 5.1.1.1 Glucometer Devices

- 5.1.1.2 Test Strips

- 5.1.1.3 Lancets

- 5.1.2 Continuous Glucose Monitoring Devices

- 5.1.2.1 Sensors

- 5.1.2.2 Durables

- 5.1.1 Self-Monitoring Blood Glucose Devices

- 5.2 By End User

- 5.2.1 Home Healthcare

- 5.2.2 Hospitals & Clinics

- 5.2.3 Pharmacies & Others

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche

- 6.3.3 Dexcom Inc.

- 6.3.4 Medtronic plc

- 6.3.5 Ascensia Diabetes Care

- 6.3.6 LifeScan Inc.

- 6.3.7 Senseonics, Inc.

- 6.3.8 Ypsomed AG

- 6.3.9 Nova Biomedical

- 6.3.10 Nipro

- 6.3.11 i-Sens

- 6.3.12 Arkray

- 6.3.13 Agamatrix

- 6.3.14 Bionime

- 6.3.15 Acon Labs

- 6.3.16 Rossmax

- 6.3.17 Terumo

- 6.3.18 Trividia Health

- 6.3.19 Medisana

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment