PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850978

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850978

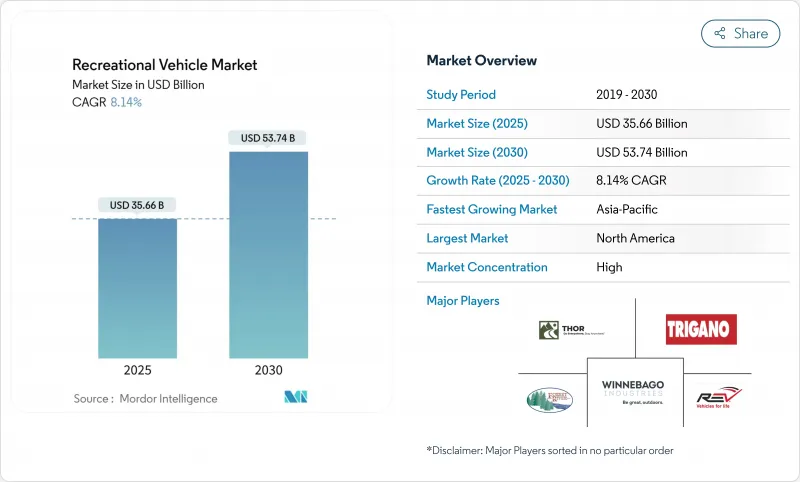

Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The recreational vehicle market is valued at USD 35.66 billion in 2025 and is forecast to advance to USD 52.74 billion by 2030, translating into an 8.14% CAGR.

A decisive shift toward flexible mobility enabled by hybrid work arrangements has broadened the customer base, while campground infrastructure investments and peer-to-peer rental platforms expand access and raise utilization rates. Electrification programs from leading OEMs and tightening emissions regulations accelerate product innovation, positioning battery-electric and hybrid models as future growth engines. At the same time, resilient domestic tourism supports steady demand, even as interest-rate volatility and a soft used-vehicle market weigh on short-term sentiment. Competitive intensity centers on software-defined vehicles and direct-to-consumer channels that compress dealer margins yet unlock subscription revenue streams.

Global Recreational Vehicle Market Trends and Insights

Remote-work culture sustaining "mobile-living" demand

Most of the campers worked from campsites in 2024, signalling that RVs now double as hybrid offices. The shift smooths demand across all seasons, supported by a 40% rise in winter camping that remains elevated after the pandemic. Motorhomes and well-equipped travel trailers gain an edge because they bundle reliable connectivity with climate control. Dealers in high-income corridors report steadier monthly throughput, reducing traditional seasonality risk. OEMs are adding adjustable desks, larger battery packs, and roof antennas, framing connected living as a core selling point.

Domestic tourism boom and campground infrastructure growth

More than 18,000 additional campsites are scheduled by 2027, expanding capacity where full hook-up occupancy averages 68%. Luxury amenities such as EV charging and fiber Wi-Fi support 5% yearly rate increases, protecting operator margins against inflation. Denser networks cut range anxiety for large motorhomes that need frequent service stops. Longer average stays of five nights boost revenue per pitch and attract institutional capital to the sector.

High interest-rate environment inflating loan costs

Credit remains tight even as rates ease, curbing demand in price-sensitive towable categories. Motorhomes, where average transaction values exceed USD 100,000, feel the squeeze most and purchase cycles lengthen. Commercial fleet buyers face extended payback periods that delay vehicle procurement. Lenders apply stricter underwriting, favoring prime borrowers and requiring higher down payments. OEM captive finance arms offer incentives, yet margin pressure limits how deeply they can buy down rates.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of RV financing and peer-to-peer rentals

- OEM electrification road maps for zero-emission lines

- Oversupply of used RVs driving price depreciation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Towable designs led revenue with 62.44% in 2024, retaining the broadest appeal among first-time buyers because they leverage existing tow vehicles and carry lower maintenance costs. Yet motorhomes are set to capture outsized value, advancing at a 9.26% CAGR through 2030 as connectivity, safety tech, and luxury finishes migrate from passenger car segments. The Class B van niche gains momentum in metro corridors where parking constraints and agile lifestyle needs favor sub-22 ft footprints. Travel trailers, meanwhile, sustain volume leadership thanks to robust axle capacity, slide-out versatility, and improved thermal packages that lengthen the camping season.

Premium fifth-wheel trailers consolidate share within the luxury towable subset, offering residential-grade appliances and auto-leveling systems that rival motorhomes. Folding campers cater to storage-challenged owners, but competition from micro motorhomes dampens growth prospects. THOR's move to consolidate Entegra Coach's diesel-pusher production under Tiffin enhances scale efficiencies and signals continued rationalization in high-price motorhome lines. Across categories, additive manufacturing of cabinetry and lightweight composites trim curb weight, boosting fuel economy, and expanding half-ton tow-vehicle compatibility.

Domestic leisure accounted for 70.63% revenue in 2024, reflecting entrenched camping culture and the post-pandemic re-engagement of families seeking affordable vacations. Still, institutional and corporate buyers are scaling fleets for mobile offices, hospitality suites and workforce housing, propelling the commercial segment to an 8.54% CAGR over the outlook period.

Commercial adoption diversifies revenue streams for OEMs and mitigates cyclical leisure exposure. Event organizers lease Class A coaches as executive green rooms, while construction firms deploy fifth-wheels for on-site accommodation in remote areas. Electric van-based models with 270-mile real-world range lower total cost of ownership for short-haul shuttle services. Tax incentives tied to clean-energy assets and accelerated depreciation schedules further sweeten ROI for corporate fleets, pushing utilization rates well above the leisure average of 18 nights per year.

The Recreational Vehicle Market Report Segmented by Type (Towable RVs and Motorhomes), Application (Domestic and Commercial), Propulsion (Internal Combustion Engine, Hybrid, and Battery Electric RVs), Length Category (Below 20-Ft, 20-30 Ft, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America generated 59.52% of global revenue in 2024, underpinned by mature distribution, financing infrastructure, and cultural familiarity with road-trip vacations. Market maturation shifts focus toward premium features-lithium house batteries, smart-home interfaces, and advanced driver assistance systems-that raise ASPs and enhance profitability. Seasonal volatility moderates as remote-work patterns extend shoulder-season usage, allowing dealers to smooth inventory ordering and finance departments to reduce flooring costs.

Europe contributes a stable but slower-growing slice, where stringent emissions rules and road-size constraints favor compact motorcaravans under 6 m. Germany, France, and the United Kingdom represent nearly two-thirds of EU demand, but economic uncertainty and high borrowing costs temper momentum. Manufacturers explore subscription-based ownership models that bundle insurance, maintenance, and campground discounts, reducing upfront barriers and aligning with circular-economy policy goals. Scandinavian camping infrastructure-supported by generous public investment-nudges adoption northward despite sparse population density.

Asia-Pacific registers the fastest expansion at 9.54% CAGR through 2030. Rising disposable income and highway investment in China and Southeast Asia broaden the target customer pool, while Australia's entrenched "caravan culture" delivers consistent base demand. Japanese demographics create a niche for compact Kei-based campers that satisfy elder travelers who favor lightweight, fuel-efficient devices for regional trips. Governments in South Korea and Thailand introduce tourism stimulus grants for RV park development, accelerating supply of hookups and dump stations. Currency fluctuations and luxury-good import duties remain risk factors, but joint-venture assembly plants mitigate tariff exposure and shorten lead times.

- Thor Industries Inc.

- Forest River Inc.

- Winnebago Industries Inc.

- REV Group Inc.

- Trigano SA

- Knaus Tabbert AG

- Jayco Inc.

- Grand Design RV Co.

- Keystone RV Co.

- Airstream Inc.

- Hymer GmbH

- Burstner GmbH

- Dethleffs GmbH

- Hobby-Wohnwagenwerk

- Adria Mobil d.o.o

- Triple E Recreational Vehicles

- Tiffin Motorhomes Inc.

- Coachmen RV

- Gulf Stream Coach Inc.

- Leisure Travel Vans

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Remote-Work Culture Sustaining Mobile Living" Demand"

- 4.2.2 Domestic Tourism Boom and Campground Infrastructure Growth

- 4.2.3 Expansion Of RV Financing and Peer-To-Peer Rental Platforms

- 4.2.4 OEM Electrification Road-Maps For Zero-Emission RV Lines

- 4.2.5 OTA Connectivity Unlocking Subscription Revenue Streams

- 4.2.6 Direct-To-Consumer Online Sales Shrinking Dealer Margins

- 4.3 Market Restraints

- 4.3.1 High Interest-Rate Environment Inflating Loan Costs

- 4.3.2 Persistent Chassis and Component Supply Bottlenecks

- 4.3.3 Oversupply of Used RVs Driving Price Depreciation

- 4.3.4 Municipal Crack-Downs On Urban Overnight Parking

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth-Wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Class A

- 5.1.2.2 Class B (Camper Vans)

- 5.1.2.3 Class C

- 5.1.1 Towable RVs

- 5.2 By Application

- 5.2.1 Domestic/Personal Use

- 5.2.2 Commercial (Rental Fleets, Mobile Offices, Events)

- 5.3 By Propulsion

- 5.3.1 Internal-Combustion Engine (ICE)

- 5.3.2 Hybrid

- 5.3.3 Battery-Electric RVs

- 5.4 By Length Category

- 5.4.1 Below 20 ft

- 5.4.2 20 - 30 ft

- 5.4.3 Above 30 ft

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Netherlands

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Kenya

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Thor Industries Inc.

- 6.4.2 Forest River Inc.

- 6.4.3 Winnebago Industries Inc.

- 6.4.4 REV Group Inc.

- 6.4.5 Trigano SA

- 6.4.6 Knaus Tabbert AG

- 6.4.7 Jayco Inc.

- 6.4.8 Grand Design RV Co.

- 6.4.9 Keystone RV Co.

- 6.4.10 Airstream Inc.

- 6.4.11 Hymer GmbH

- 6.4.12 Burstner GmbH

- 6.4.13 Dethleffs GmbH

- 6.4.14 Hobby-Wohnwagenwerk

- 6.4.15 Adria Mobil d.o.o

- 6.4.16 Triple E Recreational Vehicles

- 6.4.17 Tiffin Motorhomes Inc.

- 6.4.18 Coachmen RV

- 6.4.19 Gulf Stream Coach Inc.

- 6.4.20 Leisure Travel Vans

7 Market Opportunities and Future Outlook