PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907281

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907281

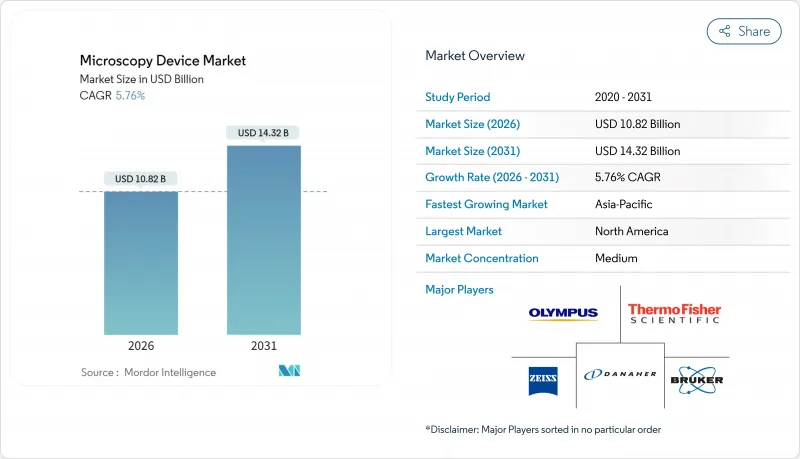

Microscopy Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The microscopy devices market is expected to grow from USD 10.23 billion in 2025 to USD 10.82 billion in 2026 and is forecast to reach USD 14.32 billion by 2031 at 5.76% CAGR over 2026-2031.

Government nanotechnology funding, semiconductor miniaturization goals and AI-enabled diagnostic workflows jointly re-shape demand , elevating microscopes from image capture tools to predictive analytics engines. Cryo-electron microscopy, quantum sensing and desktop super-resolution platforms gain traction as germanium supply constraints and skilled-labor shortages push users toward automation. Leading vendors respond by embedding artificial intelligence, robotics and cloud analytics into next-generation instruments. Maturing digital pathology, sub-5-nanometer chip production and quantum materials research sustain a broad opportunity set that anchors mid-single-digit growth for the microscopy devices market through 2030.

Global Microscopy Device Market Trends and Insights

Technological Advancements in Microscopy

Quantum sensing microscopes at the Technical University of Munich now capture cellular detail at 10-nanometer scales by converting nuclear spin signals into optical data, eliminating photodamage and setting a new resolution benchmark . Structured illumination mid-infrared photothermal microscopy from Zhejiang University delivers 60-nanometer chemical images, doubling prior performance and adding molecular specificity vital for polymer science. Adaptive optics using entangled photons further remove tissue distortion, producing crisp in-vivo vistas that traditional guide-star methods could not achieve. Together these advances foster premium demand across the microscopy devices market, encourage feature integration by suppliers and shorten discovery cycles for users.

Growing Nanotechnology & Life-Science R&D Funding

The United States National Nanotechnology Initiative secured a record USD 2.2 billion allocation for 2025, channeling money into Materials Innovation Platforms that pair synthesis and real-time microscopy. NSF added USD 84 million to the National Nanotechnology Coordinated Infrastructure, expanding shared access to advanced characterization at 16 sites. NIH's High-End Instrumentation Program now awards up to USD 2 million for microscopy suites, broadening equipment pools for immunotherapy and diagnostic imaging. Private firms typically co-invest alongside these grants, magnifying impact on the microscopy devices market and seeding future breakthroughs.

High Capital & Operating Costs

A state-of-the-art Cs-corrected STEM reaches USD 5 million, and yearly service fees consume up to 30% of purchase price. Add-on infrastructure for vibration isolation, temperature stability and electromagnetic shielding turns many proposals into multi-million-dollar projects. Smaller universities and hospitals hesitate, creating a two-tier customer base within the microscopy devices market. New FDA rules harmonizing with ISO 13485 arrive in 2026 and mandate wider quality documentation, raising compliance costs for device makers.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization of Semiconductor Devices

- AI-Enabled Automated Digital Pathology Workflows

- Shortage of Skilled Microscopists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electron Microscopy is set to post a 6.56% CAGR to 2031 while Optical Microscopy retains a 41.78% revenue base in 2025 that anchors routine workflows across life-science and materials labs. Aberration-corrected transmission electron microscopes now reach sub-angstrom clarity that semiconductor fabs and pharmaceutical researchers deem mission-critical. Cryogenic Electron Microscopy occupies the premium niche; it bypasses protein crystallization and surfaces receptor sites that fast-track antiviral and oncology programs. Hitachi's SU3900SE accepts 300 mm wafers and 5 kg samples, bringing semiconductor-grade throughput into research settings.

Demand patterns highlight convergence rather than replacement. Super-resolution optical systems pair with machine learning to close resolution gaps, while scanning probe microscopes leverage quantum sensors for non-contact atomic mapping. Integrated AI pipelines slash analysis time, lower entry barriers and keep the microscopy devices market on a path of steady capability expansion.

The Microscopy Devices Market Report is Segmented by Microscopy Type (Electron Microscopy, Optical Microscopy, Scanning Probe Microscopy, Other Technologies), Application (Nanotechnology Research, Life Science, Semiconductor & Electronics, and More), End User (Hospitals, Clinics and Diagnostic Labs, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.25% revenue in 2025, propelled by the USD 2.2 billion National Nanotechnology Initiative uplift and NIH high-end instrumentation grants. The region hosts quantum electron microscope consortia that pair academia and industry, solidifying a command position for the microscopy devices market. Yet germanium and gallium export curbs from China inflated lens-grade germanium by 75% and stretched lead times to 40 weeks, exposing supply-chain fragility.

Asia-Pacific will register the fastest 6.74% CAGR through 2031. Japan's ambition to triple chip-tool revenue, China's optics localization drive and South Korea's foundry expansion collectively buoy capital budgets. MA-tek expects Japan revenue to double in 2025 on Rapidus Corp orders for USD 5 million Cs-corrected TEMs. Regional supply chains deliver precision optics at scale, though geopolitical frictions introduce licensing uncertainty that firms navigate via joint ventures and technology-sharing safeguards.

Europe contributes balanced growth fueled by pharmaceutical research, precision-engineering heritage and EMBL partnerships that incubate imaging innovations. Harmonized ISO 13485 rules simplify cross-border device approvals, while Bundesland programs subsidize laboratory upgrades. Skilled-labor gaps and rising Asian competition temper acceleration, but high value-added niches in spatial biology and quantum materials keep the microscopy devices market momentum intact.

- Thermo Fisher Scientific (FEI)

- Carl Zeiss

- Danaher Corp. (Leica Microsystems)

- Hitachi High-Tech Corp.

- JEOL Ltd.

- Nikon Corp.

- Olympus Corp.

- Bruker Corp.

- Park Systems Corp.

- Tescan Orsay Holding

- Labomed Inc.

- Andor Technology Ltd.

- Oxford Instruments

- Becton Dickinson & Co.

- Asylum Research

- NT-MDT Spectrum Instruments

- Ametek (Cameca)

- ASML Holding (Nikon Metrology)

- Keyence Corp.

- Cytovale Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological advancements in microscopy

- 4.2.2 Growing nanotechnology & life-science R&D funding

- 4.2.3 Miniaturization of semiconductor devices

- 4.2.4 AI-enabled automated digital pathology workflows

- 4.2.5 Rapid adoption of cryo-EM for structure-based drug discovery

- 4.2.6 Desktop super-resolution systems for in-line QC

- 4.3 Market Restraints

- 4.3.1 High capital & operating costs

- 4.3.2 Shortage of skilled microscopists

- 4.3.3 IP-litigation risks in academia-industry tech transfer

- 4.3.4 Supply-chain bottlenecks for precision optics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Microscopy Type

- 5.1.1 Electron Microscopy

- 5.1.1.1 Transmission Electron Microscopy (TEM)

- 5.1.1.2 Scanning Electron Microscopy (SEM)

- 5.1.1.3 Cryogenic Electron Microscopy (Cryo-EM)

- 5.1.2 Optical Microscopy

- 5.1.2.1 Bright-field & Phase-contrast

- 5.1.2.2 Fluorescence & Confocal

- 5.1.2.3 Others

- 5.1.3 Scanning Probe Microscopy

- 5.1.4 Other Technologies

- 5.1.1 Electron Microscopy

- 5.2 By Application

- 5.2.1 Nanotechnology Research

- 5.2.2 Life Science

- 5.2.3 Semiconductor & Electronics

- 5.2.4 Materials Science & Metallurgy

- 5.2.5 Others

- 5.3 By End User

- 5.3.1 Hospitals, Clinics and Diagnostic Labs

- 5.3.2 Academic and Research Institutes

- 5.3.3 Pharmaceutical & Biotechnology Companies

- 5.3.4 Semiconductor and Electronics Manufacturers

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific (FEI)

- 6.3.2 Carl Zeiss AG

- 6.3.3 Danaher Corp. (Leica Microsystems)

- 6.3.4 Hitachi High-Tech Corp.

- 6.3.5 JEOL Ltd.

- 6.3.6 Nikon Corp.

- 6.3.7 Olympus Corp.

- 6.3.8 Bruker Corp.

- 6.3.9 Park Systems Corp.

- 6.3.10 Tescan Orsay Holding

- 6.3.11 Labomed Inc.

- 6.3.12 Andor Technology Ltd.

- 6.3.13 Oxford Instruments PLC

- 6.3.14 Becton Dickinson & Co.

- 6.3.15 Asylum Research

- 6.3.16 NT-MDT Spectrum Instruments

- 6.3.17 Ametek (Cameca)

- 6.3.18 ASML Holding (Nikon Metrology)

- 6.3.19 Keyence Corp.

- 6.3.20 Cytovale Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment