PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851506

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851506

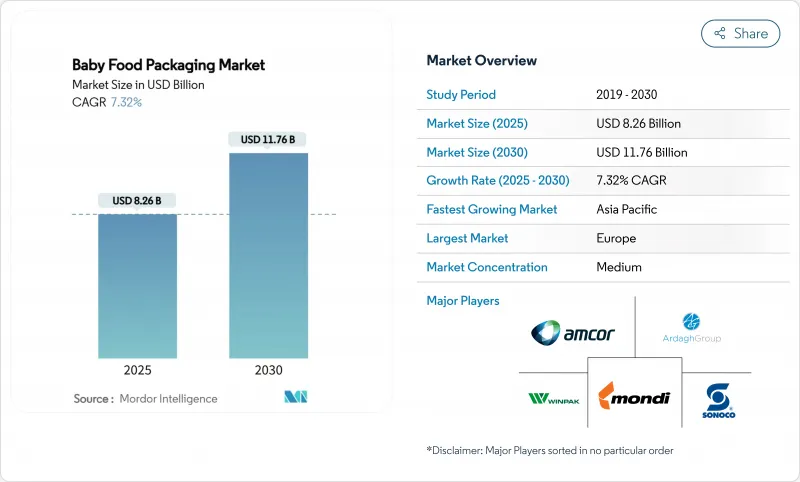

Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The baby food packaging market size stands at USD 8.26 billion in 2025 and is forecast to reach USD 11.76 billion by 2030, advancing at a 7.32% CAGR.

This growth rate exceeds the broader food-packaging category as urban families seek ready-to-serve formats, regulators impose strict infant-safety rules, and converters deploy smart materials that lengthen shelf life while enabling consumer interaction. Steady premium-price tolerance for infant-grade resins allows suppliers to pass through compliance costs, while extended-producer-responsibility (EPR) programs propel demand for recyclable or bio-based laminates. During 2025-2030, spouted pouches, aseptic filling lines, and AI-enabled traceability are expected to remain the pivotal innovation fronts that separate high-performing vendors from commodity competitors in the baby food packaging market. Heightened supply-chain discipline around pharmaceutical-grade spouts and barrier films will remain essential as global resin volatility and DIY puree trends periodically temper category momentum.

Global Baby Food Packaging Market Trends and Insights

Convenience-Driven Adoption of Baby Food Pouches

Spouted pouches have secured more than 30% share of the baby food packaging market by displacing glass jars through lighter weight, portability, and mess-free dispensing. Millennial parents view resealability and reduced breakage risk as decisive benefits, supporting price premiums and repeat purchases. Heat-resistant laminates enable hot-fill, retort, and high-pressure pasteurization, delivering preservative-free shelf stability. Brand case studies show double-digit sales lifts after switching to pouch formats, particularly in organic purees. Together, these factors underpin the segment's dual status as both largest and fastest growth engine of the baby food packaging market.

Urban Dual-Income Households Demanding Time-Saving Formats

In dense metros, working parents trade up to ready-to-consume packages that cut prep time and washing. Once Upon a Farm scaled automated lines to 1.2 million packs per week triple 2020 throughput-to meet this demand.Asia Pacific megacities show the sharpest volume increases as extended-family childcare support wanes. E-commerce penetration amplifies the trend because pouches and reinforced cartons tolerate parcel-handling shocks better than glass. Despite 20-30% price premiums, elasticity remains favorable as households equate packaging convenience with intangible time savings, providing sustained tailwinds for the baby food packaging market.

Plastics Sustainability Backlash & Legislation

EPR statutes in California, Maine, Oregon, and Colorado obligate producers to bankroll recycling systems and meet design-for-recovery criteria.The EU's Packaging and Packaging Waste Regulation further mandates 30% recycled content by 2030. Food-grade recycled PP capacity sits near 10% of total recycled polymer output, tightening supply and inflating costs. Brands able to validate recyclability or compostability gain consumer trust, whereas legacy multilayer formats face accelerating obsolescence, weighing on near-term margins across the baby food packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Infant-Safety Regulations Expanding Premium Packaging

- Aseptic Spouted-Pouch Filling Lines Gaining Ground

- Supply Bottlenecks of Pharma-Grade Spout Resins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic maintained 26.7% revenue share in 2024, reflecting extensive processing infrastructure, but bioplastics now post the quickest 9.7% CAGR as regulators and brands escalate carbon-reduction targets. Braskem's bio-circular polypropylene derived from used cooking oil offers a drop-in alternative that eases line changeovers. ADBioplastics commercialized a 100% compostable resin tailored for wet baby purees. Early adopters secure EPR credits and marketing lift, positioning biopolymers as a strategic hedge even while traditional plastics keep scale and cost advantages.

The material shift galvanizes supply-chain reengineering: converters negotiate long-term offtake with bio-polymer suppliers, and CPGs redesign labels to highlight end-of-life credentials. As volumes rise, economies of scale are expected to narrow the cost delta, further embedding bioplastics within the baby food packaging market.

Baby Food Packaging Market Report is Segmented by Material (Plastic, Paperboard, Metal, Glass, Bioplastics), Package Type (Bottles, Cartons, Jars, Pouches, Bag-In-Box), Product (Liquid Milk Formula, Dried Baby Food, Powder Milk Formula, Prepared Baby Food, Baby Snacks), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintained a 25.8% revenue lead in 2024, propelled by progressive regulation that rewards recyclable designs and punishes chemical hazards. The January 2025 BPA prohibition forces immediate reformulations, channeling business toward suppliers with qualifying materials and compliance documentation. Germany and France house active clusters of sustainable-packaging R&D, while the UK displays sustained demand for premium organic purees sold in smart pouches that embed traceability chips.

Asia Pacific shows the fastest 7.8% CAGR through 2030. Rising middle-class incomes and urban lifestyles accelerate convenience-focused SKUs, positioning the region as the largest incremental volume source for the baby food packaging market. China's infant-formula rebound H&H Group recorded 44.3% Q1 2025 revenue growth signals renewed confidence in branded nutrition after earlier safety scares. India's BPA-free mandate aligns with Amcor's USD 20 million purchase of Phoenix Flexibles, which boosts local flexible-film capacity in Gujarat. Japan and South Korea pioneer dual-QR traceability, reflecting consumer penchant for safety verification.

North America remains a high-value arena given stringent FDA rules and wide e-commerce penetration. EPR laws in four states obligate brands to finance recycling, pushing quick adoption of mono-material laminates. The 2022 formula shortage catalyzed domestic capacity investments: Bobbie's 90,000 sq ft Ohio plant now produces canned and powdered formula under strict microbiological controls. Canada's harmonized provincial EPR network incentivizes design-for-recycling across flexible and rigid formats alike, sustaining steady innovation.

- Amcor PLC

- Tetra Laval Group

- Mondi Group

- Berry Global Inc. (incl. former RPC)

- Silgan Holdings Inc.

- Sonoco Products Company

- Ardagh Group

- Winpak Ltd

- DS Smith PLC

- SIG Combibloc Group

- Cheer Pack North America

- Gualapack Group

- Scholle IPN

- UFlex Ltd

- ProAmpac LLC

- Huhtamaki Oyj

- AptarGroup Inc.

- Plastipak Packaging Inc.

- Crown Holdings Inc.

- Sealed Air Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience-driven adoption of baby food pouches

- 4.2.2 Urban dual-income households demanding time-saving formats

- 4.2.3 Stricter infant-safety regulations expanding premium packaging

- 4.2.4 Aseptic spouted-pouch filling lines gaining ground

- 4.2.5 Extended-producer-responsibility incentives for recyclability

- 4.2.6 AI-led personalised-nutrition pack design innovations

- 4.3 Market Restraints

- 4.3.1 Plastics sustainability backlash and legislation

- 4.3.2 BPA/chemicals compliance cost pressures

- 4.3.3 Supply bottlenecks of pharma-grade spout resins

- 4.3.4 DIY baby-food trend reducing packaged demand

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Bioplastics

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Cartons

- 5.2.3 Jars

- 5.2.4 Pouches

- 5.2.5 Bag-in-Box

- 5.3 By Product

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.3.5 Baby Snacks

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Southeast Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Egypt

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Tetra Laval Group

- 6.4.3 Mondi Group

- 6.4.4 Berry Global Inc. (incl. former RPC)

- 6.4.5 Silgan Holdings Inc.

- 6.4.6 Sonoco Products Company

- 6.4.7 Ardagh Group

- 6.4.8 Winpak Ltd

- 6.4.9 DS Smith PLC

- 6.4.10 SIG Combibloc Group

- 6.4.11 Cheer Pack North America

- 6.4.12 Gualapack Group

- 6.4.13 Scholle IPN

- 6.4.14 UFlex Ltd

- 6.4.15 ProAmpac LLC

- 6.4.16 Huhtamaki Oyj

- 6.4.17 AptarGroup Inc.

- 6.4.18 Plastipak Packaging Inc.

- 6.4.19 Crown Holdings Inc.

- 6.4.20 Sealed Air Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment