PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851450

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851450

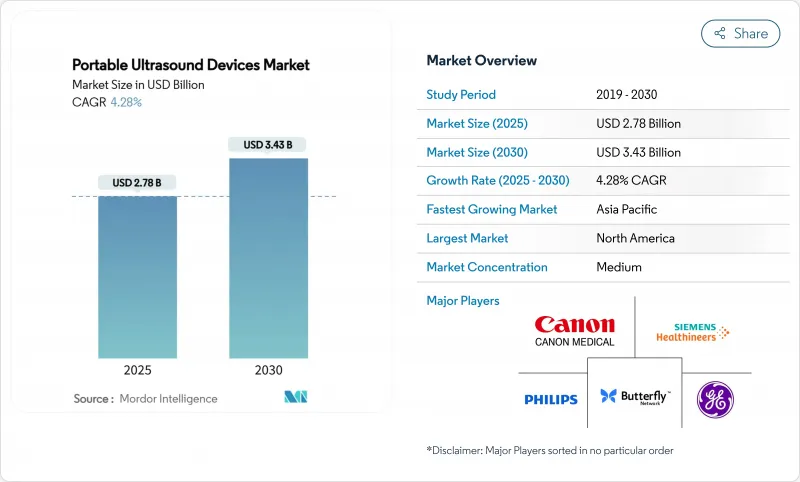

Portable Ultrasound Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Portable Ultrasound Devices Market size is estimated at USD 2.78 billion in 2025, and is expected to reach USD 3.43 billion by 2030, at a CAGR of 4.28% during the forecast period (2025-2030).

Demand is accelerating as point-of-care imaging migrates from radiology suites to bedsides, home settings and ambulatory sites. Handheld scanners that balance image quality, battery life and price are now the default choice in emergency rooms, while wearable transducers and AI-guided applications are opening double-digit expansion pockets that outpace overall growth. Asia-Pacific's rapid 11.28% annual rise is intensifying price competition and localization strategies among incumbent and emerging brands. Simultaneously, integration with telehealth platforms is unlocking remote diagnostics, yet fragmented reimbursement frameworks and operator-training deficits are tempering uptake. Industry participants that combine hardware, AI software and cloud connectivity are best positioned to capture the next wave of value creation in the portable ultrasound devices market.

Global Portable Ultrasound Devices Market Trends and Insights

Growing Global Demand for Point-of-Care Imaging Across Emergency & Primary Care Settings

Bedside ultrasound is replacing conventional radiography for rapid triage because protocols such as eFAST visualize thoracic and abdominal trauma in under five minutes. Lung ultrasound detects pneumonia more sensitively than chest X-ray and lowers treatment delays, which improves survival odds in overcrowded emergency departments. Primary-care physicians are also adopting handheld probes to refine initial diagnoses and cut referral loops. Comparative studies on older inpatients confirmed that handheld devices accurately screen for sarcopenia, highlighting their clinical utility outside imaging suites. These benefits translate into shorter hospital stays and lower imaging costs, reinforcing the pull for the portable ultrasound devices market.

Increasing Spectrum of Applications of Portable Ultrasound

Innovations such as ultrasound localization microscopy visualize myocardial microvasculature that CT angiography cannot capture, broadening cardiovascular use cases. AI-powered guidance now lets non-sonographers acquire diagnostic-grade cardiac clips, as GE HealthCare's acquisition of Caption Health demonstrates. Specialty fields ranging from anesthesiology to urology are adopting portable scanners for nerve blocks and stone characterization, creating incremental revenue streams. Robotic scanning systems that automate thyroid exams illustrate the march toward operator-independent imaging. These widening indications underpin the medium-term growth momentum of the portable ultrasound devices market.

Limited Reimbursement Coverage for Out-of-Hospital Ultrasound Procedures

Medicare and other insurers use a patchwork of National and Local Coverage Determinations, leaving gaps that discourage portable scans in primary-care and home environments. CPT code 76937 for vascular access demands time-consuming documentation, raising administrative costs for small practices. The projected 3-4% radiology reimbursement cut for 2025 could constrain budgets for new devices, especially in cost-sensitive community hospitals. Without clearer payment pathways, providers may defer adoption, dampening short-term growth in the portable ultrasound devices market

Other drivers and restraints analyzed in the detailed report include:

- Rising Geriatric Population and Chronic Disease Burden Necessitating Bedside Diagnostics

- Integration of Portable Ultrasound with Telehealth Platforms for Remote Consultations

- Shortage of Skilled Operators and Structured Training Programs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Handheld systems generated the largest revenue, holding 57.12% of portable ultrasound devices market share in 2024, thanks to balanced ergonomics and multipoint connectivity that fit emergency and critical-care workflows. Continuous upgrades-such as faster data transfer and native 3D reconstruction in the Butterfly iQ3-are deepening clinical versatility. In contrast, the portable ultrasound devices market size for wearables is projected to climb at a 13.83% CAGR through 2030 as sensor miniaturization enables round-the-clock physiology tracking.

Performance differentials are sharpening brand competition. A nine-device benchmark study awarded top scores to Vscan Air and SonoEye for overall utility, while Clarius C3HD3 excelled in B-mode imaging. Cart-based units still anchor high-acuity wards that demand larger displays, yet their relative share is eroding as handheld probes match image clarity once reserved for trolley systems. Autonomous robotic platforms like FARUS hint at a future where automated scanning cuts operator dependency while preserving portability advantages.

Two-dimensional imaging remained foundational with 49.58% share of the portable ultrasound devices market in 2024 because clinicians trust its established workflows and lower acquisition cost. However, 3D/4D modalities are forecast to deliver a 12.51% CAGR, as volume rendering improves obstetric, cardiovascular and musculoskeletal assessments.

Color Doppler and spectral Doppler maintain indispensable roles in vascular studies, and innovations such as Radiantflow visualization in GE's Voluson Signature 20 refine hemodynamic analysis. Deep-learning beamformers published in Frontiers reduce speckle noise, elevating the diagnostic confidence of compact probes. Collectively, these breakthroughs are increasing willingness to replace older scanners, reinforcing the portable ultrasound devices market.

The Portable Ultrasound Market Report is Segmented by Device Type (Handheld, Mobile/Cart-based, Wearable & Tablet-Based), Technology (2D Ultrasound, 3D/4D Ultrasound, Doppler Imaging), Application (Obstetrics & Gynecology, Cardiovascular, and More), End-User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 32.98% share in 2024, reflecting mature reimbursement frameworks and rapid AI clearances by the FDA. The Voluson Expert Series obtained AI upgrades in 2025, enabling more precise high-risk pregnancy assessments. Anticipated 3-4% radiology fee reductions pose headwinds but are unlikely to derail hospital replacement cycles given proven cost offsets in emergency throughput.

Europe retains a solid position through strong public health systems and regulatory refinements under the 2025 EU Work Program that streamline notified-body coordination for innovative scanners. An aging population is spurring bedside diagnostics for chronic disease monitoring, and cross-border telehealth pilots leverage portable probes for rural outreach.

Asia-Pacific is the growth engine, advancing at an 11.28% CAGR as China and Japan pour investment into AI-enabled diagnostics and focused ultrasound oncology startups. Local champions such as Mindray and Neusoft compete aggressively on price and after-sales service, forcing multinationals to tailor regional offerings. Government telemedicine policies in India, Indonesia and Thailand are catalyzing demand for handheld probes that bridge urban-rural care gaps. These dynamics collectively reinforce long-term upside for the portable ultrasound devices market.

- GE Healthcare

- Koninklijke Philips

- FUJIFILM

- Canon

- Siemens Healthineers

- Mindray

- Samsung Group

- Butterfly Network Inc.

- Clarius Mobile Health Corp.

- Esaote

- Terason Corporation

- Konica Minolta Healthcare

- Sonoscape Medical Corp.

- Fukuda Denshi Co., Ltd.

- VaveHealth

- Edan Instruments Inc.

- EchoNous Inc.

- Beijing Konted Medical Technology Co.

- Promed Technology Co., Ltd.

- EchoNous, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Global Demand for Point-of-Care Imaging Across Emergency & Primary Care Settings

- 4.2.2 Increasing Spectrum of Applications of Portable Ultrasound

- 4.2.3 Rising Geriatric Population and Chronic Disease Burden Necessitating Bedside Diagnostics

- 4.2.4 Integration of Portable Ultrasound with Telehealth Platforms for Remote Consultations

- 4.2.5 Technological Advancements in AI-Assisted Image Interpretation

- 4.2.6 Increased Adoption in Home Healthcare Segments

- 4.3 Market Restraints

- 4.3.1 Limited Reimbursement Coverage for Out-of-Hospital Ultrasound Procedures

- 4.3.2 Shortage of Skilled Operators and Structured Training Programs, Especially in Emerging Markets

- 4.3.3 Battery Life and Imaging Resolution Trade-offs in Portable Models

- 4.3.4 Regulatory Variability Affecting Global Market Entry

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Device Type

- 5.1.1 Handheld

- 5.1.2 Mobile/Cart-based

- 5.1.3 Wearable & Tablet-based

- 5.2 By Technology

- 5.2.1 2D Ultrasound

- 5.2.2 3D/4D Ultrasound

- 5.2.3 Doppler Imaging

- 5.3 By Application

- 5.3.1 Obstetrics & Gynecology

- 5.3.2 Cardiovascular

- 5.3.3 Urology & Renal

- 5.3.4 Musculoskeletal

- 5.3.5 Anesthesiology & Critical Care

- 5.3.6 Emergency Medicine & Trauma

- 5.3.7 Abdominal & General Imaging

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Diagnostic Imaging Centers

- 5.4.4 Maternity Centers & Fertility Clinics

- 5.4.5 Home Care & Telehealth

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE Healthcare

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 Fujifilm SonoSite Inc.

- 6.3.4 Canon Medical Systems Corp.

- 6.3.5 Siemens Healthineers

- 6.3.6 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.7 Samsung Medison Co., Ltd.

- 6.3.8 Butterfly Network Inc.

- 6.3.9 Clarius Mobile Health Corp.

- 6.3.10 Esaote SpA

- 6.3.11 Terason Corporation

- 6.3.12 Konica Minolta Healthcare

- 6.3.13 Sonoscape Medical Corp.

- 6.3.14 Fukuda Denshi Co., Ltd.

- 6.3.15 VaveHealth

- 6.3.16 Edan Instruments Inc.

- 6.3.17 EchoNous Inc.

- 6.3.18 Beijing Konted Medical Technology Co.

- 6.3.19 Promed Technology Co., Ltd.

- 6.3.20 EchoNous, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment