PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851387

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851387

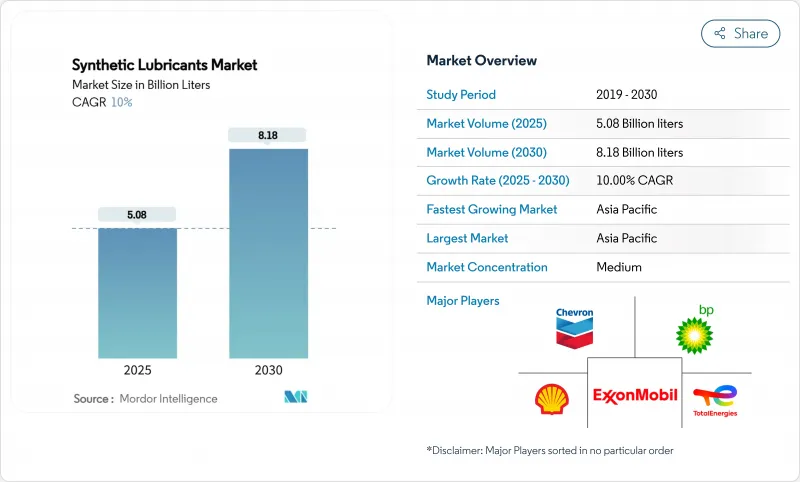

Synthetic Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Synthetic Lubricants Market size is estimated at 5.08 Billion liters in 2025, and is expected to reach 8.18 Billion liters by 2030, at a CAGR of 10% during the forecast period (2025-2030).

Rising demand for lower-viscosity engine oils, accelerated regulatory pressure on fuel economy, and the rapid adoption of high-performance fluids across automated manufacturing lines are the principal growth engines. The synthetic lubricants market is also benefiting from the introduction of the ILSAC GF-7 specification, effective March 2025, which compels automakers and service networks to shift toward advanced PAO and PAG-based formulations. Continuous investments in metallocene PAO capacity, together with product launches tuned for new API and ACEA categories, reinforce supply security and spur formulation innovation. Against this backdrop, Asia-Pacific maintains leadership on both consumption and growth, aided by China's large manufacturing base and India's recovering vehicle parc.

Global Synthetic Lubricants Market Trends and Insights

Increasing Usage of High-Performance Synthetic Engine Oils in the Automotive Aftermarket

The post-2024 aftermarket pivot toward full-synthetic engine oils became pronounced once the API SQ standard entered force in March 2025. Shell's Helix Ultra line, which satisfies the new category, demonstrates full power retention and better fuel economy, convincing service centers to recommend premium synthetics as default fills . Market preference is shifting rapidly to 0W-20 and even 0W-8 grades because lower viscosity improves fuel efficiency during cold starts. Valvoline's premium full-synthetic gear oils, launched late 2024, provide four-fold wear protection over conventional products and command price premiums that customers accept when total cost of ownership is explained. North America and Europe remain at the forefront thanks to higher regulatory stringency and consumer awareness, yet momentum is spreading to urban markets in Asia-Pacific as dealership networks highlight extended drain intervals.

Stringent Emission and Fuel-Economy Regulations

July 2025 marked the planned start of Euro 7, while EPA 2026 tightens heavy-duty requirements in the United States. These rules mandate lower-viscosity grades such as 5W-20 and 0W-20, forcing lubricant formulators to boost oxidation stability to satisfy extended service limits of 650,000 miles for next-generation diesel engines. The ILSAC GF-7 specification adds LSPI protection and timing chain wear control that mineral oils struggle to achieve, making synthetic base stocks indispensable. China's evolving China VI and India's Bharat Stage VII frameworks are converging toward similar thresholds, which effectively globalize the most stringent requirements. Harmonized standards benefit multinational suppliers that can deploy one formulation worldwide, cutting validation cycles and strengthening economies of scale.

Higher Upfront Cost of Synthetic Lubricants

Full-synthetic products often sell at prices two to three times those of mineral oils, a differential that remains a stumbling block in cost-sensitive segments. In short duty cycles the benefit of extended drains is muted, preventing fleet managers in developing economies from justifying the premium. Caltex data confirm that where service intervals sit below 5,000 km, ROI is difficult to secure. Rising crude prices, however, are lifting the cost base of mineral oils faster than synthetics, narrowing the gap. Meanwhile, predictive maintenance tools underscore lifetime savings, gradually eroding resistance among commercial fleets.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Industrial Automation Demanding Advanced Hydraulic & Gear Oils

- Rapid Expansion in Aerospace, Defense and Offshore Renewables Demanding Synthetic Turbine & Gearbox Oils

- Growing Electric-Vehicle Fleet

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oils captured 34.58% of the synthetic lubricants market in 2024 by volume, a position protected by the vast installed base of internal-combustion vehicles and the superior longevity synthetics deliver. Transmission and gear oils follow as the second-largest category because automated manufacturing lines and wind turbines both require high-load, clean-running formulations. Hydraulic fluids benefit from a construction upswing and robotics integration, supplying stable viscosity across wide temperature spreads. Greases remain indispensable in aerospace actuators and heavy machinery joints where drip-free lubrication is vital. Metalworking fluids, though holding a smaller volume share, advance at the fastest 11.15% CAGR as precision machining and additive manufacturing mature.

The segment outlook is shaped by ILSAC GF-7 and API SQ, both of which reduce permissible wear and LSPI occurrence. This shift favors premium synthetics that can sustain longer drains, reducing workshop visits, and oil disposal. Furthermore, metalworking fluids with low mist and high flash points mitigate occupational hazards, leading factories to migrate to synthetic ester-and-PAG systems. Together, these trends ensure that the synthetic lubricants market size for fluids beyond engine oils will expand steadily through 2030.

The Synthetic Lubricants Market Report Segments the Industry by Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, and More), by Base Oil (Polyalpha-Olefin (PAO), Esters, Polyalkylene Glycol (PAG), and More), by End User (Power Generation, Automotive, Heavy Equipment, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Liters).

Geography Analysis

Asia-Pacific held 40.27% of the synthetic lubricants market in 2024, with a 11.03% CAGR outlook. China's re-acceleration in advanced manufacturing, together with India's double-digit vehicle sales rebound, underpins regional consumption. New blending plants in coastal China, such as Quaker Houghton's Zhangjiagang facility scheduled for 2026, illustrate suppliers' determination to localize supply for high-growth sectors. Japan sustains demand for high-grade factory fills, while Southeast Asian economies ramp up industrial output, widening the customer base.

North America ranks second in volume and remains a technology bellwether. EPA 2026 rules and API's category pipeline push formulators into next-generation additive chemistry. The United States also dominates supply of high-viscosity PAO thanks to extensive propylene infrastructure, although propylene tightness predicted for mid-2025 could test margins. Canada's oil sands and mining fleets, plus Mexico's automotive export platforms, add stable demand pockets that rely on synthetic lubricants for uptime and warranty assurance.

Europe preserves its premium positioning through stringent environmental legislation and advanced OEM technical standards. Euro 7 compels lower viscosities and stronger aftertreatment compatibility, pushing adoption of ester-enhanced formulations in both light- and heavy-duty fleets. The North Sea offshore wind corridor and the Iberian Peninsula's emerging renewable clusters require fill-for-life gearbox oils that tolerate brine exposure, widening scope for high-value PAG and PAO blends. Eastern Europe's industrial base further diversifies demand as automation investments accelerate. The Middle East and Africa, while smaller, show a gradual shift from mineral to synthetic as Gulf petrochemical hubs and South African mines target longer drain intervals in harsh climates.

- Shell plc

- Exxon Mobil Corporation

- BP p.l.c. (Castrol)

- Chevron Corporation

- TotalEnergies

- Valvoline Global Operations (Saudi Aramco)

- China Petrochemical Corporation (Sinopec)

- PETRONAS Lubricants International

- FUCHS SE

- ENEOS Corporation

- Indian Oil Corporation Ltd

- AMSOIL Inc.

- Idemitsu Kosan Co.,Ltd.

- Gazpromneft-Lubricants Ltd.

- LUKOIL

- Phillips 66 Company

- Suncor Energy Inc.

- Quaker Chemical Corporation

- Repsol

- Motul

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Usage of High-Performance Synthetic Engine Oils in the Automotive Aftermarket

- 4.2.2 Stringent Emission & Fuel-Economy Regulations

- 4.2.3 Growth in Industrial Automation Demanding Advanced Hydraulic & Gear Oils

- 4.2.4 Rapid Expansion in Aerospace & Defence Requiring Synthetic Turbine Oils

- 4.2.5 Surge in Offshore Wind Installations Boosting Long-Drain Synthetic Gearbox Oils

- 4.3 Market Restraints

- 4.3.1 Higher Upfront Cost Versus Mineral Oils

- 4.3.2 Growing Electric-Vehicle Fleet Reducing Demand for Engine Oils

- 4.3.3 Volatility in Polyalphaolefin (PAO) Feed-Stock Supply

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oils

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Metalworking Fluids

- 5.1.5 Greases

- 5.1.6 Other Product Types (General Industrial Oils, etc.)

- 5.2 By Base Oil

- 5.2.1 Polyalpha-olefin (PAO)

- 5.2.2 Esters

- 5.2.3 Polyalkylene Glycol (PAG)

- 5.2.4 Group III / GTL-derived Synthetic

- 5.2.5 Others (Alkylated Naphthalene, etc.)

- 5.3 By End User

- 5.3.1 Automotive

- 5.3.2 Power Generation

- 5.3.3 Heavy Equipment

- 5.3.4 Metallurgy and Metalworking

- 5.3.5 Other End-user Industries (Oil and Gas, Marine, Data-centres, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Indonesia

- 5.4.1.7 Thailand

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 South Africa

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Shell plc

- 6.4.2 Exxon Mobil Corporation

- 6.4.3 BP p.l.c. (Castrol)

- 6.4.4 Chevron Corporation

- 6.4.5 TotalEnergies

- 6.4.6 Valvoline Global Operations (Saudi Aramco)

- 6.4.7 China Petrochemical Corporation (Sinopec)

- 6.4.8 PETRONAS Lubricants International

- 6.4.9 FUCHS SE

- 6.4.10 ENEOS Corporation

- 6.4.11 Indian Oil Corporation Ltd

- 6.4.12 AMSOIL Inc.

- 6.4.13 Idemitsu Kosan Co.,Ltd.

- 6.4.14 Gazpromneft-Lubricants Ltd.

- 6.4.15 LUKOIL

- 6.4.16 Phillips 66 Company

- 6.4.17 Suncor Energy Inc.

- 6.4.18 Quaker Chemical Corporation

- 6.4.19 Repsol

- 6.4.20 Motul

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Growing Adoption of Bio-lubricants