PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851012

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851012

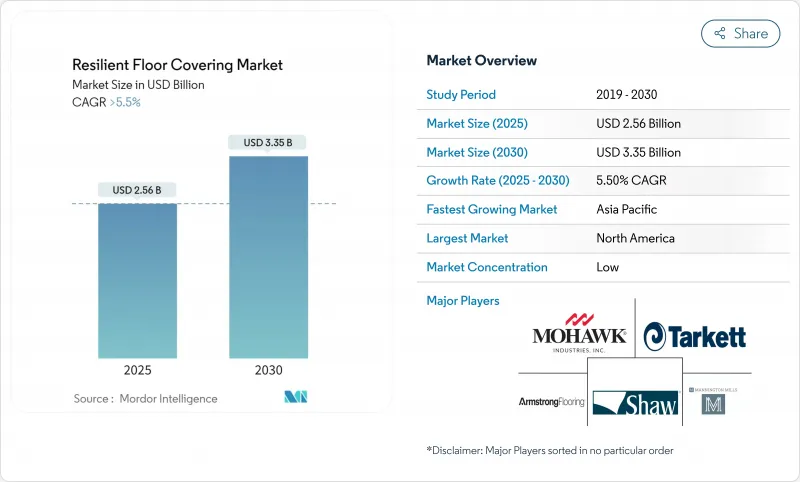

Resilient Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The resilient floor covering market is valued at USD 2.56 billion in 2025 and is forecast to reach USD 3.35 billion by 2030, reflecting a 5.5% CAGR.

Consistent demand stems from luxury vinyl tile (LVT) upgrades in homes, an expanding healthcare construction pipeline in Asia-Pacific, and steady product innovation that keeps resilient flooring competitive against ceramics, laminate, and hardwood. Digital printing, embossed-in-register texturing, and rigid-core engineering have expanded design choices and improved impact resistance, while PVC-free options strengthen environmental credentials without eroding performance. The U.S. Environmental Protection Agency issued a draft risk evaluation for DINP plasticizer, citing potential human-health risks under certain use conditions. Supply-chain shifts toward near-shore production in North America and Europe are reducing tariff exposure and lead times, making localized inventory easier to manage. Climate-driven building codes that emphasize water resistance and easy sanitation further reinforce adoption, positioning the resilient floor covering market as a reliable growth segment within the wider finishes sector.

Global Resilient Floor Covering Market Trends and Insights

Rapid Adoption of LVT in Residential Remodels

Home renovation remains the primary demand engine for LVT. Homeowners choose the product for realistic visuals, affordability, and resistance to moisture that simplifies open-plan layouts connecting kitchens, dining areas, and family rooms. Digital printing creates sharp wood and stone graphics that rival natural materials at lower price points, while click-lock profiles shorten installation time by eliminating adhesives. Even when housing starts stalled in 2024, LVT grew in share by displacing carpet and laminate, demonstrating resilience in downturns. The driver sustains significant lift for the resilient floor covering market through at least 2027, particularly in replacement projects across the United States, Germany, France, and Australia.

Healthcare Build-out in Asia-Pacific Requiring Hygienic, Slip-Resistant Floors

Hospitals and clinics under construction across China, India, Indonesia, and Vietnam demand seamless, non-porous sheets that resist microbial growth and enable strict infection control. Suppliers now combine integrated cove-rise detailing, heat-welded seams, and embedded antimicrobial layers to comply with evolving health standards. Asian governments subsidize specialty flooring for critical-care wards, creating steady tender volumes. With more than 2,000 public-sector bed additions scheduled through 2028 in India alone, healthcare construction contributes consistent momentum to the resilient floor covering market.

PVC Feed-stock Price Volatility Compressing Margins

Polyvinyl chloride costs fluctuate with oil and energy markets, disturbing price lists and squeezing margins, especially for producers lacking backward integration. Spikes in 2024 forced rapid re-quotations on large commercial bids, straining distributor relationships. Europe's push toward bio-attributed vinyl and North America's recycling programs create partial buffers, yet unpredictable input costs continue to drag on profitability across the resilient floor covering market.

Other drivers and restraints analyzed in the detailed report include:

- Waterproof SPC/WPC Demand for Climate-Resilient Housing

- Digital Printing and EIR Finishes Elevating Aesthetics

- Anti-Dumping Tariffs on Asian LVT

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Luxury vinyl tile holds 30.23% of overall demand and remains the most versatile offering in the resilient floor covering market. High-definition graphics, low maintenance, and competitive pricing underpin its continued leadership. Stone Plastic Composite is expanding more quickly, advancing at an 8.33% CAGR on the strength of rigid cores that minimize telegraphing over uneven substrates and withstand heavier impacts. Wood Plastic Composite stays relevant at the upper end of residential due to its softer underfoot feel and superior acoustics, though price premiums suppress volume. Conventional vinyl sheet persists in operating theaters and education corridors, where welded seams improve hygiene. Vinyl composition tile continues to decline as institutional buyers shift to no-wax surfaces. Niche alternatives-linoleum, rubber, and cork-collectively equal about 15% of turnover, driven by sustainability ratings and specialized acoustic needs.

SPC's limestone-reinforced spine gives installers a dimensionally stable plank that tolerates heat swings, supporting projects in sun-belt markets and glass-walled high-rises. Manufacturers run hybrid production lines capable of alternating LVT and SPC on a single shift, maintaining balanced inventories and responsive order cycles. Mass-market retailers advertise easy cleanup, dent resistance, and low lifetime cost, expanding rigid-core visibility and accelerating its share gains inside the resilient floor covering market size hierarchy.

Glue-down methods control 46.89% of the 2024 volume because permanent adhesion remains critical in hospitals, supermarkets, and schools, where rolling equipment and high foot traffic impose shear loads that floating floors struggle to support. They also facilitate welded seams that form monolithic coverings, easing sanitation protocols. However, Click-lock planks grow at 7.79% CAGR as contractors seek shorter build programs and reduced labor expense. Locking edges engage with light tapping, letting installers cover up to 100 m2 in a day, cutting downtime for busy households and fast-tracking commercial renovations. Loose-lay formats, comprising heavier tiles secured by friction and perimeter tape, cater to data centers and offices where under-floor cable access is imperative. The variety of installation choices sustains parallel growth tracks and enhances the overall adaptability of the resilient floor covering market.

The Resilient Floor Covering Market is Segmented by Product (Luxury Vinyl Tile (LVT), Vinyl Sheet, and More), by Installation Type (Glue-Down, and More), by End-User (Residential, Commercial), by Distribution Channel (Offline and Online), and by Geography (North America, South America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe contributes 31.99% of worldwide revenue, sustained by stringent indoor-air regulations, retrofit subsidies, and circular-economy directives that incentivize closed-loop recycling. Germany and France anchor demand with social-housing upgrades, while Scandinavian municipalities choose bio-based linoleum for schools. Tarkett's ReStart(R) program captures site offcuts and end-of-life material, demonstrating a regional blueprint for material recovery. Refurbishment spending remains brisk as energy-efficiency grants reward occupants who seal building envelopes and add low-VOC surfaces, favoring resilient flooring's quick installation over existing substrates.

Asia-Pacific represents the fastest growth at 9.19% CAGR, underpinned by megacity residential towers, hospital expansions, and expanding disposable income. China alone absorbs millions of square meters of resilient sheets for public hospitals and large-format retail malls. India's urban housing missions require cost-effective, waterproof solutions that stand up to monsoon humidity. Japan and South Korea request premium acoustic layers to complement lightweight steel construction. Across ASEAN, infrastructure pipelines in Indonesia, Thailand, and Vietnam lift consumption as builders pivot from ceramic tiles to easier-to-handle click-lock planks, reinforcing the scale-out trajectory of the resilient floor covering market.

North America generates roughly a quarter of global sales, and tariff actions have triggered rapid on-shoring. New lines in Georgia and Ontario support local distributors, trimming shipping times and safeguarding supply. Canadian provinces specify low-VOC products for provincial facilities, while Mexico builds capacity to serve domestic housing and export opportunities under free-trade frameworks. The region sees consistent renovation fueled by aging housing stock, with SPC planks often chosen to resolve historic moisture issues in basements and ground-floor extensions. Demand diversification across single-family, multifamily, and light commercial enhances the structural stability of the resilient floor covering market size in North America.

- Mohawk Industries Inc.

- Tarkett S.A.

- Shaw Industries Group Inc.

- Armstrong Flooring LLC (AHF Products)

- Mannington Mills Inc.

- Gerflor Group

- Forbo Flooring Systems

- Interface Inc.

- LG Hausys (LX Hausys)

- Nora Systems GmbH

- Polyflor Ltd (James Halstead)

- Engineered Floors LLC

- Karndean Designflooring

- Responsive Industries Ltd.

- CFL Flooring

- Beaulieu International Group

- Parterre Flooring Systems

- Novalis Innovative Flooring

- Milliken & Company

- Fatra a.s.

- IVC Group (BerryAlloc)

- Upofloor (Kahrs Group)*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of LVT in Residential Remodels

- 4.2.2 Healthcare Build-out in Asia-Pacific Requiring Hygienic, Slip-Resistant Floors

- 4.2.3 Waterproof SPC/WPC Demand for Climate-Resilient Housing

- 4.2.4 Digital Printing & EIR Finishes Elevating Aesthetics

- 4.2.5 Low-VOC Regulations Fueling Eco-Labelled Resilient Materials

- 4.2.6 Circular Linoleum & PVC Take-Back Boosting Green Certifications

- 4.3 Market Restraints

- 4.3.1 PVC Feed-stock Price Volatility Compressing Margins

- 4.3.2 Anti-Dumping Tariffs on Asian LVT

- 4.3.3 Environmental Scrutiny of Chlorinated Plastics

- 4.3.4 Skilled-Installer Shortage Elevating Failure Rates

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.1.1.1 Dry-Back (Glue-Down)

- 5.1.1.2 Click-Lock Floating

- 5.1.1.3 Loose-Lay

- 5.1.2 Vinyl Sheet

- 5.1.3 Vinyl Composition Tile (VCT)

- 5.1.4 Stone Plastic Composite (SPC) / Rigid Core

- 5.1.5 Wood Plastic Composite (WPC)

- 5.1.6 Linoleum

- 5.1.7 Rubber

- 5.1.8 Cork

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.2 By Installation Type

- 5.2.1 Glue-Down

- 5.2.2 Floating / Click-Lock

- 5.2.3 Loose-Lay

- 5.3 By End-User Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Healthcare Facilities

- 5.3.2.2 Education Buildings

- 5.3.2.3 Retail & Supermarkets

- 5.3.2.4 Hospitality & Leisure

- 5.3.2.5 Corporate Offices

- 5.3.2.6 Industrial & Manufacturing

- 5.4 By Distribution Channel

- 5.4.1 Offline

- 5.4.1.1 Specialty Stores

- 5.4.1.2 Home Centers & DIY Chains

- 5.4.2 Online

- 5.4.1 Offline

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 Europe

- 5.5.4.1 United Kingdom

- 5.5.4.2 Germany

- 5.5.4.3 France

- 5.5.4.4 Spain

- 5.5.4.5 Italy

- 5.5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.5.4.8 Rest of Europe

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East & Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Mohawk Industries Inc.

- 6.4.2 Tarkett S.A.

- 6.4.3 Shaw Industries Group Inc.

- 6.4.4 Armstrong Flooring LLC (AHF Products)

- 6.4.5 Mannington Mills Inc.

- 6.4.6 Gerflor Group

- 6.4.7 Forbo Flooring Systems

- 6.4.8 Interface Inc.

- 6.4.9 LG Hausys (LX Hausys)

- 6.4.10 Nora Systems GmbH

- 6.4.11 Polyflor Ltd (James Halstead)

- 6.4.12 Engineered Floors LLC

- 6.4.13 Karndean Designflooring

- 6.4.14 Responsive Industries Ltd.

- 6.4.15 CFL Flooring

- 6.4.16 Beaulieu International Group

- 6.4.17 Parterre Flooring Systems

- 6.4.18 Novalis Innovative Flooring

- 6.4.19 Milliken & Company

- 6.4.20 Fatra a.s.

- 6.4.21 IVC Group (BerryAlloc)

- 6.4.22 Upofloor (Kahrs Group)*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment