PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850989

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850989

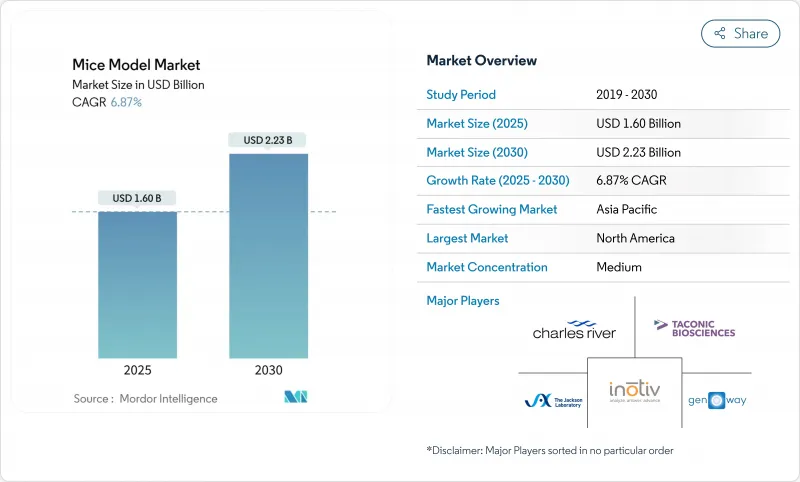

Mice Model - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mice model market size is valued at USD 1.60 billion in 2025 and is forecast to reach USD 2.23 billion by 2030, advancing at a 6.87% CAGR.

Steady demand stems from oncology, immunology, and rare-disease pipelines that depend on genetically engineered strains with greater translational validity. CRISPR/Cas9 maintains the largest technology footprint and is simultaneously the fastest-growing method, compressing model-generation timelines and lowering costs. North America retains leadership thanks to concentrated R&D funding and deep pharmaceutical activity, yet Asia-Pacific is closing the gap as China, Japan, and South Korea pour capital into local breeding infrastructure. Contract research organizations (CROs) are capturing an expanding share of outsourced studies, while humanized immune system and patient-derived xenograft (PDX) libraries rise in importance for immuno-oncology validation. Regulatory momentum toward alternative methods introduces headwinds but also pushes model developers to deliver higher-fidelity, ethically refined lines.

Global Mice Model Market Trends and Insights

Humanized mice revolutionizing immuno-oncology validation

Humanized models, generated by engrafting human immune components into immunodeficient strains, are rapidly displacing traditional xenografts. These mice replicate checkpoint-inhibitor and CAR-T responses more faithfully, trimming late-stage attrition. BioDuro reports a 70% uplift in predictive accuracy for immunotherapies, broadening use beyond efficacy studies to safety and biomarker discovery. Harvard scientists recently identified novel PD-1 resistance mechanisms in such models, highlighting their analytical depth. Pharmaceutical sponsors therefore allocate larger budgets to humanized cohorts, boosting recurring demand across North America, Europe, and China.

CRISPR technology accelerating genetic model development

CRISPR/Cas9 has moved mouse-line creation from multiyear projects to multi-month undertakings. Yale's 2025 Cas12a platform enables multiplexed edits in one generation, while Taconic shows 40% lower production costs relative to embryonic stem-cell methods. More than 60% of custom orders now specify CRISPR designs, pushing suppliers to scale automated microinjection and electroporation. As complexity rises, multiplexed edits become essential for polygenic disorders, reinforcing the technology's growth path.

Advances in in-silico and organ-on-chip alternatives reducing animal use

Artificial intelligence modeling and microfluidic organ chips are winning regulatory encouragement, with the FDA outlining a roadmap to phase out certain monoclonal antibody assays. These platforms offer rapid toxicity data and ethical advantages, drawing venture backing across North America and Europe. Yet whole-organism complexity remains hard to mimic, leading investigators to note that systemic immune and metabolic interactions still require murine confirmation. Consequently, alternative tools are viewed as complementary rather than outright replacements in the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Contract breeding services supporting big-pharma pipeline surge

- Patient-derived xenograft libraries becoming essential for oncology drug development

- Stringent 3Rs compliance creating regulatory hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Genetically uniform inbred strains captured 31.67% of the mice model market share in 2024, reinforcing their role in assay reproducibility. Nevertheless, genetically engineered mice are advancing at a 10.00% CAGR as CRISPR multiplexing simplifies complex allele combinations. The mice model market size tied to these engineered lines is forecast to add roughly USD 430 million between 2025 and 2030, propelled by oncology and neurodegenerative studies demanding polygenic constructs. Researchers value rapid knockout, knock-in, and conditional systems that clarify gene function in real time. Outbred stocks remain relevant for population-diversity modeling, while hybrid/congenic lines serve immunology niches where MHC compatibility is paramount. Vendors increasingly bundle genotyping, phenotyping, and colony management to ensure scientific rigor and to protect intellectual property tied to bespoke strains. Collaborative consortia expand global repositories, democratizing access and reducing duplication of effort across laboratories.

In the long term, multigenic humanized platforms are expected to overtake single-gene mutants as sponsors demand closer human translatability. Partnerships between academic genome centers and commercial breeders have accelerated line validation, helping dodge earlier bottlenecks in embryo availability. Advanced cryopreservation reduces drift, enabling labs to store critical alleles without active breeding. Against this backdrop, engineered murine models become indispensable for mechanism-focused precision-medicine pipelines, supporting therapeutic modalities from gene editing to antibody-drug conjugates.

Breeding services held 44.59% of the mice model market in 2024, underscoring the foundational need for reliable colony expansion. Yet genetic testing rises fastest, growing at 9.20% CAGR as sponsors require molecular confirmation of each edit before committing to GLP toxicology studies. The mice model market size associated with testing should approach USD 220 million by 2030, benefiting specialized laboratories with next-generation sequencing platforms. Cryopreservation services add resilience, preserving high-value germplasm and offsetting pathogen risks. Rederivation and quarantine remain compliance staples, especially after high-profile contamination events prompted stricter vivarium audits.

Service providers differentiate by offering integrated dashboards that track breeding metrics, genotype results, and health status in real time. Leading companies deploy barcoding and AI-assisted image recognition to flag phenotypic drift early. Pharmaceutical clients value this transparency, often embedding quality clauses into master service agreements. Consequently, the service ecosystem migrates from transactional tasks toward data-rich, consultative engagements that weave genetic insight into every stage of model utilization.

The Mice Model Market Report is Segmented by Mouse Type (Inbred Mice, Outbred Mice, and More), Service (Breeding, Cryopreservation, and More), Technology (CRISPR/CAS9 and More), Application (Oncology, Cardiovascular Studies, and More), End-User (Pharmaceutical & Biopharmaceutical Companies and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 41.92% of the mice model market in 2024, buoyed by National Institutes of Health grants that prioritize gene-based therapies and translational models. The NIH PAR-25-327 mechanism specifically funds ultra-rare neurologic disorder research using sophisticated murine systems. Regional suppliers deploy CRISPR high-throughput cores and pathogen-free facilities, cementing first-to-market advantages. Regulatory shifts, such as the FDA plan to phase out certain animal tests, pressure legacy models yet simultaneously spur demand for advanced lines with heightened predictive power.

Asia-Pacific registers the highest 8.26% CAGR, thanks to aggressive national investments. China's National Resource Center for Mutant Mice produced knockouts for 10,881 genes by mid-2024, creating a domestic pipeline that feeds CRO expansion. Japan refines quality protocols for PDX adoption, and South Korea channels Smart Farm funding into germ-free barrier facilities. Multinational sponsors partner with local breeders like GemPharmatech, which opened a San Diego node to bridge US-APAC demand.

Europe sustains a 5.81% CAGR underpinned by collaborative funding and strong ethics governance. The European Medicines Agency's Regulatory Science to 2025 agenda encourages innovative non-clinical models while upholding the 3Rs principle. Middle East & Africa and South America together represent emerging corridors with CAGRs of 7.57% and 7.04% respectively. Gulf nations fund translational centers focused on metabolic disorders prevalent in local populations, while Brazilian institutes advance tropical-disease models that align with regional epidemiology. Global pharma's clinical footprint in these areas boosts demand for standardized murine assays, ensuring harmonized data across multicenter trials.

- Aragen Bioscience

- Biocytogen Pharma

- Biomere

- Charles River

- CLEA Japan

- Crown BioScience Intl.

- Cyagen Biosciences.

- GemPharmatech

- GenOway

- Harbour BioMed

- Ingenious Targeting Laboratory

- Innovative Research

- Inotiv, Inc.

- Janvier Labs

- Melior Inc.

- Ozgene

- PolyGene AG

- Taconic Biosciences

- The Jackson Laboratory

- Trans Genic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of Humanized Mice for Immuno-Oncology Drug Validation

- 4.2.2 Rapid Adoption of CRISPR-Edited Knock-In Models for Target Gene Function Studies

- 4.2.3 Expansion of Contract Breeding Services Supporting Big-Pharma Pipeline Surge

- 4.2.4 Accelerating Demand for Patient-Derived Xenograft (PDX) Libraries among CROs

- 4.2.5 High-Throughput In-Vivo Screening Preference in Pre-Clinical Toxicology

- 4.2.6 Government-Funded Consortia Promoting Rare-Disease Mouse Model Repositories

- 4.3 Market Restraints

- 4.3.1 Advances in In-Silico Organ-on-Chip Alternatives Reducing Animal Use

- 4.3.2 Stringent 3Rs Compliance and Ethics Review Delays

- 4.3.3 Supply Disruptions from Pathogen-Free Colony Maintenance Costs

- 4.3.4 Rising Public Pressure Fueling Investor ESG Restrictions

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Mouse Type

- 5.1.1 Inbred Mice

- 5.1.2 Outbred Mice

- 5.1.3 Genetically Engineered Mice

- 5.1.4 Hybrid/Congenic Mice

- 5.2 By Service

- 5.2.1 Breeding

- 5.2.2 Cryopreservation

- 5.2.3 Rederivation & Quarantine

- 5.2.4 Genetic Testing

- 5.2.5 Other Services

- 5.3 By Technology

- 5.3.1 CRISPR/Cas9

- 5.3.2 Embryonic Stem Cell Injection

- 5.3.3 Nuclear Transfer

- 5.3.4 Microinjection

- 5.3.5 Other Technologies

- 5.4 By Application

- 5.4.1 Oncology

- 5.4.2 Immunology & Inflammation

- 5.4.3 Neurology

- 5.4.4 Cardiovascular Studies

- 5.4.5 Metabolic Diseases

- 5.4.6 Infectious Diseases

- 5.4.7 Other Applications

- 5.5 By End-User

- 5.5.1 Pharmaceutical & Biopharmaceutical Companies

- 5.5.2 Contract Research Organizations (CROs)

- 5.5.3 Academic & Research Institutes

- 5.5.4 Other End-Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Aragen Bioscience

- 6.4.2 Biocytogen Pharma

- 6.4.3 Biomere

- 6.4.4 Charles River Laboratories International Inc.

- 6.4.5 CLEA Japan

- 6.4.6 Crown BioScience Intl.

- 6.4.7 Cyagen Biosciences

- 6.4.8 GemPharmatech

- 6.4.9 GenOway

- 6.4.10 Harbour BioMed

- 6.4.11 Ingenious Targeting Laboratory

- 6.4.12 Innovative Research

- 6.4.13 Inotiv, Inc.

- 6.4.14 Janvier Labs

- 6.4.15 Melior Inc.

- 6.4.16 Ozgene Pty Ltd

- 6.4.17 PolyGene AG

- 6.4.18 Taconic Biosciences, Inc.

- 6.4.19 The Jackson Laboratory

- 6.4.20 Trans Genic Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment