PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851314

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851314

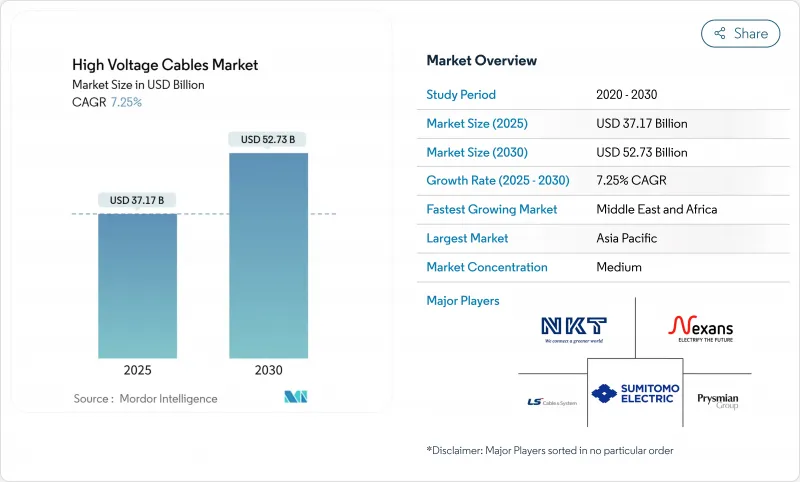

High Voltage Cables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The High Voltage Cables Market size is estimated at USD 37.17 billion in 2025, and is expected to reach USD 52.74 billion by 2030, at a CAGR of 7.25% during the forecast period (2025-2030).

Surging renewable-energy deployment, strong policy support for grid modernization, and expanding offshore wind capacity underpin this growth trajectory. Investments in long-distance transmission corridors and inter-regional interconnectors continue to rise as utilities pursue lower-loss solutions that integrate remote solar and wind resources into load centers. Meanwhile, advances in high-capacity conductor technologies and higher-voltage insulation systems help utilities transport more power along existing rights-of-way, partially alleviating permitting challenges. Submarine link construction accelerates on the back of large offshore wind targets, and utilities prioritize underground solutions in densely populated urban corridors to improve resilience against extreme weather events and public acceptance risks. However, the tight global manufacturing capacity for specialized extra-high-voltage and undersea systems keeps supply chains under strain and lengthens project delivery cycles.

Global High Voltage Cables Market Trends and Insights

Integration of renewable energy build-out

Record levels of solar and wind capacity additions compel utilities to expand and reinforce transmission corridors that can carry power from remote generation points to demand centers. Multi-GW offshore projects now specify thousands of kilometers of +-525 kV submarine HVDC cables that minimize electrical losses over distances that routinely exceed 800 km. China's +-800 kV UHVDC lines deliver 40 billion kWh annually, offsetting 17 million tons of coal and underscoring the environmental upside of moving large blocks of clean energy. In Europe, Germany's North Sea strategy targets 70 GW of offshore wind by 2045, requiring extensive subsea and onshore links that connect northern generation to southern industrial loads. The International Energy Agency (IEA) projects a cumulative 80 million km of new or refurbished transmission by 2040-a renewal on par with rebuilding today's grid. Reconductoring existing corridors with advanced aluminum or carbon-core conductors can defer new-build needs, saving up to USD 85 billion by 2035, yet manufacturing slots for these specialty conductors remain tight. Lead times for large submarine orders extend to three years, exposing project timelines to factory bottlenecks.

Rapid grid-modernisation & inter-connection projects

Aging infrastructure, proliferating data center clusters, and extreme-weather resilience pressures push utilities toward comprehensive grid upgrade plans. Federal Energy Regulatory Commission Order 1920 imposes a mandatory 20-year planning horizon in the United States, forcing developers to assess high-capacity corridors that deliver renewable flows across multiple states. Cross-border interconnections such as the 2 GW Eastern Green Link 2 subsea cable reinforce the security of supply and support seasonal balancing across Great Britain. Dynamic-line-rating sensors add 20-40% transfer capacity to existing overhead conductors, easing congestion while permit approvals for new corridors remain slow. Grid operators collectively plan more than USD 22 billion in new 765 kV lines in the U.S. Midwest to unlock surplus wind resources and improve resilience during peak-load events. Meanwhile, transformer shortages trigger utility concerns; Hitachi Energy has earmarked USD 4.5 billion for factory expansions across three continents, progressively easing those constraints by 2027.

High upfront CAPEX of HV cable projects

Submarine systems cost four to ten times more than overhead alternatives because they embed armored sheaths, specialized insulation, and custom installation vessels. Since 2019, delivered cable prices have nearly doubled due to metal costs and constrained factory slots, shifting project internal-rate-of-return calculations downward even in premium offshore wind zones. Mega-projects such as the USD 30 billion Morocco-UK Xlinks interconnector highlight the financing complexity of multi-country endeavors that rely on layered debt structures, export-credit guarantees, and power-purchase-agreement backstops. New submarine plants command USD 1 billion or more, carry five-to-seven-year paybacks, and face demand uncertainty once current offshore wind backlogs are fulfilled, deterring private equity participation. Emerging markets that depend on foreign currency debt are particularly exposed to exchange-rate swings, prompting interest from development banks that can absorb longer tenors and lower returns.

Other drivers and restraints analyzed in the detailed report include:

- Expanding offshore-wind farm installations

- Urbanisation & industrial load growth in emerging economies

- Lengthy permitting & environmental clearances

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Underground installations captured 48% of 2024 revenue as utilities in densely populated cities favor buried assets that minimize land-use conflicts and improve weather resilience. This segment's high-voltage cables market size is projected to grow with infrastructure-hardening programs replacing aging overhead feeders prone to wildfire and storm damage. Underground projects incur 400-1,000% cost premiums over overhead lines because trenching, jointing, and continuous conduit runs demand skilled labor and specialized machinery. Procurement of gas-insulated joints and cross-bonding accessories also lengthens delivery schedules, reinforcing a preference for incremental upgrades rather than wholesale conversion.

Submarine technology, representing the fastest-growing subset at 10.5% CAGR, aligns with national offshore wind roadmaps and cross-border interconnectors that share variable renewable generation. Prysmian's recent EUR 5 billion framework with Amprion covers 1,000 km of +-525 kV HVDC export links, underscoring demand visibility through 2030. Advanced polymer insulation and steel-wire armoring enable depths beyond 2,000 m, expanding route flexibility to circumvent environmentally sensitive zones. Manufacturing remains highly concentrated: only three facilities worldwide can produce 525 kV submarine cores longer than 120 km per continuous length, creating a strategic bottleneck for offshore developers. Overhead transmission is pivotal in rural corridors and developing economies where land-acquisition costs remain moderate and visual-amenity concerns are lower.

The High Voltage Cables Market is Segmented by Location of Deployment (Overhead Cables, Underground Cables, and Submarine Cables), Type of Transmission (HVDC and HVAC), Voltage Level (66 KV To 110KV, 115 KV To 330 KV, and Above 330 KV), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Size and Forecast are Provided in Value (USD).

Geography Analysis

Asia-Pacific remained the largest regional contributor, holding 38% of 2024 revenue, underpinned by China's aggressive UHV build-out and India's ongoing green corridor programs; also the fastest growing region with a CAGR of 9.8% through 2030. This region's high-voltage cable market size is buoyed by government-led capital-expenditure frameworks prioritizing domestic supply-chain development and export opportunities for turnkey EPC contractors. Chinese state grid entities invested over USD 70 billion in 2025 to reinforce transmission backbones that move variable renewable output toward coastal load centers. India accelerates 765 kV expansion to integrate 500 GW of planned renewable capacity by 2030, while Japan, South Korea, and Australia advance offshore wind deployment plans needing high-capacity subsea links.

Thanks to ambitious offshore wind commitments and flagship interconnection projects that strengthen pan-regional energy security, Europe commands a sizeable share. Germany's EUR 5 billion procurement for submarine export systems connecting 70 GW of wind capacity by 2045 exemplifies this long-term demand visibility. The United Kingdom doubles down on subsea corridors such as the 500-km Eastern Green Link 2 that channels Scottish wind to English industrial clusters. Scandinavia and the Baltics pursue offshore grids capable of meshed operation, leveraging HVDC multi-terminal advances to maximize asset utilization.

North America experiences a growth inflection as federal-funded infrastructure programs and data-center power density increase baseline demand for extra-high-voltage solutions. The USD 65 billion Infrastructure Investment and Jobs Act earmarks grants and loan guarantees for modernized conductor technologies, while pipeline projects like SunZia and Grain Belt Express obtain key permits under revised federal frameworks.

In the Middle East and Africa region, Saudi Arabia leads with a USD 126 billion transmission master plan and significant underground packages that bypass heritage sites and dense city cores. Egypt positions itself as a regional interchange through a 3 GW HVDC link to Saudi Arabia that runs a submarine segment across the Gulf of Aqaba. Gulf states cultivate local manufacturing clusters, while South Africa and Kenya secure Chinese financing for grid extensions that interconnect renewable resource zones with mining and export hubs.

- Prysmian Group

- Nexans SA

- NKT A/S

- ABB Ltd

- Siemens Energy AG

- Southwire Company LLC

- LS Cable & System Ltd

- Sumitomo Electric Industries Ltd

- General Cable Corp (Prysmian)

- KEI Industries Ltd

- Furukawa Electric Co Ltd

- Taihan Cable & Solution

- Tratos Ltd

- Finolex Cables Ltd

- Cable Corporation of India Ltd

- Jiangsu Zhongtian Technology Co

- Dubai Cable Co (DUCAB)

- Gupta Power Infrastructure Ltd

- Elsewedy Electric

- Riyadh Cables Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of renewable energy build-out

- 4.2.2 Rapid grid-modernisation & inter-connection projects

- 4.2.3 Expanding offshore-wind farm installations

- 4.2.4 Urbanisation & industrial load growth in emerging economies

- 4.2.5 Data-centre campus power-density surge

- 4.2.6 Hydrogen economy-ready transmission corridors

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX of HV cable projects

- 4.3.2 Lengthy permitting & environmental clearances

- 4.3.3 Commodity-price volatility (Cu, Al, polymers)

- 4.3.4 Shortage of certified HV jointing technicians

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Location of Deployment

- 5.1.1 Overhead Cables

- 5.1.2 Underground Cables

- 5.1.3 Submarine Cables

- 5.2 By Type of Transmission

- 5.2.1 HVDC

- 5.2.2 HVAC

- 5.3 By Voltage Level

- 5.3.1 66 kV to 110 kV

- 5.3.2 115 kV to 330 kV

- 5.3.3 Above 330 kV

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 ASEAN Countries

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Prysmian Group

- 6.4.2 Nexans SA

- 6.4.3 NKT A/S

- 6.4.4 ABB Ltd

- 6.4.5 Siemens Energy AG

- 6.4.6 Southwire Company LLC

- 6.4.7 LS Cable & System Ltd

- 6.4.8 Sumitomo Electric Industries Ltd

- 6.4.9 General Cable Corp (Prysmian)

- 6.4.10 KEI Industries Ltd

- 6.4.11 Furukawa Electric Co Ltd

- 6.4.12 Taihan Cable & Solution

- 6.4.13 Tratos Ltd

- 6.4.14 Finolex Cables Ltd

- 6.4.15 Cable Corporation of India Ltd

- 6.4.16 Jiangsu Zhongtian Technology Co

- 6.4.17 Dubai Cable Co (DUCAB)

- 6.4.18 Gupta Power Infrastructure Ltd

- 6.4.19 Elsewedy Electric

- 6.4.20 Riyadh Cables Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment