PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851488

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851488

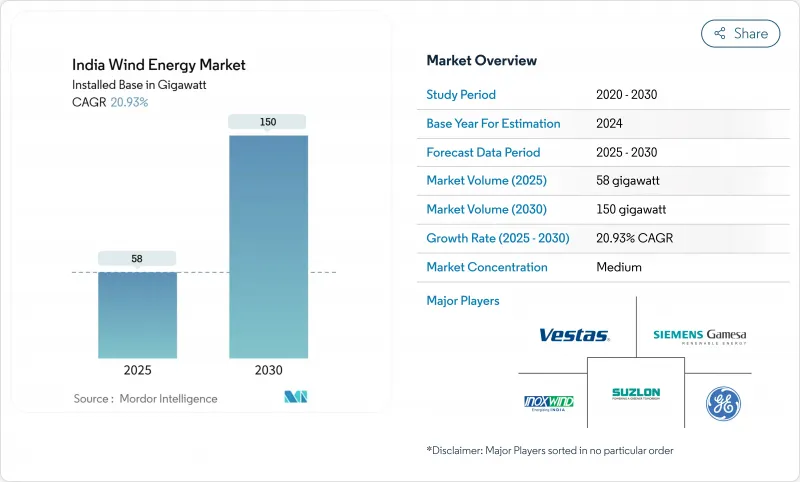

India Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Wind Energy Market size in terms of installed base is expected to grow from 58 gigawatt in 2025 to 150 gigawatt by 2030, at a CAGR of 20.93% during the forecast period (2025-2030).

Policy support under the 500 GW non-fossil target, rising corporate power-purchase agreements, and hybrid wind-solar auctions underpin this momentum. Increased grid-scale procurement by data-centre operators, resurgence in repowering of aging turbines, and the first offshore viability-gap funding tranche further strengthen growth prospects. Cost headwinds from the June 2025 expiry of interstate-transmission waivers and state-level land constraints pose near-term challenges but do not derail the long-term outlook, as domestic manufacturing depth and green-hydrogen demand create structural upside.

India Wind Energy Market Trends and Insights

Accelerated Hybrid Renewable Auctions Bundling Wind with Solar Enhancing Capacity Utilisation in Tamil Nadu & Gujarat

Hybrid tenders accounted for 43% of all renewable auctions in 2024, up from 16% in 2020. Tariffs of INR 2.58-2.67 / kWh in Gujarat and Tamil Nadu demonstrate cost competitiveness, while capacity-utilisation factors above 60% meet round-the-clock requirements for commercial consumers. Operational hybrid capacity stood at 7.7 GW in 2025 with a 30 GW pipeline, and NTPC's recent 1.2 GW award signals strong institutional backing. The approach enhances grid stability by matching complementary generation profiles, ensuring that the India wind energy market maintains robust demand across volatile load curves.

Viability-Gap Funding for Initial 4 GW Offshore Wind Round in Gujarat Catalyst for Supply-Chain Investments

The Union Cabinet's INR 74.53 billion package, including INR 6 billion for ports, narrows the tariff gap between onshore and offshore projects. Gujarat's Gulf of Khambhat and Tamil Nadu's coast jointly offer 70 GW technical potential, positioning offshore wind as a long-term diversification pillar. Port upgrades and dedicated evacuation corridors accelerate supply-chain localisation for monopiles, transition pieces, and HVDC export lines. As a result, the India wind energy market secures a foundation for high-capacity-factor assets that complement solar-heavy daytime generation.

Land Allotment Freeze in Karnataka & Maharashtra Slowing Onshore Pipeline

State-level land-bank depletion constrains project execution timelines despite Karnataka adding 1,135 MW in 2024. Regulatory reforms around open access improve downstream offtake, yet multi-agency clearances for land conversion remain protracted. Competing solar bids further tighten suitable parcels. These bottlenecks could slow the build rate for the India wind energy market until additional land-leasing frameworks are finalised.

Other drivers and restraints analyzed in the detailed report include:

- Repowering Scheme Opening 5-15 GW of Ageing Wind Farms for High-Capacity Turbines

- Green Hydrogen Policy Driving Demand for High-Load-Factor Wind Power in Industrial Clusters

- Delayed Grid Evacuation Corridors for Offshore Wind at Gulf of Khambhat

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Onshore capacity accounted for 100% India's wind energy market share in 2024, supported by 18 GW of annual domestic turbine manufacturing capacity and competitive tariffs between INR 2.68-3.6/kWh. Offshore wind, although at a nascent stage, is forecast to expand at a 35% CAGR, underpinned by the INR 74.53 billion funding scheme and superior capacity factors exceeding 40%. As a result, the India wind energy market size for offshore projects could rise from a negligible base to a double-digit gigawatt level by 2030.

Higher capital intensity and specialised logistics keep offshore levelised costs near INR 9-12/kWh without subsidies. The draft 64% domestic-content rule strengthens onshore economics while seeding local supply chains for offshore foundations and arrays. Over time, scale economies and port-led manufacturing clusters are expected to narrow cost gaps, allowing the India wind energy market to transition toward a balanced onshore-offshore mix in the next decade.

India Wind Energy Market Report is Segmented by Sector (Onshore and Offshore). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Inox Wind Limited

- Suzlon Energy Limited

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- General Electric Company

- Envision Energy

- Wind World (India) Ltd

- Tata Power Renewable Energy Ltd

- Enercon GmbH

- Senvion India

- ReNew Power (ReNew Energy Global PLC)

- Adani Green Energy Ltd

- JSW Energy - Mytrah Cluster

- Amp Energy India Pvt Ltd

- Greenko Group

- Siemens Energy AG

- Mingyang Smart Energy

- Nordex SE

- Leitwind Shriram Manufacturing Ltd

- GE T&D India Ltd

- SKF India

- Hitachi Energy India Ltd

- Bharat Heavy Electricals Ltd

- LM Wind Power (India)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Hybrid Renewable Auctions Bundling Wind with Solar Enhancing Capacity Utilisation in Tamil Nadu & Gujarat

- 4.2.2 Viability-Gap Funding for Initial 4 GW Offshore Wind Round in Gujarat Catalyst for Supply-Chain Investments

- 4.2.3 Repowering Scheme Opening 5-15 GW of Ageing Wind Farms for High-Capacity Turbines

- 4.2.4 Green Hydrogen Policy Driving Demand for High-Load-Factor Wind Power in Industrial Clusters

- 4.2.5 ISTS Charge Waivers Boosting Wind Project IRRs in Resource-Rich Western States

- 4.2.6 Corporate PPAs Surge from Data-centre Operators Seeking RTC Wind-Solar Mix

- 4.3 Market Restraints

- 4.3.1 Land Allotment Freeze in Karnataka & Maharashtra Slowing Onshore Pipeline

- 4.3.2 Delayed Grid Evacuation Corridors for Offshore Wind at Gulf of Khambhat

- 4.3.3 Rising GST on Turbine Components Eroding Cost Competitiveness vs Solar

- 4.3.4 Banking Restrictions (<30% Energy) by State DISCOMs Increasing Curtailment Risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Sector

- 5.1.1 Onshore

- 5.1.1.1 By Turbine Capacity

- 5.1.1.1.1 Up to 2 MW

- 5.1.1.1.2 2 to 3.5 MW

- 5.1.1.1.3 Above 3.5 MW

- 5.1.1.2 By Application

- 5.1.1.2.1 Utility-scale

- 5.1.1.2.2 Captive Industrial

- 5.1.1.2.3 Commercial and Institutional

- 5.1.2 Offshore

- 5.1.2.1 By Installation Type

- 5.1.2.1.1 Fixed-Bottom

- 5.1.2.1.2 Floating

- 5.1.2.2 By Water Depth

- 5.1.2.2.1 Shallow (Below 30 m)

- 5.1.2.2.2 Transitional (30 to 60 m)

- 5.1.2.2.3 Deepwater (Above 60 m)

- 5.1.1 Onshore

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Inox Wind Limited

- 6.4.2 Suzlon Energy Limited

- 6.4.3 Siemens Gamesa Renewable Energy SA

- 6.4.4 Vestas Wind Systems A/S

- 6.4.5 General Electric Company

- 6.4.6 Envision Energy

- 6.4.7 Wind World (India) Ltd

- 6.4.8 Tata Power Renewable Energy Ltd

- 6.4.9 Enercon GmbH

- 6.4.10 Senvion India

- 6.4.11 ReNew Power (ReNew Energy Global PLC)

- 6.4.12 Adani Green Energy Ltd

- 6.4.13 JSW Energy - Mytrah Cluster

- 6.4.14 Amp Energy India Pvt Ltd

- 6.4.15 Greenko Group

- 6.4.16 Siemens Energy AG

- 6.4.17 Mingyang Smart Energy

- 6.4.18 Nordex SE

- 6.4.19 Leitwind Shriram Manufacturing Ltd

- 6.4.20 GE T&D India Ltd

- 6.4.21 SKF India

- 6.4.22 Hitachi Energy India Ltd

- 6.4.23 Bharat Heavy Electricals Ltd

- 6.4.24 LM Wind Power (India)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment