PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940645

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940645

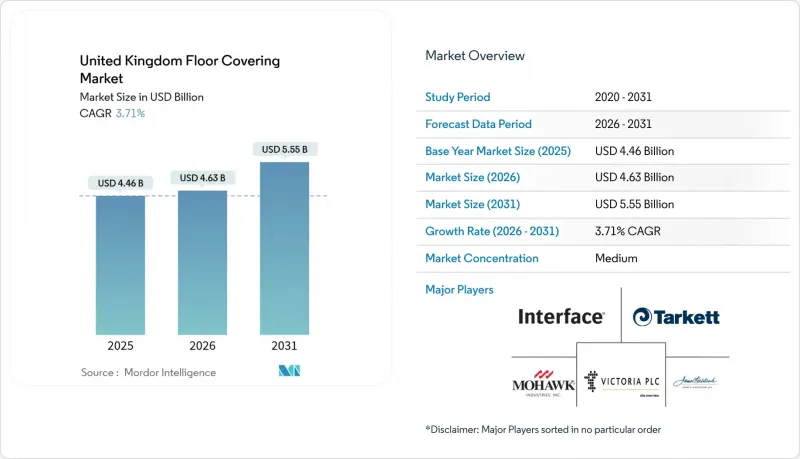

United Kingdom Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

United Kingdom floor covering market size in 2026 is estimated at USD 4.63 billion, growing from 2025 value of USD 4.46 billion with 2031 projections showing USD 5.55 billion, growing at 3.71% CAGR over 2026-2031.

This measured rise highlights a sector moving from post-pandemic volatility to steady growth as construction resumes and consumers trade up to premium surfaces. A broad demand base spanning residential renovation, commercial fit-outs, and government refurbishment programs underpins the market's resilience. Hybrid work patterns generate fresh orders for modular carpet tiles, while luxury vinyl tile (LVT) accelerates across segments due to realistic aesthetics and low upkeep requirements. Distribution shifts toward online and big-box retail channels are widening product visibility and price transparency, reinforcing competitive intensity even as raw-material cost swings and inflation challenge margins.

United Kingdom Floor Covering Market Trends and Insights

Post-pandemic home-improvement boom drives residential demand

The post-pandemic surge in home improvement activity continues to reshape residential flooring demand, with homeowners prioritizing comfort and aesthetics in spaces that now serve multiple functions. This trend extends beyond initial lockdown-driven renovations, evolving into sustained investment in premium flooring solutions that enhance both visual appeal and functional performance. Carpets are seeing a resurgence in 2025, with designers favoring rich colors and bold patterns for comfort-focused spaces such as bedrooms and living rooms. The shift toward mixed flooring materials within single spaces creates opportunities for manufacturers offering coordinated product lines that enable seamless transitions between different zones. This behavioral change reflects a fundamental recalibration of how residential spaces are conceived and utilized, driving sustained demand for diverse flooring categories.

Large-scale public-sector refurbishment pipeline creates sustained demand

Government refurbishment programs in healthcare, education, and public infrastructure create sustained flooring demand through multi-year project cycles that stabilize the market. These multi-year project cycles support market stability by ensuring steady procurement flows. Initiatives such as the NHS New Hospital Programme and national school rebuilding efforts provide predictable revenue opportunities for suppliers. Companies specializing in healthcare-compliant and education-grade flooring are particularly well-positioned to benefit. For example, James Halstead PLC's Polyflor brand reported record revenues of GBP 126 million (USD 160 million) from its healthcare and education resilient flooring segment.

High inflation constrains consumer spending power

Persistent inflation pressures force consumers to defer non-essential home improvements, creating headwinds for discretionary flooring purchases despite underlying demand strength. The United Kingdom construction material price indices show continued volatility, with specific impacts on flooring-adjacent materials affecting overall project economics. Budget-conscious consumers increasingly prioritize value propositions over premium features, potentially compressing margins for manufacturers positioned in higher-end segments. This dynamic particularly affects the residential renovation market, where project deferrals can cascade through the supply chain and impact retailer inventory management. However, the trend also creates opportunities for manufacturers offering cost-effective solutions that maintain quality standards while addressing price-sensitive demand.

Other drivers and restraints analyzed in the detailed report include:

- Growing preference for luxury vinyl tile transforms product mix

- Rising demand for modular carpet tiles reshapes commercial spaces

- Volatile raw-material prices pressure manufacturing economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, the United Kingdom market for floor coverings is witnessing a 5.93% CAGR growth in resilient surfaces, while non-resilient options command a 42.95% market share. Leading the charge, LVT (Luxury Vinyl Tile) captivates with its lifelike visuals, adaptability to wet areas, and swift installation, making it a preferred choice for both residential and commercial applications. Sheet vinyl and VCT (Vinyl Composition Tile) maintain their foothold in healthcare and education sectors, alongside niche players like cork and rubber, especially in sustainability-driven projects where eco-conscious materials are prioritized. Carpets and rugs are making a comeback, spotlighting bold patterns and eco-friendly recycled yarns, which cater to evolving consumer preferences for both aesthetics and sustainability. While hard surfaces such as porcelain and engineered wood retain their premium appeal, mid-tier laminates are losing market share as consumers increasingly opt for rigid-core LVT, which offers enhanced durability and design versatility.

A bifurcated demand map is emerging. On one side, bespoke natural materials cater to luxury developments, offering exclusivity and high-end appeal; on the other, high-performance synthetics address value and durability, meeting the needs of cost-conscious buyers. Vendors positioned across both price ladders mitigate volatility and capture a broader wallet share within projects, ensuring resilience in a competitive market landscape.

By 2031, the replacement and retrofit market is projected to grow at a rate of 4.86%, narrowing the gap with the new-build segment, which commanded 53.78% of the revenue in 2025. This growth is primarily driven by the increasing focus of owners of aging residential and commercial properties on enhancing acoustic comfort and moisture control to improve the overall quality of their spaces. They are also prioritizing quicker installations, gravitating towards loose-lay formats and floating systems that offer convenience, efficiency, and adaptability to various environments. Meanwhile, build-to-rent schemes are driving a demand for durable, easy-to-clean finishes, which are essential for properties experiencing high tenant turnover and frequent use, ensuring these properties remain functional and visually appealing over time.

While developers are specifying high-capacity materials for new residential projects and logistics parks, the pace of these developments is tempered by rising interest rates, which impact overall project feasibility and financial planning. In response to renovation economics, product engineers are now crafting SKUs that are optimized for direct installation over existing floors and require less subfloor preparation, ensuring cost-effectiveness and time efficiency in retrofit projects.

The United Kingdom Floor Covering Market Report is Segmented by Product Type (Carpet and Rugs, Resilient Floor Covering, Non-Resilient Floor Covering), Construction Type (New Construction, Renovation & Replacement), End User (Residential, Commercial, Industrial & Public Infrastructure), Distribution Channel (B2C/Retail Channels, B2B/Contractors/Dealers), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Victoria PLC

- Interface Inc.

- Tarkett SA

- James Halstead PLC (Polyflor)

- Mohawk Industries

- Shaw Industries Group

- Forbo Flooring Systems

- Gerflor Group

- Milliken & Company

- Amtico International

- Karndean Designflooring

- Cormar Carpets

- Brintons Carpets

- Balta Group

- BerryAlloc (Beaulieu)

- Moduleo (IVC Group)

- Armstrong Flooring

- BSW Timber Group

- Junckers Flooring

- Johnson Tiles

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Home-Improvement Boom

- 4.2.2 Large-Scale Public-Sector Refurbishment Pipeline

- 4.2.3 Growing Preference for Luxury Vinyl Tile (Lvt)

- 4.2.4 Rising Demand for Modular Carpet Tiles In Offices

- 4.2.5 Government Incentives For Recycled Content Flooring

- 4.2.6 Expansion of Build-To-Rent Housing Projects

- 4.3 Market Restraints

- 4.3.1 High Inflation Dampening Discretionary Spend

- 4.3.2 Volatile Crude-Derived Raw-Material Prices

- 4.3.3 Skills Shortage In Specialist Installation Labour

- 4.3.4 Extended Commercial Leasing Cycles Delaying Fit-Outs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Carpet and Rugs

- 5.1.2 Resilient Floor Covering

- 5.1.2.1 Vinyl Sheets & VCT

- 5.1.2.2 Luxury Vinyl Tiles (LVT)

- 5.1.2.3 Linoleum

- 5.1.2.4 Rubber Flooring

- 5.1.2.5 Cork Flooring

- 5.1.3 Non-Resilient Floor Covering

- 5.1.3.1 Ceramic & Porcelain Tile

- 5.1.3.2 Natural Stone

- 5.1.3.3 Hardwood

- 5.1.3.4 Engineered Wood

- 5.1.3.5 Laminate

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation & Replacement

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial & Public Infrastructure

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail Channels

- 5.4.1.1 Home Centers?

- 5.4.1.2 Specialty Stores?

- 5.4.1.3 Online?

- 5.4.1.4 Other Distribution Channels?

- 5.4.2 B2B/Contractors/Dealers

- 5.4.1 B2C/Retail Channels

- 5.5 By Geography

- 5.5.1 England

- 5.5.2 Scotland

- 5.5.3 Wales

- 5.5.4 Northern Ireland

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Victoria PLC

- 6.4.2 Interface Inc.

- 6.4.3 Tarkett SA

- 6.4.4 James Halstead PLC (Polyflor)

- 6.4.5 Mohawk Industries

- 6.4.6 Shaw Industries Group

- 6.4.7 Forbo Flooring Systems

- 6.4.8 Gerflor Group

- 6.4.9 Milliken & Company

- 6.4.10 Amtico International

- 6.4.11 Karndean Designflooring

- 6.4.12 Cormar Carpets

- 6.4.13 Brintons Carpets

- 6.4.14 Balta Group

- 6.4.15 BerryAlloc (Beaulieu)

- 6.4.16 Moduleo (IVC Group)

- 6.4.17 Armstrong Flooring

- 6.4.18 BSW Timber Group

- 6.4.19 Junckers Flooring

- 6.4.20 Johnson Tiles

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Rising Preference for Underfloor Heating-Compatible Floors

- 7.3 Increased Adoption of Waterproof And Spill-Resistant Flooring