PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850388

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850388

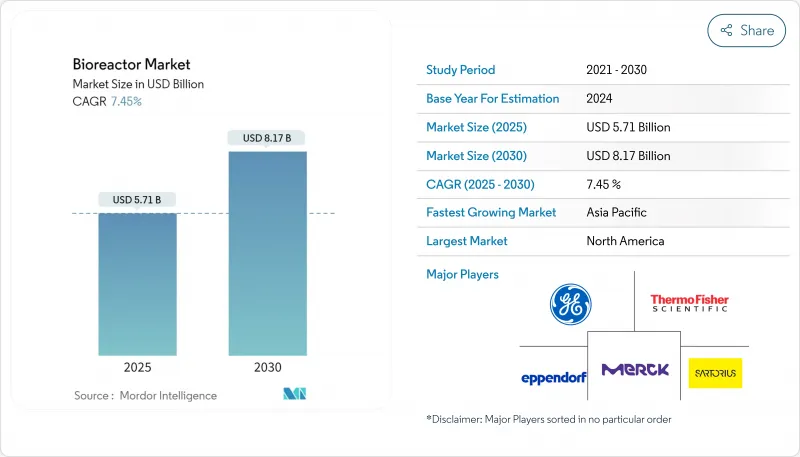

Bioreactor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global bioreactor market size stood at USD 5.68 billion in 2025 and is projected to reach USD 8.17 billion by 2030, advancing at a 7.10% CAGR during 2025-2030.

Sustained demand for complex biologics, a rapidly expanding pipeline of cell- and gene-therapy candidates, and steady improvements in process-control technology underpin this growth trajectory. Suppliers that balance flexibility with scale continue to gain ground because stainless-steel, single-use, and hybrid systems each solve distinct production challenges. Automated control is now the default configuration for new installations, and AI-driven analytics are moving from proof-of-concept trials to routine manufacturing, improving batch consistency and reducing downtime. Regional dynamics are also shifting: Asia's accelerated build-out of cGMP capacity is reshaping global supply chains, while North America maintains the largest installed base and remains the launchpad for next-generation technologies.

Global Bioreactor Market Trends and Insights

Rapid Capacity Expansion for Cell & Gene Therapy Manufacturing

Developers of cell- and gene-based products have quickly exceeded the capabilities of legacy monoclonal-antibody equipment. Novel high-density platforms such as Corning's Ascent Fixed-Bed Reactor supply extensive surface area for adherent cultures while preserving a compact footprint, easing viral-vector bottlenecks. CDMOs value these systems because they scale up rapidly without full facility overhauls. As regulators emphasize modality-specific process understanding, purpose-built bioreactors have shifted from optional upgrades to essential infrastructure, adding measurable uplift to the bioreactor market.

Shift Toward Modular & Closed-System Facilities in Emerging Markets

Manufacturers in Asia, Latin America, and parts of Africa are bypassing conventional clean-room builds by installing prefabricated, closed-system suites that integrate single-use assemblies and skid-mounted utilities. These plants reduce capital expenditure, compress validation timelines, and allow faster entry into global supply chains. Their portability also lets CDMOs relocate or expand with minimal disruption, a benefit proven during pandemic-related shortages. The distributed model lowers freight risk and brings production closer to patients, broadening the bioreactor market footprint across more locations.

Sterilization-Integrity Failures in Large-Volume Single-Use Bioreactors

Scaling disposable bags beyond 2,000 L increases stress on seams and film interfaces, raising contamination risk late in production runs. Inconsistent film extrusion and challenges in validating gamma-irradiation efficacy across thicker assemblies remain unresolved. Many producers hedge by pairing single-use seed trains with stainless-steel production tanks, trading some flexibility for sterility assurance. While suppliers are refining test protocols and upgrading materials, the added cost erodes portions of the single-use value proposition, tempering bioreactor market growth.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Continuous Bioprocessing Platforms

- Government Incentives for Vaccine Biomanufacturing in Middle East & Africa

- Global Shortage of High-Quality Single-Use Plastic Resin

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Sartorius

- Thermo Fisher Scientific

- Merck

- Danaher

- Eppendorf

- GE Healthcare

- Getinge

- Infors HT

- Bioengineering

- Solaris Biotech

- PBS Biotech Inc.

- Esco Lifesciences

- ABEC

- Cellexus International Ltd.

- Distek Inc.

- Pierre Gurin Technologies

- Bionet Innovative Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Capacity Expansion for Cell & Gene-Therapy Manufacturing

- 4.2.2 Shift Toward Modular & Closed-System Facilities in Emerging Markets

- 4.2.3 Rise of Continuous Bioprocessing Platforms

- 4.2.4 Government Incentives for Vaccine Biomanufacturing in Middle East & Africa

- 4.2.5 Collaborative CDMO Outsourcing Driving Single-Use Uptake in Latin America

- 4.2.6 Technological Advancements in Bioreactors

- 4.3 Market Restraints

- 4.3.1 Sterilisation-Integrity Failures in Large-Volume SUBs

- 4.3.2 Global Shortage of High-Quality Single-Use Plastic Resin

- 4.3.3 CapEx Constraints for Stainless-Steel Retrofits in Legacy Plants

- 4.3.4 Complex Regulatory Validation for Hybrid Configurations

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Glass

- 5.1.2 Stainless Steel

- 5.1.3 Single-Use

- 5.2 By Usage

- 5.2.1 Lab-scale Production

- 5.2.2 Pilot-scale Production

- 5.2.3 Full-scale Production

- 5.3 By Scale

- 5.3.1 5 L - 20 L

- 5.3.2 20 L - 200 L

- 5.3.3 200 L - 1,500 L

- 5.3.4 Above 1,500 L

- 5.4 By Control Type

- 5.4.1 Manual

- 5.4.2 Automated (MFCs)

- 5.5 By Bioprocess

- 5.5.1 Batch

- 5.5.2 Fed-batch

- 5.5.3 Continuous

- 5.6 By Application

- 5.6.1 Pharmaceutical & Biopharmaceutical Manufacturing

- 5.6.2 Cell & Gene Therapy

- 5.6.3 Industrial Biotechnology (Biofuels, Enzymes)

- 5.7 By End User

- 5.7.1 Biopharma & Pharma Companies

- 5.7.2 Contract Development & Manufacturing Organisations (CDMOs)

- 5.7.3 Other End Users

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Spain

- 5.8.2.6 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 India

- 5.8.3.4 South Korea

- 5.8.3.5 Australia

- 5.8.3.6 Rest of Asia-Pacific

- 5.8.4 Middle-East and Africa

- 5.8.4.1 GCC

- 5.8.4.2 South Africa

- 5.8.4.3 Rest of Middle East and Africa

- 5.8.5 South America

- 5.8.5.1 Brazil

- 5.8.5.2 Argentina

- 5.8.5.3 Rest of South America

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Sartorius AG

- 6.4.2 Thermo Fisher Scientific Inc.

- 6.4.3 Merck KGaA

- 6.4.4 Danaher

- 6.4.5 Eppendorf AG

- 6.4.6 GE Healthcare

- 6.4.7 Getinge AB

- 6.4.8 Infors HT

- 6.4.9 Bioengineering AG

- 6.4.10 Solaris Biotech

- 6.4.11 PBS Biotech Inc.

- 6.4.12 Esco Lifesciences Group

- 6.4.13 ABEC Inc.

- 6.4.14 Cellexus International Ltd.

- 6.4.15 Distek Inc.

- 6.4.16 Pierre Gurin Technologies

- 6.4.17 Bionet Innovative Technologies

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment