PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851401

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851401

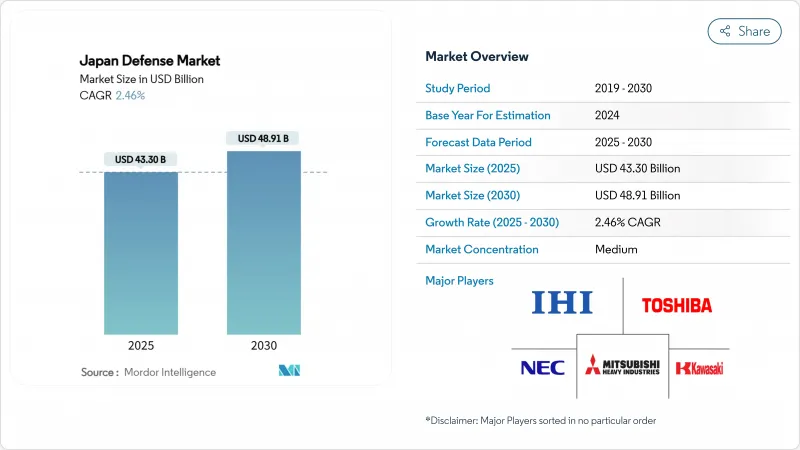

Japan Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan defense market size is valued at USD 43.30 billion in 2025 and is forecasted to climb to USD 48.91 billion by 2030, reflecting a steady 2.46% CAGR.

A sustained policy push that aligns defense spending with 2% of GDP and the December 2022 National Security Strategy that permits counterstrike capabilities underpins this measured growth. While regional neighbors are expanding force structure rapidly, Japan channels budget increases toward precision-guided munitions, integrated air and missile defense, autonomous platforms, and space-based assets. A high reliance on domestic contractors keeps supply chains resilient, yet targeted foreign procurement of technologically advanced systems-such as Tomahawk cruise missiles and F-35 fighters-helps bridge near-term capability gaps. Currency volatility and demographic pressures remain cost and manpower headwinds. Still, legislative incentives for defense supplies and a more permissive export policy provide structural offsets that stabilize the Japanese defense market trajectory.

Japan Defense Market Trends and Insights

Heightened Security Risks in the Indo-Pacific Region

China's assertiveness in the East China Sea and North Korea's hypersonic missile testing have prompted the largest doctrinal shift in Japan's post-war posture. The National Security Strategy labels China an "unprecedented strategic challenge" and funds the acquisition of 400 Tomahawk missiles alongside the 1,000 km-range Type 12 upgrade. A new Joint Operations Command was established in March 2025, unifying ground, maritime, air, space, and cyber forces, while missile units deployed to Okinawa and the Nansei islands strengthen regional deterrence. These measures sustain long-run demand for integrated air and missile defense solutions across the Japan defense market.

Significant Increase in Long-Term Defense Spending Commitments

Tokyo's five-year JPY 43 trillion (USD 315 billion) budget plan delivers predictability, encouraging domestic primes to scale production capacity. The fiscal 2025 allocation of JPY 8.70 trillion (USD 55.13 billion) prioritizes stand-off weapons, space resilience, and next-generation fighter R&D. Revised profit-margin guidelines-up to 15%-and the Defense Production Infrastructure Reinforcement Act incentivize suppliers to invest in new facilities and digital manufacturing lines. These policy tools help stabilize the Japan defense market against inflationary pressures and exchange-rate swings.

High Public Debt Levels Constraining Long-Term Budget Expansion

A debt-to-GDP ratio exceeding 260% narrows fiscal headroom once the five-year plan ends in 2027. Planned income-tax hikes have been deferred amid public resistance, leaving corporate and tobacco taxes and future bond issuances to shoulder defense costs. Demographic aging squeezes the tax base further, raising uncertainty over out-year funding even as strategic needs grow.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Advancement of Missile and Hypersonic Strike Capabilities

- Deepening Participation in Global Defense Collaboration Initiatives

- Limited Industrial Capacity and Skilled Workforce Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Army controlled 36.24% of Japan's defense market share in 2024, reflecting heavy investment in coastal missile batteries and island protection assets. Live-fire tests of Type 88 and upgraded Type 12 missiles near the Kuril Islands exemplify a posture shift toward credible land-based anti-ship deterrence. Ground Self-Defense Force units in Okinawa now field long-range missiles covering the entire Nansei chain, and mainland regiments will follow by 2026. Parallel Air Force modernization advances with a 6.21% CAGR, propelled by F-35B procurement and expanded air-to-air missile inventories. Activation of the Joint Operations Command in 2025 harmonizes these efforts, creating a multi-domain framework that leverages space, cyber, and electromagnetic capabilities. Growing UAV fleets complement manned platforms, reducing personnel demand and ensuring persistent surveillance over critical sea lines of communication.

Japan's defense market size for the Army segment is projected to expand alongside platform upgrades, whereas the Air Force's share will rise fastest as aerial threat sophistication escalates. The planned 40-aircraft F-35B fleet by 2031 enables flexible basing on Izumo-class carriers and austere airstrips, enhancing mobile air defense coverage. Personnel-related investments focus on retention bonuses and improved living quarters to offset demographic recruitment challenges. Foreign industry participation remains limited in the Army domain, but US primes capture avionics and missile electronics contracts that domestic suppliers cannot yet replicate. Overall, the Land domain's technological transformation secures the Army's primary share while enabling the Air Force to grow its relative stake within Japan's broader defense market.

Weapons and Ammunition commanded 32.11% of 2024 spending thanks to counterstrike missile orders, including 400 Tomahawk units worth USD 1.7 billion and scaled production of Type 12 missiles across seven regiments. This concentration places the segment at the center of long-range deterrence strategy and positions it to remain a cornerstone of Japan defense market size through 2030. The Japan defense market share of Unmanned Systems will rise quickly at a 7.44% CAGR as the military adopts kamikaze drones, underwater robots, and loitering munitions to compensate for shrinking human resources. A JPY 1 trillion (USD 6.94 million) five-year fund accelerates R&D of VTOL drones and autonomous swarm technologies, generating procurement demand for domestic startups and large primes.

Electronic warfare investments grew in 2024 after the USD 113 million SEWIP contract with Lockheed Martin, marking Japan's entry into advanced naval EW capabilities. Japan Steel Works' licensed production of Patria AMV XP armored vehicles injects NATO-standard designs into the land forces, while C4ISR upgrades embed private 5G networks across 50 bases by 2027. Training and protection allocations rise modestly, with Starlink satellite internet on 90% of surface vessels expected to improve crew welfare and real-time data sharing.

The Japan Defense Market Report is Segmented by Armed Forces (Army, Navy, and Air Force), Type (Personnel Training and Protection, C4ISR and Electronic Warfare, Vehicles, Weapons and Ammunition, Unmanned Systems, and Space and Cyber Systems), Domain (Land, Air, Naval, Space, and More), and Procurement Nature (Indigenous Production and Foreign Procurement). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mitsubishi Heavy Industries, Ltd.

- Kawasaki Heavy Industries, Ltd.

- IHI AEROSPACE Co., Ltd.

- ShinMaywa Industries, Ltd.

- Japan Steel Works, Ltd.

- Subaru Corporation

- NEC Corporation

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Lockheed Martin Corporation

- The Boeing Company

- BAE Systems plc

- RTX Corporation

- Northrop Grumman Corporation

- Thales Group

- Leonardo S.p.A

- L3Harris Technologies, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened security risks in the Indo-Pacific region

- 4.2.2 Significant increase in long-term defense spending commitments

- 4.2.3 Rapid advancement of missile and hypersonic strike capabilities

- 4.2.4 Deepening participation in global defense collaboration initiatives

- 4.2.5 Demographic pressures fueling growth in autonomous and uncrewed systems

- 4.2.6 Deployment of private 5G networks across defense installations

- 4.3 Market Restraints

- 4.3.1 High public debt levels constraining long-term budget expansion

- 4.3.2 Limited industrial capacity and skilled workforce availability

- 4.3.3 Currency depreciation driving up import-related procurement costs

- 4.3.4 Environmental pushback against base development and live-fire training

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Armed Forces

- 5.1.1 Air Force

- 5.1.2 Army

- 5.1.3 Navy

- 5.2 By Type

- 5.2.1 Personnel Training and Protection

- 5.2.2 C4ISR and Electronic Warfare (EW)

- 5.2.3 Vehicles

- 5.2.4 Weapons and Ammunition

- 5.2.5 Unmanned Systems

- 5.2.6 Space and Cyber Systems

- 5.3 By Domain

- 5.3.1 Land

- 5.3.2 Air

- 5.3.3 Naval

- 5.3.4 Space

- 5.3.5 Cyber and Electromagnetic Spectrum

- 5.4 By Procurement Nature

- 5.4.1 Indigenous Production

- 5.4.2 Foreign Procurement

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mitsubishi Heavy Industries, Ltd.

- 6.4.2 Kawasaki Heavy Industries, Ltd.

- 6.4.3 IHI AEROSPACE Co., Ltd.

- 6.4.4 ShinMaywa Industries, Ltd.

- 6.4.5 Japan Steel Works, Ltd.

- 6.4.6 Subaru Corporation

- 6.4.7 NEC Corporation

- 6.4.8 Toshiba Corporation

- 6.4.9 Mitsubishi Electric Corporation

- 6.4.10 Lockheed Martin Corporation

- 6.4.11 The Boeing Company

- 6.4.12 BAE Systems plc

- 6.4.13 RTX Corporation

- 6.4.14 Northrop Grumman Corporation

- 6.4.15 Thales Group

- 6.4.16 Leonardo S.p.A

- 6.4.17 L3Harris Technologies, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment