PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851156

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851156

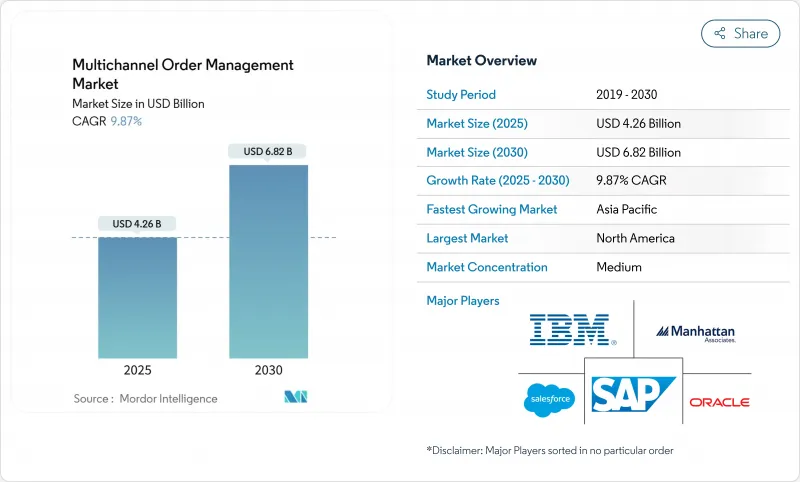

Multichannel Order Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Multichannel Order Management Market size is estimated at USD 4.26 billion in 2025, and is expected to reach USD 6.82 billion by 2030, at a CAGR of 9.87% during the forecast period (2025-2030).

Rising e-commerce penetration, the spread of omnichannel retail strategies, and mounting pressure for real-time inventory visibility are the principal growth catalysts. Large retailers are orchestrating orders across web stores, physical outlets, and social-commerce feeds, while manufacturers and wholesalers now demand the same cross-channel agility. Momentum also reflects the expanding ecosystem of cloud-native applications that integrate order management with payments, warehouse automation, carrier networks, and tax engines. Competitive intensity is increasing as established enterprise-software vendors add advanced orchestration, and niche players leverage AI to improve allocation decisions and cycle-time metrics.

Global Multichannel Order Management Market Trends and Insights

Boom in Global E-commerce Transactions

E-commerce is expected to account for 21.2% of global retail sales and generate USD 6.5 trillion in turnover, multiplying the order volume that enterprises must manage across direct-to-consumer sites, marketplaces, and wholesale portals. Retailers such as Barbeques Galore cut order-processing time by 49% after deploying a real-time orchestration platform, proving the operational upside of purpose-built systems. Mobile commerce, forecast to represent 42.9% of online sales, adds another layer of high-frequency orders that demand split-second inventory checks and payment authentication. Rapid digital-payment uptake, exceeding 50% of transaction value in Southeast Asia, reinforces the need for integrated gateways within the order-capture workflow. Social-commerce and live-shopping innovations extend order sources to video streams and influencer feeds, forcing businesses to tackle near-continuous inventory allocation challenges.

Proliferation of Omnichannel Retail Strategies

Companies with mature omnichannel programs record 9.5% higher revenue than single-channel peers, driving investment in orchestration that unifies store, warehouse, and drop-ship capacity. Unified inventory pools lower shipping costs by shipping from the closest node, while buy-online-pick-up-in-store and endless-aisle scenarios require dynamic reservation logic. OneStock clients report a 32% lift in overall sales once ship-from-store is enabled. Inditex's RFID program shows that granular stock visibility supports seamless cross-channel fulfillment. Composable commerce architectures let retailers integrate best-of-breed order components without vendor lock-in and adapt to shifting preferences.

Data-security and Privacy Risks in Cloud OMS

A misconfigured Oracle NetSuite instance exposed thousands of customer records, underscoring that shared-responsibility models amplify configuration risk. Enterprises now require deeper penetration tests and ISO attestations before onboarding sensitive order flows, elongating sales cycles. Emerging privacy statutes add encryption, localization, and audit-trail demands that further raise compliance costs. Multi-tenant footprints can heighten perceived exposure, prompting some firms to request single-tenant or hybrid deployments despite higher total cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Cloud-based SaaS OMS Platforms

- AI-driven Inventory-optimisation ROI

- Legacy ERP/WMS Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software category generated 71.6% of multichannel order management market revenue in 2024, anchoring enterprise investments in scalable orchestration engines. Services, however, are expanding at a 13.3% CAGR as organisations seek integration, customisation, and managed support to accelerate time-to-value. Custom builds often cost USD 200,000-400,000 and require up to 12 months, so firms increasingly favour expert partners to shorten roadmaps. Service consultancies also deliver training that lifts user adoption and mitigates post-go-live disruption.

Demand for composable architectures pushes up integration work, sustaining services momentum through 2030. Rapid 55-day rollouts, such as Deposco's 3PL implementation, exhibit how specialist teams compress schedules while meeting complex logistics requirements. Managed services now encompass continuous optimisation, upgrades, and AI-model tuning, turning vendors into long-term operational partners.

Cloud deployments held 68.2% revenue share in 2024 and are projected to grow at 13.1% CAGR, reflecting enterprises shifting workloads off legacy hardware. Auto-scaling capacity prevents holiday slowdowns, while operating-expense pricing appeals to finance teams. Multicloud agreements, such as Oracle's pact with AWS, let customers mix best-of-breed analytics with core order management layers.

On-premise remains in regulated industries that require sovereign hosting. Hybrid patterns bridge ERP dependencies by syncing critical data to the cloud while preserving local processing. API-first design eases connectivity with payment gateways and 3PL providers, reinforcing the predominance of cloud in the multichannel order management market.

Multichannel Order Management Market is Segmented by Offerings (Software and Services), Deployment Mode (Cloud and On-Premise), End-User Vertical (Retail and E-Commerce, Food and Beverage, and More), Organisation Size (Large Enterprises and Small and Medium Enterprises), Sales-Channel Complexity (Pure-Play Digital, Click-And-Mortar, and Marketplace Sellers), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 36.2% of 2024 revenue and remains the hub for early cloud adoption, AI proofs of concept, and marketplace partnerships. Retailers face escalating surcharges, with 2025 general rate hikes of 5.9% plus add-on fees, motivating sophisticated carrier-selection algorithms. Investment activity continues, evident in Clearwater's USD 1.5 billion acquisition of Enfusion to unify front-to-back workflows. Government support for digital sales-tax collection accelerates demand for automated compliance modules.

Asia-Pacific is the fastest-growing territory at 12.6% CAGR thanks to mobile-first consumer behaviour, live-commerce popularity, and a projected USD 230 billion Southeast-Asian e-commerce market by 2026. Shoppers often browse in-store and order online, forcing retailers to merge real-time store inventory with digital carts. Local payment methods such as e-wallets demand embedded gateways and instant reconciliation. Japanese restaurants now integrate mobile order apps with NEC point-of-sale to offset labour shortages, illustrating cross-industry adoption. Diverse tax regimes and data-localisation rules compel vendors to offer region-specific hosting and compliance layers.

Europe records steady growth supported by strict privacy regulation that mandates granular audit trails. Continuous transaction controls require real-time tax validation, leading SAP users to upgrade order flows for compliance. Consumer expectations for sustainable delivery spur features like location-based packaging suggestions and eco-route selection. Retailers prefer hybrid deployments hosted in regional data centres to satisfy GDPR and sovereignty criteria. National variations in omnichannel maturity-from click-and-collect ubiquity in the United Kingdom to store-centred fulfilment in Germany-increase demand for configurable rule engines that support country-level process nuances.

- IBM Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Manhattan Associates, Inc.

- Blue Yonder Group, Inc.

- HCL Technologies Ltd.

- Microsoft Corporation

- NetSuite (Oracle)

- Shopify Inc.

- Sage Group plc (Brightpearl)

- Zoho Corporation Pvt Ltd.

- Linnworks Ltd.

- ChannelAdvisor (CommerceHub)

- Lightspeed Commerce Inc.

- Adobe Commerce (Magento)

- Cloud Commerce Pro Ltd.

- Freestyle Solutions, Inc.

- Unicommerce eSolutions Pvt Ltd.

- VTEX

- Elastic Path Software Inc.

- 3PL Central (Skubana)

- FarEye Technologies Pvt Ltd.

- Mirakl SA

- Sanderson Design Group plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Boom in global e-commerce transactions

- 4.2.2 Proliferation of omnichannel retail strategies

- 4.2.3 Shift to cloud-based SaaS OMS platforms

- 4.2.4 Hyperscaler marketplace private-offer adoption

- 4.2.5 AI-driven inventory-optimisation ROI

- 4.2.6 Real-time tax-compliance mandates

- 4.3 Market Restraints

- 4.3.1 Data-security and privacy risks in cloud OMS

- 4.3.2 Legacy ERP/WMS integration complexity

- 4.3.3 Rising carrier surcharges eroding savings

- 4.3.4 Shortage of OMS-skilled developers

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offerings

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By End-user Vertical

- 5.3.1 Retail and E-commerce

- 5.3.2 Food and Beverage

- 5.3.3 Healthcare

- 5.3.4 3PL and Logistics

- 5.3.5 Other End-user Verticals

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Sales-Channel Complexity

- 5.5.1 Pure-play Digital

- 5.5.2 Click-and-Mortar

- 5.5.3 Marketplace Sellers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Malaysia

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Oracle Corporation

- 6.4.3 Salesforce, Inc.

- 6.4.4 SAP SE

- 6.4.5 Manhattan Associates, Inc.

- 6.4.6 Blue Yonder Group, Inc.

- 6.4.7 HCL Technologies Ltd.

- 6.4.8 Microsoft Corporation

- 6.4.9 NetSuite (Oracle)

- 6.4.10 Shopify Inc.

- 6.4.11 Sage Group plc (Brightpearl)

- 6.4.12 Zoho Corporation Pvt Ltd.

- 6.4.13 Linnworks Ltd.

- 6.4.14 ChannelAdvisor (CommerceHub)

- 6.4.15 Lightspeed Commerce Inc.

- 6.4.16 Adobe Commerce (Magento)

- 6.4.17 Cloud Commerce Pro Ltd.

- 6.4.18 Freestyle Solutions, Inc.

- 6.4.19 Unicommerce eSolutions Pvt Ltd.

- 6.4.20 VTEX

- 6.4.21 Elastic Path Software Inc.

- 6.4.22 3PL Central (Skubana)

- 6.4.23 FarEye Technologies Pvt Ltd.

- 6.4.24 Mirakl SA

- 6.4.25 Sanderson Design Group plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment