PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851367

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851367

Automotive Autonomous Emergency Braking System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

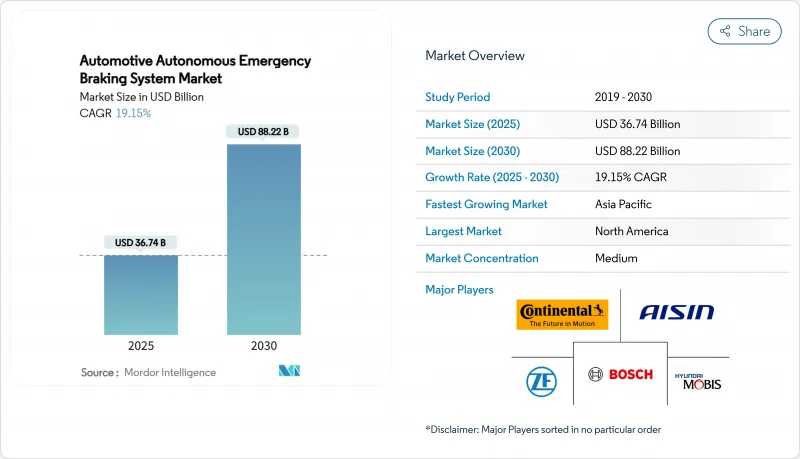

The autonomous emergency braking market reached USD 36.74 billion in 2025 and is forecast to expand to USD 88.22 billion by 2030, reflecting a 19.15% CAGR.

The growth trajectory is anchored in compulsory fitment rules now embedded in the United States, European Union, and China regulations. These regulations eliminate optional-equipment cycles and drive full-range system integration across every price segment. Mandatory performance thresholds tighten around high-speed collision avoidance, night-time pedestrian detection, and junction safety, forcing automakers to standardize multi-sensor fusion architectures. Sub-USD 50 radar modules, falling LiDAR costs, and on-chip AI processing further compress system bills of material, allowing mass-market vehicles to close the technology gap with premium models. Insurance carriers, meanwhile, offer usage-based discounts on AEB-equipped fleets, catalyzing retrofit demand in commercial transport and reinforcing the autonomous emergency braking market's momentum. Divergent regional compliance deadlines create staggered revenue waves that reward suppliers with scalable platforms capable of rapidly calibrating local protocols.

Global Automotive Autonomous Emergency Braking System Market Trends and Insights

Regulatory Mandates for Mandatory AEB Installation

Government-imposed AEB requirements create non-negotiable market expansion that transcends traditional automotive adoption cycles. NHTSA's final rule mandates that AEB systems be capable of automatic braking at speeds up to 90 mph. That pedestrian detection functionality should operate effectively in darkness, with full compliance required by September 2029.The regulation's performance-based approach, rather than technology-specific requirements, enables manufacturers to choose optimal sensor combinations while meeting stringent effectiveness thresholds. Preliminary testing reveals that only the 2023 Toyota Corolla meets these comprehensive standards, indicating substantial technology upgrades required across the industry. This regulatory framework fundamentally alters competitive dynamics by establishing minimum performance baselines that favor technologically sophisticated suppliers capable of delivering integrated sensor fusion solutions. The estimated USD 82 per vehicle implementation cost represents a minimal barrier relative to the projected USD 5.24 to USD 6.52 billion lifetime net benefits, creating compelling economic justification for accelerated adoption.

Rising Consumer Demand for NCAP 5-Star Safety Ratings

Consumer safety consciousness drives purchasing decisions beyond regulatory minimums, creating market premiums for vehicles achieving top-tier safety ratings. Euro NCAP's updated 2026 protocols introduce enhanced AEB testing scenarios, including junction collision avoidance and cyclist detection capabilities, with manufacturers requiring advanced sensor integration to achieve maximum ratings. The Insurance Institute for Highway Safety's advocacy for stringent AEB regulations reflects consumer awareness that current systems significantly underperform in darkness, creating differentiation opportunities for manufacturers deploying infrared cameras and advanced sensor fusion. This consumer-driven demand particularly influences premium vehicle segments where safety technology is a key differentiator, with manufacturers like Volvo leveraging City Safety technology to demonstrate measurable crash reduction benefits. The NCAP roadmap extending through 2033 ensures continuous technology evolution requirements, preventing market stagnation and rewarding ongoing innovation investments. Liberty Mutual's TechSafety program, offering discounts to Volvo owners with advanced safety features, demonstrates how consumer demand intersects with the insurance industry's recognition of AEB effectiveness.

High Cost of LiDAR & Multi-Sensor Stacks for Premium AEB

LiDAR integration costs constrain widespread adoption despite superior detection capabilities, creating market segmentation between premium and volume vehicle categories. While companies like Hesai plan to reduce LiDAR prices by 50% in 2025, current costs still exceed radar-camera combinations by substantial margins, limiting deployment to higher-end vehicle segments. Oliver Wyman's analysis indicates that LiDAR provides superior accuracy for safety-critical applications like emergency braking but faces competitive pressure due to improved radar resolution and cost-effectiveness. The challenge intensifies multi-sensor fusion architectures that combine LiDAR, radar, and cameras to achieve redundancy and enhanced performance, as system complexity increases, integration costs, and validation requirements. Aeva Technologies' selection as a Tier 1 LiDAR supplier for series production vehicles demonstrates market confidence in FMCW technology. However, the transition timeline extending to mid-decade reflects the substantial engineering and cost optimization required. This cost constraint particularly affects commercial vehicle adoption, where fleet operators prioritize total cost of ownership over premium safety features, potentially delaying LiDAR-based AEB penetration in high-volume segments.

Other drivers and restraints analyzed in the detailed report include:

- Declining Radar & Camera Sensor Cost with Scalable 4D Fusion

- AI-Enhanced Imaging Radar Unlocking Low-Cost High-Resolution Perception

- Sensor Performance Limits in Adverse Weather & False Positives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars hold the largest autonomous emergency braking market share at 73.68%, benefiting from rising consumer safety expectations that align with regulation. Heavy commercial vehicles represented only 6% of the market share in 2024, yet are climbing at the highest CAGR of 14.20% on the back of FMCSA rules covering trucks above 10,001 lb GVW. This high-growth base positions fleets as a strategic beachhead, with retrofit kits priced from USD 1,500 achieving payback through collision-related downtime reduction and insurance rebates. Light commercial vans retain a 20% share as e-commerce logistics multiply delivery miles. The heavy commercial vehicles' autonomous emergency braking market size is projected to more than triple between 2025 and 2030 as fleet purchasing cycles compress around compliance deadlines.

Fleets are also influencing technology paths. ZF's brake-by-wire program covering 5 million units demonstrates commercial platforms' power to set scale economies that later cascade into passenger segments. Tier 1 suppliers now design modular sensor suites that clip onto tractor cabs or trailer noses, minimizing downtime and standardizing service parts. This cross-segment technology flow ensures the autonomous emergency braking industry retains a virtuous cycle of volume and innovation.

Radar dominated the autonomous emergency braking market with a 46.32% share in 2024, prized for all-weather robustness and steadily falling cost curves. Camera-only systems cover 22% but struggle in lowlight, driving uptake of radar-camera fusion that occupies a 20% share. LiDAR, though nascent, is surging at 31.70% CAGR as vertical cavity surface-emitting lasers and FMCW architectures slash BOM and deliver sub-10 cm range accuracy. Ultrasonic units remain parked at 4% for low-speed maneuvers. The autonomous emergency braking market share of LiDAR-centric systems is expected to approach 15% by 2030, supported by global OEM order books exceeding USD 6 billion for solid-state sensors.

Convergence is increasingly likely. Hybrid modules integrate a narrow-field LiDAR for high-resolution mid-range mapping with wide-field radar to secure adverse-weather reliability, yielding cost-balanced coverage. Semiconductor roadmaps embedding radar DSP, AI accelerators, and LiDAR control on a single die promise further consolidation, amplifying competitive tension inside the autonomous emergency braking industry.

The Automotive Autonomous Emergency Braking System Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component Technology (Radar-Based, Camera-Based, LiDAR-Based AEB, and More), Operating Speed Class (Low-Speed, High-Speed, Pedestrian AEB, and More), and Sales Channel (OEM-Installed, Aftermarket Retrofit, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34.23% of 2024 revenue, a position underpinned by rigorous federal safety standards and a familiar litigation landscape that encourages proactive adoption. The region's high-average-vehicle age also underwrites robust retrofit demand as fleets accelerate compliance to capture insurance benefits. The autonomous emergency braking market size in North America is set to reach USD 28 billion by 2030, paralleling the staged FMVSS 127 compliance window.

Europe followed with 30% market share, supported by the General Safety Regulation II that synchronizes safety requirements across 27 member states and embeds AEB within a wider umbrella of Advanced Driver Assistance Systems. Euro-centric OEMs favour centralized E/E architectures that host AEB, lane-keep and adaptive cruise on a shared sensor array, improving scale effects for suppliers and boosting profitability within the autonomous emergency braking market.

Asia-Pacific posted 28% share in 2024 yet registers the highest 12.50% CAGR as Chinese OEMs like BYD inject AEB into budget EVs retailing below USD 15,000. Domestic chipsets and vertically integrated sensor supply chains compress cost structures, unlocking mass-volume deployments that dwarf European build counts. Australia's mandate for AEB on all new passenger cars from February 2025 widens regulatory coverage in the region, sustaining regional momentum. The autonomous emergency braking market size in Asia-Pacific could surpass North America before 2030 if current trajectories hold.

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Autoliv Inc.

- Hyundai Mobis Co. Ltd.

- WABCO Holdings Inc.

- Valeo SA

- Aisin Corporation

- Aptiv PLC

- Mobileye N.V.

- Magna International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Mandates for Mandatory AEB Installation

- 4.2.2 Rising Consumer Demand for NCAP 5-Star Safety Ratings

- 4.2.3 Declining Radar & Camera Sensor Cost With Scalable 4D Fusion

- 4.2.4 AI-Enhanced Imaging Radar Unlocking Low-Cost High-Resolution Perception

- 4.2.5 Usage-Based Insurance Discounts Tied to AEB-Equipped Vehicles

- 4.2.6 Night-Time Pedestrian AEB Requirements in China & US

- 4.3 Market Restraints

- 4.3.1 High Cost of LiDAR & Multi-Sensor Stacks for Premium AEB

- 4.3.2 Sensor Performance Limits in Adverse Weather & False Positives

- 4.3.3 Semiconductor Shortages for 77 GHz Radar Chipsets

- 4.3.4 Intensifying IP Litigation Around mmWave Radar Algorithms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.2 By Component Technology

- 5.2.1 Radar-based AEB

- 5.2.2 Camera-based AEB

- 5.2.3 LiDAR-based AEB

- 5.2.4 Sensor-Fusion AEB (Radar + Camera)

- 5.2.5 Ultrasonic-based AEB

- 5.3 By Operating Speed Class

- 5.3.1 Low-Speed AEB (Less Than 40 Kmph)

- 5.3.2 High-Speed AEB (More Than 40 Kmph)

- 5.3.3 Pedestrian AEB

- 5.3.4 Junction or Intersection AEB

- 5.4 By Sales Channel

- 5.4.1 OEM-Installed

- 5.4.2 Aftermarket Retrofit

- 5.4.3 Fleet Retrofit Service

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Denso Corporation

- 6.4.5 Autoliv Inc.

- 6.4.6 Hyundai Mobis Co. Ltd.

- 6.4.7 WABCO Holdings Inc.

- 6.4.8 Valeo SA

- 6.4.9 Aisin Corporation

- 6.4.10 Aptiv PLC

- 6.4.11 Mobileye N.V.

- 6.4.12 Magna International Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment