PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851039

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851039

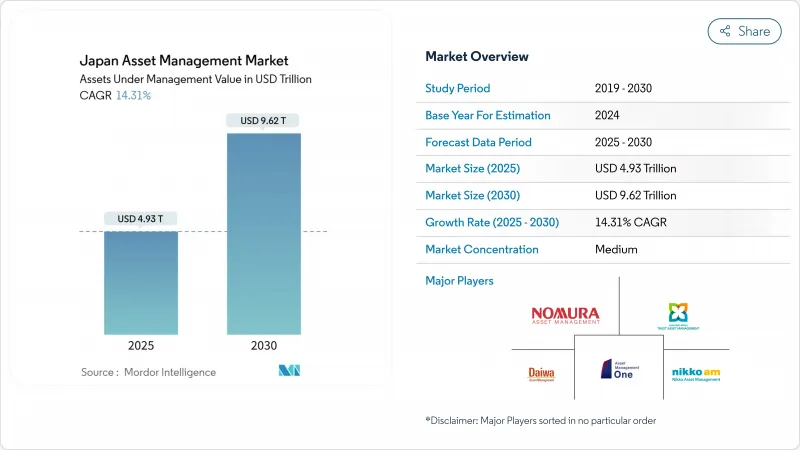

Japan Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan asset management market value stands at USD 4.93 trillion in 2025 and is forecast to reach USD 9.62 trillion by 2030, expanding at a 14.31% CAGR.

The upward trajectory reflects a decisive move away from a cash-heavy household balance sheet toward professionally managed investments, such as corporate pension reform, tax-advantaged NISA upgrades, and the Government Pension Investment Fund's (GPIF) alternative-asset strategy combine to lift net inflows. Digital onboarding, rising demand for outcome-oriented strategies, and the 2024 exit from negative interest rates further accelerate the adoption of investment products. Competitive intensity remains moderate because the Japan asset management market is still fragmented, allowing specialist houses and foreign entrants to carve out niches. Managers able to modernize legacy technology and align with environmental, social, and governance (ESG) standards appear best placed to capture share as demographic pressure prompts investors to seek higher-yielding, globally diversified portfolios.

Japan Asset Management Market Trends and Insights

Accelerating the shift from bank deposits to investment funds

Japanese households keep a large share of their wealth in cash, yet the revamped NISA program now lets individuals invest sizable sums each year without paying tax, redirecting part of those idle balances into capital markets. The Bank of Japan's decision in 2024 to end negative interest rates made equities and balanced funds more attractive than simply parking money in savings accounts. The government's goal of significantly expanding NISA participation further anchors long-term demand for mutual funds and exchange-traded funds. Large banks and securities groups are pouring resources into digital client platforms; for example, Mizuho has committed major capital to tools that nudge savers toward diversified portfolios. Managers that pair clear, low-cost fee structures with robust investor education are positioned to capture a disproportionate share of these new flows as risk-averse savers move toward professionally managed solutions.

Mandatory corporate pension reform boosting AUM inflows

Legislation requiring defined contribution (DC) plans is shifting longevity risk from corporate balance sheets to professional managers. Early movers among large manufacturers and service conglomerates are migrating legacy defined-benefit assets into professionally run DC schemes, providing multi-year visibility on fee revenue. GPIF's ESG integration template is increasingly mirrored by corporate funds, prompting demand for multi-asset, inflation-hedged, and sustainability-aligned strategies. As reforms broaden across mid-sized companies, asset managers offering bundled record-keeping, participant education, and outcome-oriented product menus can cement institutional relationships and achieve scalable growth.

Persistent near-zero interest-rate environment compressing yields

Although the Bank of Japan ended negative rates, policy remains accommodative, leaving domestic bond yields subdued and eroding traditional income streams. Asset managers must search for yield in overseas credit, infrastructure debt, and dividend-oriented equities, but smaller firms lack the global research footprint or risk infrastructure to implement these ideas competitively. This environment favors diversified houses with international reach and sophisticated hedging capabilities, widening performance dispersion and posing retention risks for legacy bond-heavy franchises.

Other drivers and restraints analyzed in the detailed report include:

- Robo-advisory adoption among mass-affluent investors

- GPIF's alternative-asset appetite is setting industry benchmarks

- Shrinking working-age population limiting long-term contribution growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equities accounted for 42.4% of the Japan asset management market size in 2024, underscoring the historical bias toward domestic stock exposure fostered by decades of familiarity with the Nikkei and TOPIX indices. The Japan asset management market size tied to alternative strategies is forecasted to rise by 16.42% annually, outpacing every traditional asset class as return expectations compress in public markets. GPIF mandates, corporate pension copycat allocations, and the search for long-duration inflation-protected cash flows are shaping demand. Real estate, infrastructure, and private equity funds designed around the government's Green Transformation roadmap slot naturally into this narrative, enabling institutions to match liability profiles while supporting domestic growth initiatives.

In response, local managers are building specialist teams or entering partnerships with global alternative houses to secure deal flow and operational expertise. Foreign firms with established global platforms are leveraging Tokyo branches to distribute seasoned funds that offer currency-hedged share classes and local reporting. Competitive differentiation is shifting toward sourcing capabilities and governance transparency rather than headline performance alone, a pattern that realigns fee structures with value delivered in the Japan asset management market.

Banks held 45.7% of the Japan asset management market size in 2024, courtesy of sprawling branch networks, but their share inches down as new investors gravitate to independent advisers touting fiduciary standards. Wealth advisory companies are projected to record a 15.87% CAGR through 2030, indicating that advice quality and perceived objectivity matter more than one-stop convenience. In the Japan asset management market, this trend forces banks to unbundle pricing, enhance product due diligence, and invest in staff training to meet heightened suitability standards.

Specialist boutiques leverage thematic expertise-ESG equities, small-cap activist funds, private credit-to attract sophisticated clients willing to pay for differentiated alpha. Broker-dealers sit between banks and pure advisers by combining research depth with transactional agility, but fee compression in execution services nudges them toward higher-margin advisory mandates. Overall, a multi-channel equilibrium is emerging in which breadth, depth, and digital engagement coexist, keeping competitive barriers in flux.

The Japan Asset Management Market is Segmented by Asset Class (Equity, Fixed Income, Alternative Assets, and Other Asset Classes), by Firm Type (Broker-Dealers, Banks, Wealth Advisory Firms, and Other Firm Types), by Mode of Advisory (Human Advisory and Robo-Advisory), by Client Type (Retail and Institutional), and by Management Source (Offshore and Onshore). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nomura Asset Management

- Nikko Asset Management

- Daiwa Asset Management

- Sumitomo Mitsui Trust Asset Management

- Asset Management One

- Mitsubishi UFJ Kokusai Asset Management

- Okasan Asset Management

- Nissay Asset Management

- T&D Asset Management

- Meiji Yasuda Asset Management

- Norinchukin Zenkyoren Asset Management

- BlackRock Japan

- Schroder Investment Management (Japan)

- Aberdeen Standard Investments Japan

- Pictet Asset Management Japan

- Invesco Asset Management Japan

- Fidelity Investments Japan

- Russell Investments Japan

- GMO Japan

- Neuberger Berman East Asia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating the shift from bank deposits to investment funds

- 4.2.2 Mandatory corporate pension reform boosting AUM inflows

- 4.2.3 Robo-advisory adoption among mass-affluent investors

- 4.2.4 GPIF's alternative-asset appetite is setting industry benchmarks

- 4.2.5 Tokenized securities pilots opening new investable asset pools

- 4.2.6 ESG transition bonds fuelling specialized fund launches

- 4.3 Market Restraints

- 4.3.1 Persistent negative / near-zero interest-rate policy compressing yields

- 4.3.2 Shrinking working-age population limiting long-term contribution growth

- 4.3.3 Legacy mainframe systems slowing product-launch cycles

- 4.3.4 High distribution fees discouraging retail switching

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Asset Class

- 5.1.1 Equity

- 5.1.2 Fixed Income

- 5.1.3 Alternative Assets

- 5.1.4 Other Asset Classes

- 5.2 By Firm Type

- 5.2.1 Broker-Dealers

- 5.2.2 Banks

- 5.2.3 Wealth Advisory Firms

- 5.2.4 Other Firm Types

- 5.3 By Mode of Advisory

- 5.3.1 Human Advisory

- 5.3.2 Robo-Advisory

- 5.4 By Client Type

- 5.4.1 Retail

- 5.4.2 Institutional

- 5.5 By Management Source

- 5.5.1 Offshore

- 5.5.2 Onshore

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Nomura Asset Management

- 6.4.2 Nikko Asset Management

- 6.4.3 Daiwa Asset Management

- 6.4.4 Sumitomo Mitsui Trust Asset Management

- 6.4.5 Asset Management One

- 6.4.6 Mitsubishi UFJ Kokusai Asset Management

- 6.4.7 Okasan Asset Management

- 6.4.8 Nissay Asset Management

- 6.4.9 T&D Asset Management

- 6.4.10 Meiji Yasuda Asset Management

- 6.4.11 Norinchukin Zenkyoren Asset Management

- 6.4.12 BlackRock Japan

- 6.4.13 Schroder Investment Management (Japan)

- 6.4.14 Aberdeen Standard Investments Japan

- 6.4.15 Pictet Asset Management Japan

- 6.4.16 Invesco Asset Management Japan

- 6.4.17 Fidelity Investments Japan

- 6.4.18 Russell Investments Japan

- 6.4.19 GMO Japan

- 6.4.20 Neuberger Berman East Asia

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment