PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851041

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851041

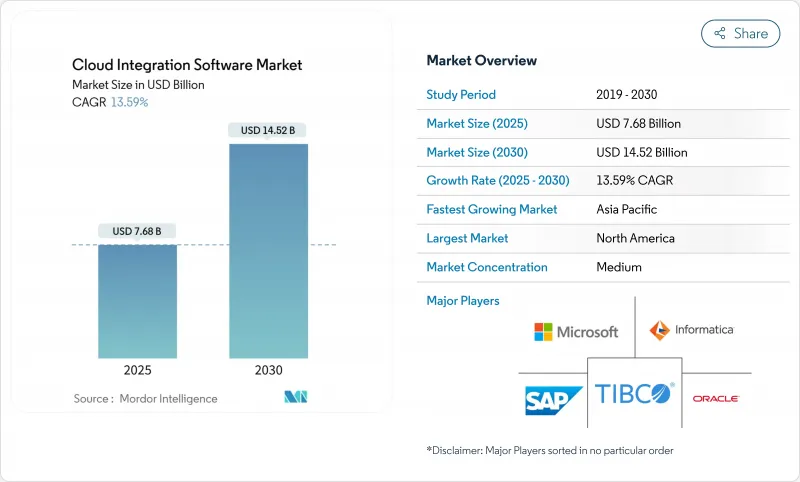

Cloud Integration Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cloud integration software market size reached USD 7.68 billion in 2025 and is projected to climb to USD 14.52 billion by 2030, reflecting a 13.6% CAGR.

Most enterprises now distribute workloads across at least two hyperscalers to contain vendor lock-in while matching compute profiles to use-case needs. Growth is amplified by sprawling SaaS portfolios that must exchange data in real time, rising adoption of event-driven analytics engines, and factory modernisation initiatives that link edge sensors with cloud AI platforms. Uptake is further helped by low-code tooling that reduces time-to-value, plus vendor consolidation that bundles API management, data pipelines, and governance in a single contract. Headwinds such as cross-border data controls and hyperscaler egress fees are pushing providers toward hybrid deployment models that process sensitive records locally while still supporting global collaboration.

Global Cloud Integration Software Market Trends and Insights

Proliferation of Multi-Cloud Adoption

Enterprises treat multi-cloud as a competitive lever rather than an insurance policy, matching GPU-dense nodes to AI training while housing regulated data in sovereign regions. Hyperscalers respond with cross-cloud database and networking services that trim latency and erase egress fees, spurring demand for control planes that abstract policy enforcement across providers. Unified governance hastens partner onboarding because encryption and logging remain consistent no matter where workloads land.

SaaS Application Sprawl Requiring Unified Integration

With the average enterprise now running more than 360 SaaS apps, point-to-point links crack under scale, fragmenting data and harming compliance. Modern iPaaS bundles pre-built connectors, schema mapping, and version control so teams can sync records instantly without scripting. Vendors further add API marketplaces that let customers sell curated connectors, turning integration from back-office cost into incremental revenue.

Data-Sovereignty and Compliance Complexity

Fragmented privacy laws force teams to build region-specific pipelines that keep regulated data resident while still enabling global analytics. Vendors answer with sovereign cloud zones and policy-based routing, but compliance audits prolong rollouts and inflate operating costs.

Other drivers and restraints analyzed in the detailed report include:

- Need for Real-Time Data Analytics and API-Led Connectivity

- Event-Driven Architectures in Microservices

- Legacy On-Premises Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform-as-a-Service kept 58.3% share in 2024 because large enterprises need advanced customisation. Yet SaaS integration will grow 15.3% annually, thanks to instant scaling, built-in observability, and subscription pricing that slashes CapEx. Vendors weave AI-based data mapping and anomaly detection into their SaaS layers, letting citizen developers build flows without code while security teams remain in control.

For regulated sectors, Infrastructure-as-a-Service integration maintains relevance by anchoring workloads on dedicated hosts under strict audit. These deployments often rely on Kubernetes operators that enforce policy templates and replicate secrets across clusters.

Application Integration dominated revenue at 36.7% in 2024, underpinning ERP and CRM linkages. API Management, however, will post a 14.2% CAGR as firms monetise digital assets and adopt microservices. Gateways now ship with self-service developer portals, quota enforcement, and schema introspection, shrinking partner onboarding windows from months to days.

EDI modernisation also gains steam: manufacturers replace batch flat-file exchanges with real-time event streams that improve inventory turns and reduce stock-outs.

The Cloud Integration Software Market Report is Segmented by Type (PaaS, Iaas, and SaaS), Integration (Application Integration, Data Integration, and More), Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Service Type (Professional Service and Managed Services), End-User Industry (BFSI, IT and Telecom, and More), and Geography.

Geography Analysis

North America held 36.4% market share in 2024, buoyed by deep cloud expertise, permissive data-flow regimes, and proximity to vendor headquarters that grants early access to bleeding-edge features. Enterprises here adopt AI-driven integration observability that correlates API calls, message queues, and data pipelines under one pane of glass.

Asia-Pacific is forecast for the fastest 14.5% CAGR through 2030. Sovereign cloud programs require hybrid platforms able to enforce data-residency while still syncing R and D workloads globally. Rapid 5G deployment and IoT proliferation in China, Japan, and South Korea generate telemetry bursts that must be cleansed at the edge before archive to central data lakes.

Europe keeps sizable share due to strict privacy mandates that emphasise audit logs, consent workflows, and immutable data lineage. The upcoming Digital Operational Resilience Act will push financial institutions to adopt event-streaming architectures that survive single-point failures.

- Microsoft

- Salesforce (MuleSoft)

- IBM

- Boomi

- Informatica

- SAP

- Oracle

- TIBCO

- SnapLogic

- Software AG

- Workato

- Celigo

- Jitterbit

- Talend

- WSO2

- Red Hat

- Axway

- Kong Inc.

- Accenture

- Deloitte

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of multi-cloud adoption

- 4.2.2 SaaS application sprawl requiring unified integration

- 4.2.3 Need for real-time data analytics and API-led connectivity

- 4.2.4 Event-driven architectures in micro-services

- 4.2.5 Edge-to-cloud orchestration for Industry 4.0

- 4.2.6 Monetisation of marketplace connectors (iPaaS)

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and compliance complexity

- 4.3.2 Legacy on-prem integration complexity

- 4.3.3 Rising hyperscaler egress charges

- 4.3.4 Scarcity of cloud-native integration talent

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 PaaS

- 5.1.2 IaaS

- 5.1.3 SaaS

- 5.2 By Integration

- 5.2.1 Application Integration

- 5.2.2 Data Integration

- 5.2.3 API Management

- 5.2.4 Process Integration and Orchestration

- 5.2.5 B2B/EDI Integration

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Service Type

- 5.4.1 Professional Services

- 5.4.2 Managed Services

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Retail and E-commerce

- 5.5.4 Education

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Manufacturing

- 5.5.7 Government and Public Sector

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft

- 6.4.2 Salesforce (MuleSoft)

- 6.4.3 IBM

- 6.4.4 Boomi

- 6.4.5 Informatica

- 6.4.6 SAP

- 6.4.7 Oracle

- 6.4.8 TIBCO

- 6.4.9 SnapLogic

- 6.4.10 Software AG

- 6.4.11 Workato

- 6.4.12 Celigo

- 6.4.13 Jitterbit

- 6.4.14 Talend

- 6.4.15 WSO2

- 6.4.16 Red Hat

- 6.4.17 Axway

- 6.4.18 Kong Inc.

- 6.4.19 Accenture

- 6.4.20 Deloitte

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment