PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851220

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851220

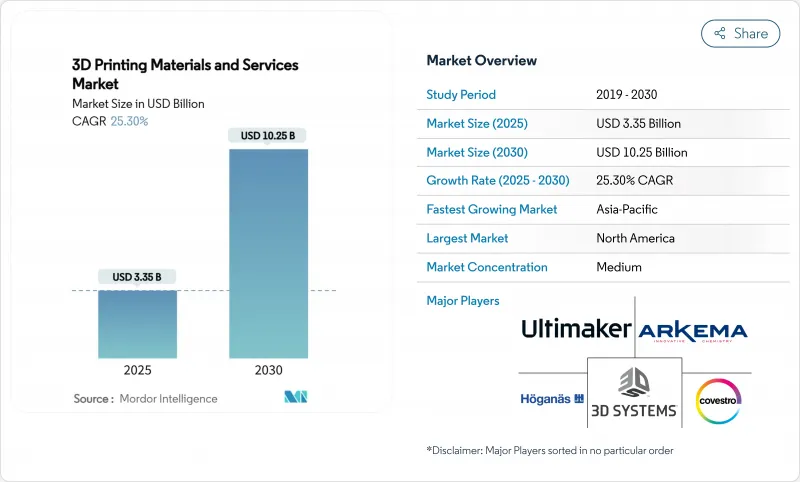

3D Printing Materials And Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The 3D Printing Materials And Services Market size is estimated at USD 3.35 billion in 2025, and is expected to reach USD 10.25 billion by 2030, at a CAGR of 25.30% during the forecast period (2025-2030).

This growth reflects the steady shift from rapid prototyping to certified, production-grade uses in aerospace, healthcare and e-mobility. Demand is amplified by Print-as-a-Service subscriptions that let small and medium enterprises avoid large capital outlays, as well as by regulatory acceptance of metal additive manufacturing (AM) in flight-critical parts. Hybrid extrusion, bio-compatible polymers and recyclable filaments are widening the material palette, while cost-down pressures push manufacturers toward distributed, on-demand builds.

Momentum is supported by North American defense funding, EU Green Deal incentives and Asia Pacific's digital manufacturing push. Services hold leadership with 58% revenue share in 2024 and also post the fastest 14% CAGR to 2030. FDM/FFF keeps the largest installed base, yet Multi Jet Fusion (MJF) and Binder Jetting are scaling 15% annually as their throughput and isotropic properties suit low-to-mid-volume production. Filament remains the dominant format, but powder usage is advancing 14% per year on the back of titanium and aluminum alloy adoption. Prototyping still commands 42% of revenue, though functional parts are increasing at 15% CAGR, particularly in aerospace where lightweight, consolidated structures shorten supply chains. Overall, the 3D printing materials and services market is entering a phase where certified production, sustainability and service models intersect to unlock new profit pools across industrial verticals.

Global 3D Printing Materials And Services Market Trends and Insights

Rapid adoption of metal AM in aerospace

Regulators now accept certified metal AM parts for flight use. Materialise obtained EN 9100 accreditation in 2025, unlocking the supply of structural titanium and aluminum components that meet aerospace quality standards. Parallel U.S. defense programs with America Makes are standardizing qualification pathways, and 3D Systems has already delivered over 2,000 mission-critical titanium or aluminum components for space missions.These milestones validate AM for safety-critical parts, accelerating procurement away from legacy castings.

Cost-down pressure fueling on-demand services

Inventory inflation and tooling costs have led manufacturers to outsource builds to distributed service bureaus. MX3D raised EUR 7 million in 2025 to scale Wire Arc AM on a Print-on-Demand model that cuts raw-material waste by up to 90%. Protolabs reported USD 83 million in 2024 3D-printing revenue, illustrating commercial traction for service-first models that compress lead time and free cash flow.

Volatility of high-purity metal powder prices

Prices for titanium and copper powders swing with ore shortages and regulatory curbs, inflating bill-of-material costs for aerospace and medical builds. The titanium AM market is expected to reach USD 1.4 billion by 2032, yet supply instability forces OEMs to stockpile feedstock and recycle scrap to maintain margins, especially in Europe, where energy tariffs are high.

Other drivers and restraints analyzed in the detailed report include:

- Bio-compatible polymers for point-of-care

- Hybrid extrusion for lightweight e-mobility

- Energy-intensive post-processing inflating TCO

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services generated 58% of 2024 revenue and are expanding at a 14% CAGR as enterprises outsource design validation and low-volume production. The 3D printing materials and services market size for services stood at USD 1.94 billion in 2025 and is forecast to exceed USD 6.1 billion by 2030. Subscription packages from providers like 3Dock lower entry barriers for intermittent users. Materials, while smaller, fuel service innovation through higher-margin specialty powders and bio-polymers.

The materials segment is growing 12% per year, propelled by powders for powder-bed fusion. Filament held the largest 48% share in 2024. HP's halogen-free PA 12 FR illustrates how engineered polymers trim operating costs by 20% while meeting strict flame-retardancy norms. Advancements in recycled filament and composite pellets appeal to customers seeking lower environmental impact, reinforcing material-driven differentiation within service offerings.

FDM/FFF retained a 38% revenue share in 2024 through its vast installed base and accessible price point. The segment still registers 11% growth, but MJF and Binder Jetting are outpacing it at a 15% CAGR. These powder-based technologies deliver near-isotropic properties that suit jigs, fixtures, and low-to-mid-volume production runs. HP and INDO-MIM's binder-jet partnership is scaling metal parts that pass aerospace validation, indicating readiness for serial output.

SLA, DLP, and SLS retain relevance for precision dental models and medical devices. EOS systems fabricate patient-specific cranial implants within days, enhancing hospital throughput. Wire Arc AM, currently niche, is gaining traction for large titanium structures in energy and maritime sectors, as demonstrated by MX3D's funded expansion.

The 3D Printing Materials & Services Market is Segmented by Offering ( Materials and More), Technology ( FDM / FFF, SLS / SLA / DLP, DMLS / EBM / L-PBF and More), Form (Materials) ( Filament, Powder and More), Application ( Prototyping, Functional Parts and More), End-User ( Aerospace and Defense, Automotive and E-Mobility, and More), and Geography

Geography Analysis

North America accounted for 40% of 2024 revenue. Defense programs accelerate metal AM qualification, and GE Aerospace's USD 1 billion capacity expansion will strengthen domestic AM supply chains. Hospitals adopt printed anatomical models that cut surgical time by up to 30%, adding healthcare pull.

Europe holds the second-largest position, bolstered by Germany's installed base and EU incentives for recyclable materials. Fraunhofer's project that converts polypropylene waste to filament illustrates policy-driven innovation. Spain's designation as Formnext 2025 partner country underscores the region's manufacturing renaissance and export orientation.

Asia Pacific is the fastest-growing region at 15% CAGR. China deploys AM for automotive, electronics, and hip implants, while Japan emphasizes precision tooling. Government grants, a deep manufacturing ecosystem, and rising healthcare spending underpin demand. Emerging markets in South America and the Middle East use AM for oil-and-gas spares and aerospace parts, providing additional, though smaller, growth nodes.

- 3D Systems Corp.

- Stratasys Ltd.

- EOS GmbH

- General Electric (GE Additive)

- HP Inc.

- SLM Solutions Group AG

- Desktop Metal Inc.

- Materialise NV

- Arkema SA

- BASF Forward AM

- Evonik Industries AG

- Hoganas AB

- Sandvik AB

- Royal DSM (Covestro)

- Markforged Holding Corp.

- Protolabs Inc.

- Voxeljet AG

- ExOne (Desktop Metal)

- Carbon Inc.

- Ultimaker B.V.

- Carpenter Technology Corporation

- Renishaw plc

- Xometry Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study AssumptionsandMarket Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of Metal AM in Aerospace for Air-Worthiness Certified Parts

- 4.2.2 Cost-Down Pressure Fueling On-Demand Manufacturing Services in USandEU

- 4.2.3 Bio-compatible Polymers Unlocking Point-of-Care Medical Printing in Asia

- 4.2.4 Hybrid Material Extrusion Enabling Lightweight e-Mobility Components

- 4.3 Market Restraints

- 4.3.1 Volatility of High-Purity Metal Powder Prices

- 4.3.2 Limited Qualification Standards for AM in Critical Parts

- 4.4 Value/Supply-Chain Analysis

- 4.5 RegulatoryandTechnological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 COVID-19 and Geo-economic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Materials

- 5.1.1.1 Plastics (PLA, ABS/ASA, PETG, Photopolymers)

- 5.1.1.2 Metals (Ti-6Al-4V, Inconel, AlSi10Mg, SS 316L)

- 5.1.1.3 Ceramics (Alumina, Zirconia, Silicon Nitride)

- 5.1.1.4 CompositesandOthers (Carbon-Fiber, Bio-Polymers)

- 5.1.2 Services

- 5.1.2.1 Rapid Prototyping

- 5.1.2.2 ToolingandFixtures

- 5.1.2.3 Production / Bridge Manufacturing

- 5.1.2.4 DesignandEngineering Services

- 5.1.1 Materials

- 5.2 By Technology

- 5.2.1 FDM / FFF

- 5.2.2 SLS / SLA / DLP

- 5.2.3 MJFandBinder Jetting

- 5.2.4 DMLS / EBM / L-PBF

- 5.2.5 Other Emerging (LCD, CLIP, WAAM)

- 5.3 By Form (Materials)

- 5.3.1 Filament

- 5.3.2 Powder

- 5.3.3 Liquid / Resin

- 5.4 By Application

- 5.4.1 Prototyping

- 5.4.2 Functional Parts

- 5.4.3 ToolingandMolds

- 5.4.4 DentalandOrthopedic Implants

- 5.5 By End-user

- 5.5.1 AerospaceandDefense

- 5.5.2 Automotiveande-Mobility

- 5.5.3 HealthcareandLife Sciences

- 5.5.4 Industrial Machinery

- 5.5.5 Consumer ProductsandElectronics

- 5.5.6 ConstructionandArchitecture

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 US

- 5.6.1.2 Canada

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 UK

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 Rest of Asia Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic MovesandFunding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, ProductsandServices, and Recent Developments)

- 6.4.1 3D Systems Corp.

- 6.4.2 Stratasys Ltd.

- 6.4.3 EOS GmbH

- 6.4.4 General Electric (GE Additive)

- 6.4.5 HP Inc.

- 6.4.6 SLM Solutions Group AG

- 6.4.7 Desktop Metal Inc.

- 6.4.8 Materialise NV

- 6.4.9 Arkema SA

- 6.4.10 BASF Forward AM

- 6.4.11 Evonik Industries AG

- 6.4.12 Hoganas AB

- 6.4.13 Sandvik AB

- 6.4.14 Royal DSM (Covestro)

- 6.4.15 Markforged Holding Corp.

- 6.4.16 Protolabs Inc.

- 6.4.17 Voxeljet AG

- 6.4.18 ExOne (Desktop Metal)

- 6.4.19 Carbon Inc.

- 6.4.20 Ultimaker B.V.

- 6.4.21 Carpenter Technology Corporation

- 6.4.22 Renishaw plc

- 6.4.23 Xometry Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-spaceandUnmet-need Assessment