PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907000

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907000

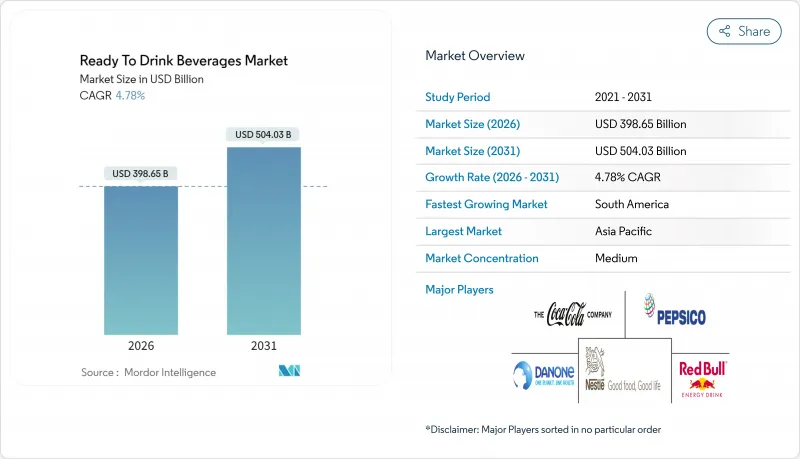

Ready To Drink Beverages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ready-to-drink beverages market size in 2026 is estimated at USD 398.65 billion, growing from 2025 value of USD 380.46 billion with 2031 projections showing USD 504.03 billion, growing at 4.78% CAGR over 2026-2031.

Households in developed nations have long embraced these products, while emerging markets are rapidly catching up. Urbanization, fast-paced lifestyles, and rising disposable incomes drive this trend. Globally, a shift towards healthier choices spans all demographics. Quick product launches focus on gut health, cognitive boosts, and immune support, while sustainability reshapes packaging, across the global ready-to-drink beverages market. Competition is moderate, with global players facing agile start-ups targeting niche markets. Regulatory scrutiny on sugar and packaging waste limits and guides innovation. Manufacturers are adopting natural sweeteners, recycled materials, and clear labeling to enhance brand value and maintain margins.

Global Ready To Drink Beverages Market Trends and Insights

Increasing Demand For On-The-Go Healthy Beverages

As lifestyles grow busier and health awareness rises, consumer expectations are evolving. The World Health Organization highlights a global shift in recognizing nutrition's role in preventing chronic diseases, driving demand for functional beverages that combine health benefits with convenience. This trend spans all age groups, with older adults increasingly opting for ready-to-drink (RTD) beverages tailored to their needs. Urban centers, where professionals face time constraints, are key growth markets for RTD beverages. In 2024, the International Labour Organization reported that 57.92% of the global population was employed, reflecting the demand for convenient, health-focused options . Brands that emphasize health benefits while maintaining RTD convenience are well-positioned for success. Additionally, government initiatives promoting reduced sugar intake and functional nutrients support the growth of health-oriented RTD drinks across the RTD beverages market.

Consumer's Inclination Towards LowSugar/Sugar-Free Beverages

Global health initiatives are driving reduced sugar consumption, with the WHO recommending free sugars make up less than 10% of energy intake. This has increased regulatory pressure on beverage manufacturers, especially in regions with sugar taxes, to develop low-calorie alternatives without compromising taste. Regulatory approvals, such as the European Food Safety Authority's endorsement of natural sweeteners, have supported these efforts. However, manufacturers face challenges in balancing taste and reduced sugar content, prompting investments in alternative sweeteners and flavor technologies. The FDA's updated nutrition labels, highlighting added sugars, have raised consumer awareness, influencing demand for lower-sugar options. Growing awareness of sugar's health impact presents opportunities for brands that combine taste and health benefits. As a result, the reduced-sugar beverage market is expected to grow significantly during the forecast period, driven by innovation and regulatory compliance in the ready-to-drink beverages market.

Health Concenrs Over Chemical Ingredients

RTD beverage manufacturers face challenges as global regulatory scrutiny of artificial ingredients grows. The European Food Safety Authority has tightened safety standards, while the FDA demands stronger safety data for synthetic additives. These pressures are significant for energy drinks and functional beverages, which often rely on synthetic components. Manufacturers are turning to natural alternatives, which meet regulatory and consumer demands but increase costs or reduce efficacy. In Canada, Health Canada's new labeling rules require clearer disclosure of artificial ingredients, reshaping consumer habits. This has driven manufacturers to prioritize clean-label products while balancing shelf stability and costs. Companies are reformulating products and introducing natural ingredient offerings, though these changes impact supply chains, profitability, and efficiency. Despite challenges, the industry's focus on innovation positions it to meet evolving expectations effectively within the ready to drink beverages industry.

Other drivers and restraints analyzed in the detailed report include:

- Innovation in Flavor, Ingredients and Packaging Format

- Rising Participation in Sports and Fitness Activities

- Environmental Impact and Packaging Waste Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, energy drinks hold a 17.42% market share, driven by innovations in functional ingredients and a growing consumer base seeking benefits beyond energy boosts. Research from the International Energy Drink Association highlights strong consumption growth, especially among the 18-34 age group. Brands are reformulating offerings with natural caffeine and functional ingredients like L-theanine to provide balanced energy and avoid crashes. The FDA's caffeine guidelines have promoted transparent labeling and responsible marketing. Strong brand loyalty and premium pricing sustain this segment as consumers prioritize consistent performance for their dynamic lifestyles, supporting growth in the ready-to-drink beverages market.

The dairy and dairy alternatives segment is projected to grow at a CAGR of 5.11% from 2026 to 2031, driven by rising awareness of protein and probiotic health benefits. The USDA's Dietary Guidelines support RTD dairy beverages as convenient nutrition sources. Manufacturers are creating high-protein products with 15-30 grams per serving to meet consumer demands. The FDA's recognition of probiotics and Health Canada's approval of probiotic strains have enabled innovation, allowing manufacturers to combine convenience with proven health benefits, driving segment growth across the broader RTD beverages market.

In 2025, conventional ingredients dominate the market with a 67.92% share, driven by established supply chains, clear regulatory pathways, and cost advantages. The FDA's safety database ensures predictable regulatory processes and lower development costs, making these ingredients essential for consistent quality and global distribution. Regulatory bodies like the European Food Safety Authority validate their safety, while consumer familiarity and cost-effectiveness strengthen their position, particularly in price-sensitive markets. Manufacturing efficiency and supply chain reliability further support high-volume production in the ready to drink beverages industry.

The natural and organic segment is projected to grow at a 5.62% CAGR from 2026-2031, driven by regulatory support for organic certification and increasing consumer preference for familiar ingredients. The USDA's National Organic Program establishes clear standards, boosting consumer confidence and enabling premium pricing. Health Canada's endorsement of natural health products and their therapeutic claims further supports this growth, allowing manufacturers to highlight specific health benefits. International organic standards, led by entities like the International Federation of Organic Agriculture Movements, facilitate global trade and enhance consumer recognition . Additionally, advancements in natural preservation and ingredient processing enable manufacturers to create clean-label products that rival conventional ones.

The Ready-To-Drink (RTD) Beverages Market Report is Segmented by Product Type (Tea, Coffee, Energy Drinks, and More), Ingredient (Conventional, and Natural and Organic), Packaging (PET/Glass Bottles, Tetra Packs, Cans, and Other Packaging Types), Distribution Channel (On-Trade and Off-Trade), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, the Asia-Pacific region leads the global ready-to-drink (RTD) beverages market with a 33.05% share. This dominance stems from urbanization, a growing middle class, and a shift toward convenience and functionality. Government initiatives emphasizing food safety and nutrition further drive growth. For instance, China's National Health Commission includes functional beverages in dietary guidelines, while India's Food Safety and Standards Authority enforces regulations for functional foods and beverages. The region's diverse preferences shape unique product offerings, supported by improved cold chain infrastructure and modern retailing. Japan's Ministry of Health, Labour and Welfare highlights functional beverage benefits, enabling credible health claims that appeal to consumers across the ready to drink beverages market.

South America is set to grow fastest, with a CAGR of 6.55% from 2026 to 2031, driven by rising incomes and lifestyle changes favoring RTD beverages. Brazil's National Health Surveillance Agency (ANVISA) has simplified regulations for functional beverages, expediting approvals. The region leverages its agricultural resources to produce beverages with indigenous ingredients for local and export markets. Argentina's mandatory nutrition labeling boosts transparency and demand for healthier options. While fresh beverages dominate, manufacturers can overcome challenges by focusing on quality and natural ingredients. Government health campaigns promoting balanced nutrition further support functional beverage growth in the RTD beverages industry.

North America maintains a strong position, balancing innovation with strict safety and quality standards. The FDA's oversight on ingredients and labeling guides manufacturers, fostering innovation in functional RTD products. Health Canada's Natural Health Products Regulations allow manufacturers to highlight approved functional ingredients' benefits, enabling premium branding and consumer education. In Europe, the European Food Safety Authority's stringent approval process ensures safety while encouraging innovation. In the Middle East and Africa, urbanization and a youthful population drive RTD adoption, though diverse regulations require tailored strategies and collaboration with local authorities.

- Red Bull GmbH

- PepsiCo, Inc.

- The Coca-Cola Company

- Nestle S.A

- Danone S.A

- Yakult Honsha Co. Ltd

- Suntory Holdings Limited

- JAB Holding Company

- Asahi Group Holdings Ltd

- Starbucks Corporation

- Unilever PLC

- Monster Energy Company

- Meiji Holdings Co. Ltd.

- Kirin Holdings Company, Limited.

- ITO EN, LTD.

- Danone S.A

- Red Bull GmbH

- The Coca Cola Company

- AriZona Beverages USA

- Milo's Tea Company, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand For On-The-Go Healthy Beverages

- 4.2.2 Consumer's Inclination Towards LowSugar/Sugar-Free Beverages

- 4.2.3 Technological Advancement in terms of Production

- 4.2.4 Innovation in Flavor, Ingredients and Packaging Format

- 4.2.5 Rising Participation in Sports and Fitness Activities

- 4.2.6 Growing Influence of Endorsements and Social Media Marketing

- 4.3 Market Restraints

- 4.3.1 Health Concenrs Over Chemical Ingredients

- 4.3.2 Consumer Inclination Towards Fresh Prepared Drinks

- 4.3.3 Environmental Impact and Packaging Waste Concerns

- 4.3.4 Fluctuating Raw Material Prices

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Tea

- 5.1.2 Coffee

- 5.1.3 Energy Drinks

- 5.1.4 Yogurt Drinks

- 5.1.5 Dairy and Dairy Alternatives

- 5.1.6 Flavored and Fortified Water

- 5.1.7 Other Product Types

- 5.2 By Ingredient

- 5.2.1 Conventional

- 5.2.2 Natural and Organic

- 5.3 By Packaging

- 5.3.1 PET/Glass Bottles

- 5.3.2 Tetra Packs

- 5.3.3 Cans

- 5.3.4 Other Packaging Types

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Red Bull GmbH

- 6.4.2 PepsiCo, Inc.

- 6.4.3 The Coca-Cola Company

- 6.4.4 Nestle S.A

- 6.4.5 Danone S.A

- 6.4.6 Yakult Honsha Co. Ltd

- 6.4.7 Suntory Holdings Limited

- 6.4.8 JAB Holding Company

- 6.4.9 Asahi Group Holdings Ltd

- 6.4.10 Starbucks Corporation

- 6.4.11 Unilever PLC

- 6.4.12 Monster Energy Company

- 6.4.13 Meiji Holdings Co. Ltd.

- 6.4.14 Kirin Holdings Company, Limited.

- 6.4.15 ITO EN, LTD.

- 6.4.16 Danone S.A

- 6.4.17 Red Bull GmbH

- 6.4.18 The Coca Cola Company

- 6.4.19 AriZona Beverages USA

- 6.4.20 Milo's Tea Company, Inc.

7 MARKET OPPURTUNITIES AND FUTURE OUTLOOK