PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850351

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850351

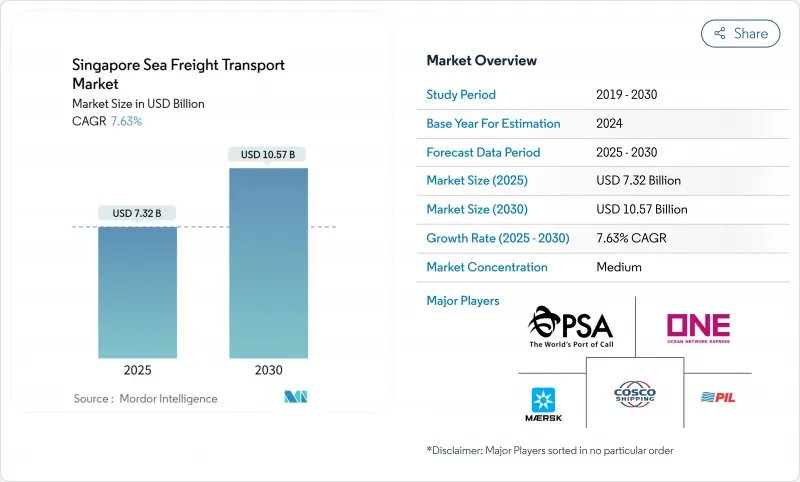

Singapore Sea Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Singapore Sea Freight Transport Market size is estimated at USD 7.32 billion in 2025, and is expected to reach USD 10.57 billion by 2030, at a CAGR of 7.63% during the forecast period (2025-2030).

This momentum rests on the phased shift of all container activity to Tuas Mega-Port, a move that frees berth capacity while cutting vessel turnaround times. Digital tools-most notably electronic bills of lading and a unified port community system-are trimming paperwork and giving carriers fresh reasons to keep Singapore at the centre of their networks. Preferential trade pacts widen the export hinterland and, together with a manufacturing tilt toward Southeast Asia, are lifting outbound TEU counts. A growing stream of liquid bulk linked to cleaner energy and a modal swing toward sea freight for temperature-controlled pharmaceuticals add further lift. Rising bunker costs and price competition from Malaysian neighbours remain watch points, yet the combination of new capacity and more diversified trade lanes keeps the growth outlook firmly on course.

Singapore Sea Freight Transport Market Trends and Insights

Tuas Mega-Port Consolidation Elevating Throughput

The consolidation of legacy city terminals into Tuas Mega-Port is transforming Singapore's competitiveness by pushing planned capacity toward 65 million TEUs in the 2040s-almost double the 37.5 million TEUs handled in 2021 . Phase 1, opened in 2022, already deploys more than 200 Automated Guided Vehicles, while an event-driven digital backbone orchestrates yard moves in real time. Because the facility sits on a single contiguous coastline, internal trans-shifts fall sharply, improving crane utilisation and vessel turnaround. The resulting predictability lets carriers rationalise dual calls on the same loop, freeing vessel days for extra sailings. An immediate inference is that shipping lines gain both cost savings and greenhouse-gas reductions through shorter port dwell, tightening Singapore's hold on hub status.

ASEAN Manufacturing Shift Driving Export TEUs

Relocation of electronics, precision-engineering and consumer-durables production from North Asia into ASEAN is pumping new export volumes through Singapore. United Microelectronics Corp.'s USD 5 billion semiconductor fab and similar investments pull in wafer tools, chemicals and finished chips that ride outbound feeder services before transhipment onto deep-sea loops. Vietnam's industrial expansion follows an identical pattern, using Singapore as its load-centre gateway via digital trade corridors being built by YCH Group and Vietnam Post. The widened supplier footprint spreads geopolitical risk and deepens network density, indicating that intra-ASEAN demand will support berth utilisation even when global cycles soften.

Volatile Bunker Prices Translating into Higher Freight Rates

Container spot rates on several long-haul trades more than doubled through late 2024, propelled by a 256 % spike on the Shanghai-Europe route tied to Red Sea diversions. In Singapore, biofuel bunkering volumes tripled in 2023, adding a fresh price reference to carriers' fuel cost base. Although alternative grades help with decarbonisation targets, their nascent supply chains inject volatility into index-linked fuel surcharges. Shippers therefore prioritise ports with minimal in-harbour delay so that bunker burn remains predictable; Singapore's efficiency gains cushion, but do not eliminate, that volatility.

Other drivers and restraints analyzed in the detailed report include:

- Preferential Trade Agreements Cutting Sea-Freight Costs

- DigitalPORT@SG & Electronic Bill-of-Lading Adoption

- Competitive Pressure from Port Klang & Tanjung Pelepas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Containerised cargo commands a 61% Singapore Sea Freight market share in 2024, and its prominence is expected to persist through 2030 as reefer adoption widens. Higher uptake of temperature-controlled boxes for vaccines and biologics is pushing PSA to add plug points and controlled-atmosphere monitoring, making container operations a strategic enabler for life-science exporters. Liquid bulk shows the fastest forecast growth at 8.1% CAGR, propelled by biofuel blending and nascent green-ammonia projects that need dedicated berths on Jurong Island. Dry bulk volumes grow modestly on the back of regional construction demand, while general cargo and roll-on/roll-off remain stable niches. The interplay of automation, digital twins, and blockchain within these segments boosts predictability, allowing terminal operators to fine-tune yard staging for each commodity class.

The Singapore Sea Freight Transport Market Report Segments the Industry Into by Cargo Type (Containerized Cargo, Dry Bulk Cargo and More), by End User Industry (Electronics & Semiconductors, Chemicals & Petrochemicals, Food & Beverage and More), by Trade Lane (Intra-Asia, North America, Europe and More) and by Region/Port Cluster(West Region, Central Region and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PSA International

- Ocean Network Express (ONE)

- Pacific International Lines (PIL)

- A.P. Moller-Maersk Singapore

- CMA CGM & ANL (Singapore)

- Evergreen Marine (Singapore)

- Hapag-Lloyd (Singapore)

- Cosco Shipping Lines (Singapore)

- Yang Ming (Singapore)

- X-Press Feeders (Sea Consortium)

- DHL Global Forwarding Singapore

- Kuehne + Nagel Singapore

- NYK Line (Yusen Logistics)

- DSV Air & Sea Singapore

- Sinotrans Singapore

- Agility Logistics Singapore

- Toll Group Singapore

- OOCL (Singapore)

- FedEx Logistics Singapore

- CEVA Logistics Singapore*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consolidation of City Terminals into Tuas Mega-Port Elevating Throughput

- 4.2.2 ASEAN Manufacturing Shift Driving Export TEUs from Singapore

- 4.2.3 Preferential Trade Agreements (RCEP, CPTPP) Cutting Sea-Freight Costs

- 4.2.4 DigitalPORT@SG & Electronic Bill-of-Lading Adoption Shortening Dwell-Time

- 4.2.5 Expansion of Cold-Chain TEUs for Pharma & Perishables

- 4.2.6 Green & Digital Shipping-Corridor Initiatives

- 4.3 Market Restraints

- 4.3.1 Volatile Bunker Prices Translating into Higher All-in Freight Rates

- 4.3.2 Competitive Pressure from Port Klang & Tanjung Pelepas Feeder Rates

- 4.3.3 Shortage of 40-ft High-Cube Reefers During Peak Season

- 4.3.4 Tight Trucking Capacity for First/Last-Mile on Jurong Island

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Cargo Type

- 5.1.1 Containerized Cargo

- 5.1.1.1 Dry

- 5.1.1.2 Reefer

- 5.1.2 Dry Bulk Cargo

- 5.1.3 Liquid Bulk Cargo

- 5.1.4 General Cargo

- 5.1.5 Roll-On/Roll-Off Cargo

- 5.1.1 Containerized Cargo

- 5.2 By End-User Industry

- 5.2.1 Electronics & Semiconductors

- 5.2.2 Chemicals & Petrochemicals

- 5.2.3 Food & Beverage

- 5.2.4 Pharmaceuticals & Healthcare

- 5.2.5 Retail & E-commerce

- 5.2.6 Others

- 5.3 By Trade Lane

- 5.3.1 Intra-Asia

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Middle East

- 5.3.5 Africa

- 5.3.6 South America

- 5.3.7 Oceania

- 5.4 By Region / Port Cluster

- 5.4.1 West Region (Tuas & Jurong)

- 5.4.2 Central Region (Pasir Panjang & Keppel)

- 5.4.3 North Region (Sembawang)

- 5.4.4 East Region (Changi & Loyang)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.4.1 PSA International

- 6.4.2 Ocean Network Express (ONE)

- 6.4.3 Pacific International Lines (PIL)

- 6.4.4 A.P. Moller-Maersk Singapore

- 6.4.5 CMA CGM & ANL (Singapore)

- 6.4.6 Evergreen Marine (Singapore)

- 6.4.7 Hapag-Lloyd (Singapore)

- 6.4.8 Cosco Shipping Lines (Singapore)

- 6.4.9 Yang Ming (Singapore)

- 6.4.10 X-Press Feeders (Sea Consortium)

- 6.4.11 DHL Global Forwarding Singapore

- 6.4.12 Kuehne + Nagel Singapore

- 6.4.13 NYK Line (Yusen Logistics)

- 6.4.14 DSV Air & Sea Singapore

- 6.4.15 Sinotrans Singapore

- 6.4.16 Agility Logistics Singapore

- 6.4.17 Toll Group Singapore

- 6.4.18 OOCL (Singapore)

- 6.4.19 FedEx Logistics Singapore

- 6.4.20 CEVA Logistics Singapore*

7 Market Opportunities & Future Outlook