PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851494

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851494

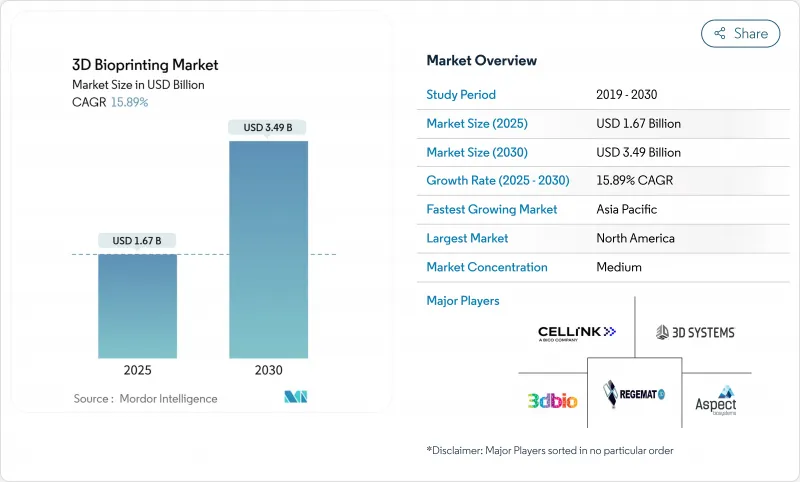

3D Bioprinting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The 3D Bioprinting Market size is estimated at USD 1.67 billion in 2025, and is expected to reach USD 3.49 billion by 2030, at a CAGR of 15.89% during the forecast period (2025-2030).

Growth rests on the convergence of AI-driven design automation, clarified regulatory pathways, and breakthroughs in vascularization that move bioprinted tissues from bench to bedside. The ARPA-H PRINT program's USD 65 million grant in March 2024 and NASA's five-year BioNutrients experiments illustrate how public capital is accelerating toward clinical goals. Aging populations in high-income economies, expanding public-private research consortia, and off-Earth healthcare initiatives add tailwinds. North America held 38.70% of the 3D bioprinting market in 2024, while Asia-Pacific is the fastest-growing region at an 18.35% CAGR to 2030, driven by Indian and Japanese policy reforms that support regenerative medicine.

Global 3D Bioprinting Market Trends and Insights

Rising Geriatric Population and Chronic Diseases

Developed economies face organ-donor backlogs, spurring hospitals to trial bioprinted vascular grafts such as Symvess, which secured FDA approval in December 2024 for trauma care. Japan's Development Bank invested 1 billion yen (USD 6.8 million) in metal-printing firm 3DEO during January 2024 to prepare for an aging society's healthcare burden. The world's first point-of-care facial implant, printed at University Hospital Basel in March 2025, illustrates how clinical adoption is meeting demographic necessity.

Growing Research and Development Funding and Public-Private Partnerships

ARPA-H's PRINT program earmarked USD 65 million for liver, kidney, and heart constructs. The University of Sydney inaugurated a Biomanufacturing Incubator in August 2024 to couple cell science with printing scale-up. Europe added momentum via the EC-funded REBORN cardiac tissue project using Newcastle University's ReJI platform. Private tie-ups such as CELLINK's renewed drug-discovery pact with a global pharma giant in June 2024 show industry embedding.

High Capital and Consumable Costs

3D Systems' 2024 revenue dipped to USD 440 million after customers deferred printer purchases; the firm launched a USD 50 million cost-cut plan while preserving R&D budgets. Hydrogels imported from specialty vendors drive up unit costs, and volumetric additive manufacturing like LLNL's NASA-funded "Replicator" cartilage system still demands high initial outlays. New entrants such as Biological Lattice Industries raised USD 1.8 million to produce lower-cost desktop biofabricators.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Multi-Material/High-Resolution Printing

- Demand for Transplant Alternatives and Regenerative Medicine

- Stringent Regulatory and Ethical Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Extrusion platforms preserved a 41.80% revenue hold in 2024, yet DLP systems are slated for a 16.40% CAGR as they replicate capillary-size geometries needed for kidney tissue viability. Inkjet and laser techniques serve research niches where cell placement fidelity outweighs throughput. Freeform Reversible Embedding (FRESH) used by Carnegie Mellon's group produces collagen constructs relevant to diabetes therapies. NASA-backed volumetric systems expect to shorten build times for cartilage in microgravity conditions.

Clinical demand for multi-material constructs favors DLP's photopolymer approach even at higher price points. Magnetic levitation and micro-valve printers occupy specialized corners like neuro-tissue modeling. Over the forecast horizon, DLP suppliers are likely to integrate AI-guided print-path optimization and close-loop imaging for real-time defect correction, reinforcing the 3D bioprinting market's technology shift.

Biomaterials will post the fastest 18.02% CAGR as researchers pivot from single-polymer gels to composite hydrogels loaded with signaling peptides. Meanwhile, 3D bioprinters, already 46.00% of sales, will diversify from desktop research models to GMP-compliant hospital units. The 3D bioprinting market size for biomaterials serving orthopedics reached USD 0.54 billion in 2025 and is forecast to expand at a 19.2% CAGR.

Next-generation scaffolds favor bioresorbable metals such as Bioretec's RemeOs, FDA-cleared in 2023, eliminating explant surgeries. Manufacturers are vertically integrating to capture powder, hydrogel, and printer sales under one umbrella, tightening ecosystem control and safeguarding print-quality reproducibility.

The 3D Bioprinting Market Report is Segmented by Technology (Syringe/Extrusion-based, Inkjet, Laser-Assisted [LAB], Magnetic Levitation, Micro-Valve, and More), Component (3D Bioprinters, Biomaterials, and Scaffolds), Application (Regenerative Medicine and Tissue Engineering, Drug Discovery and Toxicity Testing, and More), End-User (Academic and Research Institutes, Pharmaceutical and Biotechnology Cos., and More), and Geography.

Geography Analysis

North America's 38.70% hold stems from federal programs like NASA's BioNutrients initiative and ARPA-H's PRINT, coupled with FDA precedents including Symvess and 3DMatrix device clearances. Stanford and Penn State supply algorithmic and process breakthroughs that firms rapidly license. Clinical sites such as University Hospital Basel apply U.S.-developed printer hardware, underscoring cross-Atlantic influence.

Asia-Pacific, projected at an 18.35% CAGR, benefits from India's regulatory amendments allowing non-animal testing and Japanese sovereign-fund backing for additive manufacturing. China ties with the United States for scientific papers, while South Korea's POSTECH champions precision-tumor models. Despite lower labor costs, the region is importing GMP scripting from Western vendors to comply with global drug-approval standards.

Europe prizes harmonized regulation; the EC's 2024 biotech plan and ESOT's ATMP roadmap streamline approvals yet demand rigorous datasets. Newcastle University's ReJI platform and Nanoscribe's TPP resins exemplify academic-industry coupling. The United Kingdom leads in pet-food cultured meat clearances and cardiac tissue prototypes. Germany and Switzerland provide engineering depth and clinical pilots, respectively.

- CELLINK (BICO Group)

- 3D Systems Corporation

- Organovo Holdings Inc.

- Stratasys Ltd

- Aspect Biosystems Ltd

- REGEMAT 3D

- EnvisionTEC GmbH (Desktop Health)

- Cyfuse Biomedical KK

- RegenHU SA

- 3D Bioprinting Solutions

- GeSIM GmbH

- Arcam AB (GE Additive)

- Poietis SAS

- Allevi Inc. (3D Systems)

- ROKIT Healthcare

- Pandorum Technologies Pvt Ltd

- CollPlant Biotechnologies Ltd

- TandR Biofab Co. Ltd

- Fluicell AB

- Xpect INX

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising geriatric population and chronic diseases

- 4.2.2 Growing RandD funding and public-private partnerships

- 4.2.3 Advances in multi-material/high-resolution printing

- 4.2.4 Demand for transplant alternatives and regenerative medicine

- 4.2.5 Space and defence agency investment for off-earth healthcare

- 4.2.6 AI-driven design automation enabling personalised tissues

- 4.3 Market Restraints

- 4.3.1 High capital and consumable costs

- 4.3.2 Stringent regulatory and ethical hurdles

- 4.3.3 Medical-grade hydrogel supply-chain bottlenecks

- 4.3.4 Cross-lab reproducibility and standards gaps

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Extrusion/Syringe-based

- 5.1.2 Inkjet

- 5.1.3 Laser-assisted (LAB)

- 5.1.4 Magnetic Levitation

- 5.1.5 Micro-valve

- 5.1.6 Digital Light Processing (DLP)

- 5.1.7 Freeform Reversible Embedding (FRE)

- 5.1.8 Other Technologies

- 5.2 By Component

- 5.2.1 3D Bioprinters

- 5.2.1.1 Desktop

- 5.2.1.2 Industrial/Commercial

- 5.2.2 Biomaterials

- 5.2.2.1 Hydrogels

- 5.2.2.2 Nanofibrillated Cellulose

- 5.2.2.3 Decellularised ECM

- 5.2.2.4 Synthetic Polymers

- 5.2.3 Scaffolds

- 5.2.1 3D Bioprinters

- 5.3 By Application

- 5.3.1 Regenerative Medicine and Tissue Engineering

- 5.3.2 Drug Discovery and Toxicity Testing

- 5.3.3 Personalised and Precision Medicine

- 5.3.4 Food and Alternative Protein Research

- 5.3.5 Academic Research

- 5.3.6 Other Applications

- 5.4 By End-user

- 5.4.1 Academic and Research Institutes

- 5.4.2 Pharmaceutical and Biotechnology Cos.

- 5.4.3 Hospitals and Surgical Centres

- 5.4.4 Contract Research and Manufacturing Organisations

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 CELLINK (BICO Group)

- 6.4.2 3D Systems Corporation

- 6.4.3 Organovo Holdings Inc.

- 6.4.4 Stratasys Ltd

- 6.4.5 Aspect Biosystems Ltd

- 6.4.6 REGEMAT 3D

- 6.4.7 EnvisionTEC GmbH (Desktop Health)

- 6.4.8 Cyfuse Biomedical KK

- 6.4.9 RegenHU SA

- 6.4.10 3D Bioprinting Solutions

- 6.4.11 GeSIM GmbH

- 6.4.12 Arcam AB (GE Additive)

- 6.4.13 Poietis SAS

- 6.4.14 Allevi Inc. (3D Systems)

- 6.4.15 ROKIT Healthcare

- 6.4.16 Pandorum Technologies Pvt Ltd

- 6.4.17 CollPlant Biotechnologies Ltd

- 6.4.18 TandR Biofab Co. Ltd

- 6.4.19 Fluicell AB

- 6.4.20 Xpect INX

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment