PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851474

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851474

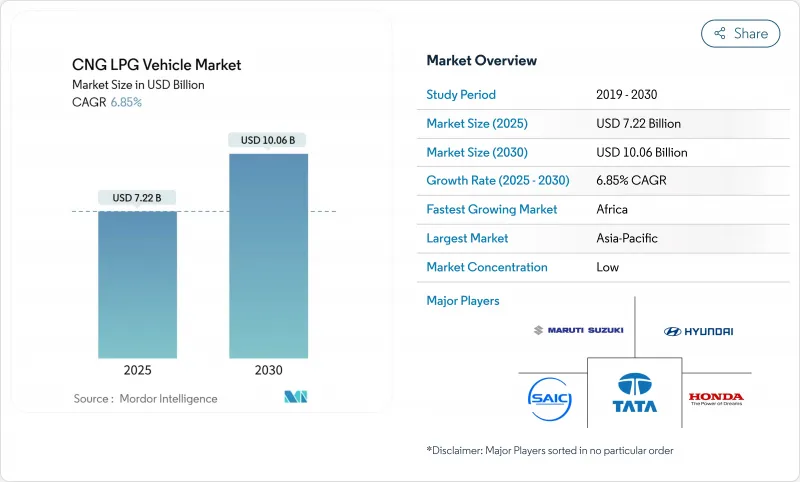

CNG LPG Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global CNG vehicle market reached USD 7.22 billion in 2025 and is forecast to grow at a 6.85% CAGR, touching USD 10.06 billion by 2030.

Rising government incentives, expanding refueling infrastructure, and technology that removes legacy usability barriers have moved the CNG vehicle market from a niche alternative into a mainstream option. Fleet operators now view gaseous fuels as long-term bridge solutions that deliver lower operating costs and assured regulatory compliance. Rapid station rollout, particularly in Asia-Pacific and Africa, improves range confidence, while twin-cylinder packaging and automated transmissions bring feature parity with petrol versions. Renewable natural gas (RNG) and bio-CNG unlock fresh decarbonization levers and hedge fossil-gas price swings, drawing commercial fleets that prioritize Scope 3 emission cuts. Competitive intensity is rising as established automakers broaden factory-fitted line-ups and new entrants court logistics, transit, and ride-hailing segments with turnkey bio-CNG services.

Global CNG LPG Vehicle Market Trends and Insights

Government Incentives and Fuel-Price Parity Initiatives

Multi-layered incentive programs are rewriting fleet economics. Nigeria's USD 450 million Presidential CNG Initiative couples station rollout with conversion vouchers, completing more than 10,000 vehicle upgrades and training 4,000 technicians. California's Drive Clean! rebates of up to USD 3,000 per light-duty vehicle plus an RNG tax credit proposal further sweeten payback periods. The UAE's Natural Gas for Vehicles program has installed dispensers able to serve 10,000 cars daily, guaranteeing supply for early adopters. Together, these actions reposition the CNG vehicle market as a strategic bridge to net-zero rather than a stop-gap.

Rapid Expansion of CNG/LPG Refueling Infrastructure

Station growth has shifted from public grants to commercial capital, signaling cash-flow viability. Clean Energy Fuels is constructing Houston's first private bus-depot CNG station sized for 2 million gallons per year. TotalEnergies operates more than 1,200 public pumps across three continents, strategically co-located on freight corridors to secure utilization. India targets 10,000 stations by 2030, underpinning Maruti Suzuki's plan to sell 600,000 factory-fitted CNG units in FY2025. A denser network alleviates range anxiety and unlocks intercity freight opportunities, driving sustained demand across the CNG vehicle market.

Limited Crash-Test Protocols for Gaseous-Fuel Vehicles

The February 2024 Wilmington truck explosion unveiled gaps in global standards. While Federal Standard 304 addresses tank integrity, holistic vehicle-level tests remain scarce, raising liability for fleets and insurers. ISO 11439 sets cylinder criteria but lacks crash simulations, slowing OEM roll-outs in risk-averse regions. Until authorities harmonize dynamic tests, these safety uncertainties will trim some upside from the CNG vehicle market.

Other drivers and restraints analyzed in the detailed report include:

- OEM Portfolio Shift Toward Factory-Fitted CNG Variants

- Stricter Tail-Pipe CO2 and NOx Norms in Urban Clusters

- Price-Volatility in LNG Feedstock for City-Gas Operators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Compressed Bio-Gas is forecast to clock a 12.83% CAGR to 2030 while Compressed Natural Gas maintains an 81.42% 2024 CNG vehicle market share. India's planned 40-fold jump in bio-CNG demand by FY2030, enabled by agriculture-waste digesters, highlights the pivot to renewables. Early launches such as the Maruti Brezza CBG posting 25.51 km/kg underline commercial viability. Concurrently, LPG maintains pockets of strength where legacy infrastructure exists, supported by Qatar and UAE's LNG projects that swell LPG supply. Regional fuel choices therefore mirror local feedstock abundance and policy pushes rather than pure technology merit.

The CNG vehicle market size for bio-CNG passenger cars is projected to expand at 15% yearly as dairy, distillery, and municipal-waste producers sign offtake deals that lock in input costs. Conversely, fossil-gas variants are growing in single digits as operators hedge against carbon taxes. The divergent trajectories show that while the overarching CNG vehicle market continues to widen, the internal mix is tilting toward renewable gas formulations.

Passenger cars controlled 62.73% of spending in 2024, yet two- and three-wheelers will deliver the sharpest 10.84% CAGR. Bajaj Auto's success in pushing CNG three-wheeler penetration from 26% to 57% between 2020 and 2023 builds technical confidence for its first CNG motorcycle in 2025. Light commercial vehicles and buses also feature prominently as duty cycles justify on-site station investments, amplifying the total CNG vehicle market size for commercial segments over the forecast window.

Increasing urban freight restrictions on diesel accelerate mini-truck adoption, while transit authorities opt for 12-year bus tenders that secure RNG supply contracts upfront. Together, these dynamics cement a diverse demand profile in the CNG vehicle market, anchored by cost-conscious two-wheelers and volume-driven commercial fleets.

The CNG and LPG Vehicle Market Report is Segmented by Fuel Type (Compressed Natural Gas (CNG) and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM-Fitted and Retrofitted/After-market), by End-Use Application (Private/Personal Use and More), by Cylinder Type (Type I and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific commanded 45.98% of 2024 revenue. India's milestone-CNG car sales overtaking diesel in early 2025-illustrates consumer acceptance; 6,959 stations underpin convenient access while twin-cylinder packaging addresses boot-space objections. China relies on CNG for heavy-duty freight routes where battery mass remains uneconomic, reinforcing the region's anchor role in the CNG vehicle market.

Africa is the fastest-advancing territory, posting a 13.28% CAGR to 2030. Nigeria's USD 450 million infrastructure program, with a 1 million-conversion target, anchors supply certainty, while South Africa's gas-to-power ambitions create additional pull. Abundant domestic gas and limited legacy automotive investment lower switching friction, accelerating the CNG vehicle market's penetration.

South America delivers an 8.1% CAGR, underpinned by Brazil's biofuel culture and Argentina's gas reserves. Brazil's ethanol flex-fuel heritage eases consumer education, and RNG pilot volumes seek transport buyers, feeding the CNG vehicle market. Hyundai's USD 1.1 billion green-mobility plan suggests OEMs perceive the continent as strategic for alternative fuels. Europe maintains a 5.2% pace, with Germany expanding biomethane output that feeds into station networks and broadens adoption.

- Hyundai Motor Company

- Suzuki Motor Corporation (Maruti Suzuki)

- Tata Motors Limited

- SAIC Motor Corporation

- IVECO Group

- AB Volvo

- Volkswagen AG

- Ford Motor Company

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- General Motors Company

- Mahindra & Mahindra Ltd.

- Great Wall Motor Co.

- Kia Corporation

- Dongfeng Motor Corporation

- Bajaj Auto Limited

- Ashok Leyland

- TVS Motor Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government incentives and fuel-price parity initiatives

- 4.2.2 Rapid expansion of CNG/LPG refueling infrastructure

- 4.2.3 OEM portfolio shift toward factory-fitted CNG variants

- 4.2.4 Stricter tail-pipe CO? and NOx norms in urban clusters

- 4.2.5 Breakthrough twin-cylinder packaging freeing boot-space

- 4.2.6 Commercial-fleet preference for bio-CNG and renewable LPG

- 4.3 Market Restraints

- 4.3.1 Limited crash-test protocols for gaseous-fuel vehicles

- 4.3.2 Price-volatility in LNG feedstock for city-gas operators

- 4.3.3 EV-capex subsidies diluting CNG demand in metros

- 4.3.4 Perception gaps on in-cab methane safety and range anxiety

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Infrastructure Readiness Analysis

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Fuel Type

- 5.1.1 Compressed Natural Gas (CNG)

- 5.1.2 Liquefied Petroleum Gas (LPG)

- 5.1.3 Compressed Bio-Gas (CBG)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Buses and Coaches

- 5.2.4 Trucks (Medium and Heavy-Duty)

- 5.2.5 Two and Three-Wheelers

- 5.3 By Sales Channel

- 5.3.1 OEM-fitted

- 5.3.2 Retrofitted / After-market

- 5.4 By End-use Application

- 5.4.1 Private / Personal Use

- 5.4.2 Taxi and Ride-hailing Fleets

- 5.4.3 Public Transit Authorities

- 5.4.4 Industrial and Utility Fleets

- 5.5 By Cylinder Type

- 5.5.1 Type I (All-metal)

- 5.5.2 Type II (Metal hoop-wrapped)

- 5.5.3 Type III (Full composite)

- 5.5.4 Type IV (Polymer-liner composite)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Colombia

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Thailand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Turkey

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Qatar

- 5.6.5.5 South Africa

- 5.6.5.6 Nigeria

- 5.6.5.7 Egypt

- 5.6.5.8 Kenya

- 5.6.5.9 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Hyundai Motor Company

- 6.4.2 Suzuki Motor Corporation (Maruti Suzuki)

- 6.4.3 Tata Motors Limited

- 6.4.4 SAIC Motor Corporation

- 6.4.5 IVECO Group

- 6.4.6 AB Volvo

- 6.4.7 Volkswagen AG

- 6.4.8 Ford Motor Company

- 6.4.9 Honda Motor Co., Ltd.

- 6.4.10 Nissan Motor Co., Ltd.

- 6.4.11 General Motors Company

- 6.4.12 Mahindra & Mahindra Ltd.

- 6.4.13 Great Wall Motor Co.

- 6.4.14 Kia Corporation

- 6.4.15 Dongfeng Motor Corporation

- 6.4.16 Bajaj Auto Limited

- 6.4.17 Ashok Leyland

- 6.4.18 TVS Motor Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment