PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851266

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851266

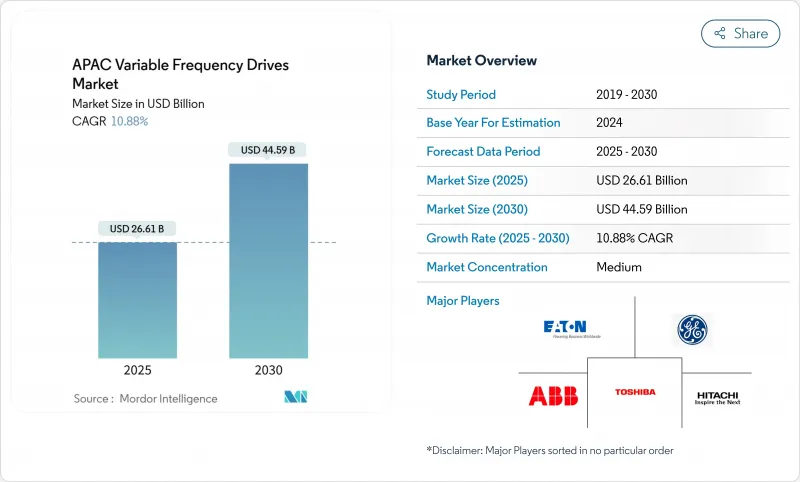

Asia Pacific Variable Frequency Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India plastic industry market is valued at USD 26.61 billion in 2025 and is projected to touch USD 44.59 billion by 2030, equating to a brisk 10.88% CAGR.

Broad-based policy support, notably the Production-Linked Incentive program and multiyear infrastructure plans, continues to widen local resin output and draw fresh downstream investments. Demand from packaging, construction, automotive and fast-moving consumer goods keeps polymer offtake on a steady upward climb, while specialty compounds gain ground as brand owners prioritize lighter packs and higher recycled content. Capacity additions in polyolefins and PVC, coming from both brownfield debottlenecking and newly sanctioned greenfield plants, are gradually shrinking India's structural import dependence. A tighter regulatory lens on waste management, volatile naphtha costs and a rapid shift toward digitally automated production lines are also nudging processors to raise operating efficiency and accelerate circularity programs.

Asia Pacific Variable Frequency Drives Market Trends and Insights

Government PLI scheme accelerating polymer capacity expansions in Gujarat

Federal incentives are steering unprecedented capital to the Jamnagar-Dahej corridor, an area already rich in refining and petrochemical infrastructure. Projects such as Reliance Industries' 1.5 MTPA PVC complex and Adani's 2 MTPA PVC build-out are scheduled to narrow the prevailing 2.5-million-tonne supply gap by 2027. In parallel, operators are installing chemical-recycling units that convert mixed plastic scrap into ISCC-Plus-certified resins, giving Gujarat a head start in regional circular-economy initiatives. Dedicated polymer rail corridors link coastal ports with inland processors, reducing transit time, cutting handling losses and reinforcing Western India's status as the consumption heart of the India plastic industry market.

Quick-commerce boom driving demand for high-rigidity food containers

Same-hour grocery delivery is redefining rigid-pack specifications. Operators look for boxes that withstand impact, preserve barrier integrity during rapid temperature swings and stack cleanly in micro-fulfilment centers. Injection-grade polypropylene and clarified random copolymers fulfill current specifications, yet brand owners are already piloting mono-material solutions to align with 2026 recyclability targets. Multiple rigid-pack converters have announced fresh capacity projects in Maharashtra and Telangana to keep pace with container demand that is rising at more than 15% annually. These plants typically install all-electric presses with integrated vision systems to assure weight consistency and lower scrap, in line with the operational efficiency goals sweeping the India plastic industry market.

Single-use plastic ban escalating compliance costs for FMCG packagers

A national prohibition removed 19 disposable SKUs from circulation and forced brand owners to pivot toward coated paper, thicker reusable formats or certified biodegradable films. Substitute substrates cost at least 40% more than legacy LDPE flexibles, squeezing margins in price-sensitive categories such as condiments, confectionery and ready-to-drink beverages. Smaller converters confront steep capital needs to retrofit extrusion-coating and lamination lines for alternate materials, and many seek contract-manufacturing tie-ups to stay afloat. The transition raises near-term cost pressure across the India plastic industry market.

Other drivers and restraints analyzed in the detailed report include:

- Swachh Bharat Phase II fueling urban HDPE pipe replacement

- EV lightweighting strategy boosting engineering plastics in two-wheelers

- Volatile naphtha feedstock prices from Middle-East tensions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AC drives commanded a dominant 74% market share in 2024, owing to their versatility across diverse industrial applications and relatively lower cost structure compared to other drive types. The widespread adoption of AC drives in pumps, fans, and compressors-applications that collectively represent over 60% of all motor loads in industrial settings-has cemented their market leadership position. Meanwhile, servo drives are emerging as the fastest-growing segment with an 8.3% CAGR (2025-2030), driven by increasing demand for high-precision motion control in robotics, CNC machines, and advanced manufacturing systems. This growth is supported by innovations like ECM PCB Stator Tech's 'Eight Ball' servo motor, which delivers 18.8 Nm of torque in an ultra-compact form factor, addressing the industry trend toward miniaturization and power density optimization.

The integration of wide bandgap semiconductors, particularly silicon carbide (SiC) and gallium nitride (GaN), is revolutionizing drive efficiency profiles across all types. Infineon's CoolSiC(TM) MOSFETs, for instance, reduce switching losses by up to 80% compared to traditional IGBTs, achieving a 50% overall loss reduction in servo drive applications. DC drives, while representing a smaller market share, maintain relevance in legacy systems and specific applications requiring precise speed control at constant torque. The competitive dynamics between drive types are increasingly influenced by total cost of ownership calculations rather than initial purchase price, as end-users become more sophisticated in evaluating lifecycle energy savings.

Low-voltage drives (Less than 690V) dominated the market with an 87.5% share in 2024, benefiting from their broad applicability across commercial and industrial applications and lower installation complexity compared to medium-voltage alternatives. The segment's strength is particularly evident in building automation, light manufacturing, and food processing industries, where smaller motor sizes predominate. Conversely, medium-voltage drives (1-35 kV) are experiencing faster growth with a 7.1% CAGR (2025-2030), driven by increasing deployments in energy-intensive industries and large infrastructure projects. GE Vernova's MV6 Medium Voltage Drive exemplifies the technological advancement in this segment, offering configurations for both diode front end and active front end operations to ensure compliance with global grid standards while providing significant energy savings in applications like petrochemicals, water treatment, and power generation.

The publication of the first global standard by the International Electrotechnical Commission (IEC) for classifying energy efficiency in high-voltage induction motors is expected to accelerate the adoption of medium-voltage drives, as it establishes clear efficiency benchmarks and is likely to influence future EU regulations on minimum efficiency requirements [ABB, "The IEC Has Published the First Global Standard to Classify Energy Efficiency for High-Voltage Induction Motors," ABB, March 6, 2024, new.abb.com]. The harmonization of international standards is particularly significant for the APAC market, where regulatory fragmentation has historically complicated product development and marketing strategies. The evolving regulatory landscape is prompting manufacturers to develop more flexible drive architectures that can adapt to varying voltage requirements and grid conditions across different markets.

Asia Pacific Variable Frequency Drives Market Share Report is Segmented by Type (AC Drives, Servo Drives, and More), Voltage Class (Low-Voltage, Medium-Voltage), Power Rating (Micro, Medium, and More), Application (Pumps, HVAC, and More), End-User Industry (Oil and Gas, Food and Beverage Processing and More), and Country (China, India and More). The Market Size and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd

- Siemens AG

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Fuji Electric Co. Ltd

- Hitachi Ltd

- Toshiba Corporation

- Yaskawa Electric Corp.

- Delta Electronics Inc.

- Danfoss A/S

- Rockwell Automation Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- Johnson Controls International plc

- Parker Hannifin Corp.

- WEG SA

- LS Electric Co. Ltd

- General Electric Company

- Nidec (Control Techniques)

- CHINT Group (Hiconics Drive)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-led Industrial Energy-Efficiency Mandates in China and India

- 4.2.2 Manufacturing-Sector Automation Wave Post-2023

- 4.2.3 Rising Electricity Tariffs Prompting Energy-Saving Retrofits

- 4.2.4 Rapid Build-out of Data Centres Requiring Precision HVAC Drives

- 4.2.5 Infrastructure Boom in Southeast Asia Boosting Pumps and Fans Demand

- 4.2.6 Shift to Electric Propulsion in Mining and Marine Equipment

- 4.3 Market Restraints

- 4.3.1 Price Competition from Low-Cost Chinese Vendors

- 4.3.2 Harmonic and EMI Compliance Challenges in Medium-Voltage Drives

- 4.3.3 Subsidy Withdrawal for Industrial Efficiency Projects in Australia

- 4.3.4 Skilled Workforce Shortage for VFD Commissioning in ASEAN

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Technology Snapshot

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 AC Drives

- 5.1.2 DC Drives

- 5.1.3 Servo Drives

- 5.2 By Voltage Class

- 5.2.1 Low-Voltage (< 690 V)

- 5.2.2 Medium-Voltage (1 - 35 kV)

- 5.3 By Power Rating (kW)

- 5.3.1 Micro (<= 5 kW)

- 5.3.2 Low (6 - 40 kW)

- 5.3.3 Medium (41 - 200 kW)

- 5.3.4 High (greater than 200 kW)

- 5.4 By Application

- 5.4.1 Pumps

- 5.4.2 Fans

- 5.4.3 Compressors

- 5.4.4 Conveyors

- 5.4.5 HVAC

- 5.4.6 Extruders

- 5.4.7 Others

- 5.5 By End-User Industry

- 5.5.1 Oil and Gas

- 5.5.2 Energy and Power

- 5.5.3 Water and Waste-water Management

- 5.5.4 Food and Beverage Processing

- 5.5.5 Pulp and Paper

- 5.5.6 Metals and Mining

- 5.5.7 Chemicals and Petrochemicals

- 5.5.8 Marine and Shipbuilding

- 5.5.9 Other Industries

- 5.6 By Country

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Australia and New Zealand

- 5.6.6 ASEAN-6 (Indonesia, Malaysia, Thailand, Philippines, Vietnam, Singapore)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Mitsubishi Electric Corporation

- 6.4.4 Schneider Electric SE

- 6.4.5 Fuji Electric Co. Ltd

- 6.4.6 Hitachi Ltd

- 6.4.7 Toshiba Corporation

- 6.4.8 Yaskawa Electric Corp.

- 6.4.9 Delta Electronics Inc.

- 6.4.10 Danfoss A/S

- 6.4.11 Rockwell Automation Inc.

- 6.4.12 Eaton Corporation plc

- 6.4.13 Emerson Electric Co.

- 6.4.14 Johnson Controls International plc

- 6.4.15 Parker Hannifin Corp.

- 6.4.16 WEG SA

- 6.4.17 LS Electric Co. Ltd

- 6.4.18 General Electric Company

- 6.4.19 Nidec (Control Techniques)

- 6.4.20 CHINT Group (Hiconics Drive)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment