PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850954

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850954

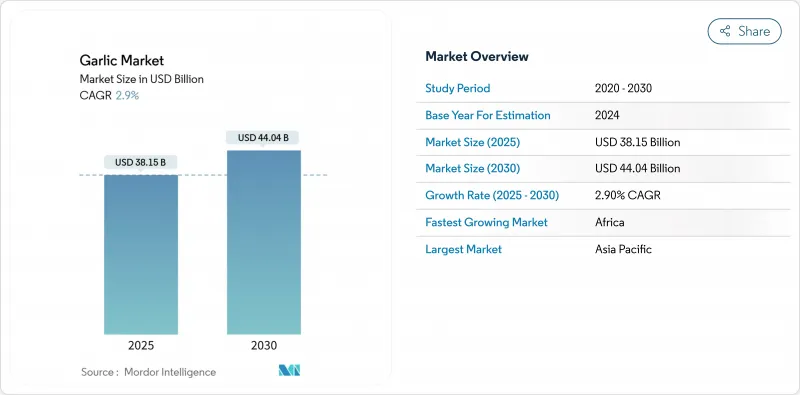

Garlic - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Garlic Market size is estimated at USD 38.15 billion in 2025 and is projected to reach USD 44.04 billion by 2030, at a CAGR of 2.9% during the forecast period.

Robust demand from food service, nutraceuticals, and premium processed segments underpins this expansion. China's 21 million metric tons annual harvest secures global supply yet creates concentration risk that can amplify price swings during weather shocks. Rising urban incomes across developing economies, more versatile cold-chain routes, and regulatory support for export diversification collectively point to sustained volume growth. Meanwhile, processors are installing automation lines that boost efficiency to 99%, indicating that cost leadership is shifting toward firms able to combine scale agriculture with high-precision handling.

Global Garlic Market Trends and Insights

Growing Demand in Pharmaceutical and Nutraceutical Industries

Pharmaceutical groups are scaling procurement of standardized garlic extracts after clinical studies highlighted allicin's cardiovascular benefits, compelling 64% of surveyed supplement users to link garlic to heart health and 45% to antibacterial functions. This validation moves garlic from commodity spice toward a medically aligned ingredient, letting contract growers command quality premiums when they provide verified potency lots. Nutraceutical formulators now anchor Research and Development budgets around odor-controlled capsules to capture wellness consumers wary of synthetic additives. As authorities clear more therapeutic claims, producers adopting traceable cultivation protocols can pivot into high-margin, extraction-grade supply chains.

Rising Popularity of Processed Garlic Products in Foodservice

Large restaurant chains are replacing in-house peeling with pre-minced, dried, or puree formats to curb labor and ensure uniform taste. An 86% usage rate for dried powder versus 83% for fresh cloves among commercial kitchens signals that time savings outweigh freshness perceptions when processing quality is high. Contract processors able to tailor granulation or moisture profiles for automated woks and ovens win recurring volumes, nudging the garlic market toward greater value-added output. This shift is critical for exporters in regions where wage inflation erodes margins on unprocessed bulbs.

Price Volatility Driven by Climatic Variability in Key Producing Regions

Heat stress alters bulb development and hormone profiles, undermining yields in the Yangtze River Basin and Indian plains. Models show that mild reductions in Chinese output ripple into global wholesale prices because the country's 21 million metric tons supply sets the benchmark for the entire garlic market. Importers respond with diversified sourcing frameworks and hedge contracts, yet smaller processors lacking financial instruments face margin erosion. Weather-indexed insurance adoption remains nascent, raising the urgency for climate-resilient cultivars.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Cold Chain Logistics Facilitating Export Markets

- Surge in Black Garlic Production for Premium Markets

- Escalating Labor Shortages Increasing Harvest Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Garlic Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific's 78% slice of the garlic market stems from large-scale growing belts and purpose-built dry ports. Jining alone exports 2.2 million metric tons annually through reefer corridors whose humidity sensors hold +-2% variance, preserving clove firmness for 30-day voyages. India's ICAR-DOGR has released varieties yielding 8-20 metric tons/ha, improving farmers' net returns and bolstering the region's garlic market size for seed and bulb trades. Still, climate variability and labor scarcity push region-wide mechanization adoption, raising capex needs.

Africa represents the fastest-growing geography with an 8.4% CAGR as urban centers pursue dietary diversification. Kenyan county governments co-invest in drip irrigation, aiming to cut post-harvest losses from 25% to 10%. Egypt's desert-reclamation drive plans 20,000 ha of garlic under pivot irrigation, and South Africa's citrus exporters add garlic to cool-chain back-haul capacity, lowering freight unit costs. If these programs succeed, African growers could capture a meaningful slice of the garlic market, reducing reliance on imported Chinese stock.

North America and Europe remain net importers yet exhibit stable demand for premium segments. January 2025 saw the United States buy USD 37.5 million in fresh garlic, mainly from Argentina, China, and Vietnam. EU directives requiring certificates of origin and sulfur-dioxide compliance elevate testing costs, but they also reward exporters meeting zero-residue pledges. Both regions nurture black garlic and organic niches, supported by gourmet retailers and functional-food brands. Consequently, the garlic market there will expand more in value than in volume.

- Market Overview

- Market Drivers

- Market Restraints

- Value/Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTEL Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand in pharmaceutical and nutraceutical industries

- 4.2.2 Rising popularity of processed garlic products in foodservice

- 4.2.3 Expansion of cold chain logistics facilitating export markets

- 4.2.4 Surge in black garlic production for premium markets

- 4.2.5 Adoption of high-yield tissue culture seed varieties

- 4.2.6 E-commerce bulk trading platforms enhancing farmer-market linkages

- 4.3 Market Restraints

- 4.3.1 Price volatility driven by climatic variability in key producing regions

- 4.3.2 Escalating labor shortages increasing harvest costs

- 4.3.3 Phytosanitary rejections due to sulfur-dioxide residues

- 4.3.4 Competition from low-odor substitutes in cuisines

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTEL Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Mexico

- 5.1.1.3 Canada

- 5.1.2 Europe

- 5.1.2.1 Spain

- 5.1.2.2 Ukraine

- 5.1.2.3 France

- 5.1.2.4 United Kingdom

- 5.1.2.5 Russia

- 5.1.3 Asia-Pacific

- 5.1.3.1 Vietnam

- 5.1.3.2 China

- 5.1.3.3 India

- 5.1.3.4 South Korea

- 5.1.3.5 Myanmar

- 5.1.3.6 Indonesia

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.5 Middle East

- 5.1.5.1 Turkey

- 5.1.5.2 Iran

- 5.1.5.3 United Arab Emirates

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Egypt

- 5.1.6.3 Kenya

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

- 6.1.1 Royal (Jinxiang) Garlic Co., Ltd.

- 6.1.2 Jining Fenduni Foodstuff Co., Ltd.

- 6.1.3 Jining Yuanfu International Trading Co., Ltd.

- 6.1.4 La Abuela Carmen

- 6.1.5 Filaree Farms

- 6.1.6 The Garlic Company

- 6.1.7 The Garlic Farm

- 6.1.8 Great Lakes Garlic Farm

- 6.1.9 California Garlic Company

- 6.1.10 Maine Garlic Company

- 6.1.11 Mad River Garlic Growers LLC.

- 6.1.12 Rasa Creek Farm Inc.

7 Market Opportunities and Future Outlook