PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850226

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850226

Vacuum Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

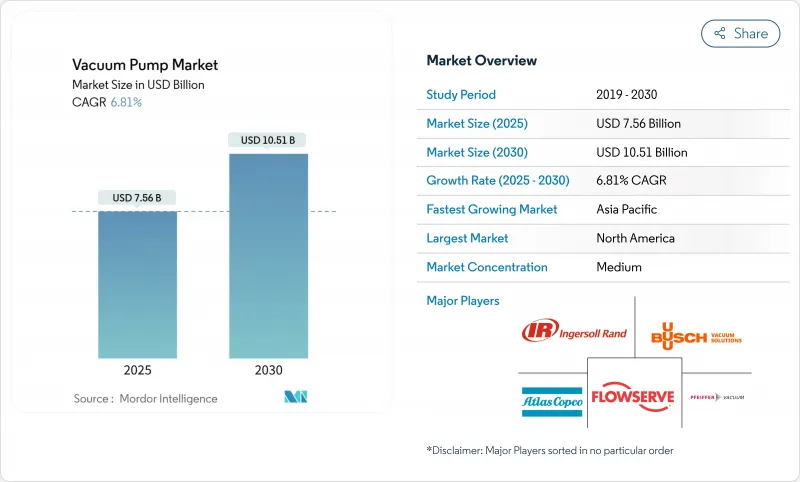

The vacuum pump market is valued at USD 7.56 billion in 2025 and is projected to reach USD 10.51 billion by 2030, translating to a 6.81% CAGR.

Demand pivots from general industrial duty toward ultra-clean, high-throughput environments in semiconductor lithography, battery manufacturing and biologics fill-finish. Mechanical architectures continue to dominate, yet dry-running variants accelerate as fabs and cell plants eliminate hydrocarbon risk and prepare for PFAS lubricant bans. Supply-side investment underwrites this trajectory: Edwards Vacuum is spending USD 319 million on a New York dry-pump plant to serve domestic chip fabs, while Atlas Copco deepens capacity via bolt-on acquisitions in Korea and China. Regulatory calls for energy frugality further stimulate adoption of smart, variable-speed systems able to cut pump-related power loads by 20-30%.

Global Vacuum Pump Market Trends and Insights

Semiconductor-grade vacuum in EUV lithography

Transition to EUV at sub-7 nm nodes forces pumps to maintain pressures below 10-9 mbar while safely managing hydrogen flows. Edwards Vacuum's recovery modules now reclaim up to 80% of process hydrogen, saving fabs millions in running costs and strengthening demand for premium ultra-high-vacuum (UHV) assemblies. ASML's forecast that global chip revenue will surpass USD 1 trillion by 2030 underpins a rising installed base where each EUV scanner integrates multiple UHV pumps. Source-efficiency gains of 280% since 2017 tighten tolerances and reward suppliers with advanced bearing and materials science. Market entry barriers hence protect incumbents from price erosion and anchor the premium positioning of UHV portfolios.

Accelerated LNG capacity additions post-2025

Electrified liquefaction trains at Cedar LNG in Canada and Qatar's CO2-managed mega-trains specify vacuum pumps rated for -162 °C duty and carbon-capture integration.The low-carbon LNG roadmap increases precision and reliability requirements, steering orders toward suppliers with proven cryogenic pedigrees. Long project cycles lock in equipment choices early, giving incumbents multi-year revenue visibility. As LNG feed-gas volatility intersects with emissions targets, high-efficiency pumps provide an operational hedge against energy cost spikes.

Volatile rare-earth prices (NdFeB motors)

Motor costs for turbomolecular units rise when neodymium prices spike, pressuring margins in segments relying on high-speed magnetic bearings. Supply-chain concentration in China magnifies exposure. Manufacturers experiment with ferrite or samarium-cobalt solutions, but trade-offs in size and efficiency constrain adoption for precision tasks. Contract hedging and dual-sourcing partly buffer the risk yet cannot eliminate the near-term cost drag.

Other drivers and restraints analyzed in the detailed report include:

- Rapid uptake of Industry 4.0 smart pumps

- Growth of global biologics fill-finish lines

- Stricter PFAS lubricant regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mechanical pumps generated the largest slice of the vacuum pump market in 2024, anchored by rotary-vane designs that captured 28% of vacuum pump market share. Reliability under medium vacuum and cost competitiveness sustain adoption across packaging, chemicals and chip backend processes. Yet high-growth niches now emerge in kinetic and entrapment families. Cryogenic entrapment models are forecast to lift the vacuum pump market size by 8.70% CAGR as hydrogen liquefaction, space simulation and quantum computing labs specify sub-5 K environments. Vendors blend traditional cast-iron robustness with digital controls to deliver hybrid value propositions.

Smart-ready mechanical skids integrate pressure sensors, vibration monitors and cloud gateways to create data loops that feed fab-wide asset health platforms. Edwards and Pfeiffer leverage integrated controller stacks to shorten commissioning time and simplify SEMI S2 compliance checks. Moreover, modular layouts let end users upgrade from oil-sealed to dry configurations without re-piping entire lines, preserving sunk capital while meeting contamination limits. Competitive advantage now rests on lifecycle cost models that factor energy, consumables and unscheduled downtime rather than headline purchase price.

Dry pumps represented 53% of the vacuum pump market in 2024 and are expected to grow 8.50% CAGR through 2030 as fabs pursue zero-contamination regimes. Eliminating oil removes wafer-killing aerosols and helps battery cell makers maintain electrode purity. Stringent PFAS curves reinforce the shift by raising uncertainty over continued use of fluorinated oils. Busch's COBRA NC portfolio highlights gains: 55% energy savings and 30% lower maintenance hours translate into breakeven payback within 18 months for high-duty installations.

Oil-sealed pumps remain relevant in labs and general industry where target vacua are moderate and budgets tight. Here, suppliers differentiate through hybrid designs featuring gas ballast enhancements that cut oil backstreaming. Some OEMs bundle environmental packages-micro-mist filters and closed-loop oil reclaim-to extend the life of legacy assets while easing compliance risk. Over the forecast horizon, dry technology is set to become baseline for any facility rated ISO Class 5 or better.

The Industrial Vacuum Pumps Market is Segmented by Pump Principle (Rotary, Reciprocating, Kinetic, Dynamic, Entrapment, Cryogenic, Getter, Ion), by Lubrication (Dry Vacuum Pumps, Oil-Sealed / Wet Vacuum Pumps), by Vacuum Level (Rough / Low, Medium, High, and More), by End-User Application (Oil and Gas, Semiconductor and Electronics, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC anchored 48% of the vacuum pump market in 2024 and is forecast to expand 7.80% CAGR through 2030. China, Japan and South Korea house >65% of global wafer starts, making them bellwethers for high-end demand. Government incentives-such as India's USD 10 billion semiconductor subsidy-signal diffusion of regional capacity and incremental vacuum pull. Local battery giants CATL, LG Energy Solution and Panasonic schedule gigafactory expansions that will each require thousands of dry screw pumps for electrode and coating lines.

North America repositions supply chains via the CHIPS and Science Act. Edwards' USD 319 million Genesee County plant will output 10,000 dry pumps annually, cutting import lead-times by eight weeks and shrinking fabs' carbon footprints. Regional OEMs pair production moves with digital service centers, improving mean-time-to-repair for domestic customers.

Europe maintains focus on advanced packaging, GaN and SiC materials, leveraging Horizon EU funding for energy-efficient process equipment. Atlas Copco's technology centers in Sweden and Belgium advance variable-speed compression platforms that share controls, spare parts and service crews with adjacent vacuum portfolios. Middle East and Africa are niche today yet benefit from LNG liquefaction projects requiring large-capacity cryogenic pumps paired with CO2 capture modules-footholds that could mature into wider regional opportunities post-2030.

- Atlas Copco AB

- Ingersoll Rand

- Busch Vacuum Solutions

- Pfeiffer Vacuum

- ULVAC Inc.

- Flowserve Corp.

- Agilent Technologies

- Leybold GmbH

- Ebara Corporation

- Shimadzu Corporation

- Gardner Denver

- Kinney (Tuthill)

- Osaka Vacuum

- Kashiyama Industries

- Becker Pumps

- Graham Corporation

- Wintek Corporation

- Tsurumi Mfg.

- Shinko Seiki Co., Ltd.

- Leyco Vacuum

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Semiconductor-grade vacuum in EUV lithography

- 4.2.2 Accelerated LNG capacity additions post-2025

- 4.2.3 Rapid uptake of Industry 4.0 smart pumps

- 4.2.4 Growth of global biologics fill-finish lines

- 4.2.5 Battery-grade graphite anode production boom

- 4.2.6 Green-hydrogen electrolyzer build-out

- 4.3 Market Restraints

- 4.3.1 Volatile rare-earth prices (NdFeB motors)

- 4.3.2 Stricter PFAS lubricant regulations

- 4.3.3 High TCO in ultra-high-vacuum (UHV) ranges

- 4.3.4 Skilled-labor shortage for pump servicing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Pump Principle (Mechanical vs Entrapment)

- 5.1.1 Mechanical (Rotary, Reciprocating, Kinetic, Dynamic)

- 5.1.2 Entrapment (Cryogenic, Getter, Ion)

- 5.2 By Lubrication

- 5.2.1 Dry Vacuum Pumps

- 5.2.2 Oil-Sealed / Wet Vacuum Pumps

- 5.3 By Vacuum Level (ISO/ASTM Pressure Range)

- 5.3.1 Rough / Low (103-1 mbar)

- 5.3.2 Medium (1-10-3 mbar)

- 5.3.3 High (10-3-10-7 mbar)

- 5.3.4 Ultra-High / Extreme (<10-7 mbar)

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Semiconductor and Electronics

- 5.4.3 Pharmaceutical and Biotechnology

- 5.4.4 Chemical Processing

- 5.4.5 Food and Beverage

- 5.4.6 Power Generation

- 5.4.7 Wood, Paper and Pulp

- 5.4.8 Others (Metallurgy, Research and Development)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Australia

- 5.5.4.7 Rest of APAC

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Atlas Copco AB

- 6.4.2 Ingersoll Rand

- 6.4.3 Busch Vacuum Solutions

- 6.4.4 Pfeiffer Vacuum

- 6.4.5 ULVAC Inc.

- 6.4.6 Flowserve Corp.

- 6.4.7 Agilent Technologies

- 6.4.8 Leybold GmbH

- 6.4.9 Ebara Corporation

- 6.4.10 Shimadzu Corporation

- 6.4.11 Gardner Denver

- 6.4.12 Kinney (Tuthill)

- 6.4.13 Osaka Vacuum

- 6.4.14 Kashiyama Industries

- 6.4.15 Becker Pumps

- 6.4.16 Graham Corporation

- 6.4.17 Wintek Corporation

- 6.4.18 Tsurumi Mfg.

- 6.4.19 Shinko Seiki Co., Ltd.

- 6.4.20 Leyco Vacuum

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment