PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850972

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850972

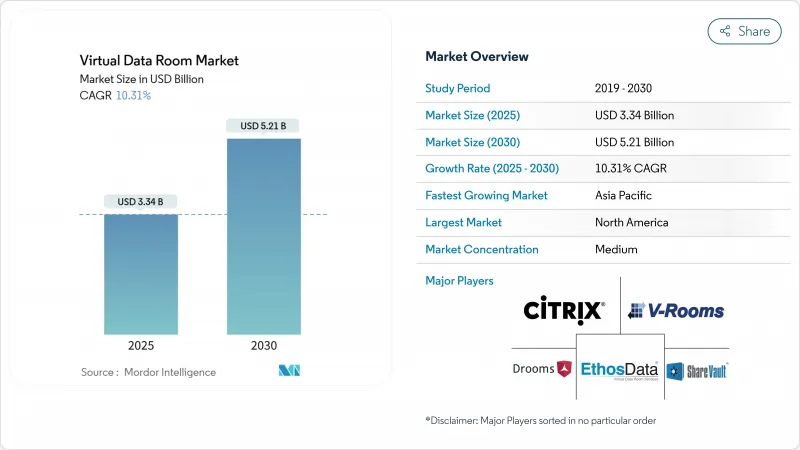

Virtual Data Room - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The virtual data room market size is valued at USD 3.34 billion in 2025 and is forecast to reach USD 5.21 billion by 2030, registering a 10.31% CAGR.

Demand is expanding as enterprises accelerate the digitization of sensitive documents to meet tightening regulatory mandates and to streamline cross-border transactions. Deals are becoming larger and more complex, pushing corporates to adopt secure, AI-enabled platforms for due diligence and post-merger integration. China's Network Data Security Management Regulations and the EU Data Act are compelling providers to localize storage and embed granular audit trails, reinforcing market expansion in both EMEA and Asia-Pacific. Large enterprises still generate most revenue, yet SMEs are the fastest-growing buyers because subscription-based models have fallen to USD 400-1,000 per month, removing historical cost barriers. Industry-specific functionality-such as eCTD viewers for life-sciences dossiers-adds further momentum in healthcare and biotech, the fastest-growing end-user vertical at 15.2% CAGR.

Global Virtual Data Room Market Trends and Insights

Accelerated Cross-border M&A Requiring Multi-jurisdiction Compliance

Cross-border deal values rose 5% in 2024 even as volumes slipped, highlighting the shift toward high-stakes transactions that must satisfy overlapping antitrust, foreign investment, and data-privacy laws. New merger-control thresholds in the UAE and stricter FDI filters in Germany illustrate the maze of approvals buyers confront. India's Digital Personal Data Protection Act requires explicit consent and country-specific processing clauses, further complicating information flows. Vendors are embedding data-sovereignty toggles and real-time regulatory checklists so deal teams can map document location, user access, and retention periods by jurisdiction.

Demand for Remote Audit & Board Collaboration in Regulated Industries

Financial institutions in Asia-Pacific are accelerating cloud migration to cut costs and modernize compliance, yet 93% cite difficulty meeting audit demands, fueling investment in secure board portals with immutable logs. China's Data Security Management Measures oblige banks to classify information and document every access event, a mandate now hard-wired into enterprise-grade VDRs. Nasdaq's patent for subsidiary governance showcases the push for multi-entity data hierarchies that streamline regulator reviews.

Data-Sovereignty Rules Limiting Cross-border Hosting

Conflicts between the EU's GDPR and the US CLOUD Act force multinationals to compartmentalize storage or risk enforcement action, driving providers to open regional data centers in Germany, Japan, and Australia. China's Trusted Data Space blueprint similarly restricts outbound transfers, raising capex for infrastructure duplication. German SMEs must also meet NIS-2 and DORA cybersecurity controls, adding compliance overhead that influences provider selection.

Other drivers and restraints analyzed in the detailed report include:

- Rise of IP-centric Transactions in Life Sciences & TMT

- Adoption of Integrated AI/ML Analytics within VDR Platforms

- Persistent User Mis-configuration Driving Security Breaches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software anchored 68% of revenue in 2024, underscoring its status as the backbone of the virtual data room market. The services component, however, is scaling faster at 13.9% CAGR as clients seek regulatory consulting, AI analytics, and integration support. Large accounts increasingly bundle platform licenses with workflow-design projects, mirroring SS&C's revenue uplift to USD 4.84 billion in 2024. Government tenders such as the UK's USD 6.5 billion G-Cloud 14 are also specifying managed services, validating a shift from pure software delivery to outcome-based engagements.

Demand for premium services rises when transactions span privacy regimes, prompting vendors to position specialized teams that configure data-residency rules, retention schedules, and AI-driven redaction models. As a result, implementation consulting, workflow automation, and on-call compliance advisory are expected to command over 30% of incremental market spend by 2030. The services stream therefore acts as a hedge against price pressure in core licensing, reinforcing revenue diversity for established players.

Cloud delivery captured 83% of 2024 revenue and exhibits the highest growth pace at 14.6% CAGR, signalling market consensus that hyperscale infrastructure can now satisfy bank-grade controls. Per-gigabyte fees-ranging from USD 60-77 per month-still influence heavy-data users, but flat-rate options at USD 400-1,000 monthly encourage midsize buyers to migrate. Sovereignty clauses are steering some clients to hybrid setups where sensitive archives stay on-premise while analytics compute bursts into the cloud.

Providers invest in multi-tenant encryption and customer-managed keys so that regulators accept cloud as an equivalent or superior control environment. The global build-out of public-cloud regions creates proximity that slices latency while satisfying residency statutes, accelerating adoption in geographically dispersed deal teams. As technological confidence mounts, legacy on-premise installations are expected to shrink below 10% of the virtual data room market by 2030.

The Virtual Data Room Market is Segmented by Component (Software, Services), Deployment Mode (Cloud-Based, On-Premise), Organization Size (SMEs, Large Enterprises), by Business Function (Legal and Compliance, Financial Management, Intellectual-Property Management, and More), End-User Industry (BFSI, IT and Telecom, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41% of 2024 revenue, supported by deep capital markets, robust private equity activity, and well-defined disclosure laws. The virtual data room market size for the region is buoyed by repeat buyers in energy, healthcare, and technology sectors that execute multi-deal pipelines annually. SS&C's rise to USD 4.84 billion revenue in 2024 underscores this demand.

Europe is gaining momentum as M&A recoveries accelerate post-pandemic, with expected 10% volume growth in 2025. The EU Data Act adds interoperability obligations that favor vendors with API-rich platforms and in-region storage nodes. Germany's heightened FDI scrutiny and mid-cap private equity rebound create use cases where VDR-enabled real-time Q&A and redaction speed closing timelines.

Asia-Pacific posts the highest CAGR at 14.4%. China's Financial Technology Development Plan and data-security regulations compel domestic hosting, prompting global providers to establish joint ventures and sovereign clouds. Japan's LegalTech-led services for electronics supply chains highlight localized innovation that addresses industry-specific compliance. India's new data-privacy law drives adoption in tech and pharma cross-border deals, cementing APAC's role as a growth engine through 2030.

- Vault Rooms Inc.

- ShareVault (Pandesa Corporation)

- Drooms GmbH

- Citrix Systems Inc.

- Ansarada Pty Ltd

- CapLinked Inc.

- Firmex Corporation

- SmartRoom (BMC Group)

- Intralinks Holdings Inc.

- Datasite (Merrill Corp.)

- iDeals Solutions Group

- Onehub

- SecureDoc Information Management Pty Ltd

- Brainloop AG

- HighQ Solutions Ltd

- Digify

- ForData

- EthosData

- Venue (Donnelley Financial)

- DealRoom

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Cross-border MandA Requiring Multi-jurisdiction Compliance Drives the Market

- 4.2.2 Demand for Remote Audit and Board Collaboration in Regulated Industries

- 4.2.3 Rise of IP-centric Transactions in Life Sciences and TMT

- 4.2.4 Adoption of Integrated AI/ML Analytics within VDR Platforms

- 4.2.5 Migration from Siloed FTP/Email to Secure SaaS-based Data Rooms

- 4.3 Market Restraints

- 4.3.1 Data-Sovereignty Rules Limiting Cross-border Hosting

- 4.3.2 Persistent User Mis-configuration Driving Security Breaches

- 4.3.3 High Subscription Costs for SME One-off Projects

- 4.3.4 Vendor-switching and Commoditization Pressure on Pricing

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Assessment of Macro Economic Trends on the Market

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud-based

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By Business Function

- 5.4.1 Legal and Compliance

- 5.4.2 Financial Management (MandA, Fund-raising, Restructuring)

- 5.4.3 Intellectual-Property Management

- 5.4.4 Sales and Marketing/ Channel Partnerships

- 5.4.5 Other Business Function

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 Government, Public Sector and Legal Services

- 5.5.5 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Vault Rooms Inc.

- 6.4.2 ShareVault (Pandesa Corporation)

- 6.4.3 Drooms GmbH

- 6.4.4 Citrix Systems Inc.

- 6.4.5 Ansarada Pty Ltd

- 6.4.6 CapLinked Inc.

- 6.4.7 Firmex Corporation

- 6.4.8 SmartRoom (BMC Group)

- 6.4.9 Intralinks Holdings Inc.

- 6.4.10 Datasite (Merrill Corp.)

- 6.4.11 iDeals Solutions Group

- 6.4.12 Onehub

- 6.4.13 SecureDoc Information Management Pty Ltd

- 6.4.14 Brainloop AG

- 6.4.15 HighQ Solutions Ltd

- 6.4.16 Digify

- 6.4.17 ForData

- 6.4.18 EthosData

- 6.4.19 Venue (Donnelley Financial)

- 6.4.20 DealRoom

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment