PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851279

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851279

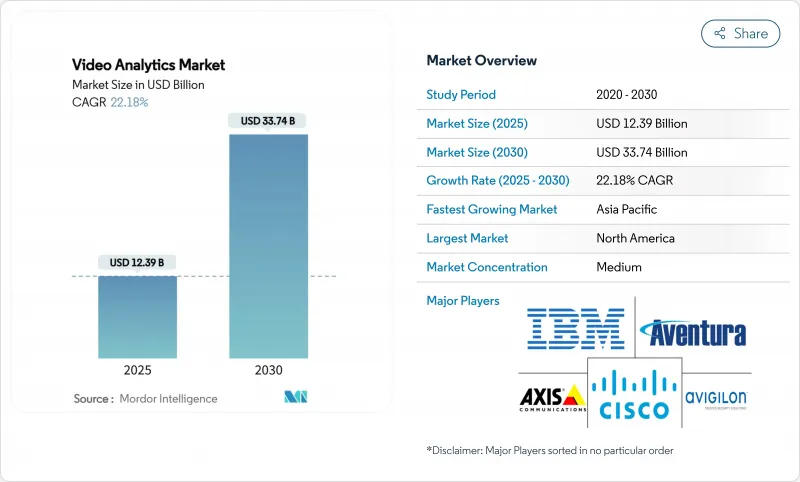

Video Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Video Analytics Market size is estimated at USD 12.39 billion in 2025, and is expected to reach USD 33.74 billion by 2030, at a CAGR of 22.18% during the forecast period (2025-2030).

Strong demand comes from AI-enabled edge computing, rapid 5G rollouts, and the falling cost of high-resolution cameras. Regulatory mandates for body-worn cameras in the United States, smart-city investments in Asia Pacific, and strict data-protection rules in Europe collectively shape adoption patterns. Supply-chain stress around GPUs and tighter semiconductor pricing put short-term pressure on margins, yet advances in low-power accelerators are easing cost barriers. Strategic alliances between cloud hyperscalers and AI-native vendors shorten time-to-market for vertical solutions, while open API ecosystems accelerate third-party innovation across retail, healthcare, and transportation.

Global Video Analytics Market Trends and Insights

Migration from CCTV Monitoring to AI-Based Analytics in GCC

The Gulf Cooperation Council is shifting from passive CCTV toward intelligent analytics that detect anomalies, predict incidents, and optimise resource allocation. Saudi Arabia's Vision 2030 and the UAE's smart-city programmes channel public funding into AI retrofits for existing camera estates, while Dubai's largest mall demonstrated real-time anomaly detection after upgrading with Icetana technology. High societal trust in technology and diversification away from oil revenue underpin sustained investment. Edge-ready appliances reduce bandwidth costs, and pan-GCC interoperability standards are emerging to ensure data-sharing across city platforms. These factors collectively add 4.2 percentage points to the forecast CAGR.

Smart-City Initiatives

Municipalities worldwide embed video analytics in traffic control, public-safety hubs, and environmental monitoring infrastructure. Orange County deployed AI analytics across 52 intersections, improving road-safety metrics and aligning with Caltrans' Vision Zero goal. Seoul's Smart Traffic Management platform applies live weather feeds to prevent congestion, while Copenhagen leverages cycling-traffic video for urban planning. 5G links enable millisecond-level response times, widening the scope from static surveillance to dynamic crowd management. Long-term smart-city funding pipelines give this driver a 3.8 percentage-point lift on CAGR.

High GPU Power Consumption in Remote Oil and Gas Sites

Off-grid facilities rely on diesel generators, making multi-GPU clusters costly and impractical. Supply constraints on high-end GPUs further intensify the hurdle. Axelera's Metis PCIe accelerator showcased 5X lower energy draw and 4X lower cost than conventional GPU setups while sustaining analytic performance. Yet thermal management, maintenance logistics, and limited technical personnel at remote sites slow adoption, subtracting 2.8 percentage points from the forecast CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Integration of Video Analytics with Retail POS in North America

- Mandates for Body-Worn-Camera Analytics in U.S. Law Enforcement

- Fragmented Camera Firmware in Latin-American Retail

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions commanded 62% of the video analytics market in 2024 as customers prioritised AI models over hardware upgrades. Subscription-priced SaaS is forecast to grow at 25.4% CAGR as enterprises trade CapEx for OpEx and tap elastic cloud capacity. Hybrid frameworks keep sensitive streams on-premise while sending metadata to the cloud, balancing sovereignty and scalability. Hardware accelerators gain traction for edge inference, especially in logistics yards and quick-service restaurants where latency budgets are strict. The University of Virginia's SMAST network underscores the jump in accuracy now achievable through transformer-based models.

Services expand in parallel. Managed offerings appeal to organisations lacking 24/7 analytics expertise, while professional services remain vital for multi-site roll-outs, API integrations, and compliance validation. As SaaS penetration deepens, managed-service providers bundle health monitoring, model updates, and cyber-hygiene checks into per-camera pricing. Together, these trends affirm software's primacy and reinforce the long-term weighting of software revenue in the video analytics market size.

Intrusion and perimeter protection retained 28% video analytics market share in 2024, anchored by critical-infrastructure and campus security mandates. Facial recognition and demographics analytics is expected to compound at 24.1% CAGR through 2030 despite patchwork regulation. Airports deploy passive watch-list screening, while retailers use face-based demographics for marketing segmentation, provided that consent rules are met. Traffic analytics also gain lift from smart-city projects, and ANPR systems alone are projected to reach USD 4.8 billion by 2027.

Behaviour recognition has matured beyond simple loitering detection; modern algorithms now isolate violent gestures in real time, aiding rapid security intervention. Retail heat-mapping closes the loop between shopper movement and merchandising. The breadth of use cases keeps application diversification high and positions analytics suites to address multiple needs within one licence.

Video Analytics Market Report is Segmented by Component (Software, Hardware Accelerators, Services), Application (Intrusion Protection, Crowd Counting, Facial Recognition and More), Deployment Mode (Edge, On-Premise, Cloud), Organization Size (Large Enterprises, Smes), End-User Vertical (Government, BFSI, Healthcare, Retail, Transportation and Morfe), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the video analytics market with 38% revenue share in 2024, anchored by federal and state grants for body-worn-camera programmes and aggressive retail loss-prevention initiatives. Post-pandemic stimulus accelerated city surveillance upgrades, while 5G rollouts underpin low-latency edge deployments. Canada's ban on selected vendors prompted public-sector buyers to diversify supply chains, opening space for domestic and European providers.

Asia Pacific is projected to post 22% CAGR through 2030, benefitting from megacity construction, factory automation, and national AI policies. China's vast surveillance estate fosters home-grown algorithm training, though export restrictions affect foreign component sourcing. Japan and South Korea emphasise industrial quality control, whereas Southeast Asian governments focus on transport modernisation. Australia's high labour costs encourage analytics-driven self-service models across retail and hospitality.

Europe balances innovation with stringent privacy rules. The EU AI Act classifies face recognition as high-risk, compelling vendors to embed bias testing and audit trails. Healthcare adoption accelerates through GDPR-compliant masking, while smart-city pilots in Scandinavia integrate environmental-sensor fusion. National security concerns spur made-in-Europe hardware initiatives, supporting regional chip sovereignty and reinforcing supply-chain resilience.

- Hikvision Digital Technology Co., Ltd.

- Axis Communications AB

- Genetec Inc.

- Cisco Systems, Inc.

- Motorola Solutions, Inc. (Avigilon)

- Honeywell International Inc.

- Bosch Security Systems GmbH

- Dahua Technology Co., Ltd.

- BriefCam Ltd. (Canon Group)

- IBM Corporation

- Qognify Ltd.

- Verint Systems Inc.

- Agent Video Intelligence Ltd. (Irisity)

- AllGoVision Technologies Pvt. Ltd.

- Senstar Corporation

- Digital Barriers PLC

- IronYun Inc.

- iOmniscient Pty Ltd.

- Herta Security, S.L.

- ObjectVideo Labs LLC

- Identiv Inc.

- ISS Inc. (AxxonSoft)

- Viseum UK Group

- Iveda Solutions Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Migration from CCTV Monitoring to AI-Based Analytics in GCC Smart-City Initiatives

- 4.2.2 Integration of Video Analytics with Retail POS in North America

- 4.2.3 Mandates for Body-Worn-Camera Analytics in U.S. Law-Enforcement

- 4.2.4 Edge-Based Analytics for Autonomous Vehicle Fleets

- 4.2.5 GDPR-Compliant Privacy Masking Boosting European Healthcare Adoption

- 4.2.6 5G Private Networks Accelerating Industrial Safety Analytics

- 4.3 Market Restraints

- 4.3.1 High GPU Power Consumption in Remote Oil and Gas Sites

- 4.3.2 Fragmented Camera Firmware in Latin-American Retail

- 4.3.3 Litigation Risks from BIPA on U.S. Facial Analytics

- 4.3.4 Lack of Local-Language Datasets in Middle-East Airports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook and Snapshot

- 4.7 Case Studies and Implementation Use-Cases

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 On-Premise

- 5.1.1.2 Cloud-Based (SaaS)

- 5.1.2 Hardware Accelerators

- 5.1.3 Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Professional Services

- 5.1.1 Software

- 5.2 By Application

- 5.2.1 Intrusion and Perimeter Protection

- 5.2.2 Crowd and People Counting

- 5.2.3 Facial Recognition and Demographics

- 5.2.4 Traffic and Vehicle Analytics (ANPR, Incident Detection)

- 5.2.5 Behaviour Recognition (Loitering, Violence)

- 5.2.6 Retail Heat-Mapping and Conversion

- 5.3 By Deployment Mode

- 5.3.1 Edge

- 5.3.2 On-Premise / Server

- 5.3.3 Cloud

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-User Vertical

- 5.5.1 Government and Public Safety

- 5.5.2 BFSI

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 Retail and E-Commerce

- 5.5.5 Transportation and Logistics

- 5.5.6 Critical Infrastructure and Energy

- 5.5.7 Hospitality and Entertainment

- 5.5.8 Manufacturing and Industrial

- 5.5.9 Others (Education, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics (DK, SE, NO, FI)

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 ASEAN

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC (SA, UAE, Qatar, etc.)

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Hikvision Digital Technology Co., Ltd.

- 6.4.2 Axis Communications AB

- 6.4.3 Genetec Inc.

- 6.4.4 Cisco Systems, Inc.

- 6.4.5 Motorola Solutions, Inc. (Avigilon)

- 6.4.6 Honeywell International Inc.

- 6.4.7 Bosch Security Systems GmbH

- 6.4.8 Dahua Technology Co., Ltd.

- 6.4.9 BriefCam Ltd. (Canon Group)

- 6.4.10 IBM Corporation

- 6.4.11 Qognify Ltd.

- 6.4.12 Verint Systems Inc.

- 6.4.13 Agent Video Intelligence Ltd. (Irisity)

- 6.4.14 AllGoVision Technologies Pvt. Ltd.

- 6.4.15 Senstar Corporation

- 6.4.16 Digital Barriers PLC

- 6.4.17 IronYun Inc.

- 6.4.18 iOmniscient Pty Ltd.

- 6.4.19 Herta Security, S.L.

- 6.4.20 ObjectVideo Labs LLC

- 6.4.21 Identiv Inc.

- 6.4.22 ISS Inc. (AxxonSoft)

- 6.4.23 Viseum UK Group

- 6.4.24 Iveda Solutions Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment