PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851370

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851370

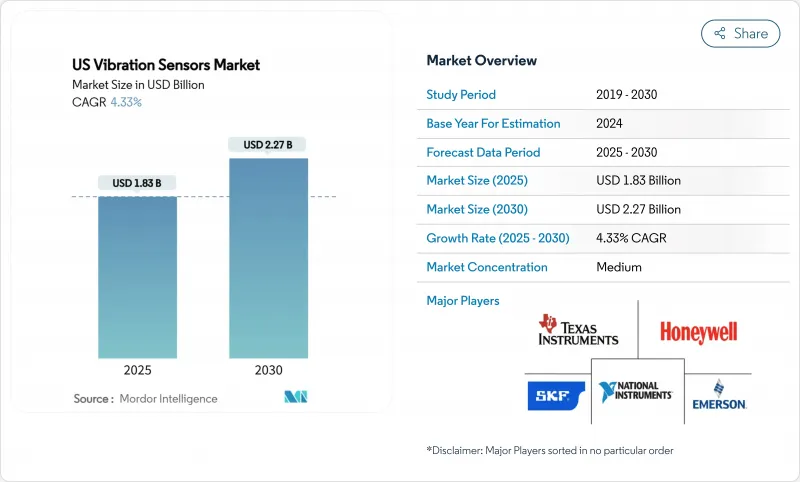

US Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States vibration sensors market size reached USD 1.83 billion in 2025 and is forecast to reach USD 2.27 billion by 2030, reflecting a 4.33% CAGR.

The United States vibration sensors market is moving from volume expansion toward technology-driven value creation as end users adopt edge AI, wireless connectivity, and Industry 4.0 practices. Uptake of predictive analytics, compliance pressures from OSHA and API standards, and the need to limit unplanned downtime underpin steady demand growth. Wireless nodes, energy-harvesting designs, and MEMS-based accelerometers broaden deployment options across aging industrial assets. Suppliers differentiate through integrated solutions that bundle hardware with cloud analytics while forming ecosystem partnerships to address cybersecurity and legacy-system integration challenges.

US Vibration Sensors Market Trends and Insights

Rising Demand for Predictive-Maintenance Programs

Unplanned downtime costs exceed USD 50 billion each year across U.S. manufacturing, prompting a shift from time-based to condition-based maintenance strategies. Many plants now deploy continuous vibration monitoring that detects bearing wear and misalignment early, extending asset life by as much as 30% while cutting spare-parts inventory. Machine learning applied to spectral data identifies anomalies that human analysts can miss, especially in facilities with interacting machines. Wind-farm operators using these tools have avoided lost production valued at EUR 4-5 million (USD 4.3-5.4 million) by predicting gearbox failures. Early adoption success is accelerating broader rollouts across automotive, metals, and food-processing sites.

IIoT-Enabled Wireless Vibration Nodes Gaining Traction

Wireless monitoring eliminates cable routing and allows coverage of assets once considered unreachable. LoRaWAN networks transmit data more than 15 kilometers, proven in remote environmental sensing. Energy-harvesting devices powered by ambient vibration or heat remove battery-change labor, addressing previous cost barriers. Baker Hughes' Ranger Pro sensor, approved for global hazardous areas, provides a template for oil and gas operators pursuing enterprise-wide condition monitoring. Short deployment times fit scheduled maintenance windows, supporting rapid ROI calculations.

Integration Issues with Legacy Machinery

Many facilities rely on equipment built decades ago without standardized sensor mounts or communication ports. Retrofitting can cost three to five times more than installing sensors on new assets. Resonance effects in older frames complicate signal fidelity and demand custom fixtures that add labor hours. Multiple generations of proprietary protocols require gateways that increase capex and cybersecurity exposure. Analog Devices' Voyager4 platform offers adaptive mounting and on-node AI to counter these hurdles, though price sensitivity slows adoption.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Adoption of MEMS-Based Low-Cost Accelerometers

- OSHA and API Compliance Pressures in Hazardous Industries

- Shortage of Intrinsically Safe Sensors for Class I/Div II Zones

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Accelerometers represented 45.1% of 2024 shipments, underlining their versatility across frequency ranges. Velocity sensors post the highest 7.81% CAGR as they capture low-frequency faults earlier in large rotating equipment. Multi-parameter devices combine acceleration, velocity, and temperature to simplify installation and reduce total cost of ownership. Analog Devices integrates edge AI in such packages, allowing on-node fault classification that trims network bandwidth. Growing use of velocity sensing in hydropower and pulp-and-paper plants supports revenue diversity within the United States vibration sensors market.

The second growth driver lies in expanding tire and gearbox testing where triaxial accelerometers track compound dynamic loads. Proximity probes, though niche, remain indispensable in non-contact turbine applications. Tachometers retain value as reference instruments for order analysis in variable-speed drives. As plants digitize, asset-health platforms ingest data from all product types, creating service fees that augment hardware margins and strengthen supplier-customer ties within the United States vibration sensors market.

Wired digital systems delivered 61.3% of 2024 revenue thanks to proven reliability and existing cable trays. However, wireless nodes grow 9.23% annually as battery life and radio resilience improve. LoRaWAN achieves kilometer-scale reach on single gateways, supporting distributed solar farms. Hybrid power-plus-wireless architectures appear in pharmaceutical cleanrooms where uptime and contamination control are paramount. Energy harvesting addresses maintenance pain points and expands use cases such as rotating kilns where slip rings add cost and complexity.

Data-diode features and AES-256 encryption mitigate cybersecurity concerns that once favored wired setups. Firmware-over-air updates let operators patch vulnerabilities without physical access. Standardization under ISA100 and IEC 62938 promotes interoperability across vendors, broadening the ecosystem for the United States vibration sensors market.

The United States Vibration Sensors Market Report is Segmented by Product Type (Accelerometers, Proximity Probes, Tachometers, Velocity Sensors, Others), Sensor Technology (Wired, Wireless), Sensing Material/Principle (Piezoelectric, MEMS, Magnetostrictive, Fiber-Optic), End-User Industry (Automotive, Aerospace and Defense, Oil and Gas, Metals and Mining, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Analog Devices Inc.

- Texas Instruments Incorporated

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation Inc.

- SKF USA Inc.

- PCB Piezotronics (MTS Systems)

- TE Connectivity Ltd.

- Wilcoxon Sensing Technologies (Amphenol)

- Siemens Digital Industries USA

- STMicroelectronics Inc.

- Bosch Sensortec GmbH

- KCF Technologies Inc.

- Banner Engineering Corp.

- Fluke Corporation

- Baker Hughes (Bently Nevada)

- Meggitt PLC (Endevco)

- Omron Corporation

- National Instruments Corp.

- Hansford Sensors Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for predictive-maintenance programs

- 4.2.2 IIoT-enabled wireless vibration nodes gaining traction

- 4.2.3 Accelerating adoption of MEMS-based low-cost accelerometers

- 4.2.4 OSHA and API compliance pressures in hazardous industries

- 4.2.5 Edge-AI analytics unlocking new value pools (under-reported)

- 4.2.6 Vehicle electrification driving high-frequency vibration sensing (under-reported)

- 4.3 Market Restraints

- 4.3.1 Integration issues with legacy machinery

- 4.3.2 Shortage of intrinsically safe sensors for Class I/Div II zones

- 4.3.3 Cyber-security risks from connected sensors (under-reported)

- 4.3.4 Supply-chain volatility in piezo-ceramic materials (under-reported)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Threat of Substitutes

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Bargaining Power of Buyers

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Accelerometers

- 5.1.2 Proximity Probes

- 5.1.3 Tachometers

- 5.1.4 Velocity Sensors

- 5.1.5 Others

- 5.2 By Sensor Technology

- 5.2.1 Wired (Analog/Digital)

- 5.2.2 Wireless (BLE, LoRa, Wi-Fi)

- 5.3 By Sensing Material / Principle

- 5.3.1 Piezoelectric

- 5.3.2 MEMS (Capacitive/Piezoresistive)

- 5.3.3 Magnetostrictive

- 5.3.4 Fiber-Optic

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Oil and Gas

- 5.4.4 Metals and Mining

- 5.4.5 Power Generation

- 5.4.6 Healthcare

- 5.4.7 Consumer Electronics

- 5.4.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Analog Devices Inc.

- 6.4.2 Texas Instruments Incorporated

- 6.4.3 Honeywell International Inc.

- 6.4.4 Emerson Electric Co.

- 6.4.5 Rockwell Automation Inc.

- 6.4.6 SKF USA Inc.

- 6.4.7 PCB Piezotronics (MTS Systems)

- 6.4.8 TE Connectivity Ltd.

- 6.4.9 Wilcoxon Sensing Technologies (Amphenol)

- 6.4.10 Siemens Digital Industries USA

- 6.4.11 STMicroelectronics Inc.

- 6.4.12 Bosch Sensortec GmbH

- 6.4.13 KCF Technologies Inc.

- 6.4.14 Banner Engineering Corp.

- 6.4.15 Fluke Corporation

- 6.4.16 Baker Hughes (Bently Nevada)

- 6.4.17 Meggitt PLC (Endevco)

- 6.4.18 Omron Corporation

- 6.4.19 National Instruments Corp.

- 6.4.20 Hansford Sensors Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment