PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851005

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851005

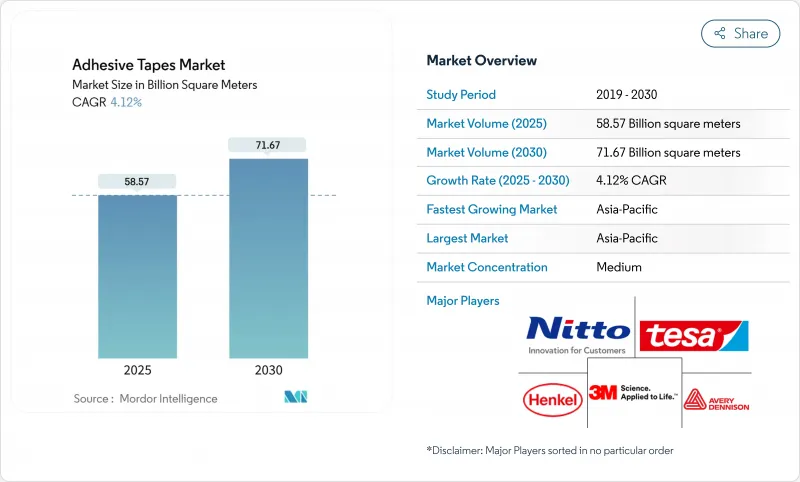

Adhesive Tapes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Adhesive Tapes Market size is estimated at 58.57 billion square meters in 2025, and is expected to reach 71.67 billion square meters by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

Consistent demand from packaging, electronics, and automotive manufacturing is offsetting raw-material cost swings and stricter limits on volatile organic compound (VOC) emissions. Water-based technologies are scaling quickly as converters pivot toward low-VOC chemistries, while pressure-sensitive formats retain volume leadership because they bond instantly and suit automated application lines. Asia-Pacific leads consumption and growth, propelled by a dense electronics supply chain and large-scale infrastructure spending. Healthcare is emerging as the fastest-growing outlet as skin-friendly silicone adhesives enable longer-wear medical devices and shift value toward high-margin specialty grades. Major producers are countering cost pressures through vertical integration, regional capacity additions, and portfolio realignment toward sustainable solutions.

Global Adhesive Tapes Market Trends and Insights

Rising Demand from E-Commerce and the Packaging Industry

Digital retail continues to push logistics operators toward faster, safer, and more sustainable packaging. Brand owners now specify fiber-based tear tapes and solvent-free box-closing systems that meet recyclability targets while surviving long distribution cycles. H.B. Fuller's Earthic portfolio exemplifies this shift, delivering certified bio-based content without sacrificing shear strength. Demand for right-sized cartons is also accelerating the customization of carton-sealing tapes that adhere to diverse corrugate grades in automated lines. Growth is most pronounced in Asia-Pacific, where cross-border parcel volumes are rising and fulfillment centers standardize on water-activated tapes to cut plastic use. These forces collectively lift the adhesive tapes market by improving the average price per square meter for high-performance packaging grades.

OEM Shift to Lightweight Wire-Harness Tapes

Automakers are replacing bulky PVC tubing with specialty cloth and PET adhesive tapes that save up to 50% harness weight while absorbing vibration and withstanding 150 °C engine-bay temperatures. tesa SuperSleeve 51026 PV6 typifies next-generation wraps that combine PET cloth with a solvent-free acrylic adhesive to resist abrasion in high-heat zones. Electric-vehicle platforms amplify the opportunity because harnesses run longer and must remain flexible for battery-pack servicing. Lighter harness assemblies help extend driving range, reinforcing OEM adoption curves. These trends feed directly into the adhesive tapes market as converters qualify tailored widths and die-cuts for automated loom wrapping.

Volatility in Prices of Raw Materials

Feedstocks such as tackifier resins and specialty carbons swing with crude oil and freight costs, compressing converter margins. Cabot announced carbon-black price increases effective December 2024, citing inflationary pressures. Producers mitigate spikes through multi-supplier sourcing and indexed contracts, but still face working-capital strain that can stall smaller converters' expansion plans, placing a near-term drag on the adhesive tapes market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Low-Trauma Silicone Tapes for Wearable Medical Devices

- Construction Boom in ASEAN and Middle East Region

- Limitations in Product Performance Under Extreme Conditions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic formulations secured 41.12% of 2024 volume, making them the largest contributor to adhesive tapes market size because they bond metals, plastics, and glass without extensive surface treatment. Their excellent UV resistance and aging stability drive uptake in outdoor electronics and solar assemblies. Rubber systems, despite lower durability, are scaling at 4.24% CAGR as automakers favor their high initial tack for wire-loom bundling and interior NVH control. Silicone PSAs, though niche in volume, command premium pricing in medical wearables and high-heat electronics thanks to biocompatibility and 200 °C service temperatures. Epoxy and polyurethane chemistries cater to structural bonding niches where shear strength outweighs repositionability. Suppliers such as Lohmann now offer thermally conductive acrylic-silicone hybrids that dissipate 2 W/mK in electric-vehicle battery packs.

Diversification within resin portfolios supports specialized end-use needs without cannibalizing acrylic share. Rubber upgrades focus on synthetic variants that withstand 125 °C engine-bay peaks, closing the historical gap with acrylics. Silicone development centers on low-cyclic-siloxane grades to satisfy European medical regulations, while epoxy tapes add latent catalysts for room-temperature cure, expanding repair capabilities in aerospace composites. These innovations collectively keep the adhesive tapes market competitive as formulators match resin chemistries to evolving functional demands.

Water-based systems represented 45.19% of 2024 sales, reflecting the sector's pivot to low-VOC processing. Producers such as 3M have slashed VOCs by 99% since 1990 by phasing out solvent carriers. The segment grows at 4.47% CAGR as converters retrofit coaters to handle high-solids acrylic emulsions that rival solvent-borne shear. Solvent-based lines still dominate high-temperature electronics because of superior wet-out on low-surface-energy substrates, but they face tightening regulatory capex. Hot-melt PSAs gain share in e-commerce packaging, where instant bond speeds maximize throughput. Reactive chemistries, including polyurethane foams that crosslink with ambient moisture, secure niche adoption in structural automotive joints.

Twin-system coaters now deliver hybrid water/solvent capability, allowing rapid changeovers and energy savings. Innovation extends to bio-based dispersions from terpene or starch feedstocks, positioning water-based adhesives for next-generation circular-economy metrics. This technology heterogeneity broadens the adhesive tapes market as converters align environmental targets with high-performance demands.

The Adhesive Tapes Market Report Segments the Industry by Resin (Acrylic, Rubber-Based, and More), Technology (Water-Based, Solvent-Based, and More), Product Type (Pressure-Sensitive Tapes, Water-Activated Tapes, and More), End-User Industry (Packaging, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific held 58.91% of the 2024 volume and is set to grow at a 5.01% CAGR as China, India, and Southeast Asia expand electronics, automotive, and construction output. Regional producers add local coating and slitting capacity, reducing lead times and tailoring SKUs to domestic requirements. Government incentives for semiconductor fabs in China and India amplify demand for ultra-clean dicing and masking tapes. Concurrently, solar-powered adhesive plants in Chennai and Suzhou demonstrate growing sustainability commitments, reinforcing supply resilience in the adhesive tapes market.

North America retains technology leadership, leveraging advanced R&D in healthcare and aerospace. 3M's solvent-free platforms and Avery Dennison's UL-94-rated EV battery tapes illustrate an innovation-driven shift toward specialized applications. Tight labor markets stimulate automation investments, favoring die-cut PSA components that accelerate assembly. The United States-Mexico-Canada Agreement also supports near-shoring of automotive harness tape production, buffering currency volatility.

Europe emphasizes eco-design and VOC compliance, accelerating water-based PSA adoption. Automotive lightweighting and electrification policies sustain demand for high-performance bonding tapes that replace rivets and welds. Meanwhile, Middle East and Africa markets benefit from infrastructure megaprojects that specify high-temperature exterior facade tapes. South America's adhesive tapes market gains incrementally through Brazil's agriculture-linked packaging sector and localized flexible-packaging plants. The combined effect of emerging-market expansion and industrial re-shoring in developed regions sustains the global growth outlook.

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- CCT (Coating & Converting Technologies, LLC)

- DuPont

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- IPG

- LINTEC Corporation

- Lohmann

- Mativ

- Nitto Denko Corporation

- Oji Holdings Corporation

- Scapa Group Ltd

- Sekisui Chemical Co., Ltd.

- Shurtape Technologies, LLC

- Sika AG

- tesa SE - A Beiersdorf Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from the E-Commerce and Packaging Industry

- 4.2.2 OEM shift to lightweight wire-harness tapes

- 4.2.3 Adoption of low-trauma silicone tapes for wearable medical devices

- 4.2.4 Construction boom in ASEAN and Middle-East region boosting adhesive tape usage

- 4.2.5 Growing Demand for Adhesive Tapes from Electronics Industry

- 4.3 Market Restraints

- 4.3.1 Volatility in Prices of Raw Materials

- 4.3.2 Limitations in Product Performance Under Extreme Conditions

- 4.3.3 Concerns of VOC Emissions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Resin

- 5.1.1 Acrylic

- 5.1.2 Rubber-based

- 5.1.3 Silicone

- 5.1.4 Epoxy

- 5.1.5 Polyurethane

- 5.2 By Technology

- 5.2.1 Water-based

- 5.2.2 Solvent-based

- 5.2.3 Hot-melt

- 5.2.4 Reactive

- 5.3 By Product Type

- 5.3.1 Pressure-Sensitive Tapes

- 5.3.2 Water-Activated Tapes

- 5.3.3 Heat-Sensitive Tapes

- 5.3.4 Specialty Tapes

- 5.4 By End-use Industry

- 5.4.1 Packaging

- 5.4.2 Automotive

- 5.4.3 Electrical and Electronics

- 5.4.4 Healthcare

- 5.4.5 Consumer/DIY

- 5.4.6 Others (Building and Construction, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Berry Global Inc.

- 6.4.4 CCT (Coating & Converting Technologies, LLC)

- 6.4.5 DuPont

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 IPG

- 6.4.9 LINTEC Corporation

- 6.4.10 Lohmann

- 6.4.11 Mativ

- 6.4.12 Nitto Denko Corporation

- 6.4.13 Oji Holdings Corporation

- 6.4.14 Scapa Group Ltd

- 6.4.15 Sekisui Chemical Co., Ltd.

- 6.4.16 Shurtape Technologies, LLC

- 6.4.17 Sika AG

- 6.4.18 tesa SE - A Beiersdorf Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment