PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851468

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851468

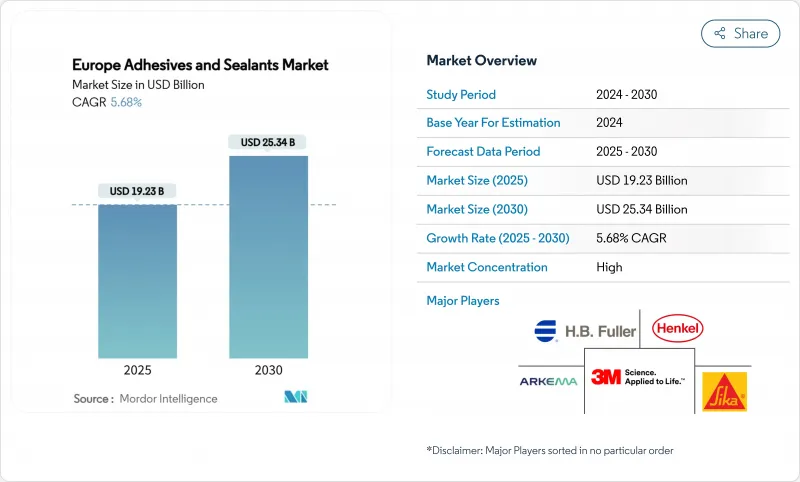

Europe Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Adhesives And Sealants Market size is estimated at USD 19.23 billion in 2025, and is expected to reach USD 25.34 billion by 2030, at a CAGR of 5.68% during the forecast period (2025-2030).

This trajectory reflects the sector's ability to navigate stringent EU Green Deal regulations while capitalizing on construction recovery, automotive lightweighting mandates, and renewable-energy expansion. Water-borne systems gain traction as VOC limits tighten, and UV-cured chemistries accelerate line speeds in electronics and automotive plants. German infrastructure outlays underpin steady demand, while Spain's renewable build-out positions it as the region's quickest-growing buyer of structural bonding solutions. Competitive intensity remains moderate, with large incumbents refocusing portfolios on bio-based resins and acquisition-driven capability expansion to safeguard margins against feedstock price volatility and carbon-reduction costs.

Europe Adhesives And Sealants Market Trends and Insights

Rising Demand from Residential Renovation

European renovation activity is gathering momentum as energy-efficiency mandates and post-pandemic lifestyle shifts lift spending on insulation, flooring, and window upgrades. The EU Renovation Wave aims to double building refurbishment rates by 2030, bolstering demand for continuous-bonding systems that eliminate thermal bridging. Germany's EUR 50 billion (~USD 58.45 billion) annual renovation market increasingly specifies bio-based products such as Henkel's LOCTITE HB S ECO, which cuts embodied CO2 by more than 60% compared with fossil-based counterparts. Nordic suppliers pioneer factory-applied adhesives for prefabricated facade panels, allowing rapid site assembly while meeting stringent indoor-air-quality norms. This renovation push is set to sustain volume growth for the European adhesives and sealants market through 2028.

Surge in E-Commerce Packaging Volumes

Rising parcel shipments prompt converters to adopt high-speed, solvent-free bonding solutions compatible with paper-recycling guidelines published by FEICA. Flexible-packaging adhesives must balance bond strength and de-inkability while supporting mono-material designs that simplify recycling under the EU Plastics Strategy. Germany and the Netherlands are upgrading automated lines that require tight viscosity control and quick setting. These trends underpin incremental gains for the European adhesives and sealants market, especially in hot-melt and waterborne grades engineered for rapid throughput.

Rising Environmental Concerns

REACH diisocyanate restrictions effective August 2023 force reformulation of polyurethane systems or mandatory worker training, while formaldehyde emission ceilings effective August 2026 drive shifts to ultra-low-emission grades. The addition of 247 SVHCs, including octamethyltrisiloxane, extends regulatory uncertainty. Sustainability investment needs 70% higher annual capital outlays across Europe's chemical sector, compressing margins yet spurring long-run innovation in bio-based feedstocks.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Lightweighting in European Auto Industry

- Fast-Growing Wind-Turbine Blade Bonding Market

- Volatile Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylics retained 37.16% revenue share of the European adhesives and sealants market in 2024, thanks to versatility and adhesion to diverse substrates. Other resins, including bio-based innovations, are forecast to expand 6.96% CAGR to 2030 as carbon-reduction mandates intensify. Europe adhesives and sealants market size for bio-based grades is projected to widen as BASF's renewable ethyl acrylate rolls out and xylan hot-melts demonstrate 30 MPa lap-shear while remaining reusable. Cyanoacrylates gain traction in electronics miniaturization, and polyurethane formulators pursue moisture-curing systems that bypass diisocyanate training. Silicone chemistries grow in high-temperature segments, whereas VAE/EVA retains cost-driven niches.

Waterborne platforms accounted for 43.19% of the 2024 revenue base, reflecting entrenched production lines and alignment with VOC caps. UV-cured systems, however, will post a 6.54% CAGR through 2030 as assembly plants seek instant-bond processing. Panacol's black UV epoxies cure in thicker layers, eliminating shadow areas, and are now specified in EV motor wire stress-relief joints.

Reactive hot melts combine rapid set with strong final bonds, serving high-speed packaging lines. Solvent-borne demand persists in aerospace, where long open time is critical, but higher-solids versions help meet tightening emission norms. Equipment upgrades toward LED-UV lamps cut energy use and further incentivize technology switching in the European adhesives and sealants market.

The Europe Adhesives and Sealants Report is Segmented by Adhesive Resin (Acrylic, Cyanoacrylate, Epoxy, and More), Adhesive Technology (Hot-Melt, Reactive, Solvent-Borne, and More), Sealant Resin (Polyurethane, Epoxy, Acrylic, and More), End-User Industry (Aerospace, Automotive, Building and Construction, and More), and Geography (Germany, United Kingdom, France, Italy, Spain, Russia, NORDIC Countries, and Rest of Europe).

List of Companies Covered in this Report:

- 3M

- Akzo Nobel N.V.

- Arkema

- Avery Dennison Corporation

- BASF

- Dow

- Dymax

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC.

- Jowat

- Mapei S.p.A

- Momentive

- Munzing

- PPG Industries, Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Residential-Renovation

- 4.2.2 Surge in E-Commerce Packaging Volumes

- 4.2.3 Accelerating Lightweighting in European Auto Industry

- 4.2.4 Fast-Growing Wind-Turbine Blade Bonding Market

- 4.2.5 Prefab Modular Construction Uptake

- 4.3 Market Restraints

- 4.3.1 Rising Environmental Concerns

- 4.3.2 Volatile Feedstock Prices

- 4.3.3 Skill Gap in Robotic Adhesive-Dispensing Workforce

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Adhesive Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE / EVA

- 5.1.7 Other Resins (Silane-Modified Polymer (SMP), Bio-based Resins, etc.)

- 5.2 By Adhesive Technology

- 5.2.1 Hot-Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-Borne

- 5.2.4 UV-Cured

- 5.2.5 Water-Borne

- 5.3 By Sealant Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins (Polysulfide, SMP Hybrid, etc.)

- 5.4 By End-User Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-User Industries (Renewable Energy,Electronics and Appliances, etc.)

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 NORDIC Countries

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Arkema

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF

- 6.4.6 Dow

- 6.4.7 Dymax

- 6.4.8 H.B. Fuller Company

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Huntsman International LLC.

- 6.4.11 Jowat

- 6.4.12 Mapei S.p.A

- 6.4.13 Momentive

- 6.4.14 Munzing

- 6.4.15 PPG Industries, Inc.

- 6.4.16 Sika AG

- 6.4.17 Soudal Group

- 6.4.18 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 EU Green Deal push for low-VOC and circular materials

- 7.3 Innovation and Development of Bio-based Adhesives