PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852038

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852038

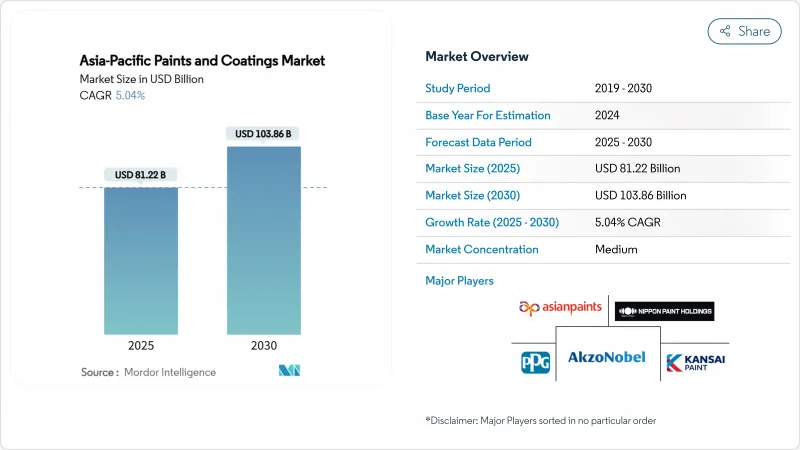

Asia-Pacific Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific Paints and Coatings Market size is estimated at USD 81.22 billion in 2025, and is expected to reach USD 103.86 billion by 2030, at a CAGR of 5.04% during the forecast period (2025-2030).

Tightening environmental regulations, accelerating urbanization, and the rapid scale-up of automotive and industrial production underpin sustained demand, while the shift to water-borne platforms positions technology leaders for margin resilience. China retained dominance with a 56.42% share in 2024, yet India is setting the growth pace through 2030 as infrastructure outlays and housing upgrades gain momentum. Raw-material volatility, especially in titanium-dioxide pricing, keeps margin management in sharp focus, and strategy realignments, such as divestitures by BASF and AkzoNobel, signal that scale, portfolio balance, and regional depth will define competitive advantage. Digitalized color tools, faster repaint cycles in premium urban housing, and policy-backed "green ship" retrofits add incremental layers of demand that distinguish the Asia-Pacific paints and coatings market from more mature chemical value chains.

Asia-Pacific Paints And Coatings Market Trends and Insights

Construction Boom in Emerging ASEAN Cities

Surging construction activity in Indonesia, Thailand, Vietnam, Malaysia, and the Philippines continues to lift architectural and protective coating volumes. Indonesia is on track to become the world's third-largest construction market by 2025, contributing 9% to national GDP while growing 13% year-on-year. Large transport corridors, industrial estates, and affordable-housing programs multiply coating touchpoints across concrete, steel, and wood substrates. International contractors typically specify low-VOC paints that align with green-building certifications, further tilting demand toward water-borne chemistry. Foreign direct investment in automotive and electronics clusters is also pushing orders for high-performance OEM, floor, and machinery coatings. Continued inflows hinge on macroeconomic stability and geopolitical calm, but near-term backlogs keep the Asia-Pacific paints and coatings market well supplied with construction-linked volume upside.

Re-painting Cycle Compression in Tier-1 Chinese Housing

China's mature property markets are experiencing shorter repaint intervals as owners prioritize aesthetic upgrades and asset preservation. Nippon Paint reported growth in Tier-1 and Tier-2 cities where repaint cycles have narrowed from 5-7 years to 3-5 years. Premium brands able to guarantee color retention for extended periods are exploiting the trend to trade customers up to higher-margin SKUs. Structural deceleration in new housing starts has redirected disposable incomes toward renovation outlays, raising value per dwelling even as unit completions soften. Demand is concentrated in interior finishes, water-borne primers and odor-free top-coats that meet GB/T 33372-2020 emission limits. Sustained momentum will depend on household income growth and sentiment in the broader real-estate market, yet the near-term uplift is already material for the Asia-Pacific paints and coatings market.

Tightening VOC and Formaldehyde Caps

China's GB/T 33372-2020 standard lowered permissible VOC thresholds for architectural coatings to 120 g/L, and provincial enforcement campaigns have intensified audit frequency. Smaller manufacturers lacking research and development and water-borne dispersion infrastructure face reformulation expenses and risk supply-chain disruptions if compliance deadlines lapse. Similar directives are taking shape in Vietnam and Malaysia, pushing cross-border suppliers to harmonize product lines, stock separate SKUs or exit low-margin solvent categories. While the long-term net effect channels demand into higher-value water-borne offerings, near-term capacity rationalization and transition costs suppress overall output, trimming Asia-Pacific paints and coatings market momentum.

Other drivers and restraints analyzed in the detailed report include:

- OEM Shift to Water-borne Auto Topcoats

- Mandated Cool-Roof Coatings in India's Smart-City Program

- Skills Deficit of Certified Industrial Coaters in Indonesia and Vietnam

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-borne formulations captured 57.05% of the Asia-Pacific paints and coatings market share in 2024 and are projected to record a 5.71% CAGR through 2030. Shanghai's 2018 exterior-wall solvent ban crystallized a wider policy wave across Guangdong, Beijing, and coastal industrial parks, steering builders toward low-VOC and low-odor alternatives. The Asia-Pacific paints and coatings market has therefore shifted from incremental adoption to systemic replacement, helped by new acrylic emulsions that deliver block resistance, early-water resistance, and rapid re-coat times comparable with solvent-borne alkyds. Automotive OEMs have validated water-borne base-coat clear-coat stacks that withstand humidity swings common to Southeast Asia, erasing previous quality concerns.

Powder, UV-curable, and high-solids systems together account for a smaller but fast-growing slice of the Asia-Pacific paints and coatings industry, particularly in metal furniture, appliances, and 3C electronics. Powder's zero-VOC credentials, plus reclamation efficiencies above 95%, appeal to ESG-driven procurement policies in Singapore and Australia. However, capital costs for ovens and pre-treatment lines limit penetration in cash-constrained SME clusters.

The Asia-Pacific Paints and Coatings Market Report is Segmented by Technology (Water-Borne, Solvent-Borne, Powder Coating, and Other Technologies), Resin Type (Acrylic, Alkyd, Polyurethane, and More), End-User Industry (Architectural/Decorative, Automotive, Wood, and More), and Geography (China, India, Japan, South Korea, Australia and New Zealand, Indonesia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3TREESGROUP

- Akzo Nobel N.V.

- Asian Paints

- Avian Brands

- Axalta Coating Systems, LLC

- BASF

- Berger Paints India

- Boysen Paints

- Chokwang Paint

- Davies Paints Philippines Inc.

- DuluxGroup Ltd

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd

- Nippon Paint Holdings Co., Ltd

- PPG Industries Inc.

- Propanraya

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction Boom in Emerging ASEAN Cities

- 4.2.2 Re-Painting Cycle Compression in Tier-1 Chinese Housing

- 4.2.3 OEM Shift to Water-Borne Auto Topcoats

- 4.2.4 Government "Green Ship" Retro-Fit Subsidies (Korea, Japan)

- 4.2.5 Mandated Cool-Roof Coatings in India's Smart-City Program

- 4.3 Market Restraints

- 4.3.1 Tightening VOC and Formaldehyde Caps (China GB/T 33372-2020, Etc.)

- 4.3.2 Titanium-Dioxide Price Volatility

- 4.3.3 Skills Deficit of Certified Industrial Coaters in Indonesia and Vietnam

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Water-Borne

- 5.1.2 Solvent-Borne

- 5.1.3 Powder Coating

- 5.1.4 Other Technologies (UV/ EB, High-Solids, etc.)

- 5.2 By Resin Type

- 5.2.1 Acrylic

- 5.2.2 Alkyd

- 5.2.3 Polyurethane

- 5.2.4 Epoxy

- 5.2.5 Polyester

- 5.2.6 Others (Phenolic, Ketonic, etc.)

- 5.3 By End-user Industry

- 5.3.1 Architectural/ Decorative

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Australia and New Zealand

- 5.4.6 Indonesia

- 5.4.7 Thailand

- 5.4.8 Malaysia

- 5.4.9 Vietnam

- 5.4.10 Philippines

- 5.4.11 Singapore

- 5.4.12 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3TREESGROUP

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Asian Paints

- 6.4.4 Avian Brands

- 6.4.5 Axalta Coating Systems, LLC

- 6.4.6 BASF

- 6.4.7 Berger Paints India

- 6.4.8 Boysen Paints

- 6.4.9 Chokwang Paint

- 6.4.10 Davies Paints Philippines Inc.

- 6.4.11 DuluxGroup Ltd

- 6.4.12 Hempel A/S

- 6.4.13 Jotun

- 6.4.14 Kansai Paint Co., Ltd

- 6.4.15 Nippon Paint Holdings Co., Ltd

- 6.4.16 PPG Industries Inc.

- 6.4.17 Propanraya

- 6.4.18 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment