PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851501

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851501

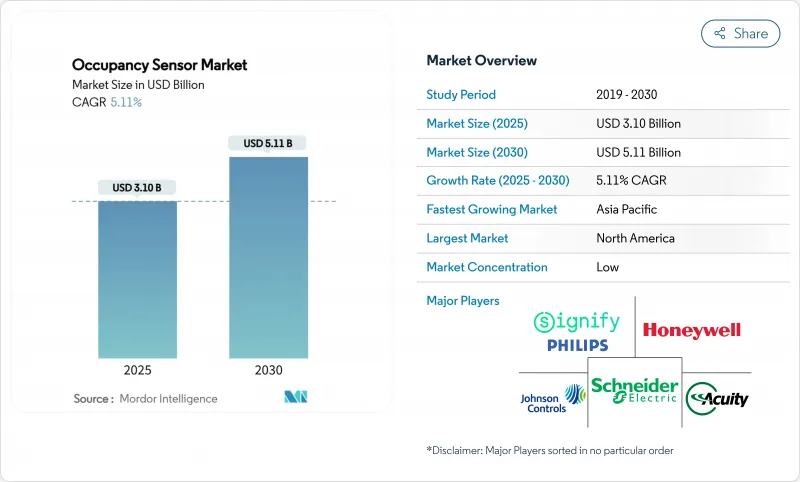

Occupancy Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Occupancy Sensor Market size is estimated at USD 3.10 billion in 2025, and is expected to reach USD 5.11 billion by 2030, at a CAGR of 5.11% during the forecast period (2025-2030).

Stricter net-zero building codes in the United States and European Union, China's dual-carbon roadmap, and expanding healthcare compliance programs are turning occupancy detection from a discretionary energy-savings measure into a legal requirement f-t.com. Corporate demand has shifted from trial deployments to systematic roll-outs that integrate sensors with building management platforms. Commercial property owners now prioritize data analytics that optimize space utilization and HVAC loads, while residential adoption gains pace as smart homes become mainstream. Technology convergence is visible: wired networks still command 62% of deployments for reliability, yet wireless nodes are advancing at a 12.4% CAGR as mesh protocols mature.

Global Occupancy Sensor Market Trends and Insights

Stricter net-zero building codes in U.S./EU mandating occupancy-based shut-off

California's Title 24 now requires occupancy sensing for receptacle and ventilation shut-off within 20 minutes of vacancy, while the 2021 International Energy Conservation Code mandates automatic controls in enclosed spaces. European renovation programs targeting 35 million buildings by 2030 echo these rules, making compliance rather than energy savings the primary adoption trigger. Commercial owners therefore embed sensors in construction documents rather than adding them post-build. This dynamic lifts baseline demand across the occupancy sensor market.

China dual-carbon roadmap boosting smart lighting IoT

China's goal of a 2030 carbon peak and 2060 neutrality propels smart building retrofits that favor sensor-based automation. Case studies in public institutions show energy savings above 20% after IoT lighting overhauls that rely on motion detection. Provincial disparity means turnkey packages that combine hardware and software succeed better than component sales, especially in tier-1 cities where budgets and technical skills align.

RF congestion & battery drain in 2.4 GHz mesh networks

Zigbee networks carrying 192 nodes keep sub-200 ms latency under clean radio conditions, yet packet loss rises sharply when Wi-Fi channels overlap. Frequent retransmits shorten coin-cell lifespan, raising maintenance costs for battery-powered devices. Building owners therefore hesitate to shift critical loads to wireless unless spectrum planning tools are in place.

Other drivers and restraints analyzed in the detailed report include:

- IoT-driven space utilization analytics upselling sensors

- Healthcare bed-occupancy programs under CMS & MDR

- False-positive events in high-heat data centers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The wired category accounted for 62% of global 2024 revenues, confirming its central role in core building systems within the occupancy sensor market. Facility managers value immunity to radio interference and easier power delivery, so Ethernet-based digital addressable networks anchor lighting and HVAC controls in new commercial construction. Retrofit environments with limited conduit space lean toward wireless nodes that reduce installation labor, which explains the 12.4% CAGR forecast for mesh-based products through 2030. Hybrid designs are emerging: a wired backbone feeds PoE luminaires while Thread or Zigbee sensors populate the periphery, balancing reliability and flexibility.

Wireless growth is driven by protocol convergence. Matter-over-Thread eliminates prior vendor lock-in, and vendors like Aqara released presence sensors that self-commission across Apple, Amazon, and Google ecosystems. Philips Hue demonstrated a software update that lets light bulbs double as motion sensors, hinting at an architecture where every luminaire becomes a data node. This blurs the lines between connectivity classes and broadens addressable installations for the

Passive infrared achieved a 50% share in 2024, reinforcing its cost advantage inside the occupancy sensor market. Demand for higher fidelity propels dual-technology modules at a 13.3% CAGR, combining PIR with ultrasonic or mmWave radar to catch minor movements and stationary occupants. Texas Instruments' AWRL6844 radar lowers per-node cost by USD 20, expanding adoption beyond premium installations.

AI-enabled edge processing reduces nuisance alarms by learning site-specific occupancy patterns. Bosch Sensortec targets 10 billion intelligent sensors by 2030, with 90% embedding AI engines that distill raw waveforms on-chip. These developments increase bill-of-material value and reinforce platform stickiness inside the occupancy sensor market.

The Occupancy Sensor Market Report is Segmented by Network Connectivity (Wired, Wireless), Technology (Passive Infrared (PIR), Ultrasonic, Microwave, and More), Mounting Type (Ceiling-Mounted, Wall-Mounted, and More), Installation Type (Retrofit, New Construction), Building Type (Residential, Commercial, Industrial & Warehousing, and More), Application, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held the largest revenue share in 2024. The United States anchors demand with Title 24 and the 2021 IECC requiring automated shut-off across commercial spaces. Canada follows similar patterns and shows strong interest in occupancy-based heating due to long heating seasons. Ongoing retrofits contend with dense 2.4 GHz spectrum in urban cores, driving hybrid deployments that mix wired backbones and sub-GHz wireless.

Europe registers solid growth under the Renovation Wave program that targets 35 million buildings by 2030. Germany, the United Kingdom, and France institute national building codes that embed occupancy-triggered lighting and ventilation cut-offs. GDPR compliance adds cost and slows AI analytics roll-outs, yet platform vendors that offer on-premise data processing mitigate these barriers. Fragmented wireless protocols force integrators to rely on multiprotocol gateways, elevating system complexity but also boosting services revenue inside the occupancy sensor market.

Asia-Pacific records the fastest CAGR to 2030. China's dual-carbon policy accelerates smart building mandates, especially in tier-1 metros where public-sector projects showcase 20% energy reduction after sensor installations. Japan and South Korea emphasize premium solutions that pair mmWave with AI for comfort optimization. In India and Southeast Asia, cost-efficient PIR nodes dominate, yet commercial office parks in Bengaluru and Singapore adopt platform architectures that align with global corporate ESG goals. This heterogeneity offers multi-tiered entry points for vendors across the occupancy sensor market.

- Signify (Philips Lighting)

- Honeywell International Inc.

- Schneider Electric SE

- Johnson Controls International plc

- Legrand S.A.

- Eaton Corporation plc

- Acuity Brands, Inc.

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

- Hubbell Incorporated

- Siemens AG (Enlighted)

- Texas Instruments Incorporated

- Panasonic Corporation

- Bosch Sensortec GmbH

- Omron Corporation

- Delta Electronics, Inc.

- RAB Lighting Inc.

- SensorWorx (B.E.L. Products)

- Stanley Black and Decker (STANLEY Security)

- OccupEye Ltd

- Pammvi Group

- General Electric Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter Net-Zero Building Codes in U.S./EU Mandating Occupancy-Based Shut-off

- 4.2.2 Rapid Retrofit Wave of Post-COVID Office Stock (NA and EU)

- 4.2.3 China Dual-Carbon Roadmap Boosting Smart Lighting

- 4.2.4 IoT-Driven Space Utilization Analytics Upselling Sensors

- 4.2.5 Healthcare Bed-Occupancy Programs Under CMS and MDR

- 4.2.6 Multi-Sensor Chipset Cost Decline Opening HVAC OEM Channel

- 4.3 Market Restraints

- 4.3.1 RF Congestion and Battery Drain in 2.4 GHz Mesh Networks

- 4.3.2 False-Positive Events in High-Heat Data Centers

- 4.3.3 Fragmented Wireless Standards Hindering EU Retrofits

- 4.3.4 GDPR/CCPA Compliance Cost for AI People Analytics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Technology Snapshot

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Network Connectivity

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.1.2.1 Wi-Fi

- 5.1.2.2 Zigbee

- 5.1.2.3 Z-Wave

- 5.2 By Technology

- 5.2.1 Passive Infrared (PIR)

- 5.2.2 Ultrasonic

- 5.2.3 Microwave

- 5.2.4 Dual / Multi-Technology (PIR + mmWave, etc.)

- 5.2.5 mmWave / FMCW Radar

- 5.3 By Mounting Type

- 5.3.1 Ceiling-Mounted

- 5.3.2 Wall-Mounted

- 5.3.3 Desk / Furniture-Integrated

- 5.3.4 In-Fixture / Embedded Luminaire

- 5.4 By Installation Type

- 5.4.1 Retrofit

- 5.4.2 New Construction

- 5.5 By Building Type

- 5.5.1 Residential

- 5.5.2 Commercial

- 5.5.3 Industrial and Warehousing

- 5.5.4 Healthcare and Assisted Living

- 5.5.5 Government and Education

- 5.6 By Application

- 5.6.1 Lighting Control

- 5.6.2 HVAC and Ventilation

- 5.6.3 Security and Surveillance

- 5.6.4 People Counting and Space Utilization

- 5.6.5 Bed / Restroom Occupancy Monitoring

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Nordics (Sweden, Norway, Denmark, Finland)

- 5.7.3.6 Rest of Europe

- 5.7.4 Middle East

- 5.7.4.1 Saudi Arabia

- 5.7.4.2 UAE

- 5.7.4.3 Turkey

- 5.7.4.4 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Nigeria

- 5.7.5.3 Rest of Africa

- 5.7.6 Asia-Pacific

- 5.7.6.1 China

- 5.7.6.2 Japan

- 5.7.6.3 India

- 5.7.6.4 South Korea

- 5.7.6.5 Australia

- 5.7.6.6 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify (Philips Lighting)

- 6.4.2 Honeywell International Inc.

- 6.4.3 Schneider Electric SE

- 6.4.4 Johnson Controls International plc

- 6.4.5 Legrand S.A.

- 6.4.6 Eaton Corporation plc

- 6.4.7 Acuity Brands, Inc.

- 6.4.8 Leviton Manufacturing Co., Inc.

- 6.4.9 Lutron Electronics Co., Inc.

- 6.4.10 Hubbell Incorporated

- 6.4.11 Siemens AG (Enlighted)

- 6.4.12 Texas Instruments Incorporated

- 6.4.13 Panasonic Corporation

- 6.4.14 Bosch Sensortec GmbH

- 6.4.15 Omron Corporation

- 6.4.16 Delta Electronics, Inc.

- 6.4.17 RAB Lighting Inc.

- 6.4.18 SensorWorx (B.E.L. Products)

- 6.4.19 Stanley Black and Decker (STANLEY Security)

- 6.4.20 OccupEye Ltd

- 6.4.21 Pammvi Group

- 6.4.22 General Electric Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment