PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850282

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850282

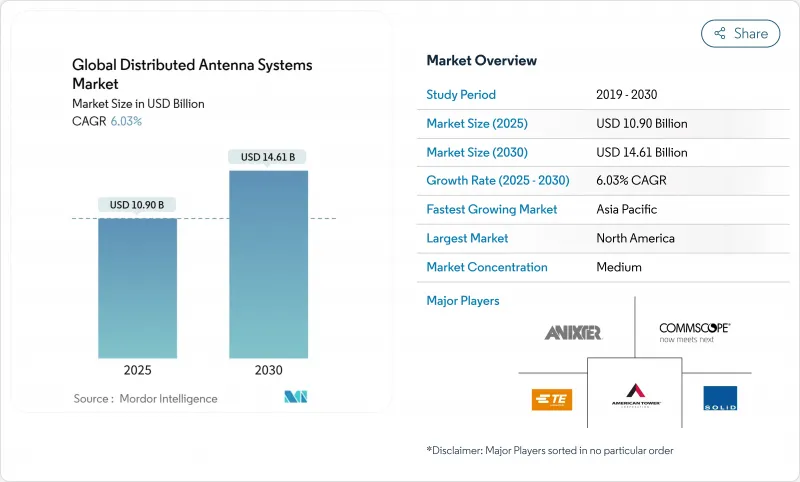

Global Distributed Antenna Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Distributed Antenna Systems Market size is estimated at USD 10.90 billion in 2025, and is expected to reach USD 14.61 billion by 2030, at a CAGR of 6.03% during the forecast period (2025-2030).

The distributed antenna systems market size stands at USD 10.90 billion in 2025 and is forecast to reach USD 14.61 billion by 2030, reflecting a 6.03% CAGR over the period. Demand is accelerating as 5G densification exposes indoor coverage gaps, while neutral-host business models ease capital burdens for venue owners. Passive architecture continues to dominate cost-sensitive deployments, and regulatory mandates for public-safety radio coverage keep the spending cycle resilient during economic swings. Artificial-intelligence-based self-optimizing networks are beginning to trim operating costs, and digital DAS designs are tempering energy draw, aligning deployments with rising corporate sustainability goals.

Global Distributed Antenna Systems Market Trends and Insights

5G Network Densification Boosting Indoor-Coverage Demand

Mobile data-use patterns confirm that more than 80% of traffic originates indoors, yet the same mid-band and millimeter-wave signals powering high-capacity 5G cells attenuate quickly inside buildings. These physics trigger urgent demand for in-building infrastructure, leading carriers such as Verizon to pair fixed-wireless offerings with millimeter-wave DAS rollouts to sustain service quality. Venue owners now link property valuations to guaranteed indoor connectivity, compelling investment decisions even in cost-sensitive commercial real-estate segments.

Regulatory Mandates for In-Building Public-Safety Coverage

Building codes modeled on the International Fire Code require 95% signal coverage throughout facilities and 99% in critical zones such as stairwells, creating non-discretionary demand for public-safety DAS. Annual recertification under National Fire Protection Association rules adds a recurring-services layer to revenue streams. As mandates spread to hospitals and transit hubs, public-safety DAS is becoming baseline building infrastructure rather than an optional amenity.

Multi-Operator Coordination & Spectrum-Clearance Complexity

Deployments that must satisfy four or more mobile network operators can stall for 6-12 months while parties align on design, signal sources, and frequency clearance. Digital DAS platforms lighten this burden by offering software-defined flexibility, but neutral-host integrators who broker end-to-end solutions frequently expedite rollouts by absorbing the complexity on behalf of property owners.

Other drivers and restraints analyzed in the detailed report include:

- Neutral-Host Business Models Lowering Property-Owner CAPEX

- AI-Driven DAS Self-Optimisation Lowers Network OPEX

- Sustainability Pressure on Energy-Intensive Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passive architectures captured a 63% distributed antenna systems market share in 2024, appealing to owners of mid-sized venues who prioritize low installation cost and simple maintenance. These systems route RF over coaxial cables and splitters, eliminating the need for extensive active electronics and thereby shrinking power requirements. Hybrid DAS, combining fiber backhaul and passive distribution, is forecast to grow at a 9.06% CAGR as it balances performance and budget constraints in hospitality properties and academic campuses. Active DAS retains its role in large stadiums and airports where blanket coverage and high capacity override cost concerns, while digital DAS gains traction for its software-defined flexibility that future-proofs multi-operator support.

Converging technology roadmaps blur historical boundaries among categories. Corning's Everon 5G Enterprise Radio Access Network integrates small-cell radios with DAS head-ends, trimming installation time 75% and ownership costs 50% compared with earlier systems. Vendors increasingly highlight energy savings and modular scalability, positioning next-generation platforms to satisfy both performance and sustainability requirements without locking buyers into fixed topologies.

Global Distributed Antenna Systems Market Report is Segmented by Type (Active, Passive, and More), End-User (Manufacturing, Healthcare, Government and Public Safety, Transportation and Logistics, Sports and Entertainment Venues, and More), Application (Enterprise DAS, Public Safety DAS, Neutral-Host / Multi-Operator DAS), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 39% distributed antenna systems market share in 2024, propelled by strict public-safety codes and rapid 5G rollouts. Requirements embedded in the International Fire Code and National Fire Protection Association standards create mandatory demand regardless of macroeconomic cycles. Carriers in the United States lean heavily on millimeter-wave small cells and DAS to complement macro densification, and property owners increasingly prefer neutral-host platforms that cap upfront costs while enhancing coverage.

Europe exhibits steady replacement demand as older office stock undergoes retrofit to meet revised building codes and sustainability targets. Both the United Kingdom and Germany extend early examples of multi-operator negotiation complexity, often lengthening deployment timelines but providing fertile ground for integrators able to streamline approvals. Meanwhile, government-backed broadband agendas in France and Spain channel grants toward digital infrastructure, carving a path for public-private DAS partnerships in transport hubs and healthcare campuses.

Asia-Pacific is the fastest-growing region at a 9.37% CAGR through 2030, buoyed by China's ongoing urbanization, Japan's high-density transit systems, and India's catch-up investments in premium commercial real estate. Chinese deployments align with smart-city projects that merge DAS with IoT sensor backbones, while Japanese operators prioritize seamless connectivity in metro stations and commercial complexes ahead of large sporting events. Spectrum-sharing mechanisms such as Japan's local 5G and India's private LTE licenses provide the regulatory runway for neutral-host experiments, reflecting a broader shift toward cost-optimized indoor coverage models across the region.

- CommScope Holding Company Inc.

- Corning Incorporated

- ATandT Inc.

- American Tower Corporation

- Cobham Limited

- SOLiD Inc.

- TE Connectivity Ltd.

- Comba Telecom Systems Holdings Ltd.

- Boingo Wireless Inc.

- JMA Wireless

- Dali Wireless Inc.

- Zinwave (Wilson Electronics)

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Radio Frequency Systems (RFS)

- Advanced RF Technologies (ADRF) Inc.

- PBE Axell Wireless

- Maven Wireless Sweden AB

- Baicells Technologies Co. Ltd.

- Tower Bersama Group

- Anixter International Inc. (Wesco)

- Amphenol Corporation

- Antenna Products Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G network densification boosting indoor-coverage demand

- 4.2.2 Regulatory mandates for in-building public-safety coverage

- 4.2.3 Neutral-host business models lowering property-owner CAPEX

- 4.2.4 AI-driven DAS self-optimisation lowers network OPEX

- 4.3 Market Restraints

- 4.3.1 Multi-operator coordination and spectrum-clearance complexity

- 4.3.2 Sustainability pressure on energy-intensive systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Active

- 5.1.2 Passive

- 5.1.3 Digital

- 5.1.4 Hybrid

- 5.2 By End-User

- 5.2.1 Manufacturing

- 5.2.2 Healthcare

- 5.2.3 Government and Public Safety

- 5.2.4 Transportation and Logistics

- 5.2.5 Sports and Entertainment Venues

- 5.2.6 Telecommunications Operators

- 5.2.7 Other Commercial Sectors

- 5.3 By Application

- 5.3.1 Enterprise DAS

- 5.3.2 Public Safety DAS

- 5.3.3 Neutral-Host / Multi-Operator DAS

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CommScope Holding Company Inc.

- 6.4.2 Corning Incorporated

- 6.4.3 ATandT Inc.

- 6.4.4 American Tower Corporation

- 6.4.5 Cobham Limited

- 6.4.6 SOLiD Inc.

- 6.4.7 TE Connectivity Ltd.

- 6.4.8 Comba Telecom Systems Holdings Ltd.

- 6.4.9 Boingo Wireless Inc.

- 6.4.10 JMA Wireless

- 6.4.11 Dali Wireless Inc.

- 6.4.12 Zinwave (Wilson Electronics)

- 6.4.13 Nokia Corporation

- 6.4.14 Ericsson AB

- 6.4.15 Huawei Technologies Co. Ltd.

- 6.4.16 Radio Frequency Systems (RFS)

- 6.4.17 Advanced RF Technologies (ADRF) Inc.

- 6.4.18 PBE Axell Wireless

- 6.4.19 Maven Wireless Sweden AB

- 6.4.20 Baicells Technologies Co. Ltd.

- 6.4.21 Tower Bersama Group

- 6.4.22 Anixter International Inc. (Wesco)

- 6.4.23 Amphenol Corporation

- 6.4.24 Antenna Products Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment