PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851019

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851019

Carpet And Rugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

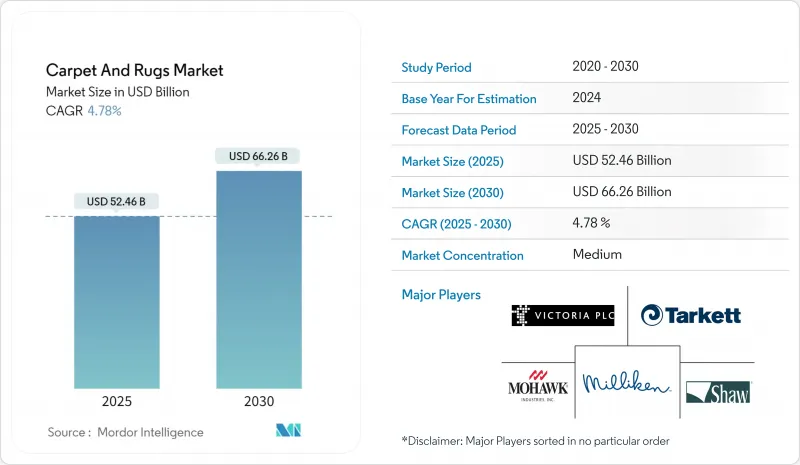

The carpet and rugs market size stands at USD 52.46 billion in 2025 and is projected to reach USD 66.26 billion by 2030, reflecting a 4.78% CAGR.

Expansion continues despite rising competition from hard-surface flooring, driven by resilient residential spending, accelerating e-commerce adoption, and sustained commercial refurbishment activity. Rapid urbanization in Asia-Pacific, a pronounced shift toward sustainable materials, and premiumization in mature economies are steering product innovation and new-capacity investments. Vertically integrated players are leveraging in-house yarn production and omnichannel distribution to shield margins from volatile petroleum costs, while smaller brands focus on niche aesthetics and direct-to-consumer models. Government regulations that reward circular design and extend producer responsibility are simultaneously raising compliance costs and spurring innovation, nudging the carpet market toward low-carbon manufacturing and closed-loop recycling strategies.

Global Carpet And Rugs Market Trends and Insights

Rising Demand for Home Decor and Interior Design

Home spaces have become lifestyle showpieces. Consumers increasingly treat carpets as focal decor elements, catalyzing demand for bold colors, digital prints, and bespoke motifs. The residential segment's 5.87% CAGR underscores the shift, while suppliers ramp up on-demand manufacturing to deliver short-run premium styles without ballooning inventory.

Growing Demand for Sustainability and Eco-Friendly Products in Home Decor

Environmental scrutiny now extends from fiber source to end-of-life disposition. Brands deploying recycled PET or bio-based yarns, lower-emission dyeing, and transparent supply-chain disclosures enjoy pricing power among younger buyers. Interface, through its Carbon Neutral Floors program, supplies cradle-to-gate carbon-neutral carpet tiles, turning compliance into brand equity.

LVT and SPC Cannibalization in Retail and Education Fit-outs

Luxury vinyl tile and stone plastic composite floors combine aesthetics with low lifetime cost, eroding carpet's position in high-traffic commercial corridors. As photo-realistic embossing mimics timber and marble, facility managers opt for resilient hard surfaces, limiting carpet specifications to acoustic zones and lounge spaces.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Online Retail Channels

- Presence of Government Initiatives and Trade Policies

- Crude-Oil Price Spikes Inflating PP and Nylon Feedstock Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tufted offerings accounted for 68.05% of carpet market share in 2024, underscoring their cost-efficiency and rapid production cycles. Continuous upgrades in multi-needle machinery now permit intricate loop-pile graphics, sustaining relevance in commercial refurbishment programs. Woven constructions occupy the durability mid-tier, appealing to hospitality lobbies that require dimensional stability. Although small in volume, the hand-knotted niche is climbing at 8.43% CAGR as affluent buyers seek heirloom craftsmanship. Knotted rugs' limited supply raises average selling prices, yet artisan attrition in India and Iran threatens pipeline continuity. Producers are adopting vocational upskilling incentives and hybrid wool-silk blends to broaden design palettes while safeguarding heritage techniques. Tufted segment commanded 68.05% share of the carpet market size in 2024, whereas knotted carpets delivered the sharpest value expansion pace.

Across all varieties, manufacturers embed recycled PET and solution-dyed nylon to cut dye-house emissions. Digital printing now bridges the aesthetic gap between tufted and woven, thereby democratizing high-definition imagery for mid-price SKUs. These converging innovations sustain the carpet market's product ladder from value to ultra-luxury.

The Global Carpet and Rugs Market is Segmented by Type (Tufted, Woven, and More), Distribution Channel (Mass Merchandisers, Home Centers, and More), End-User (Industry, Residential, and Commercial Offices), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 31.93% of the carpet market share in 2024, supported by high per-capita consumption and a robust residential replacement cycle. Cooler climates favor carpet for insulation, and remodeling incentives sustain sales amid mature housing stock. Premiumization prevails as consumers trade up to patterned loop-cut-loop styles and recycled-content nylon. Canada tracks similar trends, especially in new condo builds, while Mexico's housing stimulus and expanding middle class fuel incremental volume growth.

Asia-Pacific represents the fastest trajectory, expanding at 8.23% CAGR through 2030. Urban migration and rising disposable incomes in China, India, Indonesia, and Vietnam elevate demand for mid-range carpets in apartments and mixed-use complexes. China remains the consumption giant, whereas India stands out for export-oriented hand-knotted and tufted plants in Rajasthan and Uttar Pradesh. Developers in Australia and South Korea integrate eco-labels into specification tendering, further amplifying sustainable product demand. Asia-Pacific's share of the carpet market size is expected to surpass one-quarter by 2030, underscoring its role as the growth engine.

Europe commands significant value through stringent eco-design regulations that push the industry toward circularity. The EU's Extended Producer Responsibility framework assigns disposal fees to manufacturers, accelerating R&D in recyclable backing systems. Nordic markets reward cradle-to-cradle certification with price premiums, while Germany and the United Kingdom dominate regional volume behind robust refurbishment programs. South America shows emerging momentum, mainly in Brazil and Chile, where hospitality construction is scaling. The Middle East and Africa cater to luxury hospitality and palatial residential projects; the United Arab Emirates and Saudi Arabia import custom wool-silk blends for high-profile developments, sustaining the premium tier of the carpet market.

List of Companies Covered in this Report:

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Interface, Inc.

- Tarkett S.A.

- Beaulieu International Group

- Oriental Weavers Carpet Co.

- Milliken & Company

- Victoria PLC

- Tai Ping Carpets International Ltd.

- The Dixie Group, Inc.

- Mannington Mills, Inc.

- Balta Group

- Ruggable, LLC

- Jaipur Rugs Co.

- Couristan, Inc.

- Engineered Floors LLC

- Forbo Flooring Systems

- IKEA Group (Carpet Category)

- RugVista AB*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Home Decor and Interior Design

- 4.2.2 Growing Demand for Sustainability and Eco-Friendly Products in Home Decore

- 4.2.3 Expansion of Online Retail Channels

- 4.2.4 Presence of Government Initiatives and Trade Policies

- 4.2.5 Growth in Hospitality and Commercial Sectors

- 4.3 Market Restraints

- 4.3.1 LVT and SPC Cannibalisation in Retail and Education Fit-outs

- 4.3.2 Crude-Oil Price Spikes Inflating PP and Nylon Feedstock Costs

- 4.3.3 EU Extended-Producer-Responsibility Fees Elevate End-of-Life Cost

- 4.3.4 Skilled-Artisan Attrition Threatening Hand-Knotted Supply Chains (India, Iran)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Pricing Analysis

- 4.8 Porter's Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Tufted

- 5.1.2 Woven

- 5.1.3 Needle-Punched

- 5.1.4 Knotted

- 5.1.5 Others (Loop, Shag, Braided, etc.)

- 5.2 By Distribution Channel

- 5.2.1 Mass Merchandisers

- 5.2.2 Home Centers

- 5.2.3 Specialty Stores

- 5.2.4 Other Channels (Manufacturer Retailers, Warehouse Clubs, Discount, Omnichannel)

- 5.3 By End-Use

- 5.3.1 Residential

- 5.3.2 Commercial Offices

- 5.3.2.1 Hospitality and Leisure

- 5.3.2.2 Retail and Shopping Centres

- 5.3.2.3 Healthcare Facilities

- 5.3.2.4 Institutional (Education & Government)

- 5.3.2.5 Industrial Manufacturing Plants

- 5.3.2.6 Warehouses and Logistics Hubs

- 5.3.2.7 Cleanrooms and Controlled Environments

- 5.3.2.8 Other Industrial Facilities

- 5.3.3 Industrial

- 5.4 By Geography

- 5.5 North America

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.6 South America

- 5.6.1 Brazil

- 5.6.2 Peru

- 5.6.3 Chile

- 5.6.4 Argentina

- 5.6.5 Rest of South America

- 5.7 Asia-Pacific

- 5.7.1 India

- 5.7.2 China

- 5.7.3 Japan

- 5.7.4 Australia

- 5.7.5 South Korea

- 5.7.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.7.7 Rest of Asia-Pacific

- 5.8 Europe

- 5.8.1 United Kingdom

- 5.8.2 Germany

- 5.8.3 France

- 5.8.4 Spain

- 5.8.5 Italy

- 5.8.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.8.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.8.8 Rest of Europe

- 5.9 Middle East & Africa

- 5.9.1 United Arab Emirates

- 5.9.2 Saudi Arabia

- 5.9.3 South Africa

- 5.9.4 Nigeria

- 5.9.5 Rest of Middle East & Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Mohawk Industries, Inc.

- 6.4.2 Shaw Industries Group, Inc.

- 6.4.3 Interface, Inc.

- 6.4.4 Tarkett S.A.

- 6.4.5 Beaulieu International Group

- 6.4.6 Oriental Weavers Carpet Co.

- 6.4.7 Milliken & Company

- 6.4.8 Victoria PLC

- 6.4.9 Tai Ping Carpets International Ltd.

- 6.4.10 The Dixie Group, Inc.

- 6.4.11 Mannington Mills, Inc.

- 6.4.12 Balta Group

- 6.4.13 Ruggable, LLC

- 6.4.14 Jaipur Rugs Co.

- 6.4.15 Couristan, Inc.

- 6.4.16 Engineered Floors LLC

- 6.4.17 Forbo Flooring Systems

- 6.4.18 IKEA Group (Carpet Category)

- 6.4.19 RugVista AB*

- 6.5 Market Opportunities & Future Outlook

- 6.5.1 White-space & Unmet-Need Assessment