PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851486

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851486

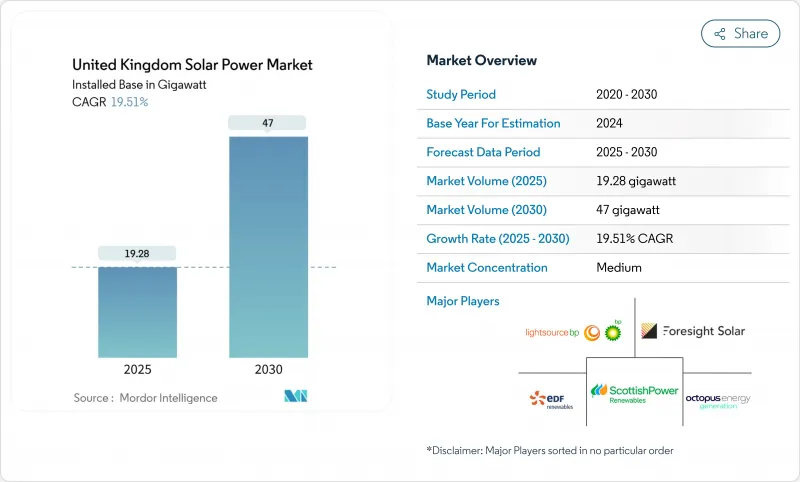

United Kingdom Solar Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom Solar Power Market size in terms of installed base is expected to grow from 19.28 gigawatt in 2025 to 47 gigawatt by 2030, at a CAGR of 19.51% during the forecast period (2025-2030).

Merchant economics now dominate as grid-parity pricing allows projects to compete without subsidies, while reforms to grid-connection rules shorten queues for ready-to-build assets. Enhanced corporate PPA activity, expanding agrivoltaics and battery-coupled plants, broadening revenue options, and supply-chain localisation incentives de-risk import reliance. Persistent hurdles include land-use planning friction, long Northern England interconnection wait times, and price volatility in the Contracts-for-Difference (CfD) auctions that narrows margins.

United Kingdom Solar Power Market Trends and Insights

Renewable Energy Obligation Certificates Extension Spurs Corporate PPAs

ROC buy-out prices rise to GBP 67.06 per certificate for 2025-2026, making direct solar PPAs cheaper than paying penalties and triggering multi-hundred-megawatt corporate contracts that now underpin debt finance structures. Corporate credit replaces subsidies as the core of project bankability, allowing developers to close financing more quickly and scale pipelines.

Grid-Parity Achievement Accelerates Merchant Solar

Levelised costs have fallen below wholesale day-ahead prices in the best-irradiated sites, letting developers forego CfD support and capture market-linked revenues. National Grid's GBP 58 billion Beyond 2030 upgrade programme specifically allocates capacity for merchant renewables, widening investor interest.

Land-Use Planning Constraints in England's NPPF

Two-thirds of renewable proposals were refused or delayed between 2018-2023 because agricultural protection rules override energy policy, forcing developers onto marginal land that inflates costs and elongates permitting. Local authorities often lack specialist staff, so objections stall projects even when national targets encourage solar expansion.

Other drivers and restraints analyzed in the detailed report include:

- National Grid ESO Reform Opens the Queue for Distributed Solar

- Battery-Coupled Solar Economics Strengthened by Flexible Connection Code

- Grid Congestion & Long Queue Times in Northern England

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monocrystalline silicon held 65% of the UK solar power market share in 2024, thanks to maturing supply chains and falling per-watt costs. Thin-film's 20.8% CAGR stems from flexible, lighter modules valued in agrivoltaic frames where translucence supports crop growth. Enhanced passivated emitter and rear contact (PERC) lines continue lowering cell prices, squeezing polycrystalline's role. Emerging tandem perovskite-on-silicon architectures test 30% lab efficiencies, with university labs targeting field pilots by 2027. Once reliability hurdles fall, the UK solar power market could adopt high-efficiency designs for roof and facade areas where space premiums justify higher module ASPs.

Ground-mounted arrays commanded 69% of the UK solar power market size 2024 on lower balance-of-plant costs and simpler layout logistics. Tracker deployment is rising on southern farms, adding 15-25% yield uplift. Residential rooftops now post a 21.5% CAGR as energy bills remain volatile and new-build rules mandate panels on all homes from June 2025. Commercial rooftops follow, using self-consumption to sidestep non-commodity charges. Floating solar feasibility studies across reservoirs total 2.7 TWh of output potential, though ecological permitting slows real-world execution.

The United Kingdom Solar Power Market Report is Segmented by Technology (Monocrystalline Silicon PV, Polycrystalline Silicon PV, and Others), Mounting (Rooftop Solar, Ground-Mounted Solar, and Others), End User (Residential, Commercial and Industrial, and Utility), Grid Connectivity (On-Grid and Off-Grid), Capacity Range (Below 5 KW, 5 To 100 KW, 100 KW To 1 MW, and Others), and Component (Solar PV Modules, Inverters, and Others).

List of Companies Covered in this Report:

- Lightsource bp Renewable Energy Investments Ltd

- EDF Renewables UK (Electricite de France SA)

- Octopus Energy Generation

- Foresight Solar Fund Ltd

- ScottishPower Renewables (Iberdrola SA)

- SSE Renewables

- Statkraft UK

- Vattenfall AB

- BayWa r.e. UK Ltd

- First Solar Inc.

- JinkoSolar Holding Co. Ltd

- Canadian Solar Inc.

- Trina Solar Co. Ltd

- Anesco Ltd

- Hive Energy Ltd

- Renewable Energy Systems Ltd

- Ecotricity Group Ltd

- Ameresco Inc.

- NextEnergy Capital Group

- Good Energy Group PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Renewable Energy Obligation Certificates (ROCs) Extension Spurs Corporate PPAs

- 4.2.2 Grid-Parity Achievement in Utility-scale Projects Accelerating Merchant Solar

- 4.2.3 National Grid's ESO Reform Favouring Distributed Solar Participation

- 4.2.4 Rising Demand for Agri-PV to Decarbonise UK Farming Sector

- 4.2.5 Battery-Coupled Solar Economics Enhanced by Ofgem's Flexible Connection Code

- 4.2.6 OEM Supply-Chain Localisation Incentives Under UK Net-Zero Strategy

- 4.3 Market Restraints

- 4.3.1 Land-Use Planning Constraints in England's National Planning Policy Framework

- 4.3.2 Import Dependency Risk from Xinjiang Silicon Module Supply Chain

- 4.3.3 Grid Congestion & Long Queue Times for Connections in Northern England

- 4.3.4 Volatile CFD Strike Prices Limiting Small-scale Project Bankability

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Monocrystalline Silicon PV

- 5.1.2 Polycrystalline Silicon PV

- 5.1.3 Thin-Film PV (CdTe, CIGS)

- 5.1.4 Emerging High-Efficiency (TOPCon, HJT, Perovskite Tandem)

- 5.2 By Mounting

- 5.2.1 Rooftop Solar

- 5.2.2 Ground-Mounted Solar

- 5.2.3 Floating Solar

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

- 5.3.3 Utility

- 5.4 By Grid Connectivity

- 5.4.1 On-Grid

- 5.4.2 Off-Grid

- 5.5 By Capacity Range

- 5.5.1 Below 5 kW

- 5.5.2 5 to 100 kW

- 5.5.3 100 kW to 1 MW

- 5.5.4 Above 1 MW

- 5.6 By Component

- 5.6.1 Solar PV Modules

- 5.6.2 Inverters

- 5.6.3 Mounting Structures and Trackers

- 5.6.4 Balance of System (BoS) Components

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Lightsource bp Renewable Energy Investments Ltd

- 6.4.2 EDF Renewables UK (Electricite de France SA)

- 6.4.3 Octopus Energy Generation

- 6.4.4 Foresight Solar Fund Ltd

- 6.4.5 ScottishPower Renewables (Iberdrola SA)

- 6.4.6 SSE Renewables

- 6.4.7 Statkraft UK

- 6.4.8 Vattenfall AB

- 6.4.9 BayWa r.e. UK Ltd

- 6.4.10 First Solar Inc.

- 6.4.11 JinkoSolar Holding Co. Ltd

- 6.4.12 Canadian Solar Inc.

- 6.4.13 Trina Solar Co. Ltd

- 6.4.14 Anesco Ltd

- 6.4.15 Hive Energy Ltd

- 6.4.16 Renewable Energy Systems Ltd

- 6.4.17 Ecotricity Group Ltd

- 6.4.18 Ameresco Inc.

- 6.4.19 NextEnergy Capital Group

- 6.4.20 Good Energy Group PLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment