PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851499

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851499

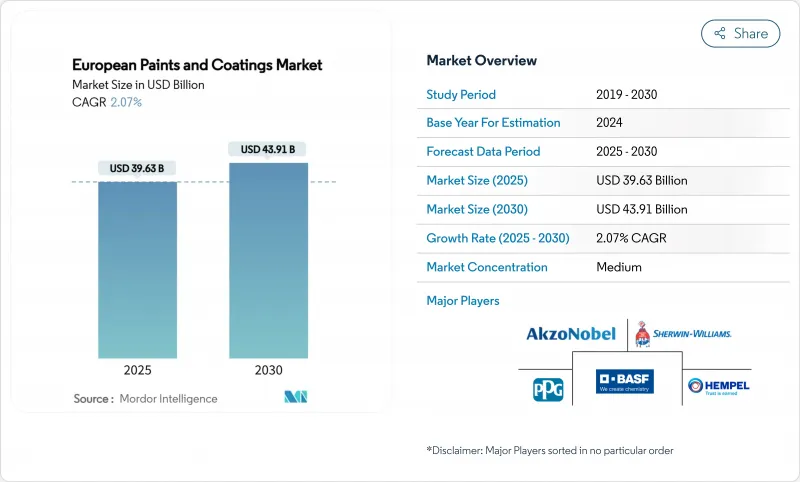

European Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The European Paints and Coatings Market size is estimated at USD 39.63 billion in 2025, and is expected to reach USD 43.91 billion by 2030, at a CAGR of 2.07% during the forecast period (2025-2030).

The European paints and coatings market is maturing in Western economies, yet renovation activity, electric-vehicle output, and renewable-energy infrastructure ensure a steady volume of high-value demand. Growth remains anchored in premium, water-borne formulations that satisfy stringent VOC caps while improving application efficiency. Raw-material cost pressures, notably for titanium dioxide, are reshaping sourcing strategies as anti-dumping duties on Chinese grades compel procurement diversification. Regional fragmentation keeps pricing disciplined, but multinationals are accelerating factory consolidations and technology upgrades to defend their share. Competition now hinges on sustainability credentials, with bio-based binders and nano-enabled protective systems moving from pilot scale toward commercial adoption.

European Paints And Coatings Market Trends and Insights

Construction-Sector Renovation Boom Boosts Demand

Renovation programmes backed by the European Green Deal are stimulating refurbishment of 35 million buildings by 2030, lifting specialty-coatings consumption per square metre well above that of new-build projects. Interior primers, elastomeric sealers, and low-VOC topcoats are now standard specifications for masonry upgrades that target energy efficiency. Architectural formulators emphasise breathability and moisture-barrier performance to meet stricter thermal regulations without trapping humidity in historic substrates. Public-sector grants channel work toward SMEs, yet large suppliers dominate premium segments through integrated tint systems and just-in-time logistics networks. The European paints and coatings market benefits as older housing stock across France, Italy, and Spain requires multiple-layer coating systems to achieve U-value targets. Retail professionals also report higher average ticket values as householders opt for antibacterial and stain-resistant finishes to enhance indoor wellness.

Accelerating Wind-Turbine Installations

Offshore wind capacity is set to jump tenfold to 300 GW by 2030, and every turbine tower, nacelle, and blade demands corrosion-resistant epoxy-polyurethane stacks of 200-300 litres per unit. Protective coatings suppliers now develop surface-tolerant primers that cure at low North Sea temperatures, allowing year-round deployment. Asset owners specify 25-year durability warranties, intensifying focus on adhesion promoters and sacrificial zinc-rich layers that slow under-film rust creep. The European paints and coatings market attracts investment in automated mixing skids and plural-component spray equipment that achieve high-build thickness with minimal overspray. Coating producers capture service-contract revenue through remote-monitoring analytics that predict maintenance intervals. Growth in the Baltic Sea mirrors North Sea momentum as Finland and Estonia approve multi-GW projects, extending demand for ice-resistant topcoats.

Volatile Feedstock Prices Squeezing Margins

Titanium dioxide now represents 40% of direct production costs for many formulators, and anti-dumping levies of EUR 0.25-0.74 kg on Chinese imports have forced substitution toward higher-priced European capacity. To stabilise procurement, large groups hedge through multi-year offtake contracts with chloride-route producers in Saudi Arabia and Mexico. Smaller firms accelerate rutile-ankerite blends that extend hiding power without compromising opacity. The European paints and coatings market thus witnesses greater vertical cooperation; several OEMs secure direct pigment allocations to insulate their coating partners from spot-market spikes. Innovation budgets shift toward extender-technology optimisation, delaying certain colour-stability projects.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Coatings from New Electric Vehicles

- Rising Demand from the Aerospace and Marine Sector

- Stricter Regulations Related to VOC Emissions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems delivered 38.74% of 2024 sales and are pacing a 3.58% CAGR, commanding the largest slice of the European paints and coatings market. The chemistry's polarity promotes water dispersion, making it the default for EU regulatory compliance. Alkyds cling to artisan woodcare niches because of depth-of-gloss aesthetics; however, longer drying times and higher solvent content shrink their volume annually.

Epoxies remain irreplaceable for cargo hold linings and bridge decks, where Europe's paints and coatings market share for the class stays at 12% but with flat growth as asset owners elongate maintenance cycles. Polyurethanes flourish in wind-blade production lines that value elongation-at-break above 10%. Acrylics also advance in automotive clearcoat blends, where hyper-branched variants deliver scratch resistance without raising viscosity. Polyester resins, preferred in powder coatings, ride automotive aluminium-trim popularity, with throughput gains from faster curing profiles that permit single-pass application.

The European Paints and Coatings Report is Segmented by Resin Type (Acrylic, Alkyd, Polyurethane, and More), Technology (Water-Borne, Solvent-Borne, Powder Coatings, and UV-Cured Coatings), End-User Industry (Architectural, Automotive, Wood, Protective Coatings, and More), and Geography (Germany, United Kingdom, France, Italy, Spain, Russia, Turkey, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ADLER

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Brillux GmbH & Co. KG

- CIN, S.A.

- Cromology

- DAW SE

- Hempel A/S

- Jotun

- Kansai Paint Co. Ltd.

- Mankiewicz Gebr. & Co.

- Metlac SpA

- PPG Industries Inc.

- RPM International Inc.

- ?nie?ka SA

- Stahl Holdings B.V.

- Teknos Group

- The Sherwin-Williams Company

- Tiger Surface Technology New Materials (Suzhou) Co., Ltd.

- Tikkurila

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction-Sector Renovation Boom Boosts Demand

- 4.2.2 Accelerating Wind-Turbine Installations

- 4.2.3 Growing Demand for Coatings from New Electric Vehicles

- 4.2.4 Rising Demand from the Aerospace and Marine Sector

- 4.2.5 Increasing Utilization from Semiconductor and Electronics Coatings

- 4.3 Market Restraints

- 4.3.1 Volatile Feedstock Prices Squeezing Margins

- 4.3.2 Stricter Regulations Related to VOC Emissions

- 4.3.3 Skilled-Applicator Labour Shortage Across Western Europe

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types (Vinyl, Fluoropolymers, etc.)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coatings

- 5.2.4 UV-Cured Coatings

- 5.3 By End-User Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Turkey

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADLER

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF

- 6.4.5 Beckers Group

- 6.4.6 Brillux GmbH & Co. KG

- 6.4.7 CIN, S.A.

- 6.4.8 Cromology

- 6.4.9 DAW SE

- 6.4.10 Hempel A/S

- 6.4.11 Jotun

- 6.4.12 Kansai Paint Co. Ltd.

- 6.4.13 Mankiewicz Gebr. & Co.

- 6.4.14 Metlac SpA

- 6.4.15 PPG Industries Inc.

- 6.4.16 RPM International Inc.

- 6.4.17 ?nie?ka SA

- 6.4.18 Stahl Holdings B.V.

- 6.4.19 Teknos Group

- 6.4.20 The Sherwin-Williams Company

- 6.4.21 Tiger Surface Technology New Materials (Suzhou) Co., Ltd.

- 6.4.22 Tikkurila

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Nano-Enabled Functional Coatings

- 7.3 Bio-based and Carbon-Negative Binders