PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851208

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851208

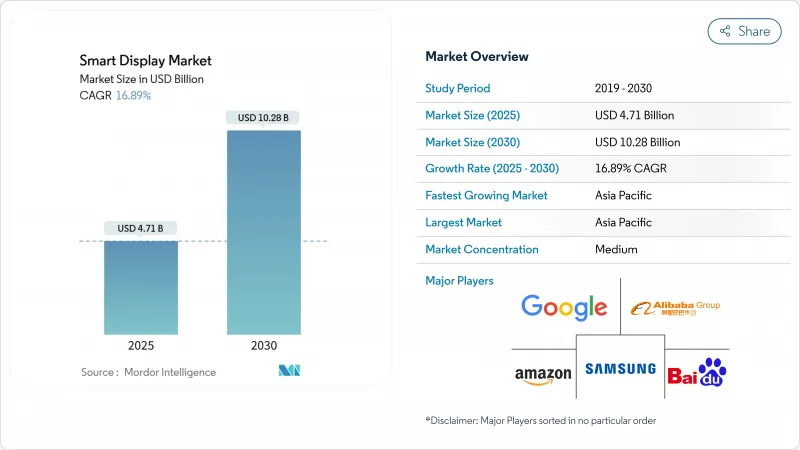

Smart Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart display market stood at USD 4.71 billion in 2025 and is projected to reach USD 10.28 billion by 2030, reflecting a 16.89% CAGR.

The upgrade cycle from voice-only screens to AI-driven multimodal hubs is widening average selling prices while enlarging the installed base. Matter protocol adoption is dismantling platform lock-in, shifting competition toward hardware innovation rather than ecosystem exclusivity. Automotive cockpits, OLED diffusion, and AI-enhanced above 10-inch models are intensifying revenue upside. Vertically integrated panel makers have preserved margins despite 8-10-inch LCD shortages. Conversely, enterprise buyers have prolonged procurement cycles because of always-on-microphone risks, tempering short-term shipment momentum.

Global Smart Display Market Trends and Insights

Rising adoption of multimodal voice-first smart-home hubs in North America

Smart displays are evolving into visual-voice hybrids that orchestrate lighting, security, and entertainment systems from a single interface. Voice-assistant penetration is expected to reach 157.1 million U.S. users by 2026, underpinning device upgrades that handle richer commands and provide contextual visuals. Generative AI is enabling proactive suggestions-such as pre-warming thermostats based on commute data-raising perceived value. Samsung's Vision AI-equipped displays helped the company capture 28.3% of premium category shipments in 2024. Retailers are bundling displays with subscription services, driving recurring revenue and stickiness. Competitive intensity is heightening as Apple prepares its first smart home display, prompting ecosystem players to refresh line-ups annually.

Proliferation of Matter-compliant devices accelerating platform interoperability

Matter 1.4 introduced certified home routers that unify Wi-Fi and Thread, slashing onboarding failures and cutting installer time. By mid-2025 more than 1,000 Matter-certified products are expected, giving consumers confidence to mix brands without fearing lock-in. Enterprises view the protocol's secure commissioning as a step toward meeting zero-trust mandates, encouraging broader commercial rollouts. Utilities are exploring Matter-based energy dashboards to support demand-response programs. The standard also unlocks retrofit opportunities in hospitality, where existing Wi-Fi infrastructure can host Thread border routers without rewiring.

Security vulnerabilities in always-on microphones causing B2B procurement delays

Financial institutions and hospitals are pausing deployments until vendors document data pathways and prove on-device processing sufficiency. Procurement cycles have stretched by up to 45 days as CISOs demand penetration tests aligned with ISO 27001 requirements. Matter's optional offline mode eases some concerns but complicates central device management, prompting requests for hybrid architectures that add cost and integration complexity. Vendors that achieve FedRAMP-equivalent attestations are winning contracts faster, creating early-mover advantages.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM integration of smart mirrors and pillar-to-pillar cockpit displays

- AI-powered contextual UI driving premium price mix in more than 10-inch category

- Persistent panel shortage in 8-10-inch LCD fabs limiting supply elasticity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The smart display market size for voice-assistant devices reached USD 4.2 billion in 2025. Amazon Alexa held 33.7% market share in 2024, riding cross-sell momentum from Fire TV and Ring. Google Assistant followed through Nest hubs, while Alibaba's TmallGenie grew at 18.7% CAGR, buoyed by AI chatbot integration that localizes content for Chinese dialects. The smart display market size for voice-assistant devices reached USD 4.2 billion in 2025, and replacement demand is strengthening as generative models enable memory of prior conversations. Apple's March 2025 six-inch Home Display announcement signals fresh competition that may draw iOS households into its HomeKit universe.

Continued expansion of Mandarin-optimized large language models is eroding Alexa's edge in China, where Baidu DuerOS controlled 41.1% of mobile smart screens despite a 10.3 percentage-point decline. Brands are differentiating via visual search, kid-safe modes, and multimodal shopping carts that link QR-based checkout. These moves illustrate how the smart display market is fragmenting into region-specific experience layers even as Matter attempts to harmonize connectivity.

The 5-10-inch category dominated with 52.7% revenue in 2024 because it balances countertop space and viewing comfort. Kitchen recipes, bedroom alarms, and desk video calls mostly fit this diagonal, keeping BOM costs low. Yet the >10-inch cohort is expanding at a 19.3% CAGR as retailers, hospitals, and vehicle dashboards demand richer visuals. Wider panels invite split-screen modes for simultaneous video chats and smart-home dashboards, elevating user engagement metrics.

Average selling prices jump when diagonal exceeds 10 inches, improving manufacturer margins. OLED penetration is higher in this tier, helping the smart display market command premium price points. Panel makers are shifting capacity toward Gen 8.6 glass substrates to serve the large-format rush. Meanwhile, <5-inch devices remain in budget niches and as bedside companions, but their slice of the smart display market is shrinking under competition from wearables that already occupy the small-screen notification role.

LCD retained 81.8% share in 2024, thanks to mature supply chains and competitive pricing. Automotive instrument clusters often favor LTPS LCD for thermal stability and brightness. However, OLED's 21.8% CAGR is accelerating as vendors exploit its deep blacks and flexibility to fashion curved or rollable form factors. Smart mirrors in luxury hotels use OLED laminates to hide inactive displays behind reflective glass, commanding higher ARPU.

The smart display market size for OLED-based units is forecast to exceed USD 3 billion by 2030, aided by Gen 6 flexible fabs in South Korea and China. MicroLED research promises even higher luminance and lifespan, with printed transfer techniques edging closer to cost targets. Manufacturers are hedging by cross-licensing patents and mixing panel portfolios to avoid single-technology risk.

The Smart Display Market Report is Segmented by Voice Assistant (Amazon Alexa, and More), Screen Size (5 - 10 Inches, and More), Display Technology (LCD, and More), Resolution (Full HD, and More), Installation Type (Stand-Alone, and More), Connectivity (Wi-Fi Only, and More), End-User Industry (Automotive, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific led the smart display market with 37.6% revenue share in 2024 and is set to compound at 17.3% CAGR through 2030. Chinese vendors such as Baidu and Alibaba responded to a 25.6% slump in 2024 smart-speaker shipments by layering large language models onto displays, resetting value propositions. Government-backed AI chip initiatives are lowering BOM costs, enabling sub-USD 100 large-screen models that widen rural penetration. South Korean brands focus on OLED innovation, leveraging local panel ecosystems to export premium units across the region.

North America remains a technology trendsetter with near-ubiquitous broadband and high voice-assistant uptake. Replacement cycles dominate growth as households swap first-generation screens for Matter-capable variants with superior microphones and edge AI. Amazon retained 29% of U.S. smart-speaker units, rolling out generative AI upgrades to Alexa that encourage upsells to larger Echo Show models. Apple's 2025 entry could lure a slice of the affluent iOS base, reshuffling vendor rankings.

Europe emphasizes privacy and sustainability, stimulating demand for devices with on-device processing and recycled materials. The European Smart Home market reached USD 22.11 billion in 2024, and energy-management features mandated by upcoming Ecodesign rules are steering procurement toward Matter-certified hubs that monitor consumption. Nordic adoption lags owing to voice-assistant language gaps, but regulatory clarity and subsidies for energy retrofits are expected to unlock latent demand. Emerging regions in South America, the Middle East, and Africa witness gradual uptake as smartphone OEMs bundle smaller screens to drive ecosystem stickiness, although price sensitivity and patchy connectivity temper volumes.

- Amazon.com Inc.

- Google LLC

- Baidu Inc.

- Alibaba Group Holding Ltd.

- Xiaomi Corp.

- Lenovo Group Ltd.

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Meta Platforms Inc. (Portal)

- Sony Corp.

- TCL Tech. Group

- Hisense Group

- Sharp Corp.

- Koninklijke Philips N.V.

- Panasonic Holdings Corp.

- Huawei Tech. Co. Ltd.

- BOE Technology Group Co. Ltd.

- Vizio Inc.

- JBL (Harman Int'l)

- Apple Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of multimodal voice-first smart-home hubs in North America

- 4.2.2 Proliferation of Matter-compliant devices accelerating platform interoperability

- 4.2.3 Automotive OEM integration of smart mirrors and pillar-to-pillar cockpit displays

- 4.2.4 AI-powered contextual UI driving premium price mix in Above 10-inch category, Asia-led

- 4.2.5 Retail demand for frictionless checkout and dynamic shelf-edge signage

- 4.2.6 Hospital bedside smart terminals improving patient engagement and HCAHPS scores

- 4.3 Market Restraints

- 4.3.1 Security vulnerabilities in always-on microphones causing B2B procurement delays

- 4.3.2 Persistent panel shortage in 8-10-inch LCD fabs limiting supply elasticity

- 4.3.3 Fragmented regional data-privacy mandates raising localisation costs

- 4.3.4 Voice-assistant language support gaps curbing uptake across Nordics and Caribbeans

5 INDUSTRY ECOSYSTEM ANALYSIS

6 TECHNOLOGICAL OUTLOOK

7 PORTER'S FIVE FORCES ANALYSIS

- 7.1 Porter's Five Forces

- 7.1.1 Bargaining Power of Suppliers

- 7.1.2 Bargaining Power of Buyers

- 7.1.3 Threat of New Entrants

- 7.1.4 Threat of Substitutes

- 7.1.5 Intensity of Competitive Rivalry

8 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 8.1 By Voice Assistant

- 8.1.1 Amazon Alexa

- 8.1.2 Google Assistant

- 8.1.3 Baidu DuerOS

- 8.1.4 Alibaba TmallGenie

- 8.1.5 Apple Siri

- 8.1.6 Others

- 8.2 By Screen Size

- 8.2.1 Less than 5 Inches

- 8.2.2 5 - 10 Inches

- 8.2.3 Above 10 Inches

- 8.3 By Display Technology

- 8.3.1 LCD

- 8.3.2 OLED

- 8.3.3 Others (Micro-LED, E-Paper)

- 8.4 By Resolution

- 8.4.1 HD (= 720p)

- 8.4.2 Full HD (1080p)

- 8.4.3 4K and Above

- 8.5 By Installation Type

- 8.5.1 Stand-alone Smart Displays

- 8.5.2 Integrated Smart Displays (smart mirrors, kiosk, shelf-edge)

- 8.6 By Connectivity

- 8.6.1 Wi-Fi Only

- 8.6.2 Wi-Fi + Cellular

- 8.6.3 Wi-Fi + Zigbee/Thread/Matter

- 8.7 By End-user Industry

- 8.7.1 Residential Smart Home

- 8.7.2 Automotive

- 8.7.3 Retail and Hospitality

- 8.7.4 Healthcare

- 8.7.5 Corporate and Education

- 8.7.6 Others (Transportation Hubs, Public Sector)

- 8.8 By Geography

- 8.8.1 North America

- 8.8.1.1 United States

- 8.8.1.2 Canada

- 8.8.1.3 Mexico

- 8.8.2 Europe

- 8.8.2.1 Germany

- 8.8.2.2 United Kingdom

- 8.8.2.3 France

- 8.8.2.4 Italy

- 8.8.2.5 Spain

- 8.8.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 8.8.2.7 Rest of Europe

- 8.8.3 Asia-Pacific

- 8.8.3.1 China

- 8.8.3.2 Japan

- 8.8.3.3 South Korea

- 8.8.3.4 India

- 8.8.3.5 Southeast Asia

- 8.8.3.6 Australia

- 8.8.3.7 Rest of Asia-Pacific

- 8.8.4 South America

- 8.8.4.1 Brazil

- 8.8.4.2 Argentina

- 8.8.4.3 Rest of South America

- 8.8.5 Middle East

- 8.8.5.1 Gulf Cooperation Council Countries

- 8.8.5.2 Turkey

- 8.8.5.3 Rest of Middle East

- 8.8.6 Africa

- 8.8.6.1 South Africa

- 8.8.6.2 Nigeria

- 8.8.6.3 Rest of Africa

- 8.8.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Market Concentration

- 9.2 Strategic Moves

- 9.3 Market Share Analysis

- 9.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 9.4.1 Amazon.com Inc.

- 9.4.2 Google LLC

- 9.4.3 Baidu Inc.

- 9.4.4 Alibaba Group Holding Ltd.

- 9.4.5 Xiaomi Corp.

- 9.4.6 Lenovo Group Ltd.

- 9.4.7 LG Electronics Inc.

- 9.4.8 Samsung Electronics Co., Ltd.

- 9.4.9 Meta Platforms Inc. (Portal)

- 9.4.10 Sony Corp.

- 9.4.11 TCL Tech. Group

- 9.4.12 Hisense Group

- 9.4.13 Sharp Corp.

- 9.4.14 Koninklijke Philips N.V.

- 9.4.15 Panasonic Holdings Corp.

- 9.4.16 Huawei Tech. Co. Ltd.

- 9.4.17 BOE Technology Group Co. Ltd.

- 9.4.18 Vizio Inc.

- 9.4.19 JBL (Harman Int'l)

- 9.4.20 Apple Inc.

10 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 10.1 White-space and Unmet-Need Assessment