PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851092

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851092

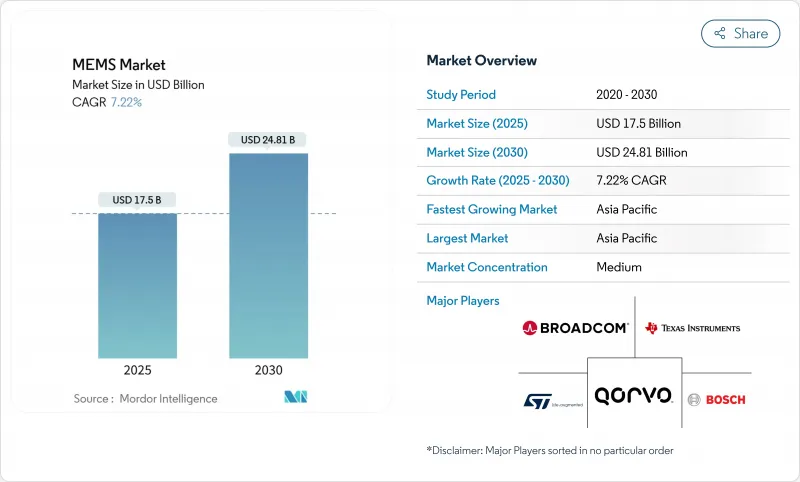

MEMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global MEMS market size stands at USD 17.50 billion in 2025 and is projected to reach USD 24.81 billion by 2030, reflecting a steady 7.22% CAGR.

Momentum stems from rising sensor penetration in smartphones, electric vehicles, medical wearables, and industrial IoT nodes that demand durable, low-power, and miniaturized components. Automotive electrification multiplies pressure, temperature, and inertial sensor counts per vehicle, while point-of-care diagnostics pull microfluidic chips from pilot lines into mass production. Advancing 5G infrastructure further amplifies demand for RF MEMS filters that sustain low insertion loss across expanding frequency bands. Supply resilience improves as 300 mm wafer processing enters pilot runs in the United States, yet competition remains fragmented, letting niche specialists capture design wins in emerging use-cases such as edge AI sensor fusion.

Global MEMS Market Trends and Insights

Rising adoption of IoT & edge devices

The climb in connected endpoints obliges factories, buildings, and logistics hubs to embed dozens of sensors per asset, turning low-power accelerometers, gyroscopes, and environmental monitors into standard bill-of-materials components. Semiconductor companies increasingly package MEMS sensors with microcontrollers to deliver localized analytics that cut backhaul bandwidth and cloud latency. Edge AI chips that run decision trees or lightweight neural networks directly on sensor nodes push suppliers to rethink design rules for power budgets below 50 µW, prompting sustained redesign cycles that enlarge the MEMS market.

Expanding sensor content in EV & ADAS

Electric vehicles contain 2-3 X more pressure, inertial, and environmental sensors than internal-combustion cars. Murata's new domestic line for automotive-grade inertial sensors underlines how Japanese suppliers pivot to mobility revenue as legacy handset volumes plateau newswitch. Optical MEMS mirrors from TDK enable adaptive headlights and solid-state LiDAR, adding differentiated sockets per vehicle. LiDAR vendor RoboSense captured 33.5% global automotive LiDAR revenue in 2024, underscoring the intertwined growth of advanced driver assistance and high-precision sensing.

Complex & capital-intensive manufacturing

Transitioning to 300 mm wafers cuts die cost but demands new lithography, bonding, and metrology tools whose acquisition can exceed USD 500 million per line. SEMI projects 6% growth in 300 mm wafer shipments in Q1 2025, yet smaller MEMS fabs struggle to raise capital for the upgrade.U.S. CHIPS Act incentives ease financing for a handful of domestic projects, including Rogue Valley Microdevices' Florida fab slated for 2025 production. Suppliers without -300 mm capacity face widening cost gaps that compress margins.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of 5G driving RF MEMS filters

- Surge in microfluidic MEMS for PoC diagnostics

- RF MEMS patent thickets raising licensing costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sensors generated 57% of 2024 revenue as handset OEMs, automotive Tier-1 suppliers, and industrial automation houses all standardize inertial, pressure, and environmental packages. This dominant slice of the MEMS market underlines how mature manufacturing nodes deliver cost efficiency while maintaining reliability in harsh environments. The segment benefits from smartphones that embed up to six discrete motion and audio sensors, and vehicles that now integrate triple-redundant accelerometers for airbag, stability, and ADAS functions. In contrast, actuators deliver stable but slower growth tied to optical image-stabilization motors and micro-mirror arrays for LiDAR beam steering. Oscillators displace quartz timing in automotive powertrains, foreseeing rising attach rates as electrification accelerates.

Microfluidic chips, at 9.8% CAGR, represent the technology frontier. Lab-on-a-chip cartridges combine capillary flow control, electrochemical sensing, and on-board reagents, cutting diagnostic cycle time from days to minutes. Hospital procurement managers value simplified sample prep and minimal operator training, pushing device makers toward fully disposable units that rely on polymer-based MEMS flow channels. Pharmaceutical firms explore organ-on-chip platforms to model human tissue response, creating additional pull for high-precision microfluidic fabrication. This emerging basket supports sustained differentiation and positions suppliers that master surface chemistry as premium partners, expanding the MEMS market beyond traditional electromechanical spheres.

Inertial sensors secured 24.5% of 2024 revenue, underpinning smartphone orientation detection, automotive rollover protection, and industrial track-and-trace modules. Their proven reliability under vibration and temperature extremes cements the category's relevance within the MEMS market. Continuous performance improvements, such as bias drift under 1°/h, extend use-cases into precision agriculture and warehouse automation robotics. Meanwhile, RF MEMS components deliver 10.4% CAGR as 5G deployments request agile spectrum tuning unattainable with fixed ceramic filters. Foundries invest in hermetic wafer-level packaging to guard high-Q cavities against moisture ingress, safeguarding yield and elevating average selling prices.

MEMS microphones, pressure sensors, and environmental detectors sustain steady volume growth. STMicroelectronics' 2024 release of an autonomous industrial IMU that integrates finite-state-machine logic underscores the pivot toward edge intelligence where small code snippets filter events before transmission. Optical MEMS mirrors advance solid-state LiDAR, benefiting from minimal moving mass and mechanical fatigue resistance.

The MEMS Market is Segmented by Device Class (Sensors, Actuators, and More), Sensor/Actuator Type (Inertial Sensors, Pressure Sensors, and More), Application (Consumer Electronics, Automotive, and More), Fabrication Process (Bulk Micromachining, Surface Micromachining, and More), Material (Silicon, Polymers, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 45% revenue share in 2024 and is tracking a 10.7% CAGR through 2030. China's domestic vendors accelerate patent filings in RF front-ends, aiming to localize supply for 5G and satellite communications. Japanese champions TDK and Murata extend capacity for automotive-grade inertial sensors to capture global electrification demand. South Korea leverages advanced memory cleanrooms to diversify into MEMS timing devices, while Singapore and Malaysia expand test-and-assembly clusters that offer lower labor cost structures.

North America benefits from strong aerospace and defense programs as well as medical device innovation pipelines. The CHIPS Program Office awarded multi-billion-dollar grant negotiations to fabs that incorporate MEMS pilot lines, encouraging shorter domestic supply chains. Silicon wafer shipments rose 2.2% year-on-year in Q1 2025, with 300 mm category demand signalling readiness for high-volume production. Florida's new MEMS foundry will add regional resilience when it enters volume production in 2025.

Europe concentrates on automotive safety, industrial automation, and medical wearables. Regulatory frameworks mandating advanced driver assistance functions accelerate sensor penetration, boosting the region's contribution to the MEMS market. STMicroelectronics' autonomous industrial IMU caters to stringent long-lifecycle demands from German and Italian equipment makers. The Middle East and Africa remain nascent, yet smart-city pilots in Gulf states create lighthouse references for distributed air-quality sensing and intelligent lighting.

- Robert Bosch GmbH

- Broadcom Inc.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- TDK Corporation (InvenSense)

- Qorvo Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Knowles Electronics LLC

- Panasonic Corporation

- GoerTek Inc.

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices Inc.

- Alps Alpine Co., Ltd.

- Omron Corporation

- Sensata Technologies

- Silex Microsystems AB

- Teledyne MEMS

- Rogue Valley Microdevices Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of IoT and edge devices

- 4.2.2 Expanding sensor content in EV and ADAS

- 4.2.3 Proliferation of 5G driving RF MEMS filters

- 4.2.4 Shift to 300 mm MEMS wafer fabrication

- 4.2.5 Heterogeneous integration and chiplet packaging

- 4.2.6 Surge in microfluidic MEMS for PoC diagnostics

- 4.3 Market Restraints

- 4.3.1 Complex and capital-intensive manufacturing

- 4.3.2 Design and process standardization gaps

- 4.3.3 Supply-chain dependence on specialty materials

- 4.3.4 RF MEMS patent thickets raising licensing costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Class

- 5.1.1 Sensors

- 5.1.2 Actuators

- 5.1.3 Oscillators and Timing

- 5.1.4 Microfluidic Chips

- 5.1.5 Power/Motion Micro-generators

- 5.2 By Sensor / Actuator Type

- 5.2.1 Inertial Sensors

- 5.2.2 Pressure Sensors

- 5.2.3 RF MEMS

- 5.2.4 Optical MEMS

- 5.2.5 Environmental Sensors

- 5.2.6 MEMS Microphones

- 5.2.7 Microbolometers and IR Detectors

- 5.2.8 Ink-jet Heads

- 5.2.9 Others

- 5.3 By Application

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Industrial and Robotics

- 5.3.4 Healthcare and Medical Devices

- 5.3.5 Telecom Infrastructure

- 5.3.6 Aerospace and Defense

- 5.3.7 Others

- 5.4 By Fabrication Process

- 5.4.1 Bulk Micromachining

- 5.4.2 Surface Micromachining

- 5.4.3 HAR Silicon Etching / DRIE

- 5.4.4 Silicon-on-Insulator (SOI) MEMS

- 5.4.5 LIGA and X-ray Lithography

- 5.4.6 Advanced 3D-Printed MEMS

- 5.5 By Material

- 5.5.1 Silicon

- 5.5.2 Polymers

- 5.5.3 Piezoelectric (AlN, PZT)

- 5.5.4 Metals

- 5.5.5 Compound Semiconductors

- 5.5.6 Quartz and Glass

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Australia and New Zealand

- 5.6.4.7 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Broadcom Inc.

- 6.4.3 STMicroelectronics N.V.

- 6.4.4 Texas Instruments Inc.

- 6.4.5 TDK Corporation (InvenSense)

- 6.4.6 Qorvo Inc.

- 6.4.7 Infineon Technologies AG

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 Knowles Electronics LLC

- 6.4.10 Panasonic Corporation

- 6.4.11 GoerTek Inc.

- 6.4.12 Honeywell International Inc.

- 6.4.13 Murata Manufacturing Co., Ltd.

- 6.4.14 Analog Devices Inc.

- 6.4.15 Alps Alpine Co., Ltd.

- 6.4.16 Omron Corporation

- 6.4.17 Sensata Technologies

- 6.4.18 Silex Microsystems AB

- 6.4.19 Teledyne MEMS

- 6.4.20 Rogue Valley Microdevices Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment